What Is Buyer Agency and Why Does It Matter?

Buyers’ Agents are getting a lot of attention thanks to a recent ruling on real estate commissions and it’s important to know why they are crucial to selling a home.

Recent signals by the Federal Reserve to cut rates in the new year are expected to usher in an improved market for buyers in 2024. As interest rates continue to decline it will not only increase buying power but it will also increase inventory as sellers who also need to buy are encouraged by lower mortgage rates to list their properties for sale. At the same time, new home builds are increasing as contractors see their building costs decline.

And with more buyer activity, there will be Buyers’ Agents ready to assist them in the purchase of their next home. Recently, there’s been an intense focus on buyers’ agents’ commissions, thanks in part to October’s Stitzer-Burnett antitrust judgment, which found that the National Association of Realtors® (NAR) and several large real estate franchisors conspired to inflate commissions. The jury awarded damages of more than $1.8 billion and the verdict is being appealed even while similar cases are being filed throughout the country.

It’s a developing story and one that has many perspectives – sellers, buyers, brokerages, and Realtors® – in the mix. But it’s buyers’ agents who will be key to helping navigate the debate for their clients.

Very simply, a Buyer Agent is a Realtor® or licensed real estate agent who represents the interests of a buyer in a sales transaction. Buyers don’t have to use an agent to buy a home, but most benefit from the knowledge, contract expertise, negotiation skills, and helpful connections during the transaction and beyond that a professional Realtor® provides.

In our region, a Buyer Agency Agreement is usually the first time a client learns what their agent will do for them during their home purchase process. It outlines the tasks an agent is required to perform as well as what the buyer is responsible for and includes a paragraph about how the Buyer Agent is paid. These agreements have been used in real estate since the 1990s and help ensure that all parties understand the agency relationship – including loyalty to the client, confidentiality about the information shared, fiduciary responsibility, and required disclosures – and offer clients the opportunity to ask questions and negotiate terms before a home search begins.

But the most important assurance the Buyer Agency Agreement offers is that a client can trust that their agent will represent them to the fullest extent and put their interests first. The seller has their own agent negotiating on their behalf so it makes sense for a buyer to avoid any conflicts of interest by also having their own representative – their champion! – during the sale. In short, a Buyer Agency Agreement ensures transparency and accountability for everyone involved.

Like buyers, sellers can represent themselves, but most hire a real estate professional to list a property and protect their interests during the transaction. In the Washington, DC metro area, the majority of homes are sold with agents, and commissions from these sales are paid to brokerages, most of whom have affiliated agents as independent contractors.

Traditionally, sellers have paid both their listing agent’s fee/commission and that of the buyer’s agent (also called a co-op fee) for bringing a qualified buyer and managing the transaction to settlement. How much commission a seller chooses to pay, and whether to offer a co-op commission, is always negotiable. These fees are disbursed at settlement, meaning both the seller’s listing agent and the buyer’s agent get paid at the end of the transaction. In the meantime, both agent sides are incurring business and operating costs that they will pay with the commissions they eventually earn from their brokerages.

One of the arguments in favor of co-op fees is that it helps buyers’ purchasing power. If buyers were required to pay the agent’s fee it would greatly reduce buying power, adding commission expense on top of hefty down payments, closing costs, and inspection fees. This would significantly impact first-time, FHA, and veteran (VA) buyers, especially those with limited equity and generational wealth. Rising home prices have already kept many of these buyers on the sidelines and could exclude an entire group of would-be homeowners. Many in the industry worry that buyers will instead choose to be unrepresented in a transaction rather than hire an agent, opening themselves up to being at a disadvantage during negotiations, inspections, deadlines, and appraisals.

While the co-op fee is at the heart of the debate in the NAR and brokerage lawsuits, it doesn’t take away from the expectation that professionals like Realtors® should be paid fairly for their work in representing their clients and their clients’ goals of homeownership. The question of who will pay for that compensation is one of the most hotly debated topics in real estate right now and will be for some time to come.

Don’t be afraid to ask your agent about commissions and how they may affect your home purchase. A professional McEnearney Associates | Middleburg Real Estate | Atoka Properties agent is ready to answer all questions, provide guidance and clarification, and get to work representing you!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Are the Real Costs of Renting?

Homeownership is not for everyone. Is that a bad thing and what does it cost in the long run?

There are times when homeownership makes sense, but is this one of those times? For many, the combination of inflation, high interest rates, and steadily increasing home prices has put homebuying plans on hold, especially for Millennials and Gen Z buyers who have less purchasing power due to lower incomes, more debt, and less equity.

In a pricey area like ours, the pinch is even worse. The DC area’s cost of living was reported this spring to be 53% higher than the national average, while the housing portion of overall costs was a whopping 144% higher. Combined with a growing population that hasn’t kept pace with housing inventory, the supply-and-demand pressure continues to keep rents high, although there are some signs the climb may be leveling. In August it was reported that the average monthly rent in DC was $1,901/month, Virginia was $1,594, and Maryland was $1,741.

About 40% of the DC metro area is made up of renters and a growing number of them report spending more than half of their monthly income on rent. A November report from Virginia Association of Realtors showed that compared with homeowners, renters are carrying more than two times higher housing costs. Data from the Census Bureau indicates that as of 2022 about 50% of renters were housing cost-burdened in Virginia, while only 20% of homeowners were housing cost-burdened (meaning 30% or more of monthly income was going toward housing costs).

