It’s All Relative: Helping Family Fund Their Way Home

Tapping into monetary gifts and family financing can be a creative – and caring – way to help loved ones get the home they want.

Real estate is one of the most effective ways that families build, generate and protect their wealth. Home appreciation offers cash equity, vacation and investment properties bring consistent revenue streams, and multigenerational living allows extended family to share expenses.

But with rising home prices, interest rates the highest they have been in a generation, and a lot of graduates carrying significant college loans (often for decades), it can be difficult if not outright impossible for new buyers to fund the purchase of a first home. According to the most recent report from the National Association of Realtors, the share of first-time home buyers in 2022 dropped to a record low of 26%, while the age of a typical first-time buyer increased to an all-time high of 36 years old, in part due to the time it takes to save for a down payment.

So, how can parents, guardians and caregivers help the next generation get to that first rung of the home investment ladder? Here are a few important family financial strategies that can guide cash-strapped relatives to the home of their dreams.

Family as Landlord – It’s often the lament of would-be Empty Nesters: a kiddo moves back home after school, during a break-up, or, more recently, into a COVID-19 bubble and just never left. Yet, all this togetherness can be a great opportunity for lessons on budgeting, saving and investing. Assuming your live-in lodger has an income, charge a small but fair amount for rent and household expenses that will be put into savings or an investment account to be used as a down payment. It may take time for this nest egg to grow but with each deposit the goal of moving on will be closer and the practice of regular saving will pay off in the long run.

Give Money – Monetary gifts for a down payment are the easiest way to assist a family member with a home purchase and can be tax free within IRS guidelines. Gifts must come from immediate family – parents, siblings, grandparents, spouse or even a partner (if engaged to be married) – and there can’t be a plan for repayment, so nothing with “strings attached.” This will be spelled out in a gift letter that will be shared with the lender. Current monetary limits are $15,000 per person buying a home, meaning if a purchase has two buyers then there can be $30,000 in gifts. Discuss any gifts with your lender to ensure they are documented properly and used accordingly.

Finance the Mortgage – Someone looking to park their cash in real estate can make it work for the greater family good and act as the lender, funding the purchase but without additional fees and a reduced interest rate. Family lenders must charge at least the Applicable Federal Rate (AFR), the minimum interest rate required to keep the assistance from being considered a gift. These rates are almost always much less than the current market rate and are three AFR tiers based on the repayment term of a family loan:

- Short-term rates, for loans with a repayment term up to three years.

- Mid-term rates, for loans with a repayment term between three and nine years.

- Long-term rates, for loans with a repayment term greater than nine years.

Rates change monthly. For example, the short-term rate for May 2023 is 4.30% (for April it was 4.86% and for March it was 4.50%); mid-term rate for May 2023 is 3.57% (for April it was 4.15% and March was 3.70%); and long-term rate for May 2023 is 3.72% (for April it was 4.02% and March was 3.74%) (Figures from NationalFamilyMortgage.com as of April 24, 2023). Before finalizing a family loan be sure to consult with an accountant or tax authority for any potential tax liability.

Co-Sign the Mortgage – Being a signatory on any debt can have risks, but sometimes it’s the fastest way to get to the settlement table. When co-signing a mortgage, the bank will take all borrowers income, assets, debts and credit worthiness into account and hold all parties equally liable. This is where having a clear and mutually agreed upon plan is critical as missed payments or a default on the loan will negatively affect all parties. Co-signers do not have to be on title, but it might be in their interest to be named on the deed so that they are co-owners and not just co-borrowers, giving them more say in management of the home as an asset.

Family as Landlord, Part 2 – Buying a home for a relative to rent is another win-win option, especially if the payment is going to a rent-to-own situation where a portion of the rent is banked toward equity in the home, or for down payment on the purchase of another property. For example, parents who buy a home and allow their child to live in it might be able to take tax deductions on property taxes, mortgage interest, repairs, maintenance, and structural improvements. Check IRS guidelines to determine rent requirements vs. personal use so there are no tax surprises.

It Takes a Village – It’s not for everyone, but bringing several relatives under one roof can be a windfall in more ways than one. Multi-generational living is nothing new, with benefits like convenient & trusted childcare, shared expenses and the ability to “age in place” giving families support and a safety net to help through life’s joys and challenges. Pooling resources among relatives increases buying power and can offer different options for what the living structure will look like: a larger traditional home, a multi-unit building where the family lives in one part and rents out the other, or a large tract of land where family dwellings can be built close together and share a common space.

As with any financial arrangement, it is important that all parties are clear about expectations and responsibilities. This is even more important with family members where emotions and personal history can have an outsized influence.

But when looking at ways to help the next generation get on the road to home ownership, sometimes it is the case that “family knows best.”

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Statistics Tell the Story

If you know how to read them, sales and inventory statistics reveal what is really happening in the local real estate market.

