NAR’s Settlement, What’s not being said

Here’s what’s not being published: why consumers choose to pay us.

Salacious headlines that imply consumers have been duped into overpaying (the same fee) are wrong. That would assume we’re all the same. Also – wrong. Who you hire matters. I don’t care if it’s your hair or your house. Results vary and will depend on who you hire.

Consumers are smart.

Their decisions are the result of a balanced risk assessment.

Let’s use your lawn as another example. Let’s say a foreign species has taken over and is growing at a ridiculous rate. If consumers want to mow it down, they’ll likely do it themselves. If they want a treatment program that actually eradicates the weed, my bet is that they understand it may take more time, effort, and money.

You’re probably thinking, “Yeah—but those are simple things. Buying or selling real property is different.”

Exactly.

Buying and selling real property isn’t straightforward, simple, or low stakes. To propagate any other idea is misleading and harmful.

Why?

Because they know they shouldn’t do a big thing badly, and they know buying or selling is a big thing. It has real and impactful consequences, and there are nuances to their move.

As with any profession, skills matter.

The average consumer intuitively knows this – and they’re willing to pay the right professional.

The proposed settlement will reinforce what is already the best real estate system in the world and the pros who operate within it. To somehow infer otherwise is shortsighted and doesn’t give the consumer much credit.

If approved, NAR’s settlement would change some operational infrastructure and ensure clear communication and education between realtors and their clients.

This settlement isn’t about paying highly skilled realtors. They’re worth it, and don’t be fooled. Consumers know it.

Sandy McMaster, a licensed real estate agent with McEnearney Associates. For over a decade, Sandy has helped hundreds of people in Alexandria and the DC area successfully navigate the changes and reduce the uncertainty that can easily become overwhelming. This experience allows her to see around corners and anticipate roadblocks. When working with Sandy, it will allow you to move quickly, with confidence and the knowledge that, no matter what happens, she’s got you.

Take a look Sandy’s website for all of her listings available throughout Virginia and Washington, D.C.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Pros & Cons of Financing and Appraisal Contingencies

In the immortal words of “The Gambler,” you gotta know when to hold ‘em and know when to fold ‘em in the high-stakes world of real estate negotiations.

It’s not always the offered price of a home that catches a seller’s attention; it could also be how quickly a contract can move to the settlement table. Factors like contingencies – addenda that allow a contract to be voided under certain specified conditions – are an important consideration for both buyers and sellers.

For most sellers, the fewer contingencies in an offer, the better. Every contingency comes with deadlines and terms that must be met and there’s potential for a contract to be delayed or derailed if the buyer doesn’t meet those terms. The reality of the current housing market is that many buyers are waiving their contingencies to appeal to a seller, including two of the most popular contingencies: Financing and Appraisal. But what happens when things go sideways and a buyer encounters trouble financing their loan or the home doesn’t appraise for the ratified contract sales price?

Brian Bonnet, SVP & Senior Loan Officer (NMLS ID 224811) for Atlantic Coast Mortgage, recently spoke with many of our Associates to run through different scenarios that buyers may encounter when using or waiving Financing and Appraisal Contingencies. While he noted that most of the contracts Atlantic Coast Mortgage is seeing have been ratified without a Financing or Appraisal contingency, there are situations where a qualified buyer should be hesitant to waive one or both of these contingencies.

What do these Contingencies do?

The Financing and Appraisal contingencies serve to protect a buyer during the real estate transaction. They are included in an offer that requires the buyer to “perform” according to the terms outlined in the contingency or risk defaulting on a ratified contract. If a buyer is not approved by the lender for their proposed financing, the Financing Contingency gives the buyer the option to cancel the contract without penalty (if they cancel within the terms of the appropriate Contingency Addendum). If a property’s appraised value – an amount that is determined by a licensed appraiser on behalf of the lending institution – doesn’t meet the contract sales price, a buyer has the option to void the contract if the seller doesn’t lower the contract sales price to the appraised value or doesn’t meet the lender’s standards required for the condition of the property.

These contingencies are available to conventional, FHA, and VA buyers while the latter two types of transactions may have additional restrictions on how they are used.

When might a Buyer waive the Financing Contingency?

If a buyer is considering waiving the Financing Contingency, beware of the pitfalls. “It is critically important that their financing is rock solid before they choose to remove that contingency,” Bonnet stressed. He recounted a recent experience with a buyer whose long-time work visa had expired and he therefore wasn’t able to continue at his current job until the visa had been renewed. Because the buyer had a Financing Contingency in place, the contract was voided. Had the contingency not been in place, the buyer could have been subject to losing their earnest money deposit (EMD) or other damages should the seller have elected to sue for defaulting on the contract.

When a Financing Contingency is put in motion, the lender will begin a “canceled, withdrawn, or denied” process and an Adverse Action Letter, also called a Rejection Letter, outlining generic terms of why the financing was denied which is then sent immediately to all parties of the contract. This will be followed up by the buyer’s agent with the required paperwork to void the contract, release the buyer from further obligations, and allow the seller to put the property back on the market.

A buyer may elect to waive this contingency if they are certain their employment is secure, are confident that their financial situation won’t change before settlement, or they are putting down a substantial downpayment that reduces the amount of their loan.

When might a Buyer waive the Appraisal Contingency?

An Appraisal is ordered by the lender to verify that a property is worth the amount of money that is being lent to purchase the property. For example, if a home is under contract for $500,000 the lender will want to see an appraisal value of $500,000 or greater. If there is an appraisal gap between the contract sales price and the appraised value, an Appraisal Contingency will spell out what happens next: the seller can agree to lower the sales price to the appraised value; the buyer and seller can renegotiate the sales price and the buyer can add additional cash to their offer to make up the difference; or the buyer can void the contract. In the absence of an Appraisal Contingency, the buyer is obligated to bring additional cash to make up the full difference in the appraisal gap.