But even with the financial burdens that renting can bring, it may actually be better for some in the long run to stay in tenancy. Because while rental prices have climbed, so have purchase prices. High list prices coupled with high interest rates mean it now costs 52% more to own a home than to rent.

The podcast The Daily from The New York Times covered this recently and reviewed the financial paths that buyers and renters take on the way to building wealth. On one path, renters hold off on buying and investing what would have been a down payment in another way; as the investment grows the renter can increase their buying power for a time when overall housing costs may be lower. On the other path, homeowners navigate the initial high costs of buying a home and are rewarded (eventually and hopefully) with equity that grows over years of ownership.

Here are a few things to consider when deciding which is the better path for you right now. Because the market can and will shift, and “timing the market” is almost never a successful strategy.

How long do you plan to stay in the home?

If it’s less than 5-7 years, it makes more sense to rent and invest cash elsewhere. Use a rent ratio calculator to determine your relative cost of renting versus buying.

How steady is your income?

Annual rent increases can be unpredictable and plenty of tenants have been surprised by a sudden unexpected hike. For the most part, mortgage payments are consistent over the term of the loan (allocating for increases in taxes, insurance, and amenity fees) and easier to budget around in the long term.

What is your budget (or patience!) for home repairs?

As a renter, home maintenance costs are borne by the landlord. If something goes wrong, you pick up the phone and someone else takes care of it. As a homeowner, you can expect to pay about 1% of the home’s purchase price every year toward home maintenance. But there are also big-ticket repairs – like a new roof, appliance upgrades, and systems repairs – that will unexpectedly take a bite out of your budget.

What is your lifestyle?

Do you like exploring new neighborhoods? Are you a traveler and want the flexibility of trying on a new city for a while? Could a major life milestone be on the horizon? Do you simply want a low-maintenance living situation? Renting offers many benefits for people who don’t want to be tied to the responsibility of paying for and maintaining a home.

The National Association of Realtors has many resources to help decide if homeownership is the right move and where to find first-time homebuyer assistance, as well as reporting relevant data to understand current market dynamics.

And, when you’re ready to find a fantastic new rental or take the first step toward homeownership, be sure to connect with an amazing agent at McEnearney Associates!

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Statistics Tell the Story: Precise Pricing is More Important Than Ever

Even in a white-hot “Seller’s Market,” owners must be careful when pricing for maximum buyer exposure.

It’s a market that can be enticing for sellers and exhausting for buyers: record-low inventory, high interest rates, and competition around every corner.

However according to David Howell, McEnearney’s Executive Vice President and Chief Information Officer, sellers still need to be smart and strategic in how they price their property. In fact, in reviewing McEnearney’s most recent statistical research, Howell observes that there are four kinds of sellers in this market – the Very Successful, the Eventually Successful, the Hopeful, and the Failures.

Let’s examine who has the numbers on their side.

The Very Successful Seller:

