Three Unexpected Advantages For Today’s Homebuyers

Think it’s the wrong time to buy? These current market perks might just change your mind.

With the current fickle market, it’s natural for homebuyers to feel hesitant about making a purchase. Interest rates aren’t providing much wiggle room, so the uncertainty is giving everyone pause. We get it! However, we’re here to challenge the question: “Should I wait this one out?”

Surprisingly, buyers may be missing out on a few hidden perks that this current market has to offer, namely less competition, excellent negotiation conditions, and boosted flexibility with timing. Let’s get into it!

1. Avoid The Hidden Costs of Waiting

It’s easy to think you’re playing it safe by waiting. You don’t want to overpay for a home, get too high an interest rate, or make a move at the wrong time. That makes sense. But here’s what many people don’t see right away. Here’s what can happen while you wait:

- Rent continues to rise

- Home prices are stabilizing (increasing in some areas)

- You’re missing out on building equity

- You pass on homes that could’ve been a great fit

There is a real cost to waiting. When you buy now, you can take advantage of today’s negotiating power and start building long-term wealth through homeownership, all while avoiding the cost of inaction. Buyers who make a move today often gain more control over their finances tomorrow.

2. Take Advantage of Buyer-Friendly Conditions

While some buyers are still on the fence, others are already making moves, and it’s not because they’re trying to perfectly time the market. It’s because they recognize the unique opportunities available right now. Here’s what we’re seeing:

- Less competition, which means fewer bidding wars and more negotiating room

- Motivated sellers offering concessions like help with closing costs or interest rate buydowns

- More inventory in certain markets, giving buyers more options and breathing room

- The ability to refinance later if rates drop (ask us about Rate Rebound), but not the ability to go back in time and buy the home you missed

The idea of “date the rate, marry the house” is becoming more and more appealing as time goes on. Acting now could give you more control, more choices, and long-term financial advantages, especially once you’re able to refinance down the road.

3. Build Long-Term Stability and Wealth Through Homeownership

Many renters and potential buyers are asking this question: Is owning a home still a good investment? The short answer is YES. Here’s why buying still makes sense:

- You build equity with every payment (renting doesn’t offer that benefit)

- Your monthly payments stay consistent, while rent often increases year after year

- You can benefit from tax advantages that aren’t available to renters

- You’re in control, from everything like designing your space to how you improve its value through renovations and remodeling

Even if you don’t plan to stay in your home forever, those early years of equity, stability, and ownership can significantly impact your financial future. In other words, the earlier you start, the more you stand to gain.

If you’ve been unsure about whether now is the right time to buy, we’re here to help you look at the full picture and assess your options. We can answer your questions and help build a strategy that works for you, now and in the future. Ready to ditch the hesitations and leap into the future? We’ll be here, ready with a preapproval whenever you are.

Bill Stern | The Stern Team

Branch Manager | NMLS ID # 267577

CMG Home Loans | NMLS ID# 1820

M: 540-222-0164

bstern@cmghomeloans.com

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

New Mortgage Rules: What Foreign Buyers Lose and All Borrowers Stand to Gain

Two major changes to know about – one restricting access for some foreign buyers, and the other aiming to protect all consumers from unwanted lender solicitations.

There are times when the residential mortgage industry is relatively free of program and policy changes. This has been the case for the past couple of years as rates have remained stubbornly high with fewer underwriting guideline changes and new loan programs.

But there are two recent industry developments to be aware of: one of which will have a negative impact on some consumers, and the other, which should prove beneficial to all consumers.

In May of this year, FHA and USDA announced that their mortgage loan programs would no longer be available to individuals who are neither US citizens nor permanent resident aliens. Prior to the change, both programs were often utilized to provide mortgage financing to non-citizens and non-permanent resident aliens who otherwise had social security numbers and could document their right to work in the United States.

For instance, an H1B Visa holder who had obtained a social security number and had built a two-year credit history was eligible for both FHA and USDA financing. That is no longer the case. According to FHA, there were 603,040 FHA purchase loans in 2024, and approximately 2.8% of those (roughly 16,885 loans) were made to foreign nationals. Going forward, it will be more difficult for foreign nationals to obtain mortgage financing.

On the flip side, the current Congress is poised to pass legislation to ban what the mortgage industry calls trigger leads, which have been a significant annoyance for consumers. For several years, the three major credit bureaus have sold data when a mortgage lender obtains a consumer credit report – including consumers’ names and contact information – which some lenders across the country then used to make cold calls and send texts and emails offering their services.

When a consumer makes an application with a mortgage lender and the lender pulls a credit report, the credit reporting agencies transfer the consumer’s contact information almost immediately to other lenders who have paid for that information. The process is automatic and results in consumers receiving multiple calls, texts, and or emails almost immediately after the consumer’s chosen lender receives the credit report. Consumers are usually confused and annoyed as to why they are receiving the communications, and have reported that the onslaught of outreach can be overwhelming.

The mortgage industry has lobbied Congress to ban the credit bureaus from the practice of automatically selling consumer contact information, and both the House and Senate recently passed similar stand-alone bills to do just that. The legislation will go through a reconciliation process and likely be sent to the President for signature, hopefully bringing relief to pestered consumers in the next few months.

No matter what changes occur in residential lending, our Atlantic Coast Mortgage team is knowledgeable, professional, and happy to assist you with the programs to achieve your ownership goals.

Brian Bonnet, SVP, Sr. Loan Officer, NMLS ID 224811

Brian Bonnet, SVP, Sr. Loan Officer, NMLS ID 224811

Atlantic Coast Mortgage, NMLS ID 643114

O: 703-766-6702 | M: 703-304-0188

Email Me

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Super Tool or Scam Attractor? When AI Turns Risky in Real Estate

AI can find your dream home – but it can also impersonate your agent and steal your deposit. Learn how to spot the difference.

Imagine a near-future real estate experience involving a virtual assistant who knows your taste in countertops, a chatbot that helps write your property’s listing copy, or a digital eye that scans satellite images to price your property. The age of Artificial Intelligence in real estate, where technology is transforming how we buy, sell, and live in our homes, isn’t around the corner… It’s HERE.

But while AI promises convenience, efficiency, and savings, it also introduces new risks. In a region as diverse as ours – spanning high-tech hubs in Northern Virginia, cozy neighborhoods in Maryland, luxury condos in D.C., equestrian estates in the western suburbs, and rural land in West Virginia – the technology’s influence can be both helpful and harmful. And anyone involved in a real estate transaction needs to keep alert for ways criminals are using AI to derail transactions and steal funds.

Here’s how AI is shaping the housing market for consumers – and what to watch out for.

The Good: AI Tools That Help You Buy or Sell Smarter

Many parts of the homebuying process are already influenced by AI tools, which are used by a growing majority of real estate agents who appreciate a streamlined process for everyone: less paperwork, more personalization, and faster deals.

Platforms like Zillow, Redfin, and Realtor.com use AI to suggest homes based on browsing behavior, tracking what you click on to deliver tailored, personalized results.

On the seller’s side, real estate agents turn to AI to make a property’s marketing stand out with descriptive copy that can be fine-tuned in seconds to specific audiences and social media platforms (ChatGPT is the most popular, but Google’s Gemini, Jasper AI, and Copy.ai are among many other competitors). Within MLS databases are a treasure trove of information that agents are using to help uncover inventory, using AI to find owners who may be ready to list based on mortgage balance, length of ownership, and whether the property is owner-occupied.