Listening to the news, it’s easy to be confused about what is really happening in real estate. Some analysts predict a crash, others say there’s no end in sight to rising prices, and others hold their fingers to the wind and take a check whenever interest rates rise and fall.

But if you are a buyer or seller and want the best strategy for your needs, where do you get real answers?

David Howell, McEnearney Associates’ Executive Vice President & Chief Information Office, gave a deep dive discussion on statistics to help address the questions and concerns that clients are sharing with their agents.

“It’s easy to get discouraged if one is a buyer or seller by some of the national headlines and media that talk about how terrible the market is,” Howell observed of news coverage of rising interest rates and other challenges, but he noted that, “We have the good fortune of being in a metropolitan area that is probably among the strongest residential real estate markets anywhere in the country.”

“We don’t want clients to make decisions based on fear or inappropriate information about what’s really going on in the market,” Howell said. There are still opportunities at every level of the market to make a great deal come together, if you know where to look.

Here are a few of the takeaways.

Is the DC/MD/VA Housing Market Really Crashing?

The DC-Metro area is one of the strongest housing markets in the nation, thanks to many factors including our employment anchors – government, technology, military, media – that keep people moving steadily into and out of our region. Howell shared that our region was never as overheated as some markets elsewhere in the country like Austin (ex: recent +350% increase in inventory should push prices down), Phoenix, Las Vegas and others.

Looking at Northern Virginia in February, for example, 43 percent of homes sold at or above the original list price. Howell added that at this time last year housing inventory was at less than a half-month’s supply and that still remains the case today. A four-month supply of housing is generally considered the threshold of a “balanced” market and we are nowhere near that in any price point in any jurisdiction throughout our region, Howell shared. DC has the highest at 2.2 months inventory.

“This is in fact a Seller’s Market,” Howell said. “Buyers need to know that in terms of negotiation strategy, sellers need to know it because it’s an incredible opportunity if they price right.”

Price Matters & Time Kills

Even in a strong seller’s market, proper initial pricing is more important than ever before. “If you price it right, you’re likely to be rewarded in a significant way. If you price it wrong in the beginning, you’re likely to get hammered in a significant way,” Howell said.

And if a listing is not getting offers within the first three weeks, the market is telling you that the price is wrong.

For February 2023, in Northern Virginia 43 percent of homes sold an average 3 percent at or above list price in an average of 13 days, while the remaining 57 percent of homes sold an average 5 percent below list price in an average of 63 days. In other areas the numbers showed a similar trend, with an overall difference of about 10 percent between pricing right and pricing too high:

- DC – 27 percent of homes sold an average of 3 percent above list in 21 days while the remaining 73 percent sold at nearly 7 percent below list price and in an average of 85 days.

- Montgomery County – 44 percent of homes sold an average of 4 percent above list in 12 days while the remaining 56 percent sold at 6 percent below list price and in an average of 64 days.

- Prince Georges County – 27 percent of homes sold an average of 4 percent above list in 19 days while the remaining 73 percent sold at more than 5 percent below list price in an average of 56 days.

- Loudoun County – 44 percent of homes sold an average of 3 percent above list in 14 days while the remaining 56 percent sold at almost 6 percent below list price in an average of 64 days.

And it’s not just the sales price that some sellers took a hit on, Howell noted. When you factor in the months of carrying costs (mortgage, taxes, utilities, homeowner fees, etc) sellers who initially overpriced their home netted significantly less overall.

Buyers, Don’t Give Up!

The combination of rising home prices and rising interest rates means that buying a home in this area today is about 40 percent more expensive in terms of monthly costs than a year ago. It’s no surprise there’s been a drawback in buyer activity, simply because many people have been priced out of the market.

And Howell said, with few exceptions, prices are not coming down. “The inescapable reality is there is not enough quality supply to reach the limited demand there is… If you believe that home prices are coming down, it’s OK to have that belief but the data does not support that belief.” And waiting could be a very expensive mistake.

But, looking at the statistics above about pricing, more than half of the homes on the market are taking more than two months to sell and are selling at a discount. Consider searching for homes that have been on the market longer than three weeks for an opportunity at a price reduction and better negotiating terms, like home inspection and other contingencies.

One Last Stat About Off-Market Sales

BrightMLS, one of the largest Multiple Listing Service databases in the industry, tracks listings and sales and is a wealth of statistical data. Off-market sales — properties sold without being listed through an MLS or sold privately or without the assistance of an agent – account for 15 percent of the market and are by nature difficult to track. However, Howell shared that from the data BrightMLS has collected, 80 percent of homes that initially started as “private exclusives” end up as active properties in BrightMLS and do not sell off-market.