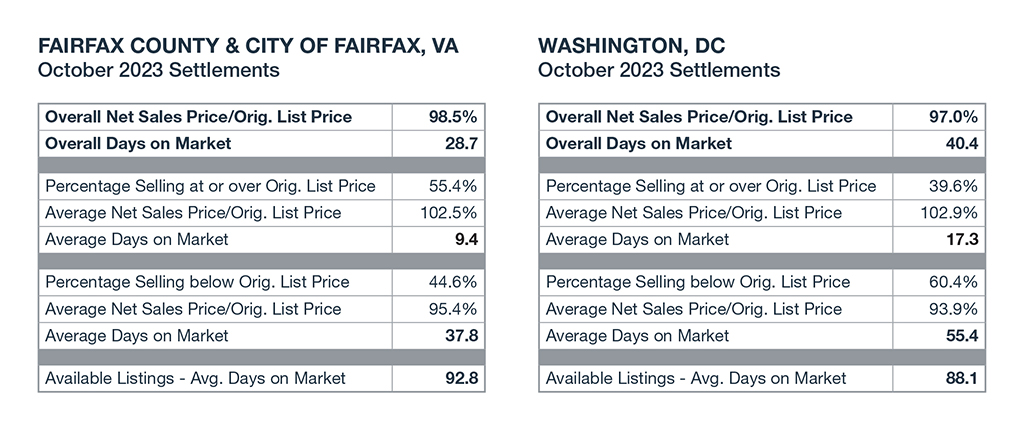

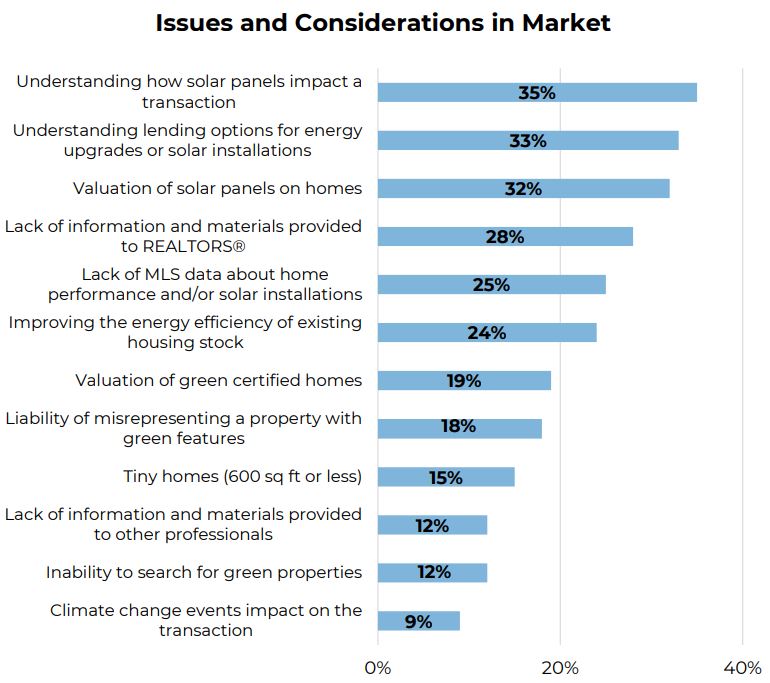

This is what every seller aims for but only about half of properties actually meet that goal. The “very successful” are those who sell at or above their original list, and those folks usually see a quick sale. For example, in October 2023 in Fairfax County and Fairfax City, 55% of all homes sold fell into that “very successful “ category, and those properties sold in an average of just 9.4 days and 2.5% above list.

The “worst of the best” in the metro area was Washington, DC, where 40% of homes sold at or above list, and sold in an average of 17.3 days. That’s still pretty darn good.

The Eventually Successful Seller:

These homes sold, but below their original list price and with longer days on the market (DOM). In the City of Alexandria, about 48% of homes fell into this category in October, selling in an average of 30.7 days at 3.6% below the list price. In comparison, 52% of homes sold in six days and 1.6% above list.

The differences are significant – those “eventually successful” sellers took a month longer to sell (that’s another mortgage payment, insurance, and HOA or condo payment!) and sold for much less money. Those homes weren’t priced correctly at the outset, and the significant majority had to reduce their price before getting a contract.

The Hopefuls:

The third category of sellers are the “hopefuls.” Those are homes on the market that haven’t yet accepted an offer. In every jurisdiction we track, the average DOM for these “hopefuls” is at least twice as much as the average days on the market for homes that sold. This is where “testing the market” is at a seller’s peril. Buyers are scouring inventory for the right home and if a listing comes to market and isn’t attracting offers, holding out longer for “That One Perfect Buyer” is not going to solve that problem.

In fact, buyer mindset can affect even normally-priced homes that haven’t yet sold. If the average DOM is 7 days and your listing is at 14 DOM, some buyers may assume something is wrong with the property, even if there isn’t. This in turn brings lower offers – if any.

The Failures:

That brings us to the final category of sellers: the “failures.” We know that sounds harsh, but roughly one in every eight homes that go into the MLS expires or is withdrawn before it sells. This could be for any number of reasons – inflexible seller, significant property damage, distressed sale – but the end result is the same: no buyers were interested.

So, if most of the Washington metro area is in a seller’s market, why aren’t these homes selling? As shown, even with so many market advantages, 3 out of 4 sellers won’t sell their home right away. In most cases, this is because they simply aren’t priced in line with the reality of today’s market where many buyers have been slammed by higher mortgage interest rates.

What can a seller do to ensure they land in the “Highly Successful” camp? The first step is to work with a licensed Realtor® who will provide local market insight and guide your pricing strategy. The second is to prepare your home to attract the most qualified buyers: fix, remodel, and paint for the best first impression, and consider offering credits for buyers.

Finally, have a plan to make a pricing adjustment if the home hasn’t sold within 21 days, which appears to be the local “tipping point” when sales prices drop. In a recent study by the National Association of Realtors, a listing that is 30 DOM without an offer is likely 3-5% overpriced. Be ready to make a pricing decision that keeps you within a competitive time-and-pricing window that keeps buyers interested.

As we have noted before, there are still buyers actively engaged in the market, but they make their decisions based on value. And they don’t see value in an overpriced home. So, heed the warnings of three out of four kinds of sellers who learned the hard way: price matters and time kills.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Where Buyers Can Find Help In This Market

Brian Bonnet, Atlantic Coast Mortgage

Even if you’ve previously bought a home, you’re experiencing market dynamics that haven’t been in play for decades. Here’s how to navigate the current market atmosphere.

It’s not a new story that it’s tough out there for buyers, but that’s not the whole story. For buyers ready to get to work with their Realtor and their lender, success could be a few smart moves away.

To thrive in a tight and expensive housing market, your Realtor is your expert and guide in the field: there to research property history, study future trends, and learn from other agents in the market. Your lender is there to ensure you have the financing necessary to get the property you want, to avoid taking on more debt than is prudent, and to find creative solutions and avoid last-minute surprises as a loan makes its way through the underwriting process.

Agents and lenders can work together to better prepare to negotiate for their clients, so consumers should prepare to work smarter in this market as well.

While the market is always evolving, there are three angles to help you succeed in any market.

Tap Into Familial Funds

The current housing market is making life especially difficult for first-time buyers, as they don’t have equity from a recent home sale to transfer to their next purchase. Saving for a down payment can take years, but cash provided as gift funds can speed up that process. That’s the good news for cash-strapped buyers: many mortgages allow family members to provide cash to help buy that first home.

Family members can offer support with a down payment, closing costs, or both, but this type of financial assistance needs to be carefully documented as gift funds,

Younger buyers are currently making the most parental ATM withdrawals, with 78% of Generation Z homeowners reporting some financial support for a down payment, mostly from their parents. 54% of Millennials have received assistance, followed by 33% of Gen Xers.

What About Adjustable-Rate Mortgages?

ARMs may not be the solution to high fixed rates.

There is a fair amount of discussion about adjustable-rate mortgages (ARMs) being a decent alternative

to fixed-rate mortgages which are currently pushing 8 percent. The truth is that most adjustable-rate

programs do not have rates significantly lower than fixed-rate products.