Even smart thermostats like Google Nest use AI to learn your habits and make homes more energy-efficient, just one of many home features using AI to make a home more attractive to potential buyers.

The Bad: When AI Is a Tool For Fraud

What AI giveth, AI also taketh away. The same tech that streamlines sales and other real estate transactions can also be weaponized by scammers, and no one, from agents to their clients to mortgage and title professionals, is immune.

You’ve probably seen deepfake videos of celebrities or politicians, but what used to look like digital trickery now feels eerily real. In 2024, multiple fraud cases surfaced involving AI-generated voices and videos impersonating real estate agents. In several instances, buyers received emails or phone calls from someone who sounded exactly like their agent, guiding them to wire money to a fake account. The communications were slick, convincing, and completely fraudulent.

AI is also helping scammers fake property and title documents, forge signatures, and redirect private communications to capture sensitive information. Even the storied Graceland – GRACELAND! The famous home of ELVIS! – was the target of a brazen scam that required a court intervention to stop thieves from stealing the property out from under the Presley estate. These tactics are especially risky in rural and exurban regions where empty or unmonitored lots can be easy targets.

The final stretch of a sales transaction is where criminals are most likely to strike, with wire fraud being the most common tactic, as it takes advantage of buyers and sellers who may be seeing important but unfamiliar paperwork for the first time. AI-generated phishing emails targeting homebuyers just before closing will spoof the names of real estate agents, title companies, or lawyers offering “guidance” and instructing recipients to send their down payment or closing costs to a fake bank account.

Just last month at the REALTORS® Legislative Meetings held in Washington, DC, cryptocurrency and “pig butchering” – an ugly term that refers to criminals “fattening up” a mark before stealing their money – took center stage as agents shared their stories of being scammed… and the shame that accompanied being the target of this particular kind of increasingly common crime.

How To Stay One Step Ahead

Federally, the Automated Valuation Model rule improves protections for consumers in mortgage/appraisal contexts, but currently, none of our local jurisdictions have enacted AI laws specifically governing real estate transactions. Maryland House Bill 1331/”Consumer Protection – Artificial Intelligence” is working its way through the legislative process and aims to regulate the development and deployment of high-risk AI systems, ensure fair and equitable decision-making by AI systems (particularly in areas where they impact individuals’ lives), and focus on transparency, accountability, and risk mitigation.

Knowing that AI is now firmly entrenched in so much of our consumer activity is the first line of defense. Here are just a few tips to keep in mind:

- Ask your agent how they use AI. A good real estate professional in today’s market should be able to explain how they’re using (and securing) AI tools on your behalf.

- Always verify wire instructions in person or over the phone. Never rely solely on email. Use contact info you already have – don’t trust a new email or phone number without verifying.

- Check your property records regularly. If you own land or a second home, make sure your name is still on the deed.

- Be wary of “too good to be true” listings. Scammers use AI to generate fake rental or sale listings, often with eye-catching photos and below-market pricing. Cross-reference listings on multiple platforms and schedule in-person tours with a licensed agent.

- Secure your smart home devices. If you’re selling a home with connected tech (smart locks, cameras, etc.), reset to factory settings before transferring ownership. And never connect your smart devices to public Wi-Fi.

- Be cautious of AI-powered homebuying/selling apps that require sensitive financial info without strong encryption. Double-check for apps that look or sound similar to more established apps. Verify, verify, verify!

- Never respond to unsolicited texts, social media messages, or emails soliciting an investment. Be cautious when sharing personal information online, as scammers will exploit personal details to build trust.

- Report cybercrimes and suspicious online activity to the Internet Crime Complaint Center (IC3). The Internet Crime Complaint Center (IC3) is the central hub for reporting cyber-enabled crime. It is run by the FBI, the lead federal agency for investigating crime.

AI isn’t going anywhere, but neither is common sense. By staying informed, working with the trusted, professional agents at Corcoran McEnearney, and double-checking key details, you can harness the power and benefits of AI without becoming a cautionary tale.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Dream It, Fix It, Love It: Renovate with a VA Loan

June is for fresh starts, including home renovations.

As the days get longer and the weather warms up, June sparks a sense of renewal. It’s the perfect time to tackle projects that have been sitting on the back burner, especially when it comes to upgrading your living space. If you’re a Veteran or active-duty service member, there’s one option that might surprise you: the VA Renovation Loan.

Whether you’re buying a new home that needs some work or looking to refresh the one you already own, this program could be the key to making it happen with little to no upfront cost.

What are the benefits of a VA Loan program?

The VA loan benefit is earned through military service and is one very advantageous way that military personnel can buy, build, or improve a home. A few reasons that VA loans are a great option for qualified buyers and current homeowners:

- No down payment as long as the sales price isn’t higher than the home’s appraised value (the value set for the home after an expert reviews the property).

- Better terms and interest rates than other loans from private banks, mortgage companies, or credit unions (also called lenders).

- The ability to borrow up to the Fannie Mae/Freddie Mac conforming loan limit on a no-down-payment loan in most areas—and more in some high-cost counties. You can borrow more than this amount if you want to make a down payment. Learn more about VA loan limits here.

- No need for private mortgage insurance (PMI) or mortgage insurance premiums (MIP).

- No penalty fee if you pay the loan off early.

What is the VA Renovation Loan?

The VA Renovation Loan lets eligible borrowers roll the cost of home improvements directly into their mortgage, without needing a second loan or draining their savings. It’s designed specifically for primary residences and offers up to 100% financing, making it one of the most accessible ways to upgrade a home.

For example, maybe you want to modernize your kitchen, replace outdated flooring, or add accessibility features to suit your needs. As long as the repairs are non-structural and can be completed within 75 days of loan funding, they may be covered.

What can you use it for?

Eligible renovations include everything from new appliances and updated HVAC systems to roof replacements, plumbing work, bathroom remodels, and more. The loan is flexible enough to support both cosmetic improvements and essential repairs. In short, if the work makes the home more livable, efficient, or functional, there’s a good chance it’s allowed.

Who can apply?

This program is available to active-duty service members, Veterans, Reservists, National Guard members, and certain surviving spouses. If you’ve served our country, this is one way your benefits can serve you—helping you build a better home with a smarter financial strategy.

Not a VA Borrower? You’ve still got options!

Even if you don’t qualify for the VA Renovation Loan, June is still a great time to explore other renovation financing options:

- FHA 203(k) Loans – These are perfect for homebuyers or homeowners looking to finance repairs and upgrades. The “Standard” version allows for structural changes and phased construction, while the “Limited” version is ideal for smaller, cosmetic projects.

- Fannie Mae HomeStyle® Renovation – A conventional loan that covers a wide range of upgrades, including landscaping, green energy improvements, and accessory dwelling units (ADUs)

- Freddie Mac CHOICERenovation® – Similar to the HomeStyle loan, this option is designed for buyers who want to customize or modernize their home purchase while keeping everything under one convenient mortgage.

Why June is the ideal time to start?

With summer break in full swing and longer daylight hours, June offers the perfect window to start a renovation project—especially one that can be completed before fall routines pick back up. Contractors may be more available, and renovation financing can give you the boost you need without delaying your goals or draining your savings.

If you’re thinking about buying a home that needs a little work or you’re ready to tackle that dream upgrade, this might be your moment. Ready to explore your options? Reach out today and take the first step toward making it happen.

Bill Stern | The Stern Team

Branch Manager | NMLS ID # 267577

CMG Home Loans | NMLS ID# 1820

M: 540-222-0164

bstern@cmghomeloans.com

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Financing Investment Properties May be Easier Than You Think

You don’t have to be a financial whiz to make smart moves in real estate investing.