A buyer may waive this contingency if they have a good cash reserve and can make up the difference without the cash outlay affecting the lending underwriting. Another scenario might be when a property is in an area where there is potential for value growth. Even if the appraisal comes in low, a buyer may elect to make up the cash difference because they are predicting that a property’s equity may grow quickly.

What can Buyers do?

- Work with a respected, local lender who will advise buyers honestly and clearly on their individual financial risk. Local lenders have a better understanding of regional market dynamics and can speak to factors that can affect the transaction better than most national lenders who don’t have ready access to local information.

- Ensure that when waiving an Appraisal Contingency, the contract specifies that an appraiser will still have access to the property. Many loans may not be approved without an appraisal, regardless of whether a buyer makes the appraisal a contingency to purchase.

- Consider the condition of the home before waiving an Appraisal Contingency. Even if the market value of the home is determined to be adequate, a lender may not approve a property deemed uninhabitable. Bonnet notes that while the “vast majority of homes meet (habitability) standards, you don’t want to be the lone property that doesn’t.”

Overall, Bonnet advises borrowers to go into any real estate transaction with “eyes wide open to make an informed decision.” Enlist a respected, local lender and an experienced McEnearney | Middleburg Real Estate | Atoka Properties Associate to be the team that helps you land your next property!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Death, Divorce, and Bankruptcy Can Mean For Real Estate Transactions

Real estate transactions can be stressful in the best of circumstances. Add in emotionally complicated factors like death, divorce, or bankruptcy and you’re looking at a process filled with potential difficulties.

A home is more than a collection of bricks, wood, concrete, and glass. It’s the center of daily activities where people gather, memories are made, dreams are discussed and communities are built.

But it’s also an important financial asset – often the largest asset a person owns – and there are circumstances where that asset must be divided and sold. If all parties with a stake in the property agree on an outcome, this can usually be managed cleanly and swiftly. But in instances of death, divorce, and bankruptcy, emotional intricacies and family dynamics can complicate matters. Grief, feelings of loss, anger, and confusion can drive people apart when they most need to collaborate.

Keith Barrett, Founder of Vesta Settlements, recently met with several of our Associates in a discussion on the thorny issues that can arise in real estate transactions and offered insight on how agents can help their clients maneuver through a maze of legalese, high emotions, and fiduciary constraints. Here are some things he encouraged sellers to keep in mind when navigating these difficult life events.

Death

The death of a loved one can be a challenging situation, sometimes causing a dramatic effect on the ability of the friends or family members to manage and sell real property owned by the deceased. To understand how the real property can be sold, we must first look back to how the decedent took title to the property at the time of purchase.

Who has the power to convey title when the owner has died? The easiest situations are when there is more than one seller and they held title (ie: were on the deed) with Right of Survivorship, meaning at the moment of death ownership rights transfer to their survivor through either Tenants by the Entirety (which is available only to married couples) and Joint Tenancy, where two or more parties have equal rights of ownership in a property. In both instances, the surviving spouse or surviving joint tenant(s) need only provide a death certificate to the title company.

A more complicated situation is Tenants in Common, where multiple owners hold title to the property together, but they each own a designated share of the property without the Right of Survivorship. Upon the passing of one owner, their ownership interest passes per their will; if they don’t have a will, then their ownership interest passes per statute in the state of the property (local examples: Section 64.2-200 of the Code of Virginia, Section 42-16 of the Code of the District of Columbia, Maryland Intestacy Law). To sell the property in these situations, the remaining owner(s) must coordinate with the administrator of the decedent’s estate. If the decedent died testate (with a will), then the executor named in the will must file the will with the probate office of the circuit court for the county in which the property lies. If the decedent died intestate (without a will), then one of the descendants must apply with the probate office of the circuit court for the county in which the property lies to be appointed as the administrator of the estate. Once an administrator or executor has been appointed by the probate office, that person may begin the process of selling the property. However, there are mitigating circumstances that may delay the timeline of a sale, depending on the jurisdiction.

The best way to ensure there are few issues arising following the death of a homeowner is to have a will that designates an heir or executor to authorize the sale of the property. Another option is to establish a Trust, which creates a private fictional entity (a document) that never “dies” and which exists to hold and own assets and gives people control over those assets and avoid probate.

Divorce

A divorcing or divorced couple can make a real estate sale stressful for everyone involved. Parties can be angry, vindictive, irrational and uncooperative. When a Realtor® is put into the middle of these relationship dynamics, it’s important that all sides feel heard, respected and empowered in their position. An agent wants both parties to stay focused on the goal of maximizing the proceeds of the sale in order for the sellers to move on to their next respective chapters.

For purposes of real estate, a couple can only be considered either married or divorced. This means that even if a couple is separated, they are still married until the court has entered the final divorce decree and property remains under the current title status (see above for Tenants by the Entirety and Joint Tenancy). However, if the divorcing couple has already agreed to a Property Settlement Agreement outlining how the property will be dispensed, it’s important to share that with an agent because the sale of a property can occur before the divorce decree is finalized.

Parties need to determine how the proceeds are to be divided prior to settlement and if the parties cannot decide on how the proceeds are to be divided, then they must decide where the proceeds should be held (typically, one the divorce attorneys can hold the funds).

Bankruptcy

Bankruptcy is a form of federal financial protection that is unfortunately often viewed through the lens of shame, embarrassment, and mistrust. There are many reasons a seller can be in dire need of financial relief and it can be one of the most anxiety-producing experiences a person will go through.

When a petition for bankruptcy is filed, it triggers an Automatic Stay by the bankruptcy court which protects the debtor from their creditors. However, once in bankruptcy, the debtor is also restricted in how they manage and sell assets, including their home. Here are three ways in which a debtor in bankruptcy can sell their home.

- A seller could obtain a discharge from bankruptcy, which means that they have completed or are on the way to completing the bankruptcy process and the bankruptcy court has closed their case. At that point, they are no longer under the restrictions of the bankruptcy court, and they can sell their property without needing to ask permission. Of course, this also removes the Automatic Stay so creditors can resume trying to collect on the debt.