The most recent daily survey of 5-year ARMs pegged the rate at 7.300% compared to 7.900% for fixed-rate programs. Occasionally, a depository institution will offer more attractive ARM rates than the general marketplace for a short period of time to boost its loan servicing portfolio to a desired level. The lower rates are generally short-lived and not widely available to consumers.

The overwhelming majority of purchase money loans being closed are still fixed-rate mortgages and as long as the 10YR-2YR Treasury yield curve is inverted, this will likely continue to be the case.

The Banking Industry Is Trying To Help

Home buyers aren’t the only ones unhappy with current mortgage interest rates. Last week, The Independent Community Bankers Association (ICBA) began promoting a plan that could reduce mortgage interest rates by 1% to 1.5%.

The ICBA was supported by the National Association of Realtors (NAR), and Community Home Lenders of America. Together, these three submitted a letter to The White House and Treasury Department outlining a plan to reduce the historically large spread between 30-year mortgage rates and 10-year Treasuries.

ICBA states that their proposal could reduce mortgage rates by up to 150 basis points. They also recommended that the following changes take place:

- The Federal Reserve should shift its policy to maintain its stock of mortgage-backed securities (MBS), suspending runoff until the spread between the 30-year fixed-rate mortgage and 10-year Treasury note stabilizes.

- Fannie Mae and Freddie Mac should be enabled to purchase their own MBS and/or Ginnie Mae MBS for a temporary period of time.

“The housing shortage is structural for the time being and has a significant impact on inflation,” the letter continues. “Our groups thoroughly respect the independence of the Federal Reserve but believe it should take this structural issue into consideration when evaluating strategies to attain the Fed’s desired 2% inflation target.”

The path from scouting homes online to meeting the moving van can be a complicated one. But knowing where to go for help – starting with a great Realtor and expert lender – gets you headed in the right direction. Connect with us today to see where that path will take you!

Brian Bonnet

SVP, Sr. Loan Officer, NMLS: 224811

Atlantic Coast Mortgage, NMLS: 643114

O: (703) 766-6702 | M: (703) 304-0188

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Benefits of Relocation Services

Buying and selling a home can be exciting and stressful all at the same time. Locally, most people know at least one real estate agent; whether an agent they have used before or someone they are acquainted with. If not, recommendations from a friend, family member, or trusted advisor are a great place to start. However, there may come a time when you have a real estate need outside of your local real estate market. When looking for an agent, you have to remember that anyone can build a beautiful website and hire a professional marketing team to support them, that doesn’t guarantee they are experienced or the best agent for your needs.

Knowing a Realtor who is part of a truly global network of vetted professionals is key. At McEnearney Associates, we are fortunate to be a member of Leading Real Estate Companies of the World® (LeadingRE). LeadingRE is home to the world’s market-leading independent residential brokerages in over 70 countries, with 550 firms and 136,000 sales associates making 130 client introductions, producing 1.2 million global transactions in 2021. Our by-invitation-only network is based on the unparalleled performance and trusted relationships that result in exceptional client experiences.

Why is this important to you?

We want to ensure you receive the same professional service anywhere in the world that you receive from us. The three most common reasons clients reach out for recommendations outside our local area include: job relocation, family needs, and life-style changes.

Job Relocation

Many employers offer a variety of packages from full relocation to flat-fee services, while other employers are not equipped to provide relocation services. If Realtor recommendations are part of your relocation program or suggested by a co-worker, you should still do your research. Job relocations add an extra level of stress due to time constraints of the position start, selling your current home, relocating family, and more. The right Realtor is experienced in your market but also “relocation best practices,” fully understanding the relocation processes, additional paperwork, and requirements of the employer so that you can take full advantage of all relocation benefits. When you are not offered relocation benefits by your employer, you must find the right agent on your own; not just an experienced one, but an agent with a true relocation background, because it will make all the difference in your move.

Family Needs

From growing families to downsizing, inherited homes to vacant land, relocation trained agents are equipped to assist with all types of family situations as they arise. For example, when parents are no longer able to age in place, relocation agent services can include: complimentary market analysis noting as-is and repaired/improved values; supplier introductions from repairs to improvements and cleaners to movers. A relocation trained agent is a full-service Realtor who specializes in the area and type of transaction you are navigating, as well as proficiency in working with out-of-town clients.

Life-Style Changes

Often buyers are comparing multiple areas as a potential destination for retirement, investment property or even a second home. Relocation specialists offer more than housing information; they provide cost of living comparisons, area tours, local life-style information, and market trends to assist you in decision making.

The best Realtors are more than local, they can also provide global real estate services. When you need an agent recommendation, anywhere in the world, McEnearney Associates are happy to help. We are your Trusted Relocation Resource.

Relocating With McEnearney Associates

Trudy McCullough & Britni Spurlock

Relocation & Referral

McEnearney Associates would be delighted to help you navigate through a very exciting transition in your life whether you are moving to or from the Washington metro region. McEnearney’s award winning and experienced Relocation Team is dedicated to personally selecting the best agent to represent you before, during, and after your move.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why Homeowners Insurance Matters

We know. Learning about homeowners insurance isn’t the most scintillating way to spend your time. But if you own or are considering buying a home, it’s imperative to understand why it’s needed, how much is needed, and how to get the right coverage … before it costs you more than you expect.

Your home is more than a place to make lifetime memories. It’s likely the biggest financial asset you have that will likely continue to grow in value over time. Protecting that asset is where homeowners insurance enters the picture.

