The State of the Housing Market in Washington, DC & Surrounding Areas – December 2025

Market in a Minute & StatPak December 2025

We profile the most important market indicators every month – contract activity, interest rates, inventory, affordability, and direction of the market – in an easy-to-read and digest summary. It’s not just the numbers; it provides context to understand why the numbers are important and what they mean for the future of the market. Published for Washington, DC, Montgomery County, Prince George’s County, Northern Virginia, and Loudoun County. A quick summary of last month’s contract activity is shown below. To see the complete “Market in a Minute” reports for each jurisdiction we cover, click on the corresponding links.

What’s the Urgency Index?

This is simply the measure of the percentage of homes going under contract that were on the market 30 days or less, giving a sense of how quickly buyers feel they must act to put an offer on a home. To see your market’s Urgency Index, click the link to view the full report.

Washington, DC

December 2025 StatPak – View Full Report

Contract activity in November 2025 was down 16.6% from November 2024 and was down in four out of six price categories. Through the first eleven months of the year, contract activity is down 4.7%. The average number of days on the market for homes receiving contracts was 76 days in November 2025, down from 77 days in November 2024.

Montgomery County

December 2025 StatPak – View Full Report

Contract activity in November 2025 was down 5.2% from November 2024 and was down in four price categories. Through the first eleven months of the year, contract activity is up just 0.2%. The average number of days on the market for homes receiving contracts was 48 days in November 2025, up significantly from 36 days last November.

Prince George’s County

December 2025 StatPak – View Full Report

Contract activity in November 2025 was down 9.8% from November 2024 and was down for three out of five price categories. Through the first eleven months of the year, contract activity is down 9.5%. The average number of days on the market for homes receiving contracts was 53 days in November 2025, up significantly from 38 days in November 2024.

Northern Virginia

December 2025 StatPak – View Full Report

Contract activity in November 2025 was up 1.3% from November 2024 and was up for four price categories. Through the first eleven months of the year, contract activity is up 1.5%. The average number of days on the market for homes receiving contracts was 45 days in November 2025, up from 36 days last November.

Loudoun County

December 2025 StatPak – View Full Report

Contract activity in November 2025 was up 11.7% from last November and was up for three price categories. Through the first eleven months of the year, contract activity is up 6.6%. The average number of days on the market for homes receiving contracts was 50 days in November 2025, up significantly from 30 days last November.

Virginia Countyside

December 2025 StatPak – View Full Report

Contract activity in November 2025 was down 11.7% from last November and was down for four price categories. Through the first eleven months of the year, contract activity is down just 0.1%. The average number of days on the market for homes receiving contracts was 49 days in November 2025, down from 50 days last November.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Year-End Money Moves & Home Equity: What Homeowners Should Know

Home equity can be a useful tool for handling big, legitimate life expenses or stabilizing finances if you understand the tradeoffs, costs, and alternatives.

‘Tis the season not just for the hustle and bustle of the holidays, but also for taking stock of what’s in your financial stocking. With the short-term focus on spending for those in our closest circles, winter expenses can add up quickly, and high-interest debt (like credit card bills) can linger well into the new year.

But overspending can delay progress on saving for other life goals. Whether you want to purchase a home or use your home equity to ease expenses, there are lending programs for homeowners to help make the transition to the new year, with responsible borrowing.

How Does Home Equity Factor Into a Household Budget?

A home is more than where you live – it’s also one of the biggest financial assets most people ever build. Over time, that equity can become a valuable safety net for real-life expenses, such as urgent repairs, unexpected bills, caregiving needs, or even a carefully planned debt consolidation. The key is understanding the options and the tradeoffs so that borrowing supports your long-term stability rather than creating new pressure later.

For homeowners with substantial equity, both a Home Equity Loan or a Home Equity Line of Credit (HELOC) may help you weather unforeseen hits to your savings. A quick explainer: A home equity loan is a specific amount of money borrowed against the equity of your home, while a HELOC is a line of credit, like a credit card, except you are borrowing against the equity of your home. A HELOC can function as a flexible backstop because it’s a revolving line you can draw from as needed rather than taking a single lump sum, as with a Home Equity Loan.