- They could ask the bankruptcy trustee to abandon the property and move it outside of the bankruptcy. Once the property is no longer a part of the bankruptcy, the debtor can sell the property without needing to have the sale terms approved. A note of caution: When the property is abandoned by the trustee and is outside of the bankruptcy, it is once again subject to creditors, and the bank could restart the foreclosure process if the debtors fall behind on payments.

- They could file a motion requesting that the bankruptcy court approve their sale of the property. Under this option, the seller would list the property and ratify a contract subject to third-party approval. The settlement date must take into account the length of time to get the motion heard by the bankruptcy court and for the appeal timeframe to have expired.

A professional Realtor® is your best advocate in these types of transactions, trained with the knowledge to guide clients through the process and ready to provide resources for areas outside their scope of expertise. Keep in mind that an agent cannot offer advice outside their realm of expertise but they can recommend legal professionals to assist in transactions where title transfer may become an issue. Let an experienced McEnearney | Middleburg Real Estate | Atoka Properties Associate be your advocate and supportive guide through any major life event you face. Because it’s not about us… it’s about you.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Luxurious Technology That’s Transforming High-End Homes

If you’ve got the means, here are tech features sure to dazzle in any property

We recently reviewed smart-home technology that was easily accessible and affordable at various price points, and thought it would be fun to review tech that’s at the higher end of home design. Since we’ve already covered the places you’d expect to see helpful tech – kitchens, bathrooms, and garages – there are plenty of other interesting ways architects and designers are creatively incorporating luxe tech throughout the home.

The Ups & Downs of Living the High Life

Elevators are common in larger vacation properties but they are becoming more popular in full-time residences as homeowners look for ways to avoid stairs in vertical homes, especially for owners who require mobility assistance, want to age-in-place, or for large families with strollers and supplies to ferry up and down. Michael Caporiccio of TK Elevators reports that installing a small, 3-stop elevator with a capacity of about 750 lbs. runs about $80,000, while a larger unit similar to the size in a public building with a capacity up to 2,000 lbs. could be as high as $150,000. Maintenance costs and repairs can be pricey, but for those who desire the ease of pushing a button and gliding to the top, a luxe lift is at the height of affluent abodes. Take a peek at this Clifton listing by Joan Reimann which features an elegant elevator.

What Are You Hiding?

Home bunkers have come a long way from Cold War Era basement enclosures, and from Panic Room to the recent Leave The World Behind, Hollywood loves to showcase how the upper echelon hides away their treasures – both material and personal. From a “safe room” where residents can protect themselves or their valuables from a home invasion or extreme weather event to entire wings of a home meant for sumptuous hiding out, security-conscious owners are adding protective home tech at an increasing pace. According to Mansion Global, costs can range from $30,000 to $80,000 for high-end vaults, $50,000 to $300,000 for basic armored rooms, and over $1M for elaborate constructions – usually in a home’s basement or dug deep into the ground elsewhere on a property. But not all hideaways have to be over-the-top: see if you can spot the tidy hidden room in this current McLean listing, represented by Chris Pritchard and Barbara Patton.

Climate-controlled wine vault in Capitol Hill Rowhouse listed by Lisa Coutts with Cher Castillo & Co.

Where Everybody Knows Your Name

Who needs a night on the town when you can serve the best drinks in town at your deluxe watering hole? Wine rooms and cellars and their tech-forward features have been de rigueur for luxury homes but in-home posh pubs are gaining ground. No longer relegated to tucked-away bar carts or basement “man caves,” these entertaining areas add a dash of glamour and style with high-tech twists, courtesy of temperature regulators, automated home brewing machines, expert mixing gadgets, and saucy cocktail apps. Check out both the sleek bar and elegant wine room in this McLean listing represented by Sara Fox and the lavish tasting room in this Leesburg home listed by Jackie Wynn…cheers!

Grab Some Popcorn and Take a Seat

No tech-forward dwelling is complete without a home theater and there are as many ways to outfit the space as there are entertainment options. Bespoke electronic systems – including TV, home cinema, audio, mood lighting, and VR gear – can be used by all members of the family and add engaging activities to any gathering. Advances in electronics move faster than most other home tech so it’s worth it to keep up with trends from experts at CES, which just held its annual conference and showcased some of the newest TV advances, including features like transparent screens, a 115” model and even a foldable TV! Try out the funky media room in this Purcellville listing by Thadd Kezar and dream about what you might add.

The Great Outdoors

Outdoor space is getting a LOT of attention at the moment, perhaps from when we were sequestered during the pandemic or as a way to maximize all the space of a property. And while the ole backyard might not seem like a place for high-tech, there are opportunities to add a bit of science to the flora & fauna. From spa-worthy pools to al fresco kitchens to eco-friendly gardens, outdoor spaces are being lavished with luxe touches. For an example of sublime outdoor spaces, spend some time with this serene oasis in The Plains, courtesy of Kevin Chung, the tiki bar and putting green at this Alexandria listing by Rebecca McCullough, and the expansive bucolic views from this Front Royal estate – with space for a helicopter or an RV! – listed by Anne McIntosh & Maria Eldredge.

Whether your budget allows for the maximum inclusion of state-of-the-art features & finishes or you’re more modest with the luxe touches, the opportunities to test out home tech can be found for every room of your home at every price point. Let an experienced McEnearney | Middleburg Real Estate | Atoka Properties Associate guide you to the home that fits your needs and speed!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

First-Time Homebuyer Programs to Help Smooth Purchase Challenges

Eric Boutcher, Atlantic Coast Mortgage.

It’s not easy being a buyer right now, but there are important lending and grant programs that give first-time home buyers a head start.