Homeowners insurance is different from a home warranty (which covers appliances, systems or structures in a home), hazard insurance (which only covers the structure of a home), or title insurance (which protects against claims of ownership or liens on the home).

In short, homeowners insurance is a form of property insurance that covers losses and damages to an individual’s residence, along with furnishings, jewelry, and other assets in the home. Homeowners insurance also provides liability coverage against accidents in the home or on the property.

Having insurance in place is generally required for buyers acquiring a mortgage and a lender will set a deadline by which a policy has to be in place prior to closing. At the very least, properties without a mortgage should still have liability insurance coverage for accidents that occur to others in the home or on the property.

First-time homeowners will need to account for this new expense in their monthly housing costs, while existing owners will want to keep watch for rising rates and changes in their household. Determining how much insurance coverage you need is based on a number of factors:

- What is the replacement cost of the home? This is not the same as the price of the home when it sold (a.k.a. market value of home and the land it sits upon) and is determined by construction costs, material, and labor. Land is not considered in replacement cost but additional structures on the property would be.

- What is the potential for a natural disaster where the property is located? Areas subject to hurricanes, tornadoes, fire, landslides, or other natural “perils” will likely require more coverage and at higher premiums, while properties subject to flooding or earthquakes may not be covered at all or will require an additional and specific insurance rider (at additional cost).

- Is your home located in a high-risk area for crime or accidents, or far from a fire hydrant,? Does it have a pool, or have other unique qualifiers like being a historic property? Insurers will drill down to find details like this that can affect your premium.

- What is the age, size, and condition of the property? Insurance for a home that’s more than 30 years old can be up to 75% higher when compared to a new home, and properties with older electrical and plumbing systems or show signs of decay will affect premium pricing.

- What is your credit score? According to Experian, a major credit-monitoring company, while the algorithms insurers use are different from lenders to determine a “worthiness score,” insurers will evaluate the potential to file a claim, which will affect premium rates.

Once you’ve estimated how much coverage you’ll need, the next step is to select an insurer. Anyone who has turned on their TV knows there is no limit to the number of companies vying for your business (surely you’ve seen commercials with Martin the Gecko, Flo, Jake, Mayhem… the mascot list goes on), and there are plenty of online calculators to help get ballpark estimates and compare coverage. If you already have another type of insurance policy in place – such as auto, personal property, renter’s coverage – ask if your current insurer will offer a bundled discount. If you are brand new to the insurance market, ask around for recommendations; your Realtor, your lender, your neighbors are a great way to crowdsource worthy companies.

Evaluate your homeowners policy at least annually, and update immediately following any important changes to your home or when you experience major life events. Contact your insurer to update coverage OR receive a discount on your premium if you experience any of the following:

- Home expansion, improvements, and renovations

- New furnishings and electronics

- Installation of security devices

- Addition of energy-efficient appliances, windows, roofing, etc.

- Installation of solar panels

- Add or remove family members living in the home (including pets!)

- Acquire new assets like jewelry, artwork, antiques, etc.

- Begin or end working from home

- Retire

With a little bit of research and an annual review of current coverage, your homeowners insurance should be one of the easiest and most cost-effective ways to protect your home and all that dwells within it. And that’s anything but boring!

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Two Years After Surfside Condo Collapse, Here’s What You Need To Know Before You Buy or Sell a Condo

Condo associations are in the spotlight as new government lending requirements for condo sales take effect this week, impacting millions of owners and potential buyers.

In the early hours of June 24, 2021, Champlain Towers South, a 12-story beachfront condominium in the Miami suburb of Surfside, FL partially collapsed, causing the deaths of 98 people.

Later that same day a lawsuit was filed in Miami Dade Circuit Court by a resident of the building against the Champlain Towers South Condominium Association, seeking $5 million in damages “due to defendant’s acts and omissions and their failure to properly protect the lives and property of plaintiff and class members”.

What followed was a year of legal maneuvering and class-action lawsuits that ultimately ended on June 23, 2022 – one day before the first anniversary of the collapse – with a $1.02 billion judge-approved settlement in favor of victims of the collapse. The defendants in the case, including the Champlain Towers South Condominium Association and other developers of the property, chose to settle rather than face lengthy litigation and exposure to additional liability.

The collapse of a seemingly sturdy building – only 42 years old at the time – put a spotlight on the culpability of condominium owners’ association boards and deferred maintenance. Reports soon emerged that the long-term degradation of reinforced concrete structural support in the basement-level parking garage under the pool deck had been a cause of the collapse. The problems had been reported in 2018 and noted as “much worse” in April 2021, and while a $15 million program of remedial works had been approved before the collapse, the main structural work had not started.

Flash forward to this week and federally funded lending companies Fannie Mae and Freddie Mac made permanent on September 18 new requirements to project eligibility standards for condominiums and housing cooperatives. Given that there are an estimated 175,000 condo associations in the U.S. – according to the Community Associations Institute (CAI), the leading international membership & advocacy organization for condo associations with over 45,000 members and 63 chapters internationally and domestically – this move will have great impact across the condo market.

According to CAI, community association boards and managers will likely see changes in lender questionnaires and requests from lenders for additional documentation, including: insurance policies, budgets, financial reports, reserve studies and funding schedules, documentation regarding special assessments, documentation about litigation or alternative dispute resolution, and – importantly – building inspection reports. If the association does not provide this information to lenders, the project may be deemed ineligible, and put on an ineligible list.

While the Fannie Mae/Freddie Mac requirements had been in temporary status since shortly after the Surfside collapse, it may come as a surprise to buyers and sellers who were not aware of them now that they have become standard practice. So what does this mean for condo owners and potential buyers?