Howell added that Bright MLS and external research partners examined differences in the prices of properties sold on and off the MLS and concluded that listings available to the public netted 16 percent more going through MLS than selling off-market. Howell explained that this doesn’t mean that off-market sales aren’t right for some sellers, but statistics show that sellers will net more money by listing their home publicly than only to a small subset of buyers.

Remember, when you hear doomsday national media declare the real estate market is in dire straits, there is no such thing as a “national” real estate market…all real estate is LOCAL! Keep track of what’s happening in your market with McEnearney’s Market in a Minute, Weekly Meter, Market Reports and McEnearney Blog updates, and consult with a McEnearney Associate to understand the statistics in your neighborhood and be informed, not afraid.

For More Events or Information About the National Cherry Blossom Festival, Click HERE!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Arlington Passes Its Controversial Missing Middle Zoning Plan. Will the Debate Come to Your Town Soon?

It’s the news that set Arlington County abuzz and could be coming to a neighborhood near you, but what exactly is “The Missing Middle” and how will it affect local real estate?

After years of debate, the Arlington County Board unanimously voted 5-0 on Wednesday (March 22) to expand housing options in portions of the county that currently only allow single-family detached homes. The changes will take effect July 1, 2023 and per the County press release, the passage of the zoning amendment “will allow for Expanded Housing Options (EHO) development for up to 6 units per residential lot—if certain conditions are met, including the same building height, setbacks, and size as allowed for single-detached homes.”

The initiative came in response to the lack of housing inventory – especially affordable housing; from March 2022 to March 2023 single family detached homes in Arlington sold at a median price of $1,167,000 and an average sales price of $1,315,000 – and encountered passionate discussion for and against the plan.

Those in favor of the amendment pointed to the fact that 75% of land zoned residential in Arlington is exclusively for single-family, detached homes, leaving a large portion of the population, including many communities with diverse demographics, with limited housing options. Those opposed had concerns about overcrowding, construction that was out of place with existing homes, and declining property values for homes next to multiplex construction. Both sides are unsure about unintended consequences to county infrastructure such as utilities, schools, parking and traffic.

While Arlington County is the first local jurisdiction to adopt a “Missing Middle” strategy, it’s an acute crisis in dense cities nationwide and local governments are moving to end outdated zoning regulations that were often enacted on the basis of racial discrimination and segregation. The Washington Post recently reported “the push to relax zoning rules, first implemented in cities such as Minneapolis and Portland, Ore., marks something of a departure from Arlington’s existing ‘smart growth’ philosophy, which encouraged density along mass-transit lines but generally kept it to a minimum everywhere else.”

It is expected the “Missing Middle” debate will be taken up throughout the DC-Metro area as inventory continues to decline and more and more buyers and renters enter the market. Demographically, there are at least five generations of buyers or sellers of real estate, ranging from Gen Z (upper range is age 26) to Post War (lowest range is age 78).

Rising construction costs due to inflation and supply chain issues and recent halts in new home construction (mid-2000’s and the Covid-19 pandemic) means more competition for existing homes while the hike in interest rates in 2022 meant many would-be sellers are staying put. In short, there are not enough homes for the people who need them and the homes that are available are often out of the price-range for Arlington citizens.

This is a continuing story and McEnearney Associates will be reporting on updates throughout the year.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Harnessing Buying Power in 2023

This year will shake up how everyone is involved in the homeownership process as consumers, lenders, and Realtors explore solutions to keep the housing market moving at a healthy pace. The days of throwing a home on the market and watching multiple offers roll in is probably a thing of the past, but there are still advantages available to both sides to ensure people can buy the homes that are available, even with rates at their highest in several years.

For buyers, taking an (honest!) inventory of finances and speaking with a lender is the first step. While it is advisable to have a healthy cash reserve when buying a home, the old standard of 20% down is rarely the case today. The National Association of Realtors 2022 study of homebuyers and sellers showed that the typical down payment for first-time buyers was 6% while for repeat buyers it was 17%.

But even with lower requirements for a down payment, buyers will still have to qualify for financing and bring money to closing. What are some options to make every dollar count on the pathway to homeownership?

Rate Buydowns: Buyers over the past several years were treated to historically low interest rates in the high 2-percentiles to low three-percentiles. With rates now in the low to mid six-percentile, diminished buyer power is leading to creative solutions in adjusting where buyers start out with their rate – and where they might end up.

