When Is The Best Time To List My Home?

Across the country, sellers are consulting their calendars to land on just the right time to list their properties.

Just like the temperature, the spring real estate market is heating up in our region, and buyers are anxious to get in on the action. Limited inventory still favors sellers, but there are strong signs that more homes will continue to be added, allowing buyers a better chance of finding a home that meets their needs.

It’s not a secret that the spring market is the busiest of the real estate cycle, but unlike local declarations of the change in season – “the first pitch of Nationals baseball” or the “first blooms of the Tidal Basin’s cherry blossoms” – there’s no clear date that sellers can peg for “The Best Day” to list their home. Locally, the “spring market” is loosely defined by many agents as “between the Super Bowl and Memorial Day,” which is pretty broad. If you’re looking to move soon and you can be flexible about your listing strategy, here’s what to consider.

Realtor.com’s annual “best time to sell” analysis identifies April 13-19 as the ideal new listing window based on seasonal trends in pricing, demand, and days on market (DOM) seen over the past seven years. But Zillow pushes their ideal date further out and predicts that, based on 2024 data, sellers who listed their home in the last two weeks of May netted an additional 1.6% on the sale, about $5,600 on the typical U.S. home.

Because all real estate is LOCAL, let’s take a look at the trends in our region, with the disclaimer that the best time to list your home is…when you need to move! Life changes can happen at any time, necessitating a move when you may least expect it. Factors like rising or falling interest rates (ex: higher interest rates are likely to keep would-be sellers in their current homes), consumer confidence, and the impact of cuts to the Federal workforce can also influence local market activity, throwing a potential curveball at well-crafted listing plans.

“In general, April and May tend to have the most available inventory, with March and June close behind. Same goes for new listings coming on the market,” says David Howell, CIO and a Principal of Corcoran McEnearney. “But it’s important to note that the relative supply doesn’t change as much as the actual inventory. And that’s because there are more buyers in the spring as well. So, the supply of homes – inventory and contracts – is only a little lower in the spring than it is in the winter months.”

“That wasn’t always the case,” says Howell. “Many years ago, we could count on the market being very quiet from Thanksgiving through most of January. But as our market grew more culturally diverse, the traditional seasonality waned to some degree.”

Another regional influence is the high number of military installations and the servicemembers who keep them operating, but even that impact is shifting from a spring/summer impact to one that is increasingly spread out over the year. “The summer months were always the biggest for military moves, but PCS (permanent change of station) moves in the military are now typically three years rather than two like they used to be, decreasing the number of moves military personnel would make,” Howell explains.

“What moves the market far more than the seasons is geography and major economic indicators – like mortgage rates and unemployment,” he adds.

As we head toward what could be peak Selling Season, what are the stats telling us about what to expect? BrightMLS, the mid-Atlantic database of real estate transactions, reports that year-to-date, new listings are up 10.4% in the D.C. region, compared to 4.8% for the overall Bright MLS service area. (This is higher than last year but is 5.3% lower than listing activity in the week prior.)

BrightMLS also reports that for the week ending March 23, the increase in local inventory is encouraging sellers to lower their prices, with the share of sellers dropping their asking price now two percentage points higher than it was a year ago. It had been anticipated that DOGE would cool housing market activity in the greater Washington, D.C. area, but BrightMLS reports that the uptick in new listing activity has drawn some sidelined buyers into the market.

“In the spring market, homes tend to go under contract about 10-15% faster, likely influenced by a combination of better weather that makes it easier to see and show houses and the simple fact that there are more buyers in the spring,” says Howell.

Sellers who are preparing to list soon should expect some negotiation from buyers who see, maybe, not “bargains” but “opportunities” with more homes to choose from. Buyer activity was relatively stronger in the D.C. area market than in other parts of the Mid-Atlantic region last week, with pending sales activity the strongest in the local markets where listing activity has increased the most.

If you’re planning to list within the next month or two to capture excited buyers and stand out from the competition, working with the experienced Realtors® at Corcoran McEnearney who understand the nuances of our local market will ensure your real estate goals are achieved no matter what season you’re selling.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producer Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What You Don’t Know About Flood Risk Can Cost You

The seasonal transition to spring rains brings a risk of flooding, but smart homeowners and buyers know how to navigate potentially troubled waters ahead.

Pop Quiz! True or False?

- Question 1: Homeowners insurance covers flood damage.

- Question 2: Flood insurance will cover the repair or replacement cost of a home, regardless of the property value.

- Question 3: If my home is damaged by a flood, I will get Federal assistance.

- Bonus Question: Sellers have to disclose if a property is in a flood zone.

The answer to all three of those questions is FALSE, and the answer to the Bonus Question is … “Probably not.“

According to the National Association of Insurance Companies (NAIC), flooding is the most frequent and expensive natural disaster in the United States. Climate change is exacerbating the risk of flooding as more frequent and violent storms and hurricanes are impacting areas that rarely see flooding, like the September inland disaster caused by Hurricane Helene moving across the southern Appalachian Mountains – devastating parts of Georgia, Tennessee, Virginia, and the Carolinas.

As we spring into flood awareness season, it’s important to understand the logistics of determining whether you need flood insurance, how to acquire it, and what it covers in the event of a claim. Flood insurance can be very expensive – one inch of water can cause $25,000 worth of damage, according to data collected from the Federal Emergency Management Agency (FEMA) – so it makes financial sense to investigate whether a property is at risk for flooding. However, where to get that information varies based on where the property is located.