Here are some year-end scenarios that may necessitate a dip into the equity you’ve built.

1) The Year-End Reset

The end of the year can leave households juggling a pile-up of normal-but-lumpy costs: insurance deductibles resetting, annual bills coming due, travel to support family, or a surprise expense that doesn’t politely wait for January. But heed this important caveat: a Home Equity Loan or a HELOC can be a bridge for uneven cash flow and is best used with a repayment plan, not as a long-term substitute for budgeting.

2) Home Systems Reality Check

Roofs don’t care about your spreadsheet. Neither do HVAC units. When a major home system fails, using home equity can be a rational “protect the asset” move because you’re investing in the home that’s generating the equity in the first place. A HELOC can be especially useful here for phased repairs, since you can borrow in stages and pay interest only on what you use.

3) Caregiving Costs

Many families face a quiet financial squeeze when helping parents or relatives: home safety modifications, short-term in-home care, or temporary support while a loved one stabilizes. These are meaningful, time-sensitive expenses that often don’t fit neatly into a monthly budget. A cash-out refinance can be one option if a homeowner needs a defined, one-time amount and prefers a predictable monthly payment.

4) Education or Career Transition

Sometimes the financially smart move isn’t flashy – it’s resilient. A tuition gap, professional certification, or a short income dip during a job change can be a legitimate reason to explore equity, especially if the expense has a clear payoff and a clear timeline. Proceeds from a cash-out refinance are often used for goals like college tuition, alongside other major needs. Meanwhile, homeowners who want flexibility while costs unfold over a semester or training cycle, a HELOC’s “borrow-as-you-go” structure may better match the rhythm of real life. Align your loan structure with the duration and certainty of the expense.

5) Debt Restructuring (with guardrails)

Using home equity to pay down high-interest debt can be wise math, but only if it’s paired with a behavior change and a real payoff plan. A cash-out refinance provides a one-time withdrawal with a fixed monthly payment, which some homeowners find easier to manage than revolving credit. But if the spending pattern that led to accumulating debt doesn’t change, the strategy just moves debt from plastic to property, which can lead to an even larger stress point down the road.

6) First-Time Buyer Support

What happens if you don’t yet have a home that’s building equity? Many first-time buyers need help closing the down payment gap, and legitimate pathways include documented gifts from family and friends and certain down payment assistance structures. CMG’s HomeFundIt is a way to organize gift contributions toward a down payment through an online campaign, while the Community ONE down payment assistance program offers reduced out-of-pocket costs.

If you’re considering using home equity during the holidays or into the new year, follow these simple steps: start with the basics, compare options, and make sure the plan fits your budget and timeline.

HELOC

- Best for: flexible, phased expenses (repairs over time, bridging uncertainty).

- Watch-outs: variable rates, temptation to treat it like a credit card.

Cash-out Refinance

- Best for: consolidating into one stable long-term plan when the new rate & costs make sense.

- Watch-outs: restarts your mortgage timeline, adds closing costs, and has potentially higher total interest.

Gift & Down Payment Assistance Pathways

- Best for: buyers without equity.

- Watch-outs: documentation rules, education requirements, and program eligibility.

A quick conversation with a qualified lender or a housing counselor can help you understand costs and avoid surprises. Are you feeling ready to wrap up the year with financial confidence? We hope we’ve provided you with helpful tools and tips to tackle the upcoming holidays like the savvy consumer that you are. As always, our CMG Team is here, night and day, to help keep the holiday blues and financial hangovers away.

Bill Stern | The Stern Team

Branch Manager | NMLS ID # 267577

CMG Home Loans | NMLS ID# 1820

M: 540-222-0164

bstern@cmghomeloans.com

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

FSBO in a Rebalancing Market: Why More Sellers Are Choosing a Pro

Go-it-alone sellers are learning the hard way that expert pricing, exposure, and negotiation are the difference between a quick win and a costly discount.

Every real estate cycle has its classic subplot: “Maybe I’ll sell it myself.” For Sale By Owner listings (FSBOs) tend to spike when headlines make selling look easy, and fade when the market reminds everyone that a home sale is not a lemonade stand.