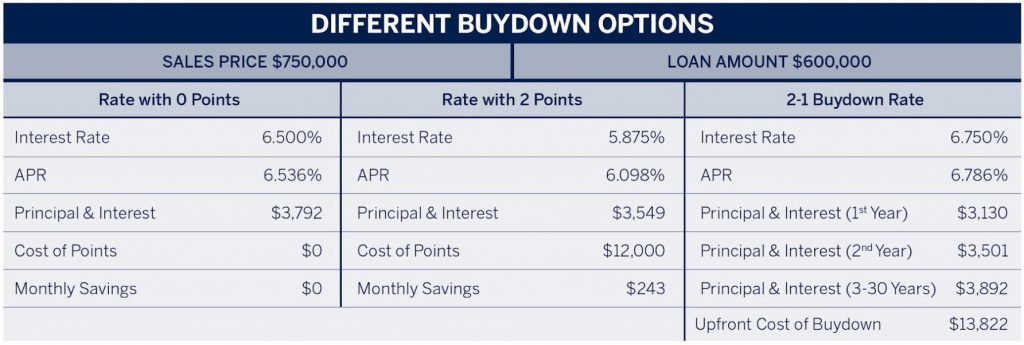

Brian Bonnet of Atlantic Coast Mortgage shared insight into two buydown strategies – one that’s traditional and one that has been sparking conversation among Realtors looking for every option to help their clients. The tried-and-true rate buydown is where buyers lower their interest rate by buying “points” at the time of closing. The lowered interest rate is fixed for the lifetime of the loan and offer buyers a consistent amortization schedule. The “2-1 Buydown” is a temporary rate adjustment where a buyer uses cash to lower their interest rate by 2% in the first year of their mortgage and 1% in the second year of the mortgage, coming back to their full rate at the 25th month of mortgage payments. For example, the buyer who would qualify at the loans note (which is generally slightly higher than the current market fixed rate – let’s say 7% — would pay to bring their rate down to 5% in 2023, 6% in 2024 and back to 7% — the rate at which the buyer was qualified – in 2025.

The benefit of this scenario is that buyers will have a cushion of two years before they start paying the fully amortized rate, and the cash can come in the form of a seller credit (see more on this topic below). Bonnet points out that consumers can’t assume rates will drop or that refinancing will be cheaper in 2025, and must think carefully about whether they will be in a better or worse position when the full rate goes into effect.

“Will rates be better after two years? Will you be in a better financial position to account for the increased interest payment? Will you be able to refinance if you aren’t?” Bonnet said the 2-1 buydown option is good for buyers who don’t expect to be in their home long-term, such as a military buyer who isn’t using their VA opportunity and plans to sell at the end of their assignment. “The typical buyer is not a 2-1 buydown consumer.”

Seller Credits: As buyers navigate higher interest rates, inflation and other economic factors, sellers may see homes taking longer to sell and with more negotiating on terms. In some cases a seller chipping in cash can be what gets a deal to the closing table. An example of a seller credit would look like this: A home is listed for $600,000 and gets an offer from a buyer who is putting a little less than 20% down and financing $500,000. Rather than negotiate the price to $590,000, the buyer offers the seller their asking price of $600,000 but asks for $10,000 to help them cover their closing costs. The net to the seller is $590,000 and the buyer is able to qualify for their loan and close with help from the seller.

Down Payment Assistance: Buyers can explore local grants and down payment assistance (DPA) programs that offer financial resources, some based on income and some are available to certain types of workers (ex: HUD’s Good Neighbor Next Door program that offers available homes at a discount to educators, civil servants, First Responders). To see what local monies may be available in your area, check these HUD resources for Virginia, Maryland and DC.

Government-Backed Mortgage Programs: FHA and VA loans are popular government-backed loans aimed at specific types of buyers and with specific criteria to qualify, usually less restrictive than conventional mortgage loans but with their own mandated processes and procedures. And for buyers who aren’t afraid of a fixer-upper, there are FHA 203(k) loans that serves as a construction loan that finances both the purchase and repairs to a home.

Adjustable Rate Mortgages: While these were popular in the mid-2000’s as buyers were trying to qualify for homes as prices dramatically rose, the economic factors aren’t as favorable for ARMs in 2023. Bonnet explained that because the bond markets currently have an inverted yield curve with a very wide spread, ARMs are generally not offering more favorable terms than fixed rates and signs do not indicate that this will improve anytime soon.

In many ways, consumers are back to basics when it comes to buying and selling a home in 2023. Save money, research options, be prepared to get creative, look for ways to collaborate. There is no magic wand when prices are high, inventory is tight and buyers are squeezed. But working with the right professionals like trusted local lenders and expert McEnearney Associates will get you where you want to go!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Celebrating English Country Style

If the winters temps as of late have been any indication, winter is still in full force here in the DMV. However, there’s something sort of charming and romantic about staying inside and cozying up with a good book as the wind howls outside, right? We find that winter is the perfect time to embrace English Country style at home—and the look has been having a major moment as of late.

Note that English Country style is all about designing a cozy, welcoming space that is still stylish and timeless. Pretend you’re stepping foot into a delightful cottage in the countryside, where nothing is taken too seriously and layers and comfort are essential. Below are a few simple steps to follow to recreate the English Country style look in your own home.