How To Uncover Risk

Sellers in DC must disclose if their property is in a flood hazard area or special flood hazard area (SFHA) on a Seller’s Disclosure Form that is provided to buyers, while Maryland sellers are only required to disclose whether water stands on the property for more than 24 hours after heavy rain and whether or not the property is located in a flood zone. Virginia sellers don’t need to make any representations about whether a property is in a flood hazard area unless the property has been deemed a “repetitive risk loss,” meaning the property has had two or more claims of $1,000 or more paid by the NFIP within any rolling 10-year period. West Virginia has no seller requirements for disclosing flood risk at all, one of 21 states without any obligation to inform a buyer of this potential hazard.

Therefore, it is up to buyers to conduct a due-diligence review of the property, and they can start by reviewing FEMA’s flood maps or state-specific resources like these for Virginia, DC, Maryland, and WV. Buyers should also look for guidance from their lending institutions, who will most likely require flood insurance as part of a mortgage.

How to Get Insured

Homeowners insurance policies do not cover flood damage so owners will have to secure a special flood policy. Some of these policies may be privately insured, but most flood insurance comes from the National Flood Insurance Program (NFIP), a public-private partnership between the federal government, the property and casualty insurance industry, states, local officials, lending institutions, and property owners. It was created by Congress in 1968 to provide insurance to help reduce the socioeconomic impact of floods to property owners, renters, and businesses.

Start with your preferred insurance company for guidance on securing coverage as they may already be connected with the NFIP. According to FEMA’s last update in 2019, the average flood policy cost to consumers was about $700, but, depending on the value of the property, an owner may need to get an additional private policy outside of their insurance company as the NFIP only covers up to $250,000 in repair costs and up to $100,000 for contents coverage. Private insurance may not be available in all states, and more restrictions are happening each year as climate change disasters push premiums ever higher and force insurers to leave some coverage areas completely. Federal programs in the event of natural disasters rarely come close to covering actual repair or recovery costs, generally providing just $3,000-$6,000 for individual grants.

Keep in mind your flood insurance coverage might not automatically renew so be sure to check your renewal date to ensure the premium is covered. Flood policies take 30 days after registration to become active so the time to get a policy in place is NOW.

The National Association of Realtors® (NAR) estimates that the NFIP is essential to 1,360 home sale closings daily, translating to approximately 41,300 affected monthly transactions nationwide. If you’re in the market to buy a home, connect with one of our expert Corcoran McEnearney Agents who will advise you on the best way to protect your purchase, no matter what storms may lie ahead.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Real Estate Taxes in the DC Metro Area: What Homeowners and Investors Need to Know

Real estate taxes are an important consideration for anyone looking to buy property or invest in real estate.

For those in the Washington, D.C. metro area, understanding the region’s tax landscape is crucial, as the area encompasses multiple jurisdictions with different tax rates, rules, and regulations. Whether you are already a homeowner, a prospective buyer, or an investor, knowing how property taxes work can help in financial decisions regarding property ownership.

Real estate taxes are local taxes levied on the value of land and buildings. They are collected by city or county governments and are a primary funding source for local services such as schools, public safety, roads, and parks. Property taxes are calculated on the assessed value of the property and the tax rate set by the particular taxing jurisdiction.

In our region, there are distinct tax regimes (e.g. state, county, and city) to consider since the area spans multiple jurisdictions – Washington, D.C., suburban Maryland, and Northern Virginia. Each jurisdiction has its own approach to real estate taxation, which can lead to significant differences in tax rates and policies. Generally, across our local jurisdictions there is a process for assessing the value of real property and then applying a tax rate, which is typically set by the jurisdictional government each spring.

Real Estate Taxes in Washington, D.C.

Washington, D.C., has its own independent property tax system. The city assesses the fair market value of the property, and imposes taxes on the property to help fund services, including public education, emergency services, and infrastructure.

Washington, D.C., imposes different tax rates on residential property and commercial property. As of 2024, the residential real estate tax rate in D.C. was $0.85 per $100 of assessed value. This means that for every $100 of assessed value, homeowners paid $0.85 in property taxes. The tax rate for commercial properties in D.C. is higher than for residential properties, standing at $1.85 per $100 of assessed value. This rate applies to properties used for business purposes.

Real Estate Taxes in Maryland (Suburban DC)

In Maryland, property values on residential property are typically assessed every three years. The assessments are conducted at the local jurisdictional level and overseen by the State Department of Assessments and Taxation (SDAT). The local governments of Montgomery and Prince George’s counties establish their own tax rates applied to each $100 of assessed value. Montgomery County is one of the largest and most populous counties in Maryland, and its real estate tax rates are among the highest in the state. As of 2024, the real property tax rate in Montgomery County was $1.04 per $100 of assessed value for residential properties.

In addition to the standard real estate tax, Montgomery County property owners may also be subject to a fire and rescue tax for properties located in certain districts. This tax is typically a small percentage of the property’s assessed value and is used to fund local emergency services.

Prince George’s County has a slightly different property tax rate. As of 2024, the real estate tax rate in Prince George’s County was $1.10 per $100 of assessed value for residential properties. Much like Montgomery County, Prince George’s also levies additional taxes for specific services, such as fire and emergency services, and may have different rates for commercial properties. It is prudent for prospective property owners to check with the local tax authority for any additional taxes that may apply.

Real Estate Taxes in Virginia (Northern Virginia)

In Virginia, real estate taxes are imposed on the fair market value of real estate as of January of each calendar year. Tax rates vary by locality. Some of the major Northern Virginia counties include Arlington, Fairfax, and Loudoun, in addition to the independent City of Alexandria. Like the other jurisdictions in the metro area, each county in Virginia establishes its own tax rate and to some degree its tax regulations.