Right now, FSBOs are fading fast. According to the National Association of Realtors® (NAR), only 5% of sellers sold without an agent this year – an all-time low. Meanwhile, 91% of sellers used a real estate professional, also a record high.

FSBOs typically sell for less — and the gap is meaningful

NAR’s latest Profile of Home Buyers and Sellers shows the median FSBO sale price was $360,000, compared with $425,000 for agent-assisted sales, about an 18% difference.

NAR also notes an important nuance: FSBO homes skew more toward rural areas and lower-priced property types, which can inflate headline comparisons. But when researchers compare similar homes sold with and without agents, FSBO sellers still tend to net less – often in the 5–6% range even after adjusting for property differences. In other words, even if we give FSBOs the benefit of the doubt, the data keeps landing in the same neighborhood. Selling solo is usually a discount strategy dressed up as a savings strategy.

Why that matters even more now in our market

Corcoran McEnearney’s CIO, David Howell’s latest stats show exactly what we’ve been feeling on the ground across DC, Northern Virginia, Virginia’s Countryside, Maryland, and Greater Baltimore:

- The metro market continues to rebalance, and every jurisdiction is weakening from the seller’s perspective.

- Supply is up everywhere year over year.

- Days on market (DOM) are higher across the board.

- Fewer homes are selling at or above their original list price.

- Homes are selling at roughly a 2% deeper discount to the original list price than a year ago. (Ex: Montgomery County went from 99.1% of the original list last October to 97.3% this October.)

- Homes are taking 7–14 days longer to go under contract. (Ex: Fairfax County jumped from 21 days last October to 34 days last month.)

- We’re seeing 10–15% fewer “Very Successful Sellers” – homes that sell at or above the original list price.

- About 40% of active listings have already had at least one price reduction.

Translation: this is no longer a “throw it on the market and see what happens” environment. Buyers have more options, and pricing has to be right immediately. Marketing has to be sharp at first glance and must appeal to current buyers’ needs. Negotiation has to be strategic when inspections, appraisals, and concessions hit the table.

That’s a tough playing field for a DIY seller.

The 5 FSBO regrets we hear again and again

RISMedia recently summed up the top reasons FSBO sellers say they wish they had used an agent. None of these are surprising, but it’s a good reminder that selling a home isn’t as easy as simply plopping a sign in the yard or window.

- Pricing was off: Sellers often start with an aspirational number (or the number a helpful friend “feels” is right). In a rebalancing market, that’s how listings go stale and end up chasing price reductions.

- They made the wrong repairs (or none at all!): A professional agent knows what buyers will ding you for, what will show up in an appraisal report, and what’s a wasted ROI.

- Time management was a grind: Coordinating showings, vetting buyers, and following up consistently is a part-time job at minimum. Most FSBO sellers underestimate the workload, adding additional stress to an experience that can be steeped in anxiety.

- Negotiation got complicated: Inspections, addenda, appraisal gaps, financing delays, contract deadlines – this is where deals are saved or lost. And it’s where experienced representation pays for itself.

- Staging and presentation weren’t competitive: Buyers are shopping hard right now. First impressions matter more when they have better-prepped alternatives queued up on their phone.

None of these regrets comes from laziness. They come from the reality that modern real estate is a complex, high-stakes transaction with too many moving parts to “figure out as you go.”

Today’s buyers aren’t just buying houses — they’re buying micro-markets

Here’s another wrinkle FSBO sellers run into: value is increasingly hyper-local and lifestyle-driven.

For example, a national NAR survey found 79% of buyers say walkability is important, and 78% say they’d pay more for it, especially younger buyers. Realtor.com’s latest trend reporting shows listings that highlight walkability have more than doubled in the past year.

That matters because premiums like walkability, transit access, school pyramids, parks, and neighborhood culture are often intangible metrics that real estate professionals are trained to understand and take into account for listing strategies. They have to be priced correctly, marketed clearly, and targeted to the right buyers. A pro isn’t just listing square footage; they’re also finding the best way to translate your “location, location, location” into demand.