“Subsequent to the tragedy in Surfside Florida, Fannie Mae and Freddie Mac implemented more stringent requirements for determining whether a condominium project is eligible for individual unit financing, meaning lenders now require an increased level of documentation and additional appraisal requirements to help determine whether a project is potentially structurally unsafe,” says Brian Bonnet, Senior Loan Officer with Atlantic Coast Mortgage. “The temporary project review requirements implemented two years ago, and which have now been made permanent, have resulted in an increased number of condo projects no longer being eligible for standard mortgage financing. Condo associations, individual unit owners and potential buyers should become educated as to the lending industry’s requirements for certifying the acceptability of a condominium project.”

As a buyer, the best start is always to speak with a local lender who will guide you through the process and let you know which condo projects are not currently eligible for some financing. There may be additional requirements for FHA and VA/veteran buyers to be aware of that conventional financing doesn’t require. For sellers, be sure to review your condo associations documents and speak with the condo association board for any updates to be aware of.

Read the full Fannie Mae & Freddie Mac review of condo lending requirements here.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Good, The Bad & The Unsure of Home Solar Panels

We know solar panels are increasingly being added to properties to cut down on energy costs and reduce emissions from other heating sources, but does that translate into value for homeowners?

A reader of The McEnearney Blog recently asked us a question about the resale value for homes with solar panels. Did it help, hurt or have no impact at all?

It wasn’t as easy a question to answer as we thought.

When we last addressed the topic of solar panels in 2020, it was a topic garnering a lot of discussion but not a lot of clarity about what impact it had in the housing market. And while there has been plenty of homeowner education about other popular green tech in properties – such as energy-efficient appliances, sustainable construction material, improved insulation – the insight on solar panels remains clouded as to what that means in actual dollars for home value.