Arlington County is known for its proximity to Washington, D.C., and is home to many government employees and young professionals. As of 2024, the real estate tax rate in Arlington County was $1.013 per $100 of assessed value. Arlington has an additional stormwater tax, which is designed to fund the local stormwater management system. The amount varies depending on the size of the property and its impact on the county’s stormwater infrastructure.

Fairfax County, the largest jurisdiction in Virginia by population, has a higher real estate tax rate than Arlington County. The 2024 tax rate in Fairfax is $1.14 per $100 of assessed value for residential properties. Like other localities, Fairfax may have additional taxes for special services such as fire protection or emergency services, depending on the specific area within the county. The City of Alexandria, an independent city within Virginia, has a tax rate that is distinct from the adjacent counties. As of 2024, the real estate tax rate for residential properties in Alexandria was $1.11 per $100 of assessed value.

Loudoun County’s tax rate for 2024 was $1.085 per $100 of assessed value. Loudoun historically provided certain exemptions for different land uses, such as agricultural, but residential development continues to decrease the instances of these exemptions.

Property Tax Appeals and Exemptions

If you feel that your property’s assessment is too high in any of the jurisdictions in the DC metro area, you have the right to appeal the assessment. Each jurisdiction has a formal process for appealing property tax assessments, and it usually involves providing evidence, such as recent appraisals or sales of similar properties.

Additionally, some jurisdictions offer property tax exemptions and credits for qualifying homeowners. For example, D.C. offers a homestead deduction that allows homeowners to exempt a portion of their property’s assessed value, reducing their overall tax burden. Similarly,

Maryland and Virginia offer various tax relief programs for seniors, disabled persons, and certain Veterans.

Local property tax payments are due twice each year, although the due dates vary from jurisdiction to jurisdiction. If a property is encumbered by a mortgage, the mortgage company may require 1/12th of the annual tax liability be included in the monthly payment, which would be placed in escrow, allowing the mortgage company to make the semi-annual tax payment to the appropriate jurisdiction. Most mortgages are set up to require a tax escrow payment, though a conventional mortgage may not require a tax escrow if the loan amount falls below a specific loan-to-value.

Taxes help fund the services in our communities and it’s important to understand how they are collected and what they are used for. If you’re interested in understanding how taxes will affect your home affordability scenario, reach out to me or anyone on the Atlantic Coast Mortgage team to learn more.

Brian Bonnet, SVP, Sr. Loan Officer, NMLS ID 224811

Atlantic Coast Mortgage, NMLS ID 643114

O: 703-766-6702 | M: 703-304-0188

Email Me

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Use Your Tax Refund Toward Homebuying Costs

For many, it’s a once a year windfall. Check out the best ways to make your tax refund work for you.

Tax season is right around the corner, and if you’re expecting a sizeable tax refund and want to invest in your homeownership future, here’s something you might not have considered: using your tax refund to buy your home. You’d be surprised at the creative ways you can utilize your tax refund for home buying success, so let’s review some options.

Your Down Payment

One of the first avenues you can funnel your tax refund to is towards your down payment. While it likely won’t be enough to cover the full down payment, you can combine it with CMG’s HomeFundIt™ program, a down payment gifting platform that allows you to raise funds from your community. HomeFundIt also guarantees a $2,000 matching grant to first-time home buyers.* If paired with your tax refund, you’ll have a healthy amount to put towards your home purchase.

Closing Costs

Various fees and expenses the borrower pays at closing can typically range from 2-5% of the total purchase price of the house. Some buyers forget that there is more to starting a mortgage than just covering the down payment. Closing costs are also split by both the buyer and seller, and your tax refund can significantly help cover those costs.

Emergency Funds

An emergency fund is an excellent option for your tax refund, especially if you’ve already covered the down payment and closing costs.

Unexpected expenses go hand-in-hand with being a homeowner, and if a plumbing issue or environmental damage happens to your home right off the bat, it will be a huge weight off your shoulders if that emergency money is ready to go.

Moving Costs

Whether it’s renting a U-Haul or hiring movers, there are extra fees to consider when making the big move once all loan documents have been signed off. Not only will you need to pay to move, but there could be deposits required for utilities, extra storage, or paying for new furniture and household items.

Next Steps

It can be tempting to use a cash windfall for a “treat” like vacations, travel expenditures, a shopping spree and the like. However, if you’re a hopeful homeowner, it may be a better idea to invest in your future and start building equity sooner rather than later. Whether you funnel your refund towards your down payment, closing costs, emergency funds, or other costs associated with moving into a new home, you won’t regret planning ahead and setting yourself up for success.

Reach out to our CMG financial advisors today for more tips on preparing yourself for homeownership.

*Grant is a $2-to-$1 match on regular down payment gifts received on HomeFundIt™, up to the lesser of $2,000 or 1% of purchase price for first-time buyers, as defined by Fannie Mae, who complete home buyer education prior to signing a purchase contract. Talk to your loan officer or visit your HomeFundIt dashboard for next steps, or you can also find a housing counselor near you by visiting https://www.hud.gov/counseling.

Grant funds are applied to nonrecurring closing costs. If closing costs are fully paid by seller or interested party, grant funds can be used to buy down the rate. Grant funds cannot be used towards a down payment. Visit https://www.homefundit.com/Grant for complete terms and conditions.