Be Sure to Mix Patterns

In an English Country style home, pattern mixing is key. Don’t be afraid to combine different prints and colors within one space; doing so will only add more charm to your home. This is not the time to try to recreate one of the all-white, ultra sleek rooms we’re seeing on social media.

Integrate Classic Furnishings

When shopping for furniture, antique pieces with character are your best bet if you’re seeking to design an English Country inspired space. Pieces like leather Chesterfield sofas, fringed sofas, and wingback armchairs are winners. Wood furniture is also key. While the past decade or so has been characterized by the white, modern spaces mentioned above, classic wooden furniture is said to be making a comeback this year. Don’t miss out on these pieces: If you see one, you’ll want to scoop it up quickly, as wooden dressers, armoires, and dining sets are on everyone’s radar at the moment!

Below, DC area designer Shannon Claire Smith skillfully integrated a wooden hutch into her living room, incorporating English Country accents like a sweet sheep statue, tufted ottoman, and topiaries. Potted plants give that “straight from the garden” feel that is oh so English.

Have Fun With Cheeky Lighting

Don’t forget to have fun with lighting, too. Pick up some scalloped or fringed lampshades for your table lamps, and install brass sconces on the walls. Note that English Country style and Grandmillennial style have a bit of overlap. Wicker furniture pieces, floral patterns, and stripes all look excellent in rooms of both styles.

While spending extra time indoors during the chilly winter months can get a bit tiring, long days are more enjoyable when you’re spending them in a space you love. Get started working English Country touches into your home today!

Sarah Lyon is a New York City-based freelance writer, originally from Bethesda, MD. She contributes to a number of national design and lifestyle publications like Architectural Digest, Apartment Therapy, MyDomaine, the Washington Post, and more. Sarah also works with designers to help them style spaces for photo shoots. Find more shelfies on her Instagram page, @sarahlyon9

We are Global.

If you are looking for your own English Country Home, McEnearney Associates can help you find an agent in the U.K. through our international connections at Luxury Portfolio International. Contact us today!

[smartslider3 slider=”102″]

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Realtors Wish Landlords & Tenants Knew About Rentals

Last month we reviewed the Blueprint for a Renter Bill of Rights, the Federal Government’s recommendations for how to make rental housing more equitable and expand renters’ rights when it comes to rent increases, lease terms, and evictions. This month we’ll take a look at the rental market from the Realtor® perspective.

McEnearney Associates recently convened a “Masterclass” with several of our top agents who have made a name for themselves as rental experts – both for tenants and landlords – as well as staff from our Property Management team. It was a lively discussion and we’re sharing some of the tips and processes that Lauren Budik (McLean), Ann Duff (Alexandria), and Sarah Picot (Arlington) believe will make the rental process more efficient and less stressful for everyone involved.

Stay tuned next month for tips from our DC and Maryland offices!

FOR TENANTS

DON’T: Start your search too early. We understand, it’s exciting to imagine your next home and see all the options out there. But if you are looking to move in May and want to start looking in January, you will be spinning your wheels. Most leases require a 60-day notice to vacate, and the landlord will look to turn them over quickly. Most landlords will not hold a property if you’re not ready to make a move on their terms.

DO: Understand that most leasing documents are standardized and will have to be completed before or during the rental search. Expect to sign a representation agreement that spells out the responsibilities of both you and your agent, review, and sign disclosures about the property, and understand that leases are standard forms used by most landlords and brokerages in the area. Changing boilerplate clauses or asking for too many changes in terms likely won’t be possible.

DON’T: Hide or be shy about sharing credit issues. Financial setbacks happen and the best way to work around them is to let your agent know if there are credit dings that could affect your rental application. Your agent will help to strategize on the best approach, such as offering to pre-pay several months of rent in advance. A letter explaining how your credit was affected and what you’ve done to repair it can go a long way in assuring a cooperative landlord that past issues have been resolved.

DO: Have a good amount of cash ready for securing a property. Between the first month’s rent, security deposits, pet fees, building move-in/move-out fees, and other moving costs, you may need an outlay of several thousand dollars just to secure a lease. Make sure you’ve set a reasonable budget and saved your money for those immediate payments.

DO: Work with a Realtor®! You’ve heard it before: inventory is extremely tight and great properties go quickly. Having a leasing agent working with you in your housing search ensures that you get access to listed properties quickly (and safely), that your application will be submitted correctly with the proper documentation. Helping clients find the right home is what Realtors® do every day so use their expertise to your advantage in this competitive market!

FOR LANDLORDS

DO: Follow all Fair Housing requirements. Your Realtor® is bound by a professional code of ethics and will ensure that the public is treated fairly during the leasing process of your property. Fair Housing violations can be reported to the local Realtor® association and may result in fines. Learn about your Fair Housing requirements and explore resources for Virginia, DC and Maryland, and ask your agent for clarification on anything you have questions about.