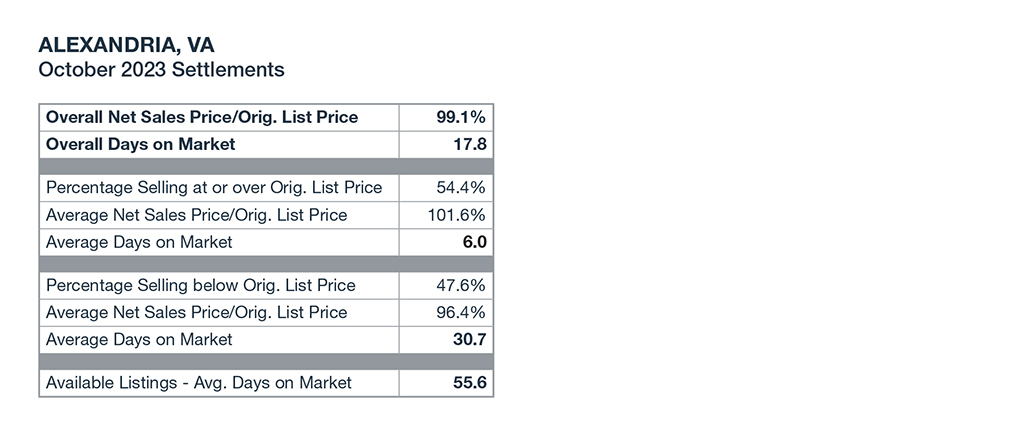

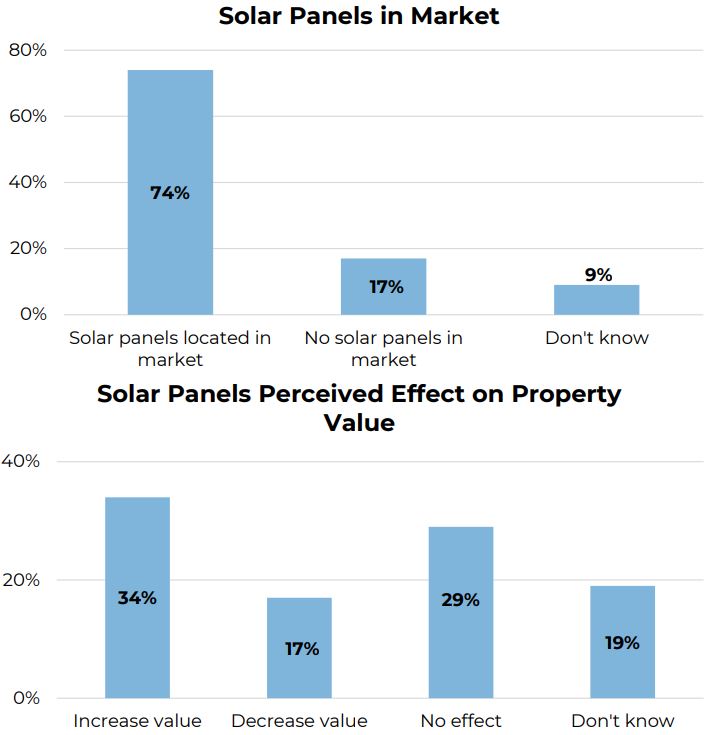

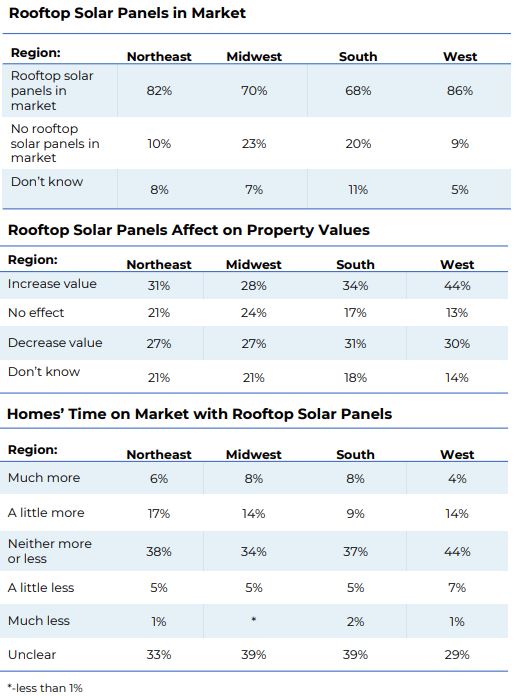

Each year the National Association of Realtors® releases a report on sustainability issues facing the real estate industry. The 2023 REALTORS® and Sustainability Report – Residential was released in May and showed that a majority (63%) of agents and brokers said promoting green technology in listings is “very” or “somewhat” important.

When it comes specifically to solar’s value to a home, 34% (a 2-point drop from 2022) said properties with solar panels increased the perceived property value, compared to 17% who said it decreased value and 29% that said they had no effect (19% said they didn’t know the impact on value). Also, 38% of agents and brokers said that days on market was neither longer nor shorter for properties with solar panels and 37% believed the difference in time on the market due to the solar panels was unclear.

The green home features that Realtors® believed were most important to clients include windows, doors and siding (39%); proximity to frequently visited places (37%); a comfortable living space (37%); and a home’s utility bills and operating costs (25%). Solar panels don’t make the cut of top features cited.

However, of the top five (out of 12) sustainability issues facing their markets, four were questions about solar panels with most agents and brokers citing the need to understand how solar panels impact a transaction (35%), understanding lending options for energy upgrades or solar installations (33%) valuation of solar panels on homes (32%) and the lack of MLS data about home performance and/or solar installations (25%).

In short, there are still a lot of questions about how solar panels are impacting home values and for a feature that can cost anywhere from $16,000-$23,000 to install. So, we asked some of our McEnearney Associates to tell us about their experience with solar panels in the Virginia, Maryland and DC markets.

Christine Robinson works in Virginia and said consumer education will go a long way to having homeowners experiment with solar technology. When her clients finally found a home that fit their needs, it came with solar panels and also with a lien against the property for the solar panels. The buyers didn’t want to assume the loan for the panels so the sellers had to pay it off before closing. And the listing agent wasn’t knowledgeable about how the solar panels worked so it was up to the buyers to educate themselves about the pros & cons.

Several years ago, even Robinson’s client who is a LEED professional with a background in green technology found it difficult to get clarity on how to get solar installed with new construction, and even harder to get information about solar installations in existing homes.

“I feel strongly that consumers want this type of product but it’s more involved than just dropping panels onto the home,” Robinson adds, running through a list of considerations to keep in mind.

“What upgrades may I have to consider for my home installation? What are the rules in my state? How will it affect my insurance? What safety precautions regarding energy storage, battery back-up, fire suppression, and local utilities do I have to consider?”

Sometimes there are issues with solar panels that have nothing to do with energy supply. Jillian Keck Hogan works in all three jurisdictions and said most owners are indifferent as to whether the panels added value to their home, they installed them for personal reasons. However, the results aren’t always positive.

“We just listed a house for sale/rent in DC that had solar panels and during the listing process we discovered that the installation had caused damage to the roof and led to water damage during rain storms,” Hogan shared. “The company was good at coming out for repairs but it still doesn’t feel like it was contributing to the home in a positive way besides the advantage of a low electric bill and a potential positive environmental impact.”

And for some buyers, it’s simply a no-go. Bob Shaffer, an agent who works in DC and Maryland, has had buyer clients who were definitely “turned off” by solar panels (no pun intended!) “My clients do not take a liking to solar panels and avoid homes with them, even if there were other elements in a home that they liked,” he said.

Some other tips from agents:

– Pay for the upgrades on solar panel roof installation. Just like any home improvement project, there are upsells that will add extra costs but are worth it in the long run. For example, spring for the barriers that will prevent animals from nesting under or damaging solar connections.

– Be sure to check for tax incentives regarding solar or green technology, including those in your local jurisdiction

– Check out this recent segment on WAMU’s 1A radio program that discussed the Inflation Reduction Act and solar energy incentives.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Women Account for 54% of Luxury Homeowners Under 35: SOLRE Report

This week we would like to share some insight from our partners at Luxury Portfolio.

Women account for 54 percent of luxury homeowners under 35, indicating a significant female presence in the purchasing of luxury real estate.

Per a new study from Luxury Portfolio International, more women are climbing the corporate ladder and achieving financial success on their own, with an equal percentage of men and women in corporate leadership – 48 percent – reporting that they hold executive leadership positions. This is reflected in the changing demographics of luxury homeowners.

“Affluent young women are on trajectory to level the playing field, wielding purchasing power, wealth accumulation, education and corporate positions to make serious real estate decisions earlier in their life,” said Mickey Alam Khan, New York-based president of Luxury Portfolio. “This has major ramifications for brands and retailers targeting homeowners and the luxury property sector.”

A Family Affair

Luxury Portfolio’s research has unveiled some interesting changes and value differences amongst Gen Z and younger millennial luxury consumers.