Brian W. Kempf

Senior Vice President, Branch Manager, NMLS ID# 483525

CMG Home Loans, NMLS ID# 1820

571-309-4911

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Home Purchase 411: The Top Five Things You Might Not Know

In homebuying, what you don’t know can indeed hurt you in the long run.

If you’re in the market for a new home you may be pondering many things: Will I get the best interest rate? What will my commute to work be like? What can we do with the basement? Will the primary bedroom closet fit all my clothes? Is there a cul-de-sac for the kids to play? Will I be able to afford the loan payment?

All important considerations, no doubt. But there are some not-so-obvious aspects of buying a home – one of largest, most important, and expensive transactions most people will undertake – that buyers should consider to minimize risk for what should be a happy and positive life milestone.

Keith Barrett, an attorney and founder of Vesta Settlements, recently met with many of our agents to discuss his Top Five things that buyers should be aware of.

Title Insurance

Title is the formal right of ownership of property; title insurance protects and insures an owner’s (or lender’s) interest in real property. Specifically, it is a policy of indemnification (“making whole”) against loss caused by any covered defect in the title. Title insurance is unique in its scope because where most insurance policies protect against future unknown events, title insurance is retrospective and looks back in history (generally back 40 years) at what has occurred to land or a property regarding ownership. It’s also unique in that the premium is paid once, rather than monthly or annual premiums like other insurance policies.

Why is this important? Title insurance protects a seller for the rest of their life because seller’s maintain liability related to the warranty they provide in the deed of conveyance.. As a result, the title policy protects the seller even after the property has sold … for all eternity! And even though you should permanently retain all title insurance documents, don’t worry if you happen to lose the physical copy of your title insurance as there will likely be a record at one the largest four title insurance companies.

There are two types of title policies: an optional Owner’s Policy (protects the homebuyer for life, with a one-time premium based on the purchase price) and a required Lender’s Policy (protects the lender until the loan is paid off, with a one-time premium based on the loan amount). And although title insurance is optional, it’s an expensive gamble to skip it. Barrett advises buyers ask themselves, “Am I willing to self-insure here?”

He used an example of the “extended warranties” that are pitched when buying appliances. If a $100 printer breaks down and you don’t have a warranty, it’s not that big a hit to buy another printer and be out a couple of hundred dollars. But when you’re looking at a $900,000 home for which you’ve put down a hefty downpayment of $100-200K, is that something you want to be on the hook for if a title claim arises.?

(Here’s an interesting bit of local history related to deeds: Barrett shared that most of our region’s land and property records were destroyed during the Civil War, but Loudoun County clerks had time to collect their records and hide them in various places throughout Virginia. This means Loudoun County still has their original records from more than 200 years ago! Worth taking a visit to tour this local bit of national history.)

Caveat Emptor…Buyer Beware!

If you’re a buyer in Virginia, the onus is on you to do your due diligence before purchasing a home to ensure the property is of suitable type and condition. While Virginia law requires a seller to provide a Residential Property Disclosure, it’s really a disclaimer statement and not a disclosure. A seller makes no representation to the buyer as to the condition of the property, adjacent parcels, covenants, or restrictions. Generally a seller will only be liable in the event actions were taken to conceal a condition or evidence of other fraudulent activities.

Why is this important?

Buyers might assume that sellers have a legal obligation to tell them about problems in a home, but in reality, in Virginia a seller doesn’t have an obligation to disclose known material adverse facts about the property and it’s up to the buyer to conduct inspections and seek out information. By law, agents are held to a higher standard for disclosure than their seller clients. Barrett offered an example of how disclosure works, such as a broken washing machine, by answering these five questions:

- Is it material to a buyer?

- Is it a fact?

- Is it adverse?

- Is it regarding the physical condition of the property?

- Does the agent have actual knowledge of this?

Surveys

Imagine you are walking the backyard of a property and you see a traditional white-picket fence. You might assume that everything inside the fence is part of the property and everything outside the fence is not. But without a survey, you have no actual knowledge of where a property line actually falls.

A survey is a physical depiction of the property including boundary lines and other characteristics such as patios, sheds, decks, driveways, fences, setback lines and, possibly, easements. In the example above, a survey could reveal that the fence was in fact built on the neighbor’s property and, therefore, certain property inside the fenceline is not actually the property.

Why is this important? Conducting a property survey is not required by lenders, but that doesn’t mean buyers should skip one. Through the American Land Title Association, lenders receive survey coverage in their final title policies whether the buyer gets a survey or not. But the lender’s coverage does not cover a buyer.

Barrett joked that, despite the great expense and work that it takes to buy a home in our region, “Sometimes I feel like people do more due diligence buying a smartphone than they do buying an $800,000 or $900,000 home.” He shared that the average cost of a survey runs around $350, a mere pittance when thinking about the consequences of having to move a driveway or a shed because it fell a few feet into over a boundary line.

Taking Title

When two or more people take title to property, a tenancy will have to be selected from one of these three options:

- Tenancy by the Entirety – reserved for married couples only. Includes rights of survivorship and basic asset protection to the extent the creditors of only one spouse cannot lien the property under this tenancy.

- Joint Tenants – with this tenancy, each tenant holds equal undivided shares in the property. Includes rights of survivorship.

- Tenants in Common – each tenant holds a proportionate undivided interest in the property, but it does not have to be equal shares. (Note that this is the default tenancy in Virginia.)

Why is this important? If you’re single or married, there’s very little to decide about tenancy. But when you have more than one buyer and they are not married it can have significant consequences down the road if the parties don’t understand how each tenancy plays out and how the home as an asset might be divided or protected in the case of a claim against assets (ex: creditors).