Owning residential investment property in the Washington Metropolitan area provides multiple advantages: steady cash flow, solid appreciation, and a hedge against inflation. Rental properties, which command a high enough monthly rent to cover a mortgage payment, may be viewed similarly to a blue-chip stock where the monthly principal curtailment is akin to a regular dividend payment. And while a stock can theoretically lose all of its value, “dirt does not go to zero.”

For some, acquiring residential investment property is a function of converting an existing primary residence into one that brings cash flow. For others, the acquisition requires purchasing property and obtaining financing for that purchase. The good news is that underwriting guidelines for residential investment financing have loosened in recent years, and Fannie Mae and Freddie Mac investment property loans no longer require down payments of 20%. A purchaser may put down as little as 15% of the purchase price, making the acquisition more attainable for some. If the down payment is less than 20% then mortgage insurance is required, which increases the monthly payment. Interest rates are more favorable if the down payment is at least 20%, and even more so if the down payment is at least 25%. Note that investment property loans do not allow for the use of gift funds to cover down payment, closing costs or reserve requirements.

For most individuals, qualifying for an investment property loan from an income and debt standpoint has also become easier. Lenders will generally use 75% of the expected rental income to offset the proposed mortgage payment. For instance, if the proposed mortgage payment on an investment property purchase is $3000 per month and the anticipated rent as determined by the lender’s appraiser is also $3000 per month, in most cases, the lender will give the mortgage applicant credit for $2250 (75% of anticipated rent) to offset the new monthly payment. This results in a new debt for qualifying purposes of only $750 per month. Standard conforming conventional loans do not require a lease to be in place for the property to be purchased and borrowers do not need to show a history of managing rental property.

Investment property loans do require the borrower to show reserve assets in the form of savings, brokerage, or retirement assets. The guidelines differ somewhat between Fannie Mae and Freddie Mac loans; Fannie requires reserve assets calculated as a percentage of the unpaid balances on all real estate loans held by the borrower, while Freddie requires a certain number of months of principal, interest, taxes, insurance, and HOA/Condo dues (PITIA) for all financed property held by the borrower. Neither set of guidelines is too onerous as Fannie requires reserves to be as little as 2% of outstanding balances on all mortgages held and Freddie requires as little as 2 months of PITIA on all properties owned and encumbered by mortgages.

The borrower’s application process for investment property loans is identical to that for a loan to purchase a primary residence, and there is no significant additional time needed by the lender to complete the underwriting process. The lender’s appraisal of the property will include one additional component referred to as a comparable rent schedule, which is used to determine the likely gross monthly rental income of the property. Other than that, the overall lender process and documentation requirements of the borrower are no different than for other residential loan applications. A borrower can ratify a contract for an investment property purchase and proceed to settlement just as quickly as they could for the purchase of a primary residence.

Ownership of residential investment property does not require advanced financial education and financing the purchase of residential investment property is generally just as easy as financing a primary residence.