DO: Understand the difference between pets, emotional support animals and service animals. Tenants with registered support animals and service animals do not fall under “no pets” provisions. Virginia has a helpful brochure that outlines what qualifies for what and how tenants with service animals must be accommodated, and you can see DC and Maryland guidelines here.

DO: Consider accepting Housing Vouchers. The lack of affordable housing is a growing problem throughout the country, and is felt by many in our region. Housing vouchers – awarded to eligible tenants after a complex and thorough screening by government and housing officials – ensure that low-income, elderly, disabled and other housing-insecure people have access to a decent, safe and sanitary place to live. Landlords who participate in voucher programs will receive government subsidies for a portion of the rent and tenants will pay the difference based on their voucher award. This ensures consistent payment with tenants who have already passed federal and local screening processes.

Because of the lack of landlords who participate in subsidized housing programs, there are some voucher recipients who have been waiting several years to find an affordable home match. We encourage landlords to speak with their agent to find out how they can be part of helping many deserving tenants find a place to call home.

DO: Work with a Realtor®! It may seem like a landlord could put a “For Rent” sign in the yard and wait for qualified applicants to roll in without any help from an agent. But good Realtors® know that the right presentation, careful application screening processes, and a professional approach to onboarding a tenant can make all the difference between a smooth move between tenants and a logistical leasing nightmare. Count on the expertise and market knowledge that a seasoned agent brings to assist in the successful renting of your valuable investment!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What is the Blueprint for a Renter Bill of Rights? New Federal Guidelines Aim to Bring Fairness to the Rental Market

It has been a tense few years for renters and landlords, with rising housing costs due to shrinking inventory and inflation running headlong into the Covid-19 pandemic and federal and local moratoriums that prohibited landlords from evicting tenants.

Adding complicating factors like the rise of short-term rentals such as AirBnB and VRBO, and private equity investors – many from outside of the United States – who are buying up starter homes, apartment buildings and the land beneath trailer parks, the roughly 35 percent of population – approximately 44 million people – navigating the U.S. rental market may feel like it’s the Wild, Wild West with few places to turn for help.

Enter the White House’s Blueprint for a Renter Bill of Rights.

Released on January 25, this policy paper areas that the Biden Administration wants to see implemented at state and local levels to follow the lead of “the new commitments by federal agencies to advance a stronger, more equitable rental market.” Included in the new Blueprint is the Resident-Centered Housing Challenge, which seeks input from stakeholders and community leaders and “encourages states, local, Tribal, and territorial governments to enhance existing policies and develop new ones that promote fairness and transparency in the rental market.”

These are not new laws but instead are a set of principles that the White House and participating agencies – including the Federal Housing Finance Agency (FHFA), Federal Trade Commission, Consumer Financial Protection Bureau, Department of Housing and Urban Development, Department of Defense (involved on behalf of military personnel) and Department of Justice – say will “support the development of policies and practices that promote fairness for Americans living in rental housing.”

According to the White House announcement, the Blueprint “sets out five common-sense principles that create a shared baseline for fairness for renters in the housing market,” including access for renters to:

- Safe, Quality, Accessible, and Affordable Housing

- Clear and Fair Leases: Lease with defined rental terms, rights, and responsibilities

- Education, Enforcement, and Enhancement of Renter Rights: Federal, state, and local governments should do all they can to ensure renters know their rights and to protect renters from unlawful discrimination and exclusion.

- The Right to Organize: Renters should have the freedom to organize without obstruction or harassment from their housing provider or property manager.

- Eviction Prevention, Diversion, and Relief: Renters should be able to access resources that help them avoid eviction, ensure the legal process during an eviction proceeding is fair, and avoid future housing instability

However, without judicial consequences behind this effort, what the Blueprint means for the local Washington-Metro market is still to be worked out. But rising eviction rates in all jurisdictions makes this an issue that local leaders are being pressed to address.

For more information about rental assistance in a specific local area, please visit these resources for additional information:

VIRGINIA

- Virginia State Rental Assistance Program

- City of Alexandria, Office of Housing

- Arlington County Housing Assistance

- Fairfax County Housing and Community Development

- Loudoun County Health & Human Services, Rent & Mortgage Assistance

MARYLAND

- Maryland Department of Housing & Community Development

- Montgomery County Department of Health & Human Services – Emergency Eviction Prevention

- Prince George’s Emergency Rental Assistance Program (currently closed to new applications)

WASHINGTON DC

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Selling Your Home Early In The New Year

One of the very first things I learned when I became a real estate agent twenty plus years ago was that you never sold your house in January, February, or March. “Wait for the spring market,” is something that I told numerous sellers early in my career because that was what the real estate industry taught us. You have to wait for the azaleas to be in bloom, for the grass to green up, and for the new crop of buyers to start entering the market. For the most part, that is what we did; we circled dates in early April, figuring that was going to give our sellers the best opportunity to get the most for their properties. As agents, we embraced the notion that the first three months of the year were going to be on the slower side and that, once we turned the calendar to April (yes—we still used an old-school paper calendar), we would all be going a thousand miles an hour until the traditional summer slow down.