Home Inspections

As we saw above in “Caveat Emptor,” buyers need to do their homework about the state and condition of the property to uncover any issues. But most buyers don’t know what to look for when it comes to major systems like electrical, HVAC, plumbing, roofing, and foundations.

Why is this important? Without knowing the condition of a property, a buyer could get a nasty surprise when something major fails. Even in a competitive market, it’s critical to bring in an expert home inspector to do a thorough review of the home, looking at the age and condition of major systems and look for future issues that could arise. If a buyer wants to make an offer without including a home inspection contingency, ask to conduct a pre-offer inspection. That way the buyer is informed what may need to be updated, repaired, or replaced and can move forward with an offer or move onto a different property.

While homebuyers have a lot to worry about, these five areas are not normally top of mind. But giving these topics more thought and consideration will reduce headaches later. To make sure you’re working with an agent who will ask the out-of-the-ordinary questions to ensure you are informed about tricky subjects, reach out to any of our experts at Corcoran McEnearney to help keep trouble at bay.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

![]()

Why Pricing Matters, Even In a Hot Seller’s Market

Every seller thinks their home is The Best Listing. But the most successful sellers have a plan to make their property stand out to buyers.

The winter holidays aren’t known for frantic selling of real estate, especially when homes to buy are few and far between and buyers are focused on spending their dollars elsewhere. And stubborn interest rates that refuse to move below 7% is keeping a lot of people on the sidelines. But as we prepare for what’s new in 2025, it’s smart to look to last month’s statistics for clues as to what savvy home sellers can do to be ready… and where buyers should be focused.

There has been a significant pullback on the overall relationship of sales price to original list price, and the average days on market has increased as well. Nonetheless, overall housing supply in almost all of the 17+ jurisdictions we track is still less than 2 months, an indication of a strong seller’s market; a balanced market is when there is a 5- to 6-month supply of housing inventory.

(The notable exceptions are: Washington, DC, where overall supply reached 5.5 months, and all three property types – detached, townhome & condominium – exceed 4 months, and Baltimore City, where supply is 2.9 months.)

A modest easing of the market isn’t new and we’ve watched this trend for several months. What it tells us is that sellers who ”get it right” still sell quickly at a substantial premium. And despite this move toward a slightly more balanced market, there is still a significant gap between “Very Successful Sellers” and all the other sellers. Let’s take a look at their advantages.

The Difference Between Immediate Success and an Eventual Sale

The “Very Successful Sellers” are those who sold at or above original list price. In DC in December, 35% of all homes going to settlement sold above original list price – a 1.9% premium above list. And they sold in an average of just 39 days.

Contrast that with the “Eventually Successful Sellers,” who sold below original list price. That was 65% of all homes settling in DC in December and they took a big haircut, selling for an average of 12.1% below original list and with an average of 103 days to sell. That’s a lot of money and a lot of time those sellers lost by not pricing their homes correctly at the outset.

Pity the “Hopeful Sellers” – those whose homes are still on the market, waiting for offers — who have been on the market for an average of 122 days.

Let’s look at some other regional stats:

- In Montgomery County, half of the properties that settled sold at an average of +2% above original list in an average of 19 days. The other half of properties sold at just 94% of original list in 53 days. The average days on market for those homes that are unsold is 79.

- In Alexandria, 36.6% of homes sold in 18 days at an average +1.8% above list price, while 63.4% of homes sold at an average of -4.4% below list price and took nearly 52 days to sell, just beating out those still unsold at 58 days on market.

- Arlington & Falls Church sales averaged almost 45 days on market, with 43% of very successful sellers finding buyers within 13.5 days and for +2.4% above list, compared to 57% of eventually successful sellers who took almost 70 days to sell and -5.1% below list price. Hopeful sellers languished at nearly 90 days unsold, one of the highest of all the areas we surveyed.

- In Fairfax County & Fairfax City, successful sellers made up more than half of all sales – 53.6% – with a healthy +2.1% above list price and under contract in 13 days. The remaining 46.4% of eventual sellers sold at almost -6% below list and it took nearly two months to get there. The hopeful sellers are hanging on for nearly 74 days.

- Prince William County has one of the tightest markets for inventory, with just a 0.9 month’s supply of available properties. The most successful sellers saw +1.4% over list price and went under contract in 16.7 days. Eventual sellers got there in 51 days but at -4.8% below list price. If there’s a glimmer of hope for those unsold properties, it’s that they had the lowest days on market of the regions we surveyed, at 49 days unsold.

- In Prince Georges County, 53.6% sellers sold at +1.4% above list in 21 days, while the remaining sellers netted -5.7% below list and it took just over two months to sell. Unsold homes have been on the market for and average of 65.6 days.

- Big round of applause for Loudoun County most successful sellers, 56.5% of whom took just 9 days to sell and got +1.2% above list. The eventual sellers took 44 days with a -4.7% under list price, while unsold homes remained on the market for 71 days.

- The Virginia Countryside’s most successful sellers saw the closest list/sale price of +0.6% in 17 days, but they were just 38.5% of all sales. The remaining 61.5% of sellers took 70.5 days to sell at a lackluster -8.1% below list price. That’s making it tough for the “hopeful” sellers who take 2nd place to DC in remaining days on market at 94.9 days.

- West Virginia rounds out our regional look with a 2.3 month supply of inventory. This was also the most evenly divided of statistical insight: successful sellers made up 50.3% of sales at +0.5 above list in 44 days while eventual sellers made up 49.7% of sales netting -6.3% below list price over two months on market. Hopeful sellers have been on the market for nearly three months.