Navigating the intricacies of the real estate market can be daunting for any home buyer. From finding the perfect property to securing the best deal, the journey to homeownership can be filled with challenges. Partnering with the right professionals can make all the difference. Throughout the DMV, there are a number of programs available for first-time home buyers as well as qualified repeat buyers that may provide you with valuable assistance.

Let’s dive into a high-level overview of some programs that may help make ownership more affordable.

DC Open Doors:

DC Open Doors is a program aimed at making homeownership more accessible. It offers 100% financing options via 0% interest, deferred down payment assistance loans, as well as reduced mortgage insurance costs to qualified buyers. The program is open to both first-time and repeat buyers, with income and purchase price limits, and provides educational resources and counseling to help individuals navigate the home-buying process.

DC Tax Abatement Program:

The DC Tax Abatement Program is designed to assist low- to moderate-income individuals and families in Washington, DC, with purchasing a home by providing relief from certain property taxes. Eligible buyers may receive an exemption from paying the recordation tax at closing and an abatement of the real property tax for the first five years of homeownership. To qualify, applicants must meet income and purchase price limits, use the property as their primary residence, and fulfill other criteria. The program aims to make homeownership more accessible and affordable for residents, particularly those with lower incomes, by reducing upfront and ongoing housing costs.

Discounted Recordation Taxes for first time DC Buyers:

First-time purchasers in Washington, DC might be eligible for a significant discount in the recordation taxes paid to the District. For a purchase price below $400,000, both the buyer and the seller typically pay 1.1% in taxes; at or above a $400,000 sales price, both parties typically pay 1.45% in tax. For those individuals purchasing a primary residence in DC, eligible for the homestead deduction, and below certain income limits, the amount of recordation taxes you will have to pay can be capped at .725%. As an example, for the purchase of a $600,000 home in DC, a qualified individual would only have to pay $4,350 in recordation taxes to the city rather than the standard $8,700 – a savings of $4,350!

VHDA:

The Virginia Housing Development Authority (VHDA) is a key resource for individuals seeking to achieve homeownership in Virginia. Recently, VHDA introduced groundbreaking changes aimed at expanding accessibility to their programs, notably eliminating the first-time homebuyer requirement which opens opportunities for a broader range of buyers. Additionally, VHDA offers a 2% grant program, providing financial assistance towards down payments and closing costs, easing the financial burden of purchasing a home. Another noteworthy initiative is the VHDA Plus program, which offers 100% financing, and some buyers may even qualify for an additional 1.5% in funds to be applied toward closing costs. Through the recent guideline changes, VHDA is enhancing affordability and making homeownership dreams more achievable for Virginians.

Maryland Mortgage Program:

The Maryland Mortgage Program (MMP) offers a range of products to assist Maryland residents in achieving their homeownership goals. These include:

- Down Payment Assistance: MMP provides various down payment assistance options, including grants and loans, to help homebuyers cover upfront costs.

- Maryland SmartBuy: Aimed at helping individuals with existing student debt purchase a home, SmartBuy offers assistance with student loan repayment through a home purchase incentive.

- Partner Match: MMP collaborates with local employers, nonprofits, and other organizations to offer additional down payment and closing cost assistance to eligible homebuyers.

- Mortgage Loans: MMP provides fixed-rate and adjustable-rate mortgage loans with competitive interest rates and flexible terms, catering to a variety of financial situations and preferences.

- Flex Loans: These loans offer higher loan-to-value ratios and relaxed underwriting guidelines, making homeownership more attainable for individuals with lower credit scores or limited down payment funds.

Overall, the Maryland Mortgage Program provides a comprehensive suite of products and services designed to make homeownership more accessible and affordable for Maryland residents.

ACM Grant Program for Eligible First-Time Buyers and Community Partners:

Atlantic Coast Mortgage offers a grant program for eligible buyers to help with down payment and closing cost assistance. Eligible first-time home buyers can receive up to a $12,500 grant and community partners – which includes firefighters, first responders, doctors, nurses, law enforcement, educators, and more – may be eligible for a grant of up to $15,000. This program has income limits based on household size but is eligible throughout the DMV and beyond.

Beyond the programs highlighted above, there are conventional loan products offering as little as 3% down, programs that offer reduced interest rates and mortgage insurance costs, and other programs that might be a better fit for your specific needs. Discover why working with the right team of experts who understand how to navigate the market is essential for a smooth and successful home-buying experience.

Eric Boutcher,

VP, Sales Manager, Sr. Loan Officer

NMLS ID: 1063065

Atlantic Coast Mortgage, NMLS: 643114

O: 202-347-0908 | M: 202-870-6343

Email Me

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Does a Real Estate Agent Really Do?

If you were to watch an episode of Million Dollar Listing or any of the many other real estate shows you might think you have an idea of what a real estate agent actually does on a day-to-day basis: they spend their days looking at gorgeous properties while driving around town in a fancy car and cashing large commission checks.

As with many things in life, what you see on TV is seldom an accurate representation of reality. Unless you have recently bought or sold a home, you likely have very little idea about everything that real estate professionals do to serve their clients. So, let’s take a look at just a few of the things an agent must do to be a successful local expert:

Market Knowledge – You’ve probably been at a party or an event, found yourself talking to a real estate agent, and asked them, “How’s the market?” Being able to answer this question accurately, clearly, and with relevant market data is something every agent is expected to do. They have to stay up-to-date with market activity, statistics, trends in pricing, and how one segment of the market differs from another. Our clients rely on us to advise them on pricing and it’s our responsibility to deliver.

Contracts – The DC Metro real estate market differs from many other parts of the country, and in our region, your agent is responsible for drafting and negotiating contracts on behalf of clients. These are legally binding documents so your agent is always working to understand every word of the contract, some of which can be up to 70 pages!

Marketing and Advertising – In addition to marketing properties, successful agents put together a comprehensive communication and outreach plan to stay in touch with clients and network with other agents. That can involve client events, mailings, market reports, and much more.