Brian Bonnet, SVP, Sr. Loan Officer, NMLS ID 224811

Brian Bonnet, SVP, Sr. Loan Officer, NMLS ID 224811

Atlantic Coast Mortgage, NMLS ID 643114

O: 703-766-6702 | M: 703-304-0188

Email Me

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

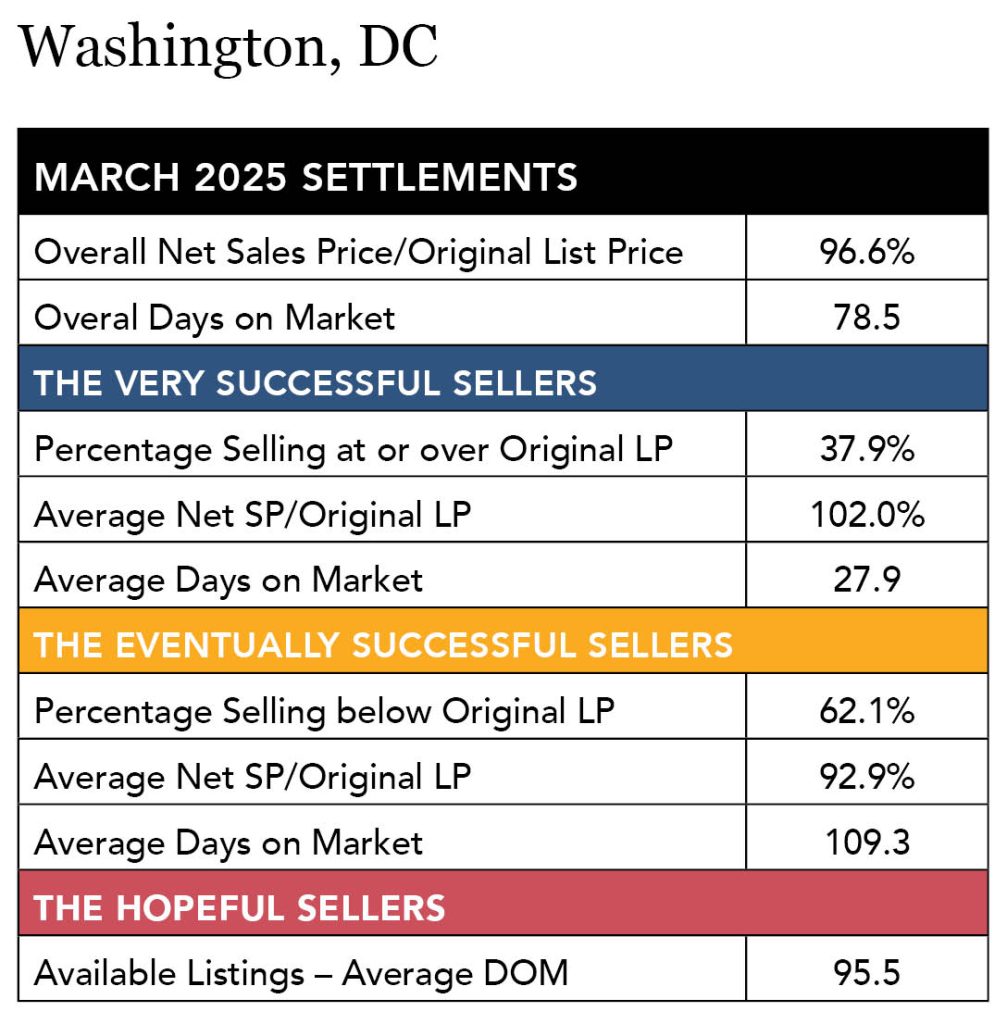

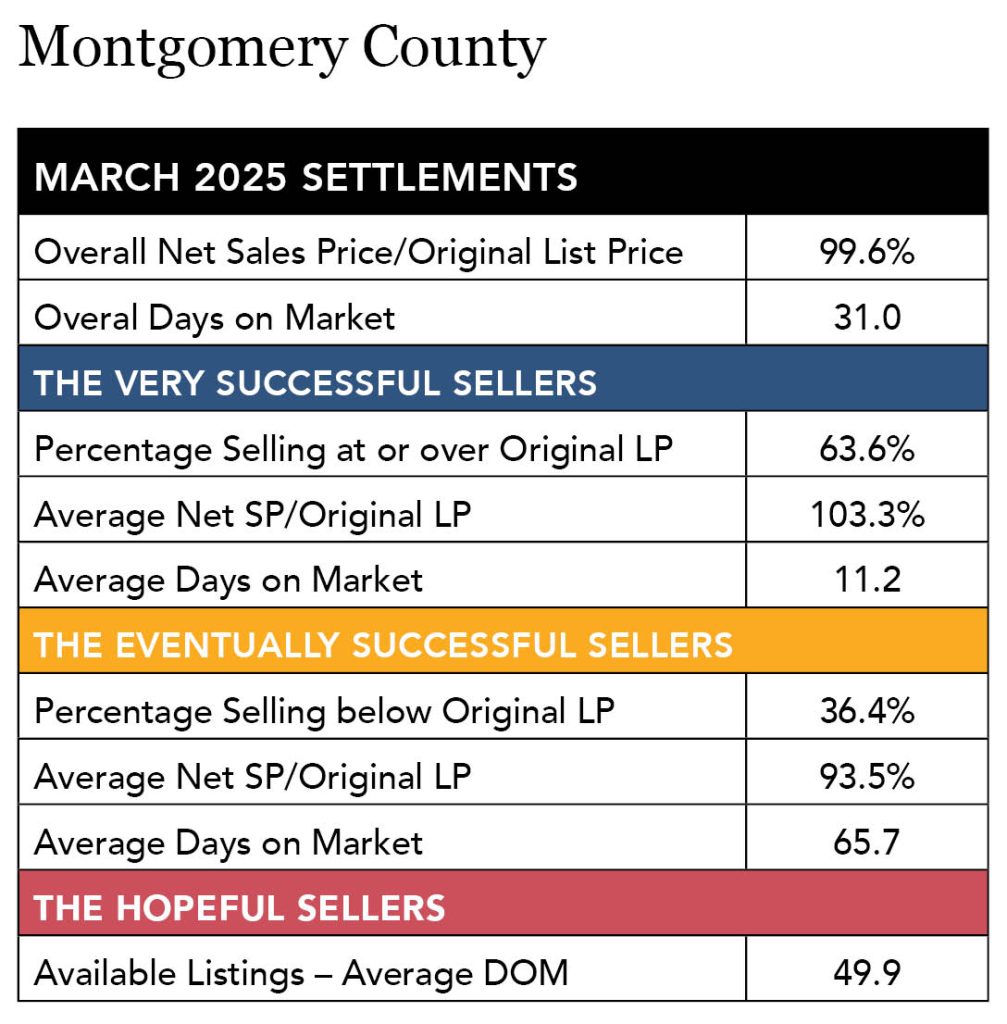

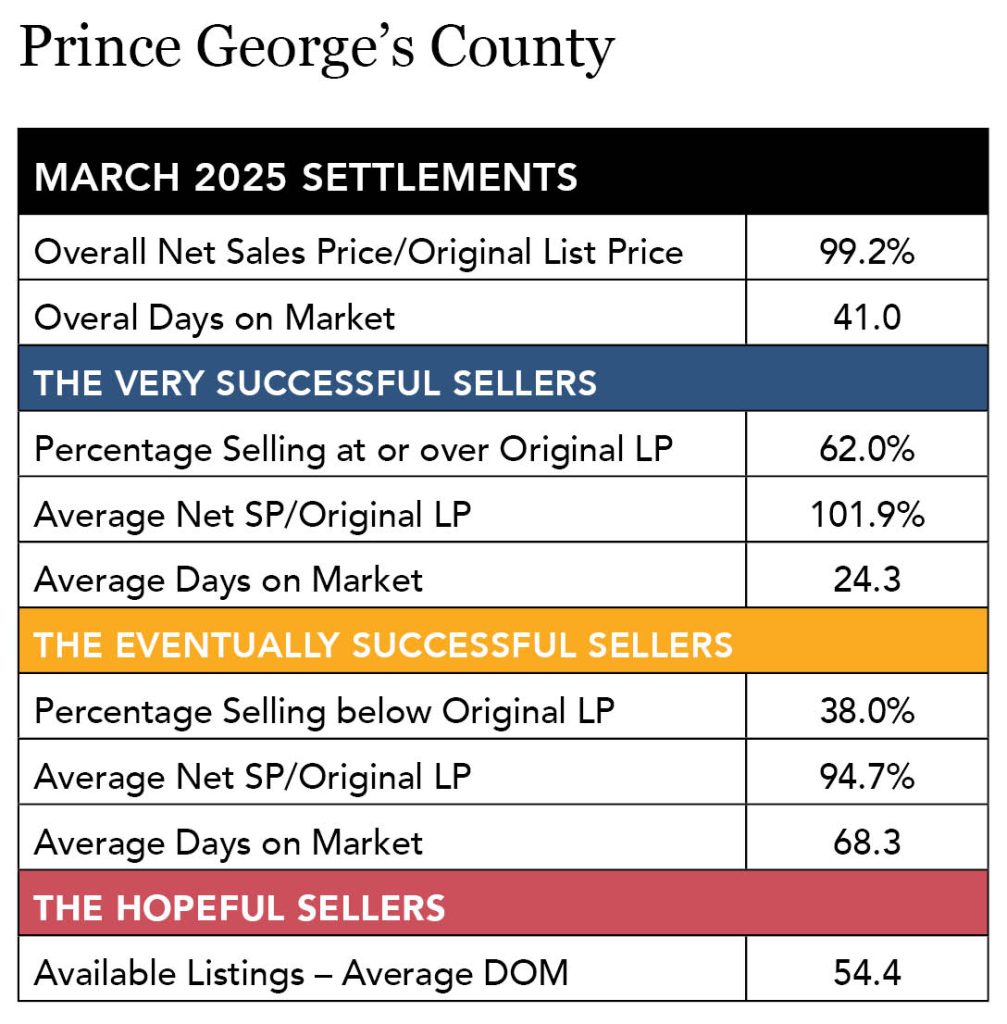

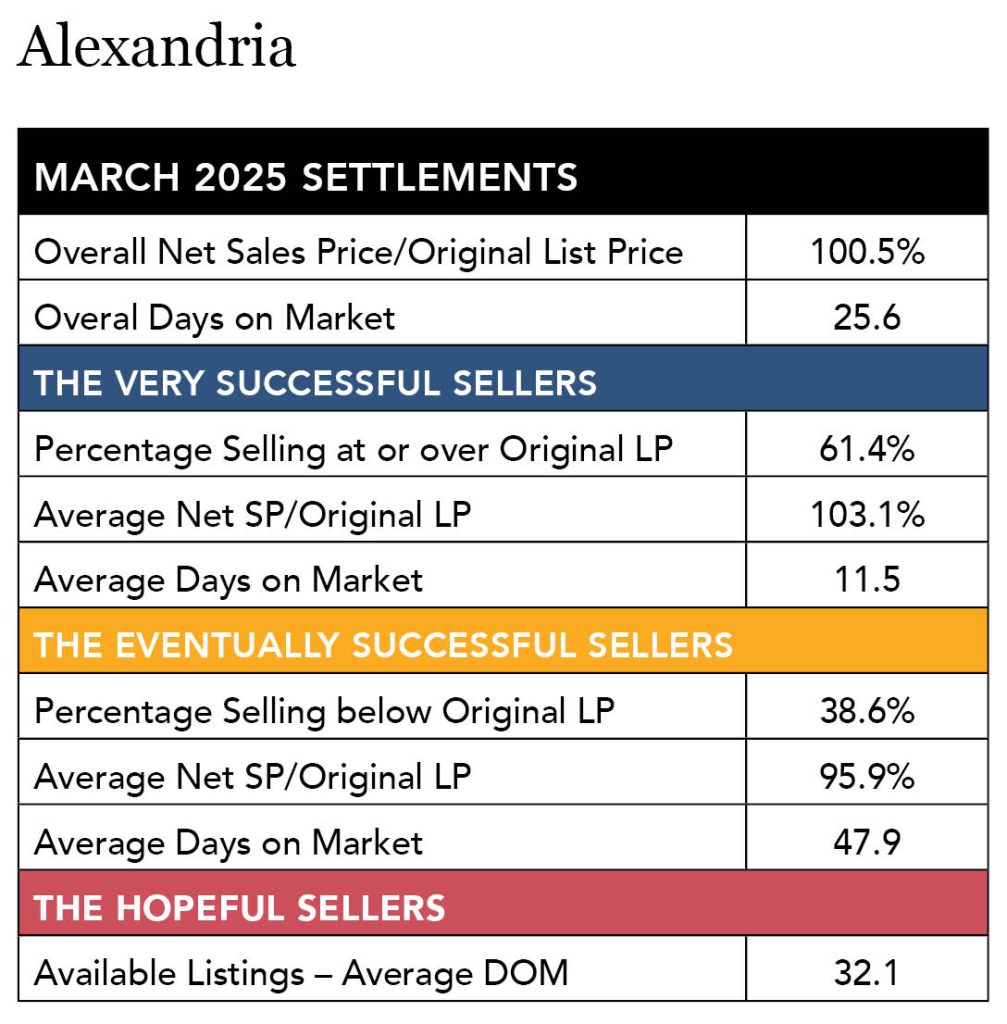

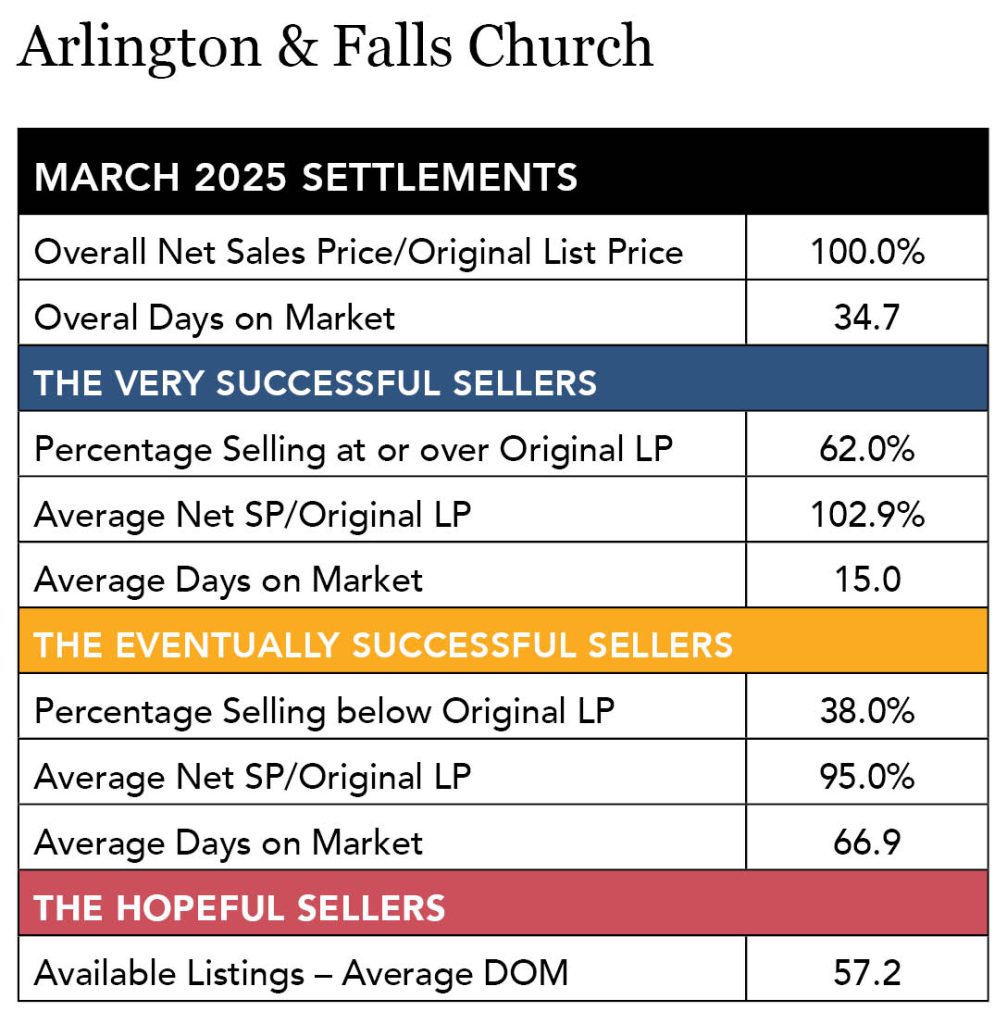

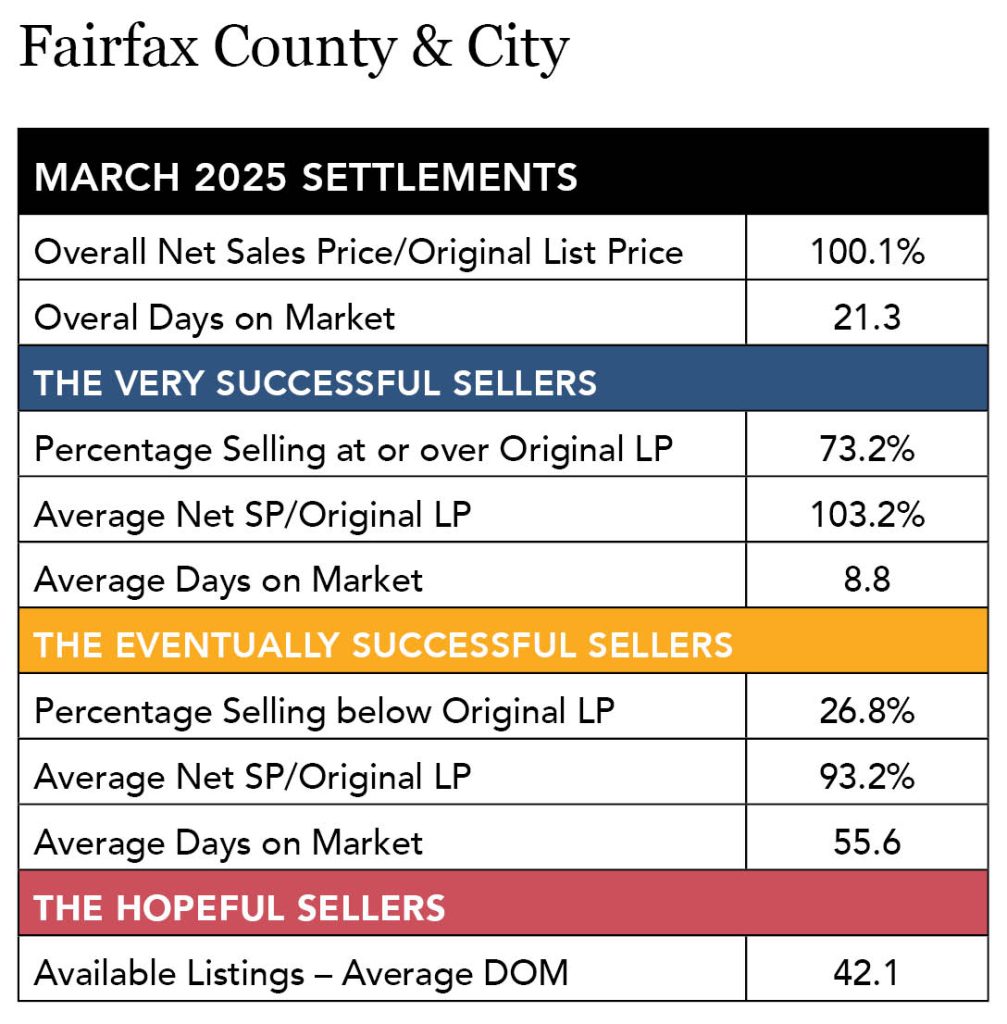

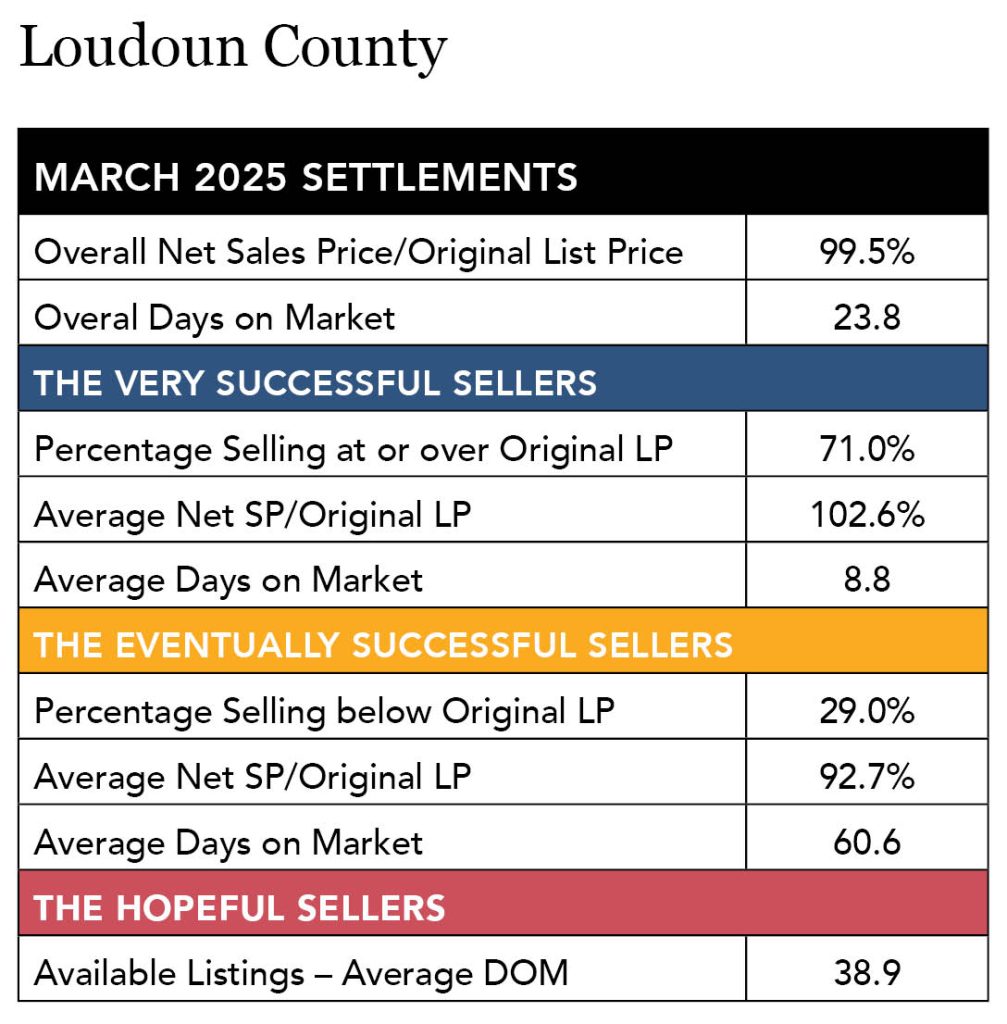

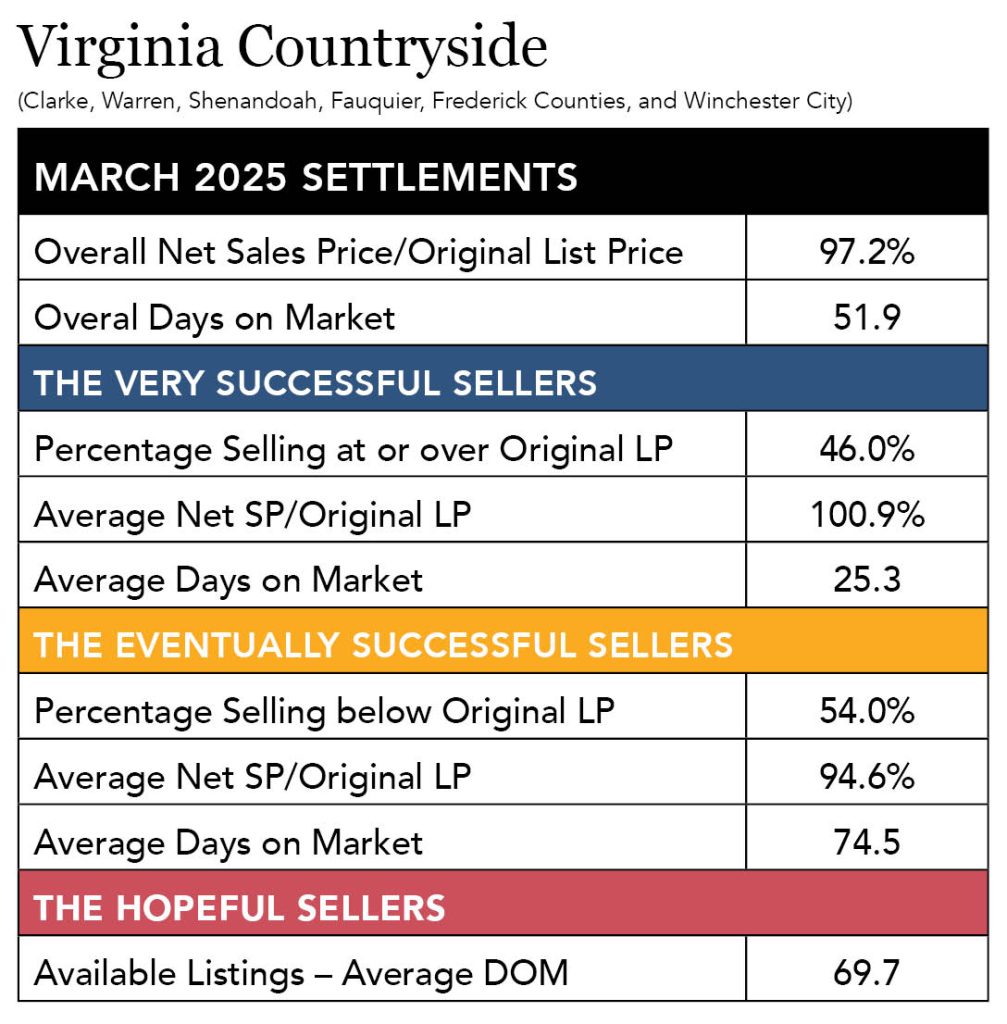

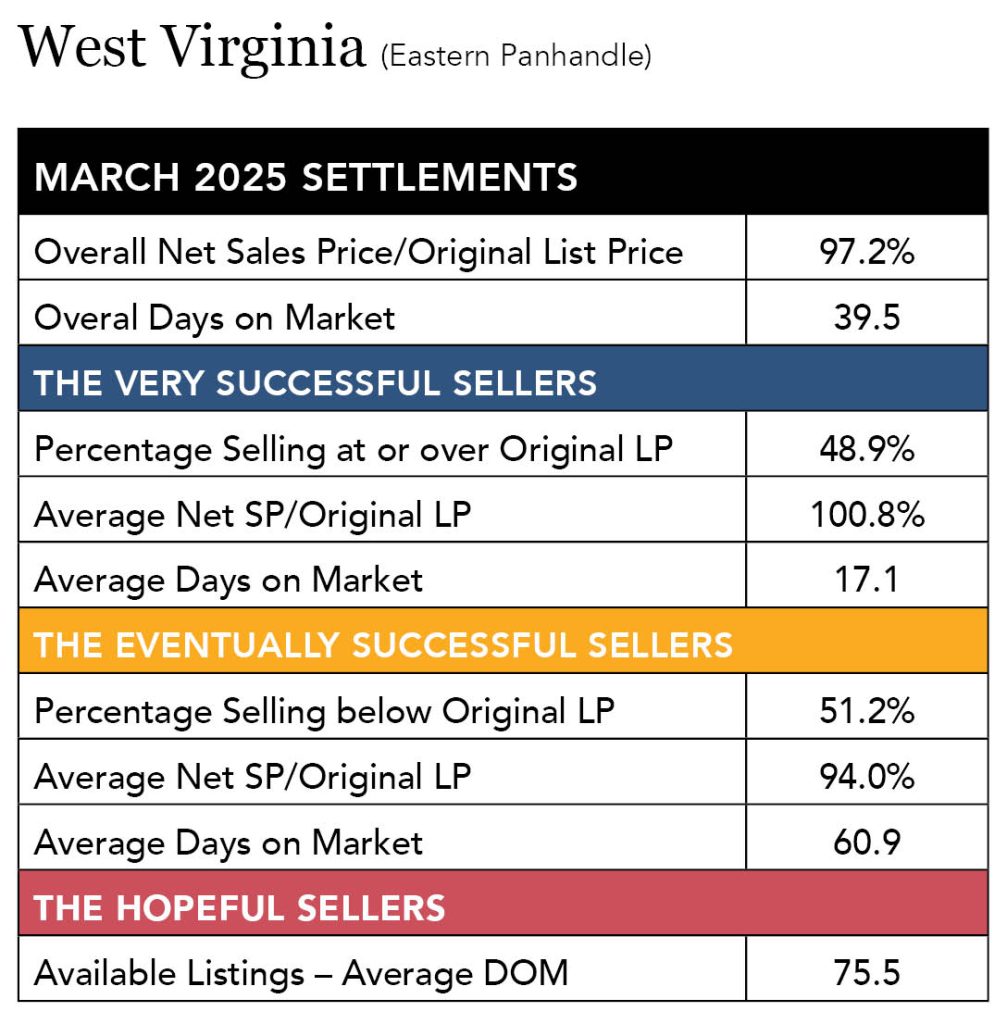

Spring 2025 Selling Trends: Inventory Is Up, Pricing Is Crucial

Data is coming in from the start of the spring selling market. Inventory is up, but it’s still a seller’s market … if the price is right.

Now that we are in the thick of the spring market, let’s look at which sellers are succeeding and which are still waiting for their buyers. And if you’re a seller getting ready to come to market, heed the warning: price matters and time kills.

General Takeaways

Compared to March 2024, there has been a noticeable cooling of the market. Homes in general are taking a little longer to sell and aren’t selling as close to their original list price. But the differences aren’t huge – about 1% less and about 5 days longer.