That’s especially true in the DC-metro market, where two homes just a couple of blocks apart can mean two price realities. A Realtor’s® job is to understand the micro-shifts and market desires that influence where an initial price should land, and see proof that the pricing strategy is delivering qualified buyers to the door – or the can’t-miss signals that it’s not.

Can a FSBO ever work?

Sure. A FSBO can work in narrow cases: when a seller already has a buyer, or when the home is simple to price and the owner has deep market knowledge, time, and negotiation skills.

But that’s not the typical FSBO seller, and it’s definitely not typical for the kinds of transactions we see in our region.

In a market that rewards precision, the cost of being off by even a little is bigger than people expect. A home that misses the early window often winds up taking longer and selling for less. Howell’s numbers earlier in this article show it locally, and NAR’s numbers show it nationally.

The Bottom Line

The reason FSBOs are at an all-time low isn’t fear. It’s math.

Most sellers aren’t trying to save money at the cost of tens of thousands in equity. They want full-market exposure, expert pricing, tough-love guidance, and a skilled negotiator between them and the emotional roller coaster of a contract.

And in a rebalancing market like ours, that professional edge isn’t a luxury. It’s how sellers stay out of the “eventually successful” category and into the “very successful” one.

If you’re thinking about selling, this is the moment for a frank conversation about pricing, strategy, and what your micro-market is really doing. At Corcoran McEnearney, we’re here for that.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Elite Negotiators Win Home Deals Without the Drama

Lessons from expert negotiator Mickey Bergman for buyers and sellers in the DMV.

Negotiation in real estate isn’t a price duel. It’s the art of influencing decisions under pressure.

And influencing decisions under pressure is the guiding thesis of Mickey Bergman’s work. As CEO of Global Reach and the author of In the Shadows: True Stories of High Stakes Negotiations to Free Americans Abroad, Bergman spends his days navigating some of the toughest rooms on earth, and the principles he uses translate surprisingly well to buying or selling a home.

Mickey Bergman recently spoke to Corcoran McEnearney agents and leadership about negotiation.

Bergman, a professor at Georgetown University’s School of Foreign Service and Arlington resident, recently reviewed his approach to high-stakes negotiating with the agents and leadership of Corcoran McEnearney at a packed event in Arlington, offering a unique perspective on how his approach to negotiations can work in our local real estate markets. “Negotiation is less about a transaction and more about influencing behavior and decisions,” Bergman said.

Read on for more insight into what Bergman thinks will make a difference in getting your desired real estate outcome, without the high-stakes drama.

The Long Game: Relationships Before You Need Them

In 2021, American journalist Danny Fenster was released from Myanmar after months of detention. That outcome rested on the trust Bergman’s team had begun building nine years earlier – training local leaders, showing up, earning credibility. When the crisis came, the door was already cracked open. That mindset pays off in real estate, where a warm path beats a cold call.

For Buyers: Start early.

- Visit open houses to learn the market, talk with a lender before you’re “serious,” and show up at neighborhood events.

- Connect with a trusted Realtor® and determine a purchase strategy. Make sure to let your agent know your tolerance for risk and discuss how to approach different negotiation points of the sale.

- Securing a strong pre-approval letter and a lender who will vouch for you to inquiring seller agents makes your offer feel real, not theoretical.

For Sellers: Goodwill and preparation grease the skids.

- Hire a Realtor®. This is not the market to be winging it, and you’ll need an expert agent to help you navigate the many moving – and confusing! – aspects of listing a home and finding the right buyer.

- Give a courteous heads-up to neighbors before showings, especially on Open House days when parking and foot traffic may be impacted.

- Create a clear “house manual” for the next owner to signal a smooth closing and post-settlement ahead.

Small, consistent touches beforehand often become the reason a future offer is accepted – or the reason your showing gets a second look.

Personalities > Policies: Tailor Your Approach

Preparing to negotiate in Myanmar, Bergman didn’t study policy papers first. He studied people – tone of voice, presence, comfort level. He noticed the military general he’d be meeting was soft-spoken and introverted. The strategy followed: no public confrontation, a respectful one-on-one conversation, and language that affirmed a quiet leadership style.