I am here to tell you that, for the most part, we were all living a lie. As it turns out, the first three months of the year can often be the best time to list your property. Despite what many of us believed a decade or two ago, I now truly believe that January, February, and March are quite possibly the best three months to sell your home, and I am going to tell you why.

Increased Lack of Inventory

One of the largest factors driving our real estate market is an overall lack of inventory. Simply put, there are not enough homes for all of the potential buyers in our area. Even with the slower-paced market that we have been in for the last eight months, our overall supply in most areas is still between two and four months, which is incredibly low. To put that into perspective, at the peak of the great recession of 2008, 2009 and 2010, our inventory levels were consistently between a twenty-five and thirty month supply. To make matters worse, many builders have canceled or delayed new construction projects as the market has shifted away from the frenetic pace of 2020, 2021, and the first half of 2022, which is putting an even greater strain on our already depleted inventory. The supply levels for our region are typically at their lowest in January, February, and March, potentially making that a fantastic time to list your property.

New Buyers Entering The Market

One thing that we have consistently seen over the last ten years or so is that the new year brings out new buyers. Even with the recent rise in interest rates, this has held true in 2023 as well. Speak to any reputable mortgage lender, and they will tell you that the number of new mortgage applications rises sharply in the new year. Many agents have taken on several new buyer clients and/or had purchasers reach back out to them, saying now they are ready to buy. While you will see new buyers entering the market throughout the year, one could make a very strong case that the largest collection of them are starting their home buying journey just after the holidays. What this has meant for many agents early on in 2023 is fully booked showing schedules on their listings, multiple offers, and, in some cases, escalation clauses that are going well above the original list price.

If you are a seller, the laws of supply and demand may not be any more in your favor throughout the year than they are in January, February, and March. Obviously, there are exceptions to everything, but historically, many of the highest prices we have seen for properties are for those that sold in the first three months of the year. While waiting for the spring market was what we used to think was the best strategy for sellers, now may, in fact, be the best time to list your property. So, if you are considering selling your home, it is important that you speak to your trusted McEnearney Associate about whether now is the right time for you.

Andy Hill is Executive Vice President and Managing Broker for the Washington, DC and Maryland offices of McEnearney Associates.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Anticipation & The Agony of New Construction

I started my real estate career selling new construction and it was a unique and educational experience for me and my clients. There is nothing quite like watching a hole in the ground become a bustling construction zone that gradually evolves into a beautiful dream home, despite all the annoyances of delays due to weather, supplies, or contractor issues. It’s a process that can be both exciting and agonizing, with a lot of unknowns along the way.

When a potential buyer comes into the sales office for a new development, it would be an understatement to say there is a high potential to be overwhelmed. This is where having a trusted, professional Realtor working for you is crucial.

First, there are the numerous options – plantation shutters! wood grain! Sub-Zero refrigeration! heated tiles in the bathroom! a doggie shower! – and floor plans to choose from and it’s inevitable that there is always that one feature from one floor plan that a buyer wants to make work in a different floor plan.

Builders are becoming much more flexible with buyer customizations, but where the new build is in the construction process will determine how much tweaking can be done. For example, when a home is 3/4-complete, a buyer cannot expect the builder to now add extra outlets, a speaker system or a fireplace. In building their “Forever Home,” you would be amazed at the last-minute changes buyers expect a builder to do. Of course, the builder wants to make the customer happy and will try to accommodate them…for an additional price. Your Realtor can advise on the features that offer the best bang for your buck and what will unnecessarily increase the price tag.

Second, there’s the question of “location, location, location” and consistency in aesthetics. What are the premier lots in the development? How does lot elevation affect views or noise? How much can a townhome be customized if an entire row of homes are being built at the same time? Do buyers get to choose the brick color on the house? A builder does not want to have two townhomes or detached houses next to each other with the same features and aims to have an appealing and cohesive look to the block/street/development.

Builders want to make all models of a home enticing, so you may have some features that are better on an interior unit than an end-unit to make both equally saleable, but if you want that end-unit with upgrades, it will cost you. Some plans may already include an extension on the back or a finished lower level including a full bath. Depending on the buyer’s budget, there may be a rough-in for a bathroom that the buyer can complete at a later date. Timing is important so knowing the timeline of construction will allow your Realtor to help you keep track of deadlines to make changes. For example, if construction on a townhouse has not been started there is a slight chance a buyer can make a small change (i.e. extra outlets, wiring for a ceiling fan, removing decorative columns, adding a bump-out.)