Inventory is also influencing the statistical story. In every jurisdiction, the number of homes on the market at the end of March 2025 was up considerably from March of last year. An example: Northern Virginia inventory is 69% higher than it was this time last year. But, again, it’s a matter of context. Despite the big percentage increases, inventory in most areas is still well below the “normal” levels we saw pre-COVID. Overall supply in most of the suburban markets is still less than 1.5 months. DC stands at 4 months.

The biggest difference in most areas we track are the average days on market for the “eventually successful sellers” – those who sold at a net sales price less than their original list price. Compared to last March, those sellers are typically taking 20 days to as much as 40 days longer to sell than a year ago.

Even with the increase in inventory, absorption rates – the number of homes that are sold in a specified month in comparison to those still on the market – are still north of the 30% threshold for a “seller’s market” almost everywhere in the Greater DC/Baltimore Metroplex. The exceptions are all three property types in DC itself, and condos in Baltimore City – those reflect a balanced market.

Given the uncertainty in the economy, the market is holding up well. And as always, the specifics change when looking at more granular geographic, property type and price range data. For example, even though the overall condo absorption rate in Arlington County was 34% in March, it was 58% in Shirlington/Fairlington and 20% in Crystal City. Those differences really matter to a seller when making the final decision with an agent about what price to list a property.