While men continue to dominate luxury homeownership in older age groups (59 percent of those 35-64), women make up 54 percent of luxury property owners under 35. Forty-eight percent of younger women also report holding executive positions at work.

Family dynamics are changing, as well, with more consumers under 35 remaining single (18 percent) and only 77 percent reporting that they are married. Only 6 percent of the older age groups say they are single and 88 percent are married.

Despite this difference, the younger age group seems to hold higher “family values” than their older counterparts.

While 68 percent of both groups want to ensure generational wealth, 92 percent of those under 35 said they prioritized family financial security versus 87 percent of older homeowners, and 65 percent of those under 35 wanted to provide ongoing financial security for their family versus 56 percent of those 35 and up.

The younger age group also owns more extended-family properties – 52 percent of them do, in fact, compared to just 38 percent of older homeowners.

Priority Shifts

When it comes to sustainability, all age groups take small steps, such as using reusable bags and water bottles.

But younger generations are more willing to take big leaps at home: 74 percent said sustainability is a major factor in their home search criteria and 52 percent will pay more for sustainability features, compared to 62 and 47 percent, respectively, for the older generations.

Most luxury homeowners surveyed (91 percent) are considering making more real estate investments.

Multi-family apartment buildings are a popular choice with all age groups.

Interestingly, younger buyers also invest more in office properties (45 percent vs. 37 percent) and properties in college towns (22 percent vs. nine percent). Those under 35 are also looking for vacation homes at a much higher rate.

Unsurprisingly, younger consumers are much more interested in owning digital or metaverse property – 25 percent do so, while only 19 percent of older consumers do.

Agent Advice

For real estate agents looking to tap into the market of younger homeowners, they should look no further than these consumers’ favorite luxury brands for inspiration.

While both age groups expect name recognition from their brands of choice, younger generations put high importance on originality, exclusivity, reputation and social responsibility.

When it comes to the skills their agent possesses, all age groups reported similar interest in a real estate professional who has access to exclusive services, attention to detail, a digital marketing strategy and knowledge of the local market.

However, younger homeowners showed a significant preference for the brokerage’s brand affiliation (38 percent vs. 28 percent) and their agent’s ability to use high-tech tools (32 percent vs. 19 percent).

Younger consumers also look to social media for property content such as photos and videos of homes and a behind-the-scenes peek into the luxury market.

However, the digital sphere will not replace in-person visits or the importance of agents any time soon. Forty-three percent of those under 35 also said they prefer a real estate professional as a resource.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What is “The 85% Perfect Home” and How Does It Help Buyers?

Seeking perfection is noble but it could cost you in this market.

We’ve all read the industry reports and heard buyers’ distress about the lack of inventory in our area. Interest rates have stabilized but are still much higher than what’s been available for most of the last decade. Listings are few, competition is fierce and homes are getting snapped up at top dollar. In a very hot seller’s market, what’s a buyer to do?

Enter “The 85% Perfect Home.” In the HGTV-era, this challenges the notion that the “perfect” home is out there and that all a buyer has to do is wade through multiple listings to find “The One” that will deliver exactly what they want. But this kind of thinking can lead to buyer frustration because holding out for perfection can often mean missing out on an otherwise great home.

As we reported in an earlier article, even in this hot seller’s market more than half the homes on the market are taking more than two months to sell and are selling at a discount. That’s a lot of inventory that’s being overlooked in the pursuit of perfection.

McEnearney Associates recently held a panel with a number of agents to brainstorm ways to help clients find properties that are within their budget, fit with their timeline, and helped solve their housing needs. Here are suggestions from our agents who have successfully helped their buyer clients get unstuck from the belief that the home had to be perfect to be theirs.

Rebecca McCullough

Don’t get stuck on things that are beyond your control like rising interest rates and limited inventory. Figure out what you can afford now. If you are motivated to move, you buy within those means. If last year that was a $1million house and this year it’s an $800,000 house, that’s just the way it is. Stop living for last year’s market.

Renneye Pike

Bring a foldable paper template of your largest or can’t-live-without pieces of furniture that includes the floor parameters as well as height dimensions. This will allow you to see if the house fits your needs logistically but it can also give you an idea of how you will live in it.

Kate Crawley

Is this home meant to be your “Forever Home” or is this a stepping stone? Younger buyers can expect life changes that mean they’ll be shopping for a larger home or taking a job in another area sooner than they expect.

Shagufta Hasan

Think of the “Pareto 80/20 Rule” and how it applies to how you’d live in your house. If 80 percent of your time is spent in 20 percent of your dwelling, then focus on the spaces that you will be using the most. For example, don’t elevate the importance of a dining room if you’re only using it for special occasions.

Gordon Wood

Especially for buyers who move here from less competitive markets, reaching even 70-80% in a home is a win! You can learn that in the first week, or you can take a year to learn that lesson. But there’s a chance that you will miss “The Right Home” by searching for “The Perfect Home” for too long.

Another good suggestion is that buyers can also enlist the advice of a contractor to help see past the current floorplan and price out changes big or small that could make the property fit what you’re looking for. Just having an expert set of eyes to envision how moving a wall here or a doorway there can open up possibilities that are within your budget. Agents have these contacts at their fingertips so don’t be afraid to ask!

Buyers have many concerns that can prevent them from buying a home: paying too much, buying a home that’s not in good condition, missing out on a better property, and more worries. These are valid reasons to keep looking but it’s as important in homebuying as it is in life to know that perfection is almost always unattainable.

Make the best decision with the information and circumstances at this moment and heed the advice of experienced agents who are here to get you into a home that you can make just right for your needs.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link