It’s not just interest rates that are rising, so are the ages of home buyers and sellers.

Each fall the National Association of Realtors® (NAR) releases a comprehensive report on the demographics of real estate clients and compiles research on sales activities. This year, one of the most talked about trends was the rising age of buyers and sellers and a decrease in first-time homebuyers.

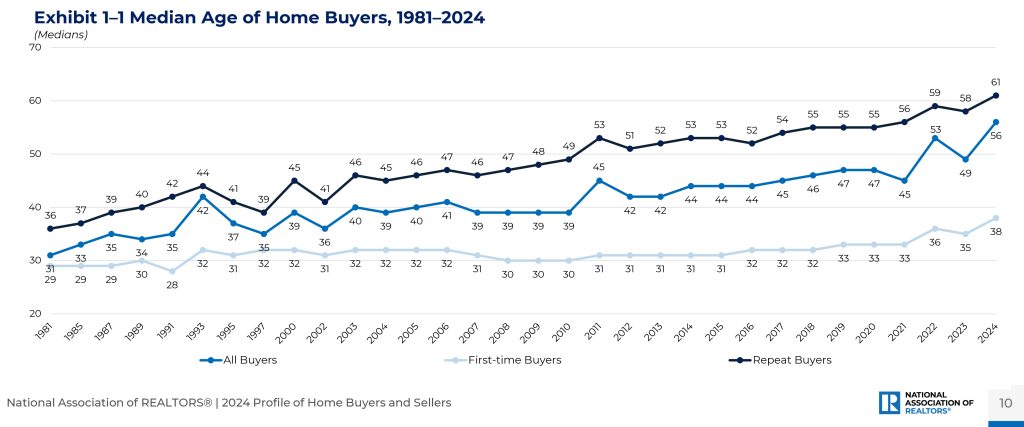

The first-time homebuyer market share dropped to a historic low of 24%, down from 32% last year, while buyers’ ages hit record highs. The median buyer age rose to 56 years (from 49), 38 for first-time buyers (up from 35), and 61 for repeat buyers (previously 58). By comparison, in 2002 the median age of first-time buyers was 31 and repeat buyers was 41.

Jessica Lautz, NAR’s deputy chief economist, noted, “The U.S. housing market is split: first-time buyers face high prices, high mortgage rates, and limited inventory, making them older and wealthier than previous generations, while current homeowners are using their equity for cash purchases or large down payments.”

Statistics were drawn from transactions that happened between July 2023 and June 2024 and included overviews of salaries, ethnic make-up, and marital status. Findings include:

- The median household income of buyers rose to $108,800 from $107,000 in 2022.

- First-time buyers had a median income of $97,000, a $26,000 increase over two years, while repeat buyers saw their incomes rise to $114,300 from $111,700.

- Among all buyers, 62% were married couples, up slightly, while single females increased to 20%.

- Single males and unmarried couples decreased by 8% and 6%, respectively, while single female first-time buyers increased by 5%.

- 73% of buyers reported no children under 18 in the home, the highest yet recorded.

- 83% of buyers were White, 7% were Black, 6% were Hispanic/Latino, 4% were Asian or Pacific Islander, and 3% were other ethnicities.

Multigenerational homes comprised 17% of purchases, the highest in the series. Lautz explained that rising costs have influenced buyers to “double up as families,” with young adults returning home due to prohibitive housing costs and elderly relatives moving in as families focus on close-knit support.

On the seller side, the typical age of home sellers reached the highest ever recorded at 63 years. The share of married couples selling their homes increased for the first time in four years, climbing from 65% last year to 69%. The most cited reasons for selling were the desire to move closer to friends and family (23%), the home was too small (12%), the home was too large (11%), and the neighborhood becoming less desirable (10%).

Other interesting takeaways from the report:

- The Price Is Right: Most sellers got 100% of their asking price, the highest median since 2002. But prices were lower for homes that stayed on the market for five to eight weeks and sold for slightly less at 98% of list price.

- Moving Into the Golden Years: Senior-related housing remained at 19% of buyers over the age of 60 this year; 58% purchased a detached single-family home, and 52% bought in a suburb or subdivision.

- Military Stats: 16% of recent home buyers were veterans and 2% were active-duty service members.

- FSBOs struggled: For-sale-by-owner listings, which represented a record low of 6% of all sales, typically fetched a lower sale price than homes represented by an agent with a median price of $380,000, far lower than the median selling price of all homes, which was $435,000.

- Price reductions uncommon: Even though price reductions were on the rise in 2024 compared to the pandemic years, the majority of sellers did not need to lower their sale price to close the deal: 65% never reduced the asking price, and 21% reduced it once.

- Sellers call the shots, usually: Because sellers largely retained the advantage in the housing market last year, just 24% (down from 33% last year) offered incentives to buyers; 76% of sellers offered no incentives, 9% provided assistance with closing costs, and 8% offered a home warranty.

- The White Picket Fence Dream: Detached single-family homes represented 81% of sales (up from 79% last year) followed by town- or rowhomes at 7%.

- Home Sweet Home: Overall, buyers expected to live in their homes for a median of 15 years, while 25% said that they were never moving.

But maybe the most important finding of the report was that both buyers and sellers overwhelmingly believed in the importance of using a real estate agent: 88% of buyers and 90% of sellers used an agent to assist with their transactions. Home buyers primarily sought help from an agent or broker in finding the right home to purchase (49%) and negotiating the terms of the sale (14%). Meanwhile, seller respondents reported that agents were most helpful for marketing the home to potential buyers (22%), pricing the home competitively (20%), and selling the home within a specific timeframe (18%). Finally, 88% of home buyers would use their agent again or recommend them to others.

If you’re contemplating a move, reach out to any of our experts at McEnearney Associates | Middleburg Real Estate | Atoka Properties to help you reach your real estate goals.

Read the full NAR report here.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link