It’s still a seller’s market throughout most of the region, but, in general, sellers don’t have as much leverage as they’ve had in the most recent past. Missing the market hurts, and waiting for a price to get aligned with the trends of the market hurts even more. Just ask the “Eventual Sellers” shown in the charts below, the majority of whom sold below their original list price and sat on the market upwards of two months longer than the “Very Successful Sellers.”

List Price Matters

Source: BrightMLS

Plan for Success

What can a seller do to ensure they land in the “Highly Successful” camp? The first step is to work with a licensed Realtor® who will provide local market insight and guide your pricing strategy. The second is to prepare your home to attract the most qualified buyers: fix, remodel, and paint for the best first impression, and consider offering credits for buyers.

Finally, have a plan to make a pricing adjustment if the home hasn’t sold within 21 days, which appears to be the local “tipping point” when sales prices drop. Most experts agree that a listing that is 30 days on market without an offer is likely 3-5% overpriced. Be ready to make a pricing decision that keeps you within a competitive time-and-pricing window that keeps buyers interested.

Read more housing analysis in our Market in a Minute and Weekly Meter, and connect with one of our agents to find the best strategy to very successfully sell your home!

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producer Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Let’s Get Moving! Expert Tips To Smooth the Journey Home

THE Team from Town & Country Movers joins us this week for tips on a smooth move.

Moving can be the most stressful part of buying or selling a home, but it doesn’t have to be.

The spring market is one of the busiest times for everyone associated with real estate, with Realtors® and their clients managing many different aspects of a sale or rental and interacting with many different vendors along the way. And given that the typical homeowner stays in their property for about 12 years, it’s not unusual to have questions about how to prepare for a major but infrequent life event: moving.

At Town & Country Movers, we understand the stress that comes with relocating and we believe that a smooth and stress-free move starts with a plan and the right team to help you get things moving. We’re a local, family-owned business that has been providing clients concierge-level service throughout DC, Maryland, and Virginia since 1977 and we’ve learned a lot over the years about the best strategies to get folks settled into their new homes.

If you’re planning a move to a new home either locally or out of the region, here’s what to think about as you vet and choose the professional moving company that’s right for you.