Business Development – Agents are the CEOs of their own start-up companies and they must have the right strategies in place to be successful. Much like marketing and advertising, most agents will have a business development plan in place to generate more leads and grow their business.

Social Media Manager – Real estate agents are just like most other businesses in that having a presence on social media and keeping up with ever-evolving trends is imperative.

Financing – Because agents work closely with loan officers throughout the buying process, they must have a strong understanding of myriad financing and loan programs to accurately advise their clients.

Multiple Jurisdictions – Whether your agent is working in Virginia, Maryland, Washington, DC, West Virginia, or any other state, they must know the difference between them as it pertains to things like tax rates, building restrictions, and much more.

Costs – It’s an absolute requirement that your agent knows the costs their clients will incur during the purchase or sale of their home. These include things like transfer and recordation taxes, settlement fees, lending fees, home inspection costs, and many more.

Community Knowledge – A good agent stays continually informed on what’s happening in the communities where they work, including development projects, transportation initiatives, changes to local schools, businesses that might be coming to or leaving the area, and any number of factors that could impact property value.

Continuing Education – Agents are constantly learning. In addition to continuing education required by every jurisdiction to maintain a license, agents attend national, state, and local seminars and conferences, participate in weekly or monthly brokerage business meetings, and serve on association committees to gain the knowledge that helps them better serve their clients. That’s in addition to the daily industry news they keep up.

These are a few of the many areas where a good real estate agent is a market expert, but this does not include other things an agent does daily like being a therapist, couples counselor, furniture mover, house cleaner, landscaper, babysitter, florist, stager, window washer, trash hauler and so much more.

We love what we do and we work hard to represent our clients’ best interests but it’s not always as glamorous as it’s portrayed on TV.

Andy Hill is Executive Vice President and Managing Broker for the Washington, DC and Maryland offices of McEnearney Associates.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Must-Have Smart Tech Features That Are Affordable For Any Home

Upgrading technology in your home doesn’t need to be expensive or difficult to incorporate.

The 2024 Spring Housing Market has already taken off, with declining interest rates bringing many homebuyers off the sidelines and into the purchasing game. Sellers are preparing their homes for eager buyers and are learning what features will attract the most offers at the highest price. And while fresh paint and gleaming floors will always be pleasing to see in a home, there’s one thing that savvy buyers are asking for more than anything else: convenient, integrated, and affordable Smart Tech throughout the home.

We polled our McEnearney colleagues to find out what the easiest and most popular features are that are mentioned by their clients to make life easier, energy efficient, and, in some cases, fun!

Tom Hallex, a key member of McEnearney’s Digital Resources team, has incorporated many of the most common and inexpensive gadgets in his own home, including a Nest doorbell and door lock which allows for remote access to view visitors to your property and access into your home; a myQ garage-door opener that allows for individualized PIN code access and visual access to confirm activity around the garage entry; smart-outlets like Enbrighten that work with a home’s wi-fi for remote on/off control and customizable adjustments with voice or app commands; and even a wi-fi linked microwave for under $200!

Realtor Sean McEnearney is also a fan of smart-USBs after working with a tech-savvy seller client. “I was selling a townhome for a client a few years ago and there was a lot of work that needed to be done before we put it on the market, especially in the kitchen and master bath,” Sean recounts. “He replaced a few outlets and had the electrician install outlets that included USB receptacles as well as the typical electric outlets. He had them installed in the master bedroom and bath as well. It was a small thing, but a thoughtful add-on that impressed me.”

Rookie Realtor Rachel O has been learning what’s on the Tech Must-Have list for buyers, including her own husband who wanted at minimum a smart thermostat and the aforementioned USB plugs incorporated into the outlets. But it’s understanding what younger buyers, who have grown up with accessibility at their fingertips, want in a home that keeps her alert to tech trends and what makes for a quick sale.

“I’ve seen a lot of new construction homes that have (common tech gadgets) included and my newlywed first-time homebuyers in their early 30s do seem to have an expectation and preference for these inclusions. I believe if an older home had them, they would likely be more inclined to purchase,” O shared. “The best thing I’ve seen thus far is a smart oven that allows you to preheat your oven from your cell phone so that you can start it on your way home from work and then immediately pop in your food to be cooked.”

Moving up the chain to affordable luxury, Top Producer Realtor Susan Tull O’Reilly cited a recent sale that had a built-in wine cooler with select zones for different types of wines, even in a small space: colder on the bottom and less chilled on top. A quick search shows that there are intricate builds for the expert sommelier but even vino neophytes can find tech-enabled options that offer climate-centric options in a small package, ranging from the $200 range to up and above $4,000.

In a sign of must-haves to come, Realtor Christine Robinson is seeing more and more homeowners investing in tech like electric vehicle (EV) chargers – popular in both sales and rentals – that range in price from $300-700. Search recent home listing descriptions and you’re likely to see this feature spotlighted as a selling point and some sellers are willing to add them for on-the-fence buyers. She’s seen clients who both want and loathe solar panels but the trend toward sustainable construction means solar technology will continue to be a factor in home improvements.

One of the tech features mentioned most often by our agents were home generators, both portable generators that sell for an affordable $300 and up, and standby generators which are professionally installed and cost between $5,000-$7,000.

Read more here about tech features in high-end homes that are popular with luxury buyers. Be ready to be dazzled! In the meantime, if you would like a tech-savvy agent to assist you with insight into what appeals to buyers and sellers in this busy market, reach out to a McEnearney | Middleburg Real Estate | Atoka Properties Associate to get the right home ecosystem for your needs.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

There Are More Options To Homeownership Than You Think

There are myriad programs and creative financing options that can pave the way to owning a home if you know who to ask and prepare ahead.

As we prepare for the 2024 spring market, Realtors and their clients are having in-depth discussions about what they can afford and how to secure their financing. But many wannabe buyers are dissuaded from believing homeownership is in the cards because they don’t have a big down payment, need to sell an existing home first, or are retired, among other hurdles. But with guidance from a savvy lender, the doors to homeownership start to open up.