Plan for Success

What can a seller do to ensure they land in the “Highly Successful” camp? The first step is to work with a licensed Realtor® who will provide local market insight and guide your pricing strategy. The second is to prepare your home to attract the most qualified buyers: fix, remodel, and paint for the best first impression, and consider offering credits for buyers.

Finally, have a plan to make a pricing adjustment if the home hasn’t sold within 21 days, which appears to be the local “tipping point” when sales prices drop. Most experts agree that a listing that is 30 days on market without an offer is likely 3-5% overpriced. Be ready to make a pricing decision that keeps you within a competitive time-and-pricing window that keeps buyers interested.

As we have noted before, there are still buyers actively engaged in the market, but they make their decisions based on value. And they don’t see value in an overpriced home. So, heed the warnings of three out of four kinds of sellers who learned the hard way: price matters and time kills.

Read more housing analysis in our Market in a Minute and Weekly Meter and connect with one of our agents to find the best strategy to very successfully sell your home!

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

![]()

Why Mortgage Rates Aren’t Dropping

The Fed lowered the Fed Funds Rate last fall but mortgage rates have increased. Why?

The Federal Reserve began lowering the Fed Funds Rate this past September with a ½ point decrease, followed by additional ¼ point reductions in November and December. Consumers had eagerly awaited these reductions in the hope that rates on consumer loans, such as mortgages, would follow.

Unfortunately, the opposite has been the case.

According to Freddie Mac’s weekly mortgage rate survey, the average rate on 30-year fixed-rate loans closed during the week of the September Fed rate cut was 6.08%. The survey shows the average rate increasing in the following months with that number currently sitting at 7.04%. So, with a total decrease in the Fed Funds rate of 1.0%, mortgage interest rates have actually increased 1.0%. Why?

Mortgage rates generally track the direction of the 10-year Treasury Yield. The 10-year yield and the yields of other long-term treasuries and bonds are driven largely by expectations of where short-term interest rates will be in the future, as opposed to where they are now.

The Federal Reserve lowered the extremely short-term interest rate, the Fed Funds Rate, but economic reports and even commentary from Federal Reserve governors continues to indicate concerns that instead of moving closer to the Fed’s 2% inflation target, we are actually moving away from it.

In addition to the actual economic numbers we are currently seeing, we have the prospect of tariffs being added to the mix, the result of which would very likely be inflationary. Fed commentary suggests they are less likely to continue lowering the Fed Funds Rate in the near term which has the impact of keeping long term yields, including mortgage rates at higher levels.

No one can tell consumers when mortgage rates will trend lower again, but waiting for lower rates before purchasing a home may not be the wisest financial move. The median price for a home in the DC Metro area rose approximately 6.2% in 2024 to $610,000. We continue to see low inventory and will likely see similar increases in home prices during 2025. As prices increase, so do loan amounts. Consumers should remember when rates decline, you can refinance a loan to a lower rate, but you can never “refinance” your purchase price to a lower price.

Let’s look at an example: a $610,000 purchase price now with 20% down at a rate of 7% results in a principal and interest payment of $3,247 on a loan of $488,000. Refinancing the balance a year later to a 6% rate reduces the P&I payment to $2,896.

But if a consumer waits that same year for rates to drop to 6%, the price of that same home will likely be $647,820, an increase of almost $40,000. With 20% down the loan would increase to $518,256 which results in a P&I payment of $3,107, or just $140 less than the previous year.

So while the purchaser saved $140/month in their P&I payment in the second example by waiting to purchase until rates dropped the next year, they could have saved $351/month by refinancing the loan if they had purchased the year before. Waiting for rates to decrease while home prices increase almost never makes sense.

If you’re in the market to purchase a home, we’d love to create a home-buying strategy that gets you a rate you can live with for a home you can afford today. Please reach out to me or my colleagues at Atlantic Coast Mortgage to get started.

Brian Bonnet

SVP, Sr. Loan Officer, NMLS: 224811

Atlantic Coast Mortgage, NMLS: 643114

O: (703) 766-6702 | M: (703) 304-0188

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

![]()

The Importance of an Emergency Fund When Planning on Buying a Home

By Bill Stern, Branch Manager for CMG Home Loans

Saving for your home doesn’t end with a down payment.

If you’re looking to buy a home, do you have an emergency fund? If you’re like many prospective first-time home buyers, this question may have sent a chill of anxiety down your spine.

You’re not alone. This is a big financial regret for many, but especially for Gen Zers and Millennials, who, according to CNBC, feel “not saving enough for emergencies ranks at the top of their lists.”

But don’t worry! We’re here to provide you with helpful information about emergency funds and calm any homeowning anxieties you may have, ensuring that your homeownership journey is a successful one.

A Safety Net for the Unexpected

It’s not just good to be prepared for the worst, it’s essential. What if you’ve just moved into your house using all of your savings, only for a tree to smash through your roof a week later — how can you afford the repairs? An emergency fund is exactly what you need in these unpredictable, money-leeching scenarios. Your back-up savings account is the bread and butter of happy homeownership, like a friend you can always count on in an emergency.

Other New Home Repair Woes

Aside from a tree crashing on your roof, the unexpected “joys” of homeownership can have a funny habit of making themselves known within the first few months of moving into your dream home. The furnace might be on its last leg and you might’ve moved in right before winter. Or you may have to deal with a closet collapsing, a leaking garage roof, water damage in your crawlspace, a malfunctioning defrost tube in your fridge, or perhaps your water stops working in general, leading you to fully replace your well pump and pressure tank.