How does this translate to real estate? Match your styles to the humans “across the table” you’ll be working with. Your agent’s job is to “read the room,” then shape terms and tone accordingly.

- Selling to a meticulous engineer? Lead with clean data and tight logic: comps, timelines, appraisal pathways, and a tidy addendum.

- Buying from a sentimental owner? Anchor your offer in dignity and show you’ll be a respectful steward of what they’ve built.

Public price cuts can bruise a seller’s pride, and they are becoming more common in our shifting market. When a buyer shows they value the property and the efforts of the sellers, it lands better when it comes time to ask for credits, rent-backs, and flexible possession.

Empathy Isn’t Surrender: Understand Without Giving In

Bergman draws a bright line here: “Empathy is a must. Sympathy is a trap.”

Empathy is stepping into the other person’s shoes to see their world; sympathy is aligning your goals with theirs. In a home deal, empathy is the superpower.

A sudden “no” – a fixation on a small repair, a hard line on closing date – may ignite one of those emotional brushfires that can pull focus from the goal of completing the deal, seeing the other side as a combatant rather than a partner in a deal. But these are often signals of a deeper interest: aligning school calendars, fear of a double move, pride in a renovation. When you can identify the real stressor and empathize with the pain it’s causing the other side, without making it your own. Then you can solve for it without giving away the store.

Here’s an example of a quick script to lower the temperature: “It sounds like timing is the stressor. If we could make the seller’s move-out easier with a 30-day rent-back, would that change how they feel about the price we offered?”

Understanding isn’t capitulating. It’s efficient. Be human. Acknowledge the other side’s legitimate concerns before proposing a fix. People accept offered solutions when they feel seen.

Authentic Beats Loud: Credibility Closes

Bergman shared a story from North Korea: on his first delegation, he admitted to his minder that he was nervous. That simple bit of honesty built rapport and opened doors.

Buyers and sellers don’t need theatrics. They need credibility.

- For Buyers: Pair your offer with a lender call to the listing agent, clean documents, and a short, sincere “why us” note that your agent can include with the offer (if it fits the situation).

- For Sellers: Be transparent (within reason) about timelines and constraints. When the other side trusts your signals, they stop gaming the unknowns and start solving the deal.

- Offer options. Respond with two counters (e.g., Price A + closing credit vs. Price B as-is). Options let buyers keep dignity while choosing the outcome you prefer.

“Authenticity is the most important key in your communications,” Bergman emphasized. Authenticity makes people more cooperative, and cooperative people close.

It’s Never a One-Time Game: Protect the Future

Buying or selling a home may feel like a one-off transaction, but it rarely is. People talk (especially in a city with as many leaks as Washington, DC!) and professionals cross paths again. If you squeeze every last dollar with a scorched-earth approach, the other side often “evens the score” later – dragging feet on repairs, fighting small issues, or turning the post-settlement occupancy into purgatory.

Play the repeat game:

- Offer choice-based counters (two paths you can live with) so the other side can save face.

- Agree early on rules of engagement for surprises: for example, discuss with your agent a pre-set credit range that you’ll consider for inspection items, or a clear process for addressing appraisal gaps.

The win is getting to the closing table with your goals intact and your blood pressure normal. Remember: Each small agreement builds momentum, and the more predictable you are, the stronger your position becomes.

The DMV Angle: Why This Approach Wins Here

Our region rewards civility and preparation, and is full of professionals who have years of diplomatic, legal, and negotiation skills, who are itching to put that expertise into action. Tight inventory and fast clocks mean the perception of risk often matters as much as the number itself. Sellers who keep dignity central see fewer last-minute blowups, and buyers who solve real problems, not hypothetical ones, land the house.

- Clean offers with credible financing, respectful timing solutions, and level-headed communication consistently outcompete louder money.

- The best negotiations aren’t dramatic; they’re disciplined.

- Build relationships early.

- Read personalities and tailor your approach.

- Use empathy to diagnose the real issue.

- Lead with authenticity and plan for the repeat game.

Follow these directives and you don’t just win the house or the sale – you win a calmer path to the closing table.