Brian Bonnet and Carey Meushaw of Atlantic Coast Mortgage recently held a class for McEnearney agents to review financing programs and products for buyers eager to purchase but who need a little extra help putting their financing together. They reviewed common buyer challenges and the solutions available through ACM’s lending programs and those offered by housing agencies like Virginia Housing, Maryland’s Community Development Agency, and DC’s Open Doors.

Scenario 1: First-time purchaser with little available cash

Agents shared that many buyers are waiting on the sidelines because of concerns of not having a 20% down payment. In reality, Meushaw explained that there are many lower down payment options, even for conventional loans.

For Fannie Mae and Freddie Mac, who provide guidelines for the vast majority of loans originated nationwide, the minimum down payment is only 3% for first-time homebuyers (which applies even if you’ve owned a home before but not in the last three years) and for higher-priced loans of $766,550-$1,149,825 the minimum down payment is only 5%. There are even lower down payment programs, such as those provided by VH, which are income-dependent programs with 0-3% down payments. VHDA provides both conventional first mortgages up to 97% and grants that can be used toward down payments.

In one example Bonnet shared, a qualified buyer using the Virginia Housing (VH) Plus program could purchase a $300,000 condo with a first mortgage of $291,000 and a second mortgage of $13,500 for total financing of $304,500. That means the buyer can finance $4,500 of the total closing costs, leaving them with a cash requirement of roughly $8,200.

In another example, for a $500,000 townhouse with a first mortgage of $485,000 and a second mortgage of $22,500, the borrower’s cash needed is approximately $7,900. In both scenarios, buyers do need cash funds, but as seen in these examples, the amount required was less than $10,000, much lower than many buyers expect they’ll need.

Scenario 2: Home to sell and can’t compete with a Home Sale Contingency

In a competitive market, a home sale contingency is generally a non-starter for sellers who want “clean” contracts with few or zero contingencies, but agents know that potential seller-buyers want to avoid selling their existing home before they have their next home to move to. Stalemate, right?

Not always, says Bonnet. “I have active customers who thought they couldn’t purchase before first selling because they needed the cash equity from their existing home, and they cannot qualify for the new traditional loan without getting rid of the existing home loan,” he shared as he explained how they worked out a plan using a bridge loan.

There are two types of bridge loans that Atlantic Coast Mortgage offers: a cash-out bridge loan and a purchase bridge loan. In the first, owners can refinance their current home to allow for a line of credit that can be used for a down payment or closing costs on a new home and must be repaid within three months.

“We have qualified them for a bridge loan on their existing home without consideration of their debt service on the next home,” Bonnet explained. With that bridge loan, they convert equity to cash to be used as a down payment on the next $1.1M home.”

Bonnet continued, “Because they don’t qualify for a traditional loan on the next home while carrying the debt on the existing home, we have also qualified them for a bridge loan on the new home without consideration of the debt on the existing home. With this unique Atlantic Coast Mortgage underwriting guideline, the seller-buyers are now able to write a contract that is not contingent on the sale of their existing home, and, if they choose, they can waive financing and appraisal contingencies and be in the hunt as competitive prospective homebuyers.”

Scenario 3: Retirees and self-employed buyers without steady incomes

There are other ways a smart lender can set clients up for success, even without a monthly income. Self-employed buyers will have many deductions that can reduce their net income (on paper), but with the right documentation, lenders can help them add back depreciation, thereby increasing their eligible qualifying income. Meushaw also ran through an example of a retiree who could begin drawing from their qualified retirement account penalty-free at 59 ½ years old. With a $1M retirement fund, the retiree could set up a distribution of $10,000/month that can be counted as immediate income that can be used for qualification purposes.

Both Bonnet and Meushaw agreed that the more information a lender has, the better they can advise buyers, and advise buyers to get in contact with their financing expert as soon as possible. This gives buyers the opportunity to review with their lender which programs they might qualify for and what timelines they will be working under.

Don’t let a challenging market get in the way of your dream of homeownership. Work with an experienced McEnearney | Middleburg Real Estate | Atoka Properties agent and trusted lender to find the options and avenues you didn’t know were possible to get you on your way.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