Local Moving: How to Select a Mover

From a couple of local college kids with a truck to nationally-recognized brands, you have many options for who will handle your move so it’s important to know what to look for as you’re researching moving companies. Start first with their experience and expertise:

- Are the crews full-time, professional movers? You’ll want to know that they have dedicated personnel who have had background checks, and who will arrive on time and fully staffed so not a minute is wasted in getting your household packed up. Find out if there is a point-person on site that you can communicate with to ensure all logistics are covered.

- Are they experienced in moving specialty items? If you have an impressive art collection, uniquely-sized furniture, or large items like a piano, make sure you choose a mover who has the right equipment to deliver these items safely.

- Do they offer packing assistance? This is time-consuming work and requires extraordinary care to ensure your goods are delivered safely to their destination. Save yourself time by choosing a mover who includes packing assistance in their services, at the very least for your breakable items. It will be money well spent!

Speaking of money well-spent, ask how your mover about their fees and how they are paid:

- Is a deposit required? Clarify upfront whether the company requires a deposit before the move, and if so, what their payment terms are. Legitimate movers will provide you with a clear, written estimate, which includes the total cost and any upfront deposit required.

- What is the pricing structure? Do they charge by weight, distance, time, materials, or is it a flat fee? Get a breakdown of all potential charges so that you aren’t surprised by additional fees like disassembling/assembling furniture, using stairs, or specialized handling.

- What forms of payment do they take? Reputable movers will be set up for credit card payments, but some may offer discounts for cash. Remember that some moving expenses are tax-deductible so you’ll want to get receipts for all payments.

And while experienced movers will take every precaution to ensure the careful handling of goods, accidents happen. Find out early what the company will do to compensate you if the worst-case scenario happens:

- What happens if there’s damage? Ensure that the moving company has liability coverage and clear policies for handling any potential damages to your belongings during transit. Movers may also provide you with worksheets to help you value your items for insurance purposes. This guide from the Department of Transportation offers statistics and other tips to keep in mind.

Long-Distance Moving: What You Need to Know

In addition to all the questions listed above, a long-distance move requires a bit more investigation and logistics. Here’s what to consider:

- Does the company manage your move from start to finish? Ask if the company provides end-to-end service, or if your belongings will be transferred to a different company or a different truck during the move.

- What are the delivery terms? Understand when and how your belongings will be delivered. Will your items arrive in one trip, or will they be stored temporarily at a facility?

- Who assists on delivery? Ensure that the company uses trained, professional movers at the delivery location. It’s also important that any movers assisting with the unloading have had background checks for your safety and peace of mind.

- How is the long-distance move priced? Long-distance movers may charge based on weight, distance, and packing requirements so get a clear estimate based on the specifics of your move.

- Will you have a single point of contact throughout the move? A moving company with a dedicated point of contact makes communication easier and ensures you’re always in the loop.

Why Choose THE Team, Town & Country Movers?

At Town & Country Movers, we believe in providing concierge-level service that makes your move as easy and stress-free as possible. Our team is composed of three women with nearly 35 years of combined experience in the moving industry. We pride ourselves on offering one point of contact from the very first call to the final unloading of your belongings.

Amy, Sarah, and Errin

Town & Country Movers, Inc.

703-216-1977 direct

THETeam@townandcountrymovers.com

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Your Mortgage Closing: What to Expect and How to Prepare

Bill Stern of CMG Home Loans joins us this week for a mortgage update.

Your offer has been accepted, you’ve sent your earnest money in, and you’ve started working with your trusty mortgage team whose goal is to get your loan through underwriting and fully approved for your closing. Congratulations!

But along the way, you’ve heard a lot of financial terms bandied about, and you’re feeling a little overwhelmed by all the “mortgagese” used in this industry. Ready for an overview of your loan closing process to help clear things up? Let’s jump right into it!

Understanding Mortgage Terms

During your home closing process, it can be tricky to wrap your head around all the jargon and terms, especially for first-time home buyers. What’s PMI? DTI, LTV, CTC, CD, so many acronyms to keep track of! Below are a few important terms to keep in mind:

- Loan-to-Value Ratio (LTV): An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. An LTV of 80% means the mortgage loan is for 80% of the value of the property, with the borrower making a 20% down payment

- Debt-to-Income Ratio (DTI): Your DTI ratio represents the total amount of debt you owe compared to the total amount of money you earn each month, measured as the percentage of your monthly gross income that goes to paying your monthly debt payments

- Example: If your gross monthly income is $6,000 and your debt adds up to $2,000 a month, you divide the debt by your income. Therefore, your debt-to-income ratio is 33 percent ($2,000 is 33% of $6,000)

- Clear to Close (CTC): The golden term in mortgage closing, CTC essentially means that underwriting has greenlit the loan for closing

- Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP): PMI is mortgage insurance required on Conventional Loans with a down payment below 20%, which is added on as a portion of your monthly mortgage payment. MIP is the mortgage insurance required on all FHA Loans, regardless of the size of your down payment. There’s both an upfront premium (UFMIP) and an annual premium payment

- Closing Disclosure (CD): Your initial CD is a breakdown that includes fees like your purchase price, loan fees, estimated real estate taxes, title costs, insurance, closing costs, and various other expenses besides – and note: you must sign the CD three business days prior to closing!

The Step-by-Step Process

Simply, here’s a quick snapshot of your mortgage closing process, easily laid out in these 6 steps:

- Loan Processing

- Underwriting

- Conditional Approval

- Clear to Close

- Closing

- Loan Funding

Homeowners Insurance

It’s vital to set up your homeowners policy with a reliable insurance agent. Your closing could be delayed if your policy isn’t created with the correct information as underwriters often have strict requirements for property home coverage. It’s for a good reason – they want to ensure your home is fully insured. Your insurance requirements could be even steeper if you live in a flood zone, which will require you to obtain flood insurance separate from your regular homeowners policy. Here are a few important insurance items that your agent will need to provide us ahead of time:

- Policy declaration page or binder providing 12 months of coverage

- Invoice or paid receipt

- Replacement Cost (noted on policy) or a separate Replacement Cost Estimator (RCE) document

Please Note: If your closing date does move up, even by a day, be sure to call your homeowners insurance agent to adjust the policy periods. Your policy period cannot start after your closing; it can start up to 15 days before your closing but never after.

Title Insurance

Title insurance offers protection from problems with a property’s title, including liens, ownership disputes, and encroachments. It’s a safeguard for both the lender and the home buyer against potential issues with the deed once it’s transferred from the previous owner. As the lender, we will request this and update the old title insurance with our mortgagee clause and your information. On top of the title policy, we receive the Closing Protection Letter (CPL), the title invoice, and the Wire Instructions.

Your Closing Date

It seems simple: you’ve received CTC, you’ve signed your closing disclosure three days prior to your closing, and your closing date is set with the title company and the sellers – you’re ready to move! What else is left to do? We just ask that you set realistic expectations, even at this final stage. Maybe the seller needs to move up or push back the date for various reasons. Delays can happen at any stage. We also ask that you try not to move your own closing date willy-nilly. You may need to update your insurance policy’s effective dates, for instance. We may also need to re-verify your employment if the closing gets pushed back. These are important things to keep in mind!

We hope you now feel ready to take on homeownership since we’ve ironed out some of the details of the loan process itself. You’ll have a dedicated team working with you throughout the loan processing period, so if you need anything clarified or re-explained, we’re here to help you every step of the way.

Bill Stern | The Stern Team

Branch Manager | NMLS ID # 267577

CMG Home Loans | NMLS ID# 1820

M: 540-222-0164

bstern@cmghomeloans.com

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link