At Corcoran McEnearney, we operationalize this approach. We map interests, sequence issues, and keep dignity central so your deal gets to “YES” without the stress. Ready to game-plan your next move with a quieter, smarter playbook? Connect with our agents today to strategize for your negotiating win.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Turning Reflection into Readiness (The Finale of The Emotional Side of Selling)

Moving forward after selling a home isn’t just about where you’ll live next. It’s about how you want to live.

This article is the final installment in our three-part series, The Emotional Side of Selling, inspired by 1000WATT’s research into how real people experience the highs and lows of selling a home.

You faced your worries, honored your memories, and handed over the keys. Now comes the question so many sellers quietly ask themselves afterward – what’s next?

The 1000WATT Emotional Landscape of Homeselling report dug deep into how sellers navigate their feelings and concerns about moving from one property to another. One revealing statistic was that most sellers today aren’t motivated by job changes or finances: 61% said their decision to sell was driven by lifestyle priorities.

That means people are moving for more than practicality. They’re seeking alignment in a space that fits who they’ve become. Maybe it’s trading a long commute for walkable mornings, or downsizing to a space that feels easier and freer. Regardless of the motivation, it’s clear that the decision to move is more than just about square footage and logistics.

As you prepare for your next move, ask yourself:

- What do I want more of in my everyday life?

- What do I want less of?

- What kind of space will support the routines and energy I crave?

The answers might surprise you – and they’re worth more than any square footage number.

The Price of a Home Is About More Than Money

Money isn’t just math in real estate. It has meaning, representing validation, timing, and closure. Many sellers in the 1000WATT survey described pricing as the most emotional part of the process. It’s where hopes and reality meet, and where confidence is often built or shaken.

If you’re still reflecting on your own sale, or preparing for the next one, try this mindset reset:

- Dream Price: The number that feels like a celebration.

- Fair Market Price: What the data and your agent can back up.

- Move-Forward Price: The one that gives you peace and freedom to take the next step.

A “good” sale isn’t just the highest price – it’s the one that lets you move forward without regret. By setting expectations early, you can focus less on second-guessing and more on envisioning your new chapter.

Packing Up For Moving Day: The Real Finale

If Part 2 was about the emotional goodbye, this is about the logistical one: the day the boxes, movers, and emotions collide. Only 44% of sellers in the report said their move day went as expected. The rest described it as a mix of exhaustion, excitement, and relief.

Here’s your permission slip: move day doesn’t have to be perfect to be meaningful. The inevitable messiness will be part of the stories you’ll share as you settle into your next home, so make it as fun and memorable as possible.

- Plan for one real break – a coffee run, a stretch, or a few deep breaths. This is a marathon, not a sprint. Give yourself moments to recoup your physical and emotional energy.

- Keep one comfort item handy – a favorite mug, photo, or playlist. Use it to remind yourself that the important things are coming with you, even if it’s hard to say goodbye.

- Delegate – let friends, family, and your Realtor® help with food, errands, or laughter. Find someone who loves to play the role of organizer to help keep things moving along and give you logistical and emotional support.

Settling In With Intention

When the boxes are stacked and the echo in your new space feels strange, take a moment before the unpacking frenzy begins.

Make your first act something grounding. Light a candle, brew some comforting tea, play the song that always makes you feel calm and hopeful (or energetic and excited!) Unpack one space that feels restorative, maybe your reading chair, kitchen essentials, or favorite blanket. Whatever means “home” to you is what you want as your template for bringing comfort and joy into your new space.

Then, write a short note to your future self: “Here’s what I hope this next chapter brings.”

Homes may change, but the heart you bring to them doesn’t.

One Door Closes…

Selling a home is more than a transaction – it’s a transformation. You’ve moved through the uncertainty, honored what mattered, and opened yourself to what’s next.

When you’re ready to begin your next search (or just want to talk through what kind of home fits this new stage of life), our Corcoran McEnearney agents are here with the perspective, empathy, and expertise to help you move forward with confidence.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How the Government Shutdown Could Affect Real Estate Loans

With the federal shutdown now underway and anxiety rippling through housing, there are clear, practical ways to stay informed and keep transactions moving.