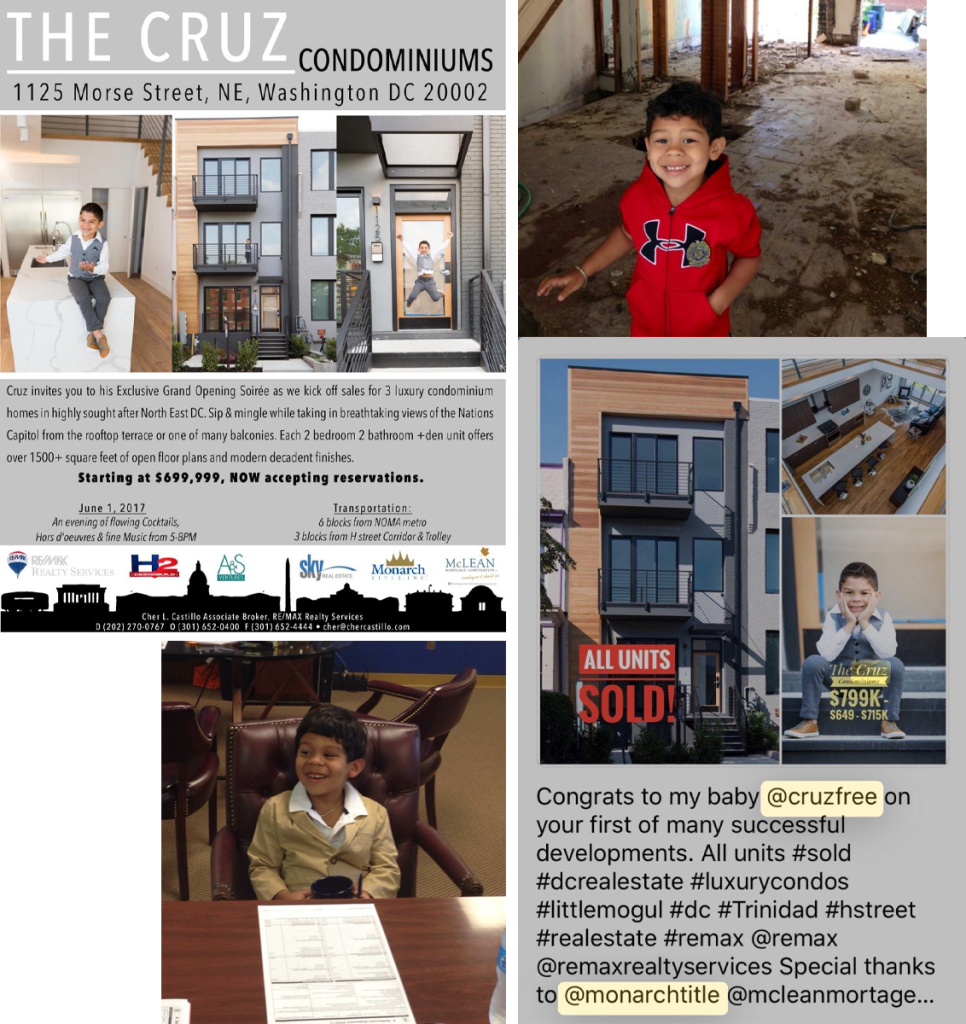

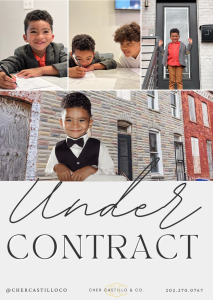

How Young Moguls Are Shaping Generational Wealth Through Homeownership

How young is too young to be a homeowner? For the minor children of a top-producing Realtor®, you can’t start soon enough.

Cher Castillo began building her real estate savvy when she was an undergrad at the University of Florida in the late 1990s and found a condo she thought was a great buy at only $40,000. But she needed the help of her mother, who was not enthusiastic about the purchase and passed.

By the time Cher graduated, that little condo had increased in value to $200,000 and she knew her instincts had been correct. She also knew that one day when she had a family of her own she would encourage them to take the leap into homeownership as soon as possible.

That’s how her sons Cruz and Lincoln both became property owners at age 4.

But before sharing her wisdom with her children, Cher first had to build her own knowledge base. She was finally able to buy her first home after graduating and moving to the DC area at age 22 for a job on Capitol Hill. She beat out 15 other offers and paid $150,000 for a Victorian row home in Eckington that was in need of renovations, which she did herself room by room.

Along the way, she discovered a love for the property development process and making an income in real estate. She sold the home 2 years later for $450,000 and after purchasing two more properties, she opened her own brokerage at 26.

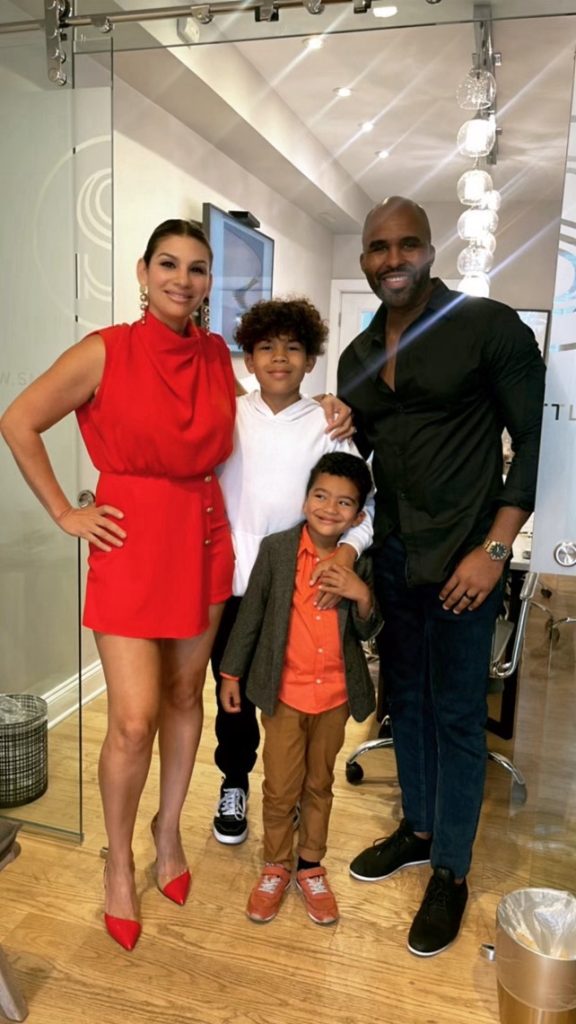

Fast-forward to the present and Cher’s family includes a blended family of six children, all of whom have an interest in real estate. But it’s the youngest who have – quite literally – become the poster children for building generational wealth through real estate.

Cruz, now 14, became an owner at age 4 with the purchase of a property in Baltimore for the nominal amount of $2,500 (which Cher had negotiated down from $10,000) and without yet doing any improvements have already increased in value to $125,000.

She asked Cruz, now that he owned a property, what he planned to do with it. He answered, “Renting! That way I get money every month rather than selling it and just get money once.” His ability to conceptually understand the complexities of buying and holding real estate impressed Cher, but Cruz took it in stride. “I listen to you all the time in the car, Mom,” he told her.

Not long after the Baltimore purchase, at age 8 he became the face of Cruz Condominiums, a development with three luxury condos in North East DC. “He really got a turn-key experience in terms of developing and selling with this project,” Cher recalls. Cruz accompanied his mom on project development meetings, renovation tours, and open houses, and was featured in all the property marketing. Cher says that he has a large poster of himself and the condos on his wall at home and is proud to show it off to his friends, who are also curious about real estate.