Third, as sales progress on a development it’s common for the premier lots/models to sell out on that fancy map builders have in their sales showroom, and buyers who come later in the construction process may have less to choose from. A savvy Realtor can keep track of what pending sales fall out because of financing or delivery issues and help buyers pounce on under-contract homes that may be coming back on the market.

Finally, the most important thing for buyers to keep in mind when purchasing new construction is that the sales representatives – while very knowledgeable and helpful in providing information and recommending options for the home – are working for the developers. Their job is to sell homes at the highest profit possible. Unrepresented buyers are essentially trusting this important purchase to a company that is not looking out for their best interests, but the interests of the builder. Having a Realtor guiding their clients through the construction process, maintaining direct and regular contact with the sales office and ensuring that their clients are dealt with fairly and professionally is the best way to make building a “Dream Home” as smooth and easy as possible.

If building a new home is on your wish list for this year or next, I would love to be the experienced and trusted advisor to take you through this journey. Please feel free to call me at 703.898.0032, visit MadelineHomes.com and follow me at @madelinehomes on Facebook or Instagram.

Madeline Caporiccio earned her realtor license in March 1988. When starting her career in new homes, she was the New Homes Sales Rookie of the Year for Long Signature homes. As your real estate advocate, Madeline is ready to help you sift through all the information available in the media and online, and advise you on what’s right and what may be misleading or inaccurate. You can contact Madeline by phone 703-898-0032 or by email at mcaporiccio@mcenearney.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Ready to turn the page?

Are you feeling either unsettled or bored?

Take a look at challenges faced by five of my recent buyers and see if you find yourself in their shoes.

- Active, handsome fellow using lots of energy walking his dog, but cursing his aching knees when climbing stairs in his townhouse.

- Dynamic, world-traveler in need of pizazz, after years in her large Arlington house, proud of her garden but tiring of lawn-mowing and repair responsibilities.

- Couple well-known in Atlanta for their neighborhood parties, transferring and forced to give up their famous outdoor pizza oven for urban living.

- Busy professional woman deciding whether to up-light the dramatic landscaping around her estate-sized home ($$$) or explore a totally new lifestyle instead.

- Fun duo living with history, contemplating stepping away from years of renovation and restoration to find classy new one-level living with water views.

For so many reasons and personal experiences, I am finding buyer after buyer wanting to turn the page. These wise ones are not following, but creating, a trend to reward themselves with their own “happy” place. They are figuring out what they want but do realize that some compromises will be required. I hear them saying to themselves “step away from the warming drawer and embrace the wine refrigerator,” “let’s bag snow shoveling and applaud the work of doormen and porters,” and “next steps, no steps.”

Consider me your part-time life whisperer. I ask questions such as “how often do you really have houseguests?” “Would you like to simply pack a bag and head to the airport for Nantucket or Florence?” “Is that cherry buffet from your great-grandmother cherished by other family members who would like it delivered next week?” “Will you read those books a second time?” and “Do you need the phone number for 1-800-GOTJUNK?”

After “whispering,” it’s time to consider individual concerns and get real life suggestions. Do you need that amount of square footage? If you’ve always wanted a place for a piano, go for it. Concerned about making paint selections and appropriately-sized furniture choices — hire a designer! What really will make your life more enjoyable?

So, what happened to each of my friends above?

- He happily garages his car, takes a short elevator ride up to greet the waiting dog ready for her walk and lives in a glamorous, one-level condominium complex at the north end of Old Town. (We sold the pretty townhouse to younger-kneed people).

- Three days after settlement of her detached house, she moved into a very hip-and-cool new condominium in D.C.’s Dupont/Shaw, took delivery of all her furniture stored in a POD during house marketing and is getting to know her neighbors.

- Amazingly, their big NW D.C. luxury residence gives them almost more useable space than their detached Atlanta home, so they are inviting lots of friends and family to visit this special historic condo while searching for the best brick oven pizza in town — ideas?

- Still a work in progress, she is looking toward a 2023 move, while we study a wide range of striking D.C., Alexandria and Fairfax properties which must accommodate a grand piano or two.

- Since those wished-for water views might not be in Florida but in Alexandria instead, they are enjoying the fruits of their labors in their restored circa 1880 townhome, now almost ready for the market when the time is right, and the special water view residence is found.

So where are you in your journey — beginning, middle or already “in your happy place?” There is no script for getting there, just decisions, compromises and making it up as you go along. Without naming names, I can share the experiences of others and provide resources that will help… from suggesting handymen/women, painters, designers, movers and more. We Realtors are important partners in your “page turning.” Of course, the stocking of that wine refrigerator for those discussions is a good place to start, too!

Ann Duff is a licensed real estate agent in VA, DC, and MD with McEnearney Associates, Inc. in Old Town Alexandria, VA. If you would like more information on selling or buying in today’s complex market, contact Ann at 703-965.8700 or visit her website AnnDuff.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link