We are into Week Two of our federal government shutdown, and everyone involved in the nation’s housing market is watching and waiting for a quick resolution to keep home loans and settlements moving through the pipeline.

A federal shutdown doesn’t halt every mortgage program equally. Conventional financing typically continues, while some government-backed loans and flood insurance can see slowdowns or brief pauses. Here’s a clear rundown of what’s likely to keep moving, where to expect delays, and practical steps to keep transactions on track.

Let’s take a look at how most lending programs may be affected.

Conventional (non-government) Loans

Conventional loans are generally the steadiest path during a shutdown because Fannie Mae and Freddie Mac don’t rely on annual appropriations. The mechanics of underwriting still work; the friction shows up when a human step or government system is needed. Here’s what to watch:

- Status: Fannie Mae and Freddie Mac operations are not funded through annual appropriations, and generally should continue without disruption.

- Potential bottlenecks: Employment and income verification for federal workers, certain third-party data pulls, or manual checks may take longer—especially if a shutdown stretches past ~30 days.

- Workarounds: Lenders often use alternative documentation (recent pay stubs, bank statements, written VOE alternatives) to keep files moving.

FHA & Ginnie Mae (HUD) loans

FHA lending often continues in a limited-staff environment, with automated systems doing most of the heavy lifting. The trade-off is slower responses when an exception or a manual review is required. Expect the following dynamics:

- Status: Historically, FHA has continued endorsing most single-family loans during shutdowns, though staffing is limited and some programs (e.g., HECM, Title I) can be restricted.

- Impacts you may feel: Slower response times from HUD offices and help desks; case-by-case delays when a manual touch is needed. Automated underwriting systems often stay online, allowing many loans to progress.

VA home loans

VA guarantees typically remain available, which keeps the core engine running. The pinch point is support capacity—regional offices and help lines may be short-staffed, so order anything that needs VA’s direct involvement early. Key specifics:

- Status: VA guarantees typically remain available, but call centers and regional support may be curtailed if significant staff are furloughed, and some estimates predict up to 70% of Veteran Benefits Administration staff may be sidelined.

- Impacts you may feel: Possible delays in Certificates of Eligibility (COEs), appraisal reviews/Notices of Value (NOVs), and manual verification items. Early ordering and complete files help minimize friction.

USDA (Rural Development) loans

USDA is the most sensitive to a shutdown because new commitments usually require active agency action, and it has been predicted more than half its workforce will be furloughed. Files with pre-issued commitments may still move; brand-new approvals often have to wait. Practical implications include:

- Status: New conditional commitments or guarantees are often paused during a shutdown.

- Impacts you may feel: If a USDA loan already has a valid commitment issued before a shutdown, it may still close under certain circumstances; otherwise, new approvals may wait until funding resumes.

National Flood Insurance Program (NFIP)

A lapse in NFIP is one of the fastest ways a closing can stall in flood zones. Existing policies remain in force, but new or renewal policies can’t be issued until Congress reauthorizes the program. That means:

- Status: If NFIP lapses, no new policies or renewals can be issued until reauthorized. Existing, in-force policies remain valid until their normal expiration. Claims may continue while available funds last.

- Why it matters: Federally backed mortgages in designated flood zones require active coverage to close. Transactions needing a brand-new or renewed policy could be delayed until NFIP is back online.

How to keep deals moving

A little choreography goes a long way, and here are some best practices to be aware of and discuss with your Realtor®:

- If you have a VA, FHA, or USDA loan or a property in a flood zone, have an open and honest conversation with your agent so you can anticipate timelines and sequence how to close strategically.

- Front-load documentation. Gather tax returns, recent pay stubs, identity/SSN checks, and (where applicable) flood insurance applications or proof of existing coverage early.

- Pad your timing. Add buffers to contract deadlines and rate-lock periods to absorb potential delays.

- Consider alternatives. Where appropriate, evaluate a shift to conventional financing or programs less exposed to shutdown effects.

- Stay proactive with your agent and communicate with all the parties of the transaction – your lender, the other party in the contract, settlement partners, etc. – and get/provide regular updates as agency guidance evolves.