If you’re not a handy person, you’ll pay a sizeable amount to professionals to patch together the home you just spent a big down payment to buy. An emergency fund can help assuage your anxieties and take care of these unforeseen circumstances.

Offset Income Loss or Unemployment

Career changes and unexpected unemployment are an unfortunate possibility. Whether it’s a reduction in your work hours or a companywide lay-off, an emergency fund can serve as another type of safety net. You’ll want to save enough money to cover your monthly mortgage payments and other household essentials.

How Much Should I Save?

This general rule of thumb suggests 3-6 months of basic living expenses to set aside. However, once you hit that goal, don’t stop setting aside money. Keep contributing a set amount from each paycheck every month just in case. Our loan professionals can help customize your own emergency fund strategy by evaluating your income and lifestyle so that you have a better understanding of how much is enough for your unique situation. You can jumpstart the process by setting a household budget, which doesn’t have to be overly complicated; here’s one from Nerd Wallet that works for nearly every type of household at any income level.

Avoid High-Interest Debt

Because many don’t have an emergency fund before they become homeowners, people often have to turn to high-interest credit cards to cover those unexpected costs. Having your safety cushion means that you don’t have to accumulate high-interest fees and can avoid a nasty cycle of debt, keeping both your credit score and financial health intact.

Set Realistic Goals

The idea of starting an emergency fund may seem daunting, but it doesn’t have to be. You can start small and set realistic savings goals, increasing these goals as you achieve them. You can easily set up automatic transfers from your checking account to your savings account. It’s all about making saving money a habit.

It’s important that you move into your new home with a solid financial foundation and a boosted peace of mind. Reach out to our CMG financial advisors today for more tips on preparing yourself for homeownership and setting yourself up for success.

Bill Stern, Branch Manager | NMLS ID# 267577

CMG Home Loans | NMLS ID# 1820

540-222-0164 | Website | Email Me

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

What NAR’s Report Says About Buyers & Sellers

It’s not just interest rates that are rising, so are the ages of home buyers and sellers.

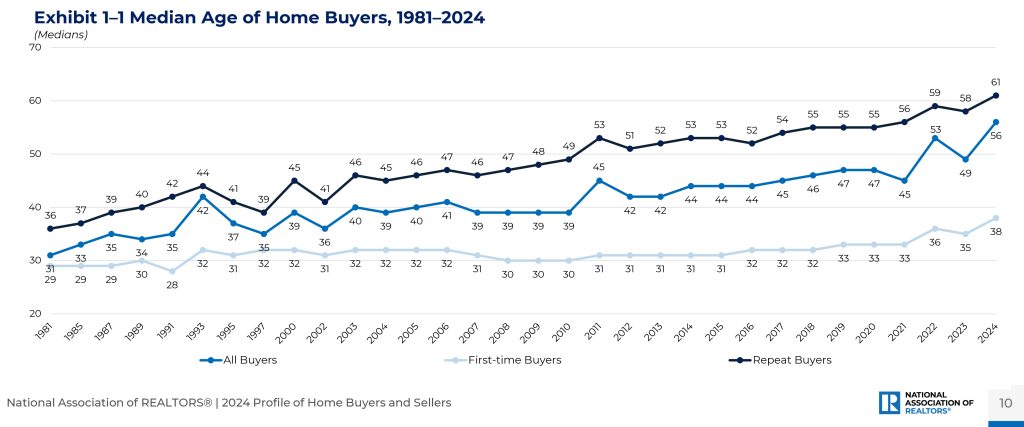

Each fall the National Association of Realtors® (NAR) releases a comprehensive report on the demographics of real estate clients and compiles research on sales activities. This year, one of the most talked about trends was the rising age of buyers and sellers and a decrease in first-time homebuyers.

The first-time homebuyer market share dropped to a historic low of 24%, down from 32% last year, while buyers’ ages hit record highs. The median buyer age rose to 56 years (from 49), 38 for first-time buyers (up from 35), and 61 for repeat buyers (previously 58). By comparison, in 2002 the median age of first-time buyers was 31 and repeat buyers was 41.

Jessica Lautz, NAR’s deputy chief economist, noted, “The U.S. housing market is split: first-time buyers face high prices, high mortgage rates, and limited inventory, making them older and wealthier than previous generations, while current homeowners are using their equity for cash purchases or large down payments.”

Statistics were drawn from transactions that happened between July 2023 and June 2024 and included overviews of salaries, ethnic make-up, and marital status. Findings include:

- The median household income of buyers rose to $108,800 from $107,000 in 2022.

- First-time buyers had a median income of $97,000, a $26,000 increase over two years, while repeat buyers saw their incomes rise to $114,300 from $111,700.

- Among all buyers, 62% were married couples, up slightly, while single females increased to 20%.

- Single males and unmarried couples decreased by 8% and 6%, respectively, while single female first-time buyers increased by 5%.

- 73% of buyers reported no children under 18 in the home, the highest yet recorded.

- 83% of buyers were White, 7% were Black, 6% were Hispanic/Latino, 4% were Asian or Pacific Islander, and 3% were other ethnicities.

Multigenerational homes comprised 17% of purchases, the highest in the series. Lautz explained that rising costs have influenced buyers to “double up as families,” with young adults returning home due to prohibitive housing costs and elderly relatives moving in as families focus on close-knit support.