“We lived on the same block that the condos were being built and kids would come by and ask questions,” Cher says. “They would see my name on the sign and wonder what that meant, and I was able to explain how real estate worked.”

Lincoln followed his big brother and bought his first property in Baltimore City as well and went through the purchase process just like any other buyer, complete with a settlement meeting arranged by an attorney friend of the family.

Obviously, the purchase of real estate property by a minor requires responsible adults to navigate the process, but the homes are indeed in the childrens’ name through an LLC that is connected to a trust that the boys will have access to at age 21. “IF they behave themselves,” Cher jokes. She advises that parents or guardians who want to purchase properties in their kiddos’ names should first consult an attorney and an accountant to ensure legal and financial logistics are buttoned up.

Cher also advises having a trusted Realtor® guide the property search and dig for information about what areas are ripe for investment. “Don’t just buy because it’s cheap,” she cautions. “Is it in an area where development is happening? Is there growth potential? Approach it with an investment mindset.”

She also encourages parents and guardians to involve and educate their children throughout the home

-buying process. “If you are going to do this, walk your kids through it from A to Z so they understand all the parts of the transaction,” she says. “Helping them understand the journey is the part that will make them fall in love with the process.”

To that end, Cher is developing a non-profit she calls Young Moguls, aimed at helping 4-17-year-olds learn how to build a real estate portfolio and generate wealth and equity at a young age.

The most important thing that Cher wants children and the adults who are guiding them to do is not to wait to buy real estate. “If you show them the possibilities of home ownership as early as possible, they won’t be afraid of it in the future.

Cher Castillo & Family

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Is Buyer Agency and Why Does It Matter?

Buyers’ Agents are getting a lot of attention thanks to a recent ruling on real estate commissions and it’s important to know why they are crucial to selling a home.

Recent signals by the Federal Reserve to cut rates in the new year are expected to usher in an improved market for buyers in 2024. As interest rates continue to decline it will not only increase buying power but it will also increase inventory as sellers who also need to buy are encouraged by lower mortgage rates to list their properties for sale. At the same time, new home builds are increasing as contractors see their building costs decline.

And with more buyer activity, there will be Buyers’ Agents ready to assist them in the purchase of their next home. Recently, there’s been an intense focus on buyers’ agents’ commissions, thanks in part to October’s Stitzer-Burnett antitrust judgment, which found that the National Association of Realtors® (NAR) and several large real estate franchisors conspired to inflate commissions. The jury awarded damages of more than $1.8 billion and the verdict is being appealed even while similar cases are being filed throughout the country.

It’s a developing story and one that has many perspectives – sellers, buyers, brokerages, and Realtors® – in the mix. But it’s buyers’ agents who will be key to helping navigate the debate for their clients.

Very simply, a Buyer Agent is a Realtor® or licensed real estate agent who represents the interests of a buyer in a sales transaction. Buyers don’t have to use an agent to buy a home, but most benefit from the knowledge, contract expertise, negotiation skills, and helpful connections during the transaction and beyond that a professional Realtor® provides.

In our region, a Buyer Agency Agreement is usually the first time a client learns what their agent will do for them during their home purchase process. It outlines the tasks an agent is required to perform as well as what the buyer is responsible for and includes a paragraph about how the Buyer Agent is paid. These agreements have been used in real estate since the 1990s and help ensure that all parties understand the agency relationship – including loyalty to the client, confidentiality about the information shared, fiduciary responsibility, and required disclosures – and offer clients the opportunity to ask questions and negotiate terms before a home search begins.

But the most important assurance the Buyer Agency Agreement offers is that a client can trust that their agent will represent them to the fullest extent and put their interests first. The seller has their own agent negotiating on their behalf so it makes sense for a buyer to avoid any conflicts of interest by also having their own representative – their champion! – during the sale. In short, a Buyer Agency Agreement ensures transparency and accountability for everyone involved.

Like buyers, sellers can represent themselves, but most hire a real estate professional to list a property and protect their interests during the transaction. In the Washington, DC metro area, the majority of homes are sold with agents, and commissions from these sales are paid to brokerages, most of whom have affiliated agents as independent contractors.

Traditionally, sellers have paid both their listing agent’s fee/commission and that of the buyer’s agent (also called a co-op fee) for bringing a qualified buyer and managing the transaction to settlement. How much commission a seller chooses to pay, and whether to offer a co-op commission, is always negotiable. These fees are disbursed at settlement, meaning both the seller’s listing agent and the buyer’s agent get paid at the end of the transaction. In the meantime, both agent sides are incurring business and operating costs that they will pay with the commissions they eventually earn from their brokerages.

One of the arguments in favor of co-op fees is that it helps buyers’ purchasing power. If buyers were required to pay the agent’s fee it would greatly reduce buying power, adding commission expense on top of hefty down payments, closing costs, and inspection fees. This would significantly impact first-time, FHA, and veteran (VA) buyers, especially those with limited equity and generational wealth. Rising home prices have already kept many of these buyers on the sidelines and could exclude an entire group of would-be homeowners. Many in the industry worry that buyers will instead choose to be unrepresented in a transaction rather than hire an agent, opening themselves up to being at a disadvantage during negotiations, inspections, deadlines, and appraisals.

While the co-op fee is at the heart of the debate in the NAR and brokerage lawsuits, it doesn’t take away from the expectation that professionals like Realtors® should be paid fairly for their work in representing their clients and their clients’ goals of homeownership. The question of who will pay for that compensation is one of the most hotly debated topics in real estate right now and will be for some time to come.

Don’t be afraid to ask your agent about commissions and how they may affect your home purchase. A professional McEnearney Associates | Middleburg Real Estate | Atoka Properties agent is ready to answer all questions, provide guidance and clarification, and get to work representing you!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link