On the seller side, the typical age of home sellers reached the highest ever recorded at 63 years. The share of married couples selling their homes increased for the first time in four years, climbing from 65% last year to 69%. The most cited reasons for selling were the desire to move closer to friends and family (23%), the home was too small (12%), the home was too large (11%), and the neighborhood becoming less desirable (10%).

Other interesting takeaways from the report:

- The Price Is Right: Most sellers got 100% of their asking price, the highest median since 2002. But prices were lower for homes that stayed on the market for five to eight weeks and sold for slightly less at 98% of list price.

- Moving Into the Golden Years: Senior-related housing remained at 19% of buyers over the age of 60 this year; 58% purchased a detached single-family home, and 52% bought in a suburb or subdivision.

- Military Stats: 16% of recent home buyers were veterans and 2% were active-duty service members.

- FSBOs struggled: For-sale-by-owner listings, which represented a record low of 6% of all sales, typically fetched a lower sale price than homes represented by an agent with a median price of $380,000, far lower than the median selling price of all homes, which was $435,000.

- Price reductions uncommon: Even though price reductions were on the rise in 2024 compared to the pandemic years, the majority of sellers did not need to lower their sale price to close the deal: 65% never reduced the asking price, and 21% reduced it once.

- Sellers call the shots, usually: Because sellers largely retained the advantage in the housing market last year, just 24% (down from 33% last year) offered incentives to buyers; 76% of sellers offered no incentives, 9% provided assistance with closing costs, and 8% offered a home warranty.

- The White Picket Fence Dream: Detached single-family homes represented 81% of sales (up from 79% last year) followed by town- or rowhomes at 7%.

- Home Sweet Home: Overall, buyers expected to live in their homes for a median of 15 years, while 25% said that they were never moving.

But maybe the most important finding of the report was that both buyers and sellers overwhelmingly believed in the importance of using a real estate agent: 88% of buyers and 90% of sellers used an agent to assist with their transactions. Home buyers primarily sought help from an agent or broker in finding the right home to purchase (49%) and negotiating the terms of the sale (14%). Meanwhile, seller respondents reported that agents were most helpful for marketing the home to potential buyers (22%), pricing the home competitively (20%), and selling the home within a specific timeframe (18%). Finally, 88% of home buyers would use their agent again or recommend them to others.

If you’re contemplating a move, reach out to any of our experts at McEnearney Associates | Middleburg Real Estate | Atoka Properties to help you reach your real estate goals.

Read the full NAR report here.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Financing a Fixer-Upper

When the housing market is this tight, considering a home that needs a bit of work can pay off big dividends for flexible buyers.

Let’s face it, when purchasing a new home, most of us would prefer to purchase one with upgraded kitchens and baths, a new roof, new windows, new systems, and our favorite paint colors – oh, and in the ideal location. Most of us would also like to win the lottery.

None of those are realities for most people.

The housing market continues to struggle with a level of supply that is not keeping pace with demand. Buyers are competing for too few available houses and properties deemed “fixer-uppers” get less prospective buyer attention. However, these properties have untapped potential and should not be overlooked if a buyer is willing to take on the home improvement challenge and can identify the means to finance the effort.

As different properties require various levels of effort to improve them, the methods of financing those improvements can also differ greatly. Some buyers are flush with cash and have enough to cover a large down payment, closing costs, and improvements. Others struggle with how to meet the minimum cash requirement just to purchase a home. Just as homes differ in big and small ways, buyers need financing options that differ as well. Here are some general questions to consider.

Instead of making the down payment I had planned, can I make a smaller down payment and cover the cost of improvements with the cash I have retained?

The smaller down payment means a larger loan which requires a higher monthly payment. But since we are talking about fixer-uppers, the starting price for the home is presumably lower and therefore the loan amount is lower than would be the case for a home that did not need upgrades and improvements.

Can I borrow from my active retirement account to increase my cash to cover the down payment and the costs of improvements?

Most qualified retirement programs allow active participants to borrow for the purchase of a new home. The funds available can supplement or replace other savings which can then be used to cover the cost of repairs and improvements.

Does an FHA 203K loan make sense for my particular fixer-upper scenario?

Some lenders provide FHA 203K renovation loans for home purchasers that allow them to finance 96.5% of the cost of the purchase price plus qualified improvements and renovations.

- The streamlined 203K program allows for the purchase price plus non-structural renovations and upgrades up to an additional $75,000 in cost.

- The full 203K program allows for a purchase with major renovations up to a maximum loan amount in the Washington metro area of $1,149,825.

- The FHA programs require only 3.5% of the combined cost of the home purchase and renovations or upgrades from the purchaser.

Am I ready to take on a construction loan to turn the fixer-upper into my dream home?

Some lenders provide true construction financing which can finance anything from a major kitchen and bath renovation to buying a vacant lot and building a new home and can be an effective method to finance the complete renovation of a true fixer-upper. Often there is great value in the “bones” of the structure and the location of that structure but very little value in anything else associated with the property. A construction loan may be the best approach to acquiring and bringing new life to a tired, old, fixer-upper.

If you are lucky enough to find your perfect turn-key home in this competitive market, you can expect to pay top dollar for it. But savvy home buyers will tell you the best value is in properties that require some sweat equity and TLC. Keeping that in mind and identifying the best way to finance those efforts can open more homebuying opportunities in our tight housing market.

Please reach out to me or my colleagues at Atlantic Coast Mortgage to have a conversation about whether a construction loan works for your homebuying goals.

Brian Bonnet

SVP, Sr. Loan Officer, NMLS: 224811

Atlantic Coast Mortgage, NMLS: 643114

O: (703) 766-6702 | M: (703) 304-0188

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link