- Monitor policy updates. Keep an eye on NFIP reauthorization and any operational notices from HUD/FHA, VA, and USDA.

Bottom line

A shutdown can introduce friction, but with early verification, careful sequencing, and clear communication, many transactions can still reach the finish line. If you’re unsure which path is most resilient for you, let’s talk through options before you write an offer with your agent or accept terms on a current listing.

Questions about a specific file or scenario? I’m here to help you game-plan.

Bill Stern | The Stern Team

Branch Manager | NMLS ID # 267577

CMG Home Loans | NMLS ID# 1820

M: 540-222-0164

bstern@cmghomeloans.com

Notice: This is an advertisement and is not a commitment to lend. Contact a loan officer today to explore the financing options specific to each borrower.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

More Than a House: The Emotional Goodbye (Part 2 of The Emotional Side of Selling)

In Part 1, we explored the stress of selling – those late-night worries about pricing, inspections, and deals falling apart. But once the paperwork is nearly done, a different emotion surfaces – letting go.

If you felt a knot in your stomach while reading about the first stage, reading on will definitely tug at your heart.

But it’s okay! As we shared in our earlier post, real estate analysts and marketing company 1000WATT released an original research report, “The Emotional Landscape of Homeselling,” that explored the feelings of home sellers. The study, based on a June 2025 survey of 1,000 U.S. adults who sold a home in the past five years, focuses on sellers’ perceptions of real estate agents, their fears and anxieties during the process, and emotional connections to their homes. They found that 64% of sellers struggled with leaving memories behind, and 53% found driving away harder than expected. If that sounds familiar, you’re not alone.

Selling a home isn’t just about what’s next – it’s about honoring what’s been. For many people, the hardest moments aren’t the open houses or the paperwork; they’re the quiet, deeply human goodbyes.

A home and its surroundings hold more than furniture. It keeps your milestones, routines, and tiny rituals:

- The corner where the first steps happened.

- The kitchen island that knew every science project and midnight snack.

- The porch where birthdays, thunderstorms, and long talks lived.

- The neighbors who became family.

So when it’s time to go, it makes sense that emotions arrive in layers — gratitude, grief, excitement, and a pinch of “wait, are we really doing this?”

What really trips sellers up

When asked what mattered most in their decision to sell, the 1000Watt survey showed that the majority of homeowners (61%) pointed to lifestyle priorities such as wanting a home that better fits their stage of life, personal needs, or sense of identity, while fewer (39%) cited logistical or financial drivers. This reveals that selling today is more about transformation: people are moving to create the lives they want.

But part of that transformation is acknowledging that the current life they love is going to look different in the next home. Most people expect to handle the challenges of staging, hearing honest feedback about their home from strangers, the physical work of packing. The surprise is what tugs at the heartstrings:

- Saying goodbye to neighbors. The people who turned a street into a community.

- Walking through an empty house. Every echo turns into a memory reel.

- Handing over the keys. A simple gesture that feels like closing a chapter.

Honor the Goodbye

As frantic as the moving pieces in selling a home might be, don’t rush through saying goodbye. A few intentional moments can turn a difficult process into a meaningful transition. Here are some suggestions for special rituals to help with closing a chapter.

- A last dinner (or toast) in the empty kitchen – One final meal, picnic-style. Share a favorite story from the room you’re in – what you cooked most, who gathered here, what you learned sitting around at that table.

- A final photo on the front steps – Simple, sweet, and grounding. It’s less about a perfect picture, more about marking the moment together.

- A sticky-note “Memory Walk” – Give each person a pad of sticky notes in their own color – family members, roommates, close friends, even neighbors who spent meaningful time there. Walk room to room and write a favorite memory wherever it happened. Some examples might be:

– “First sleepover — too much candy.”

– “Painted this wall at 2 a.m. and somehow loved the color anyway.”

– “Clarence the Cat brought down the Christmas Tree.”

– “Grandma’s Sunday dinners — best stories, best dessert.”

When you’re done, choose your ending:

- Keepsake: Gather the notes into a scrapbook or memory jar.

- Gift: Ask the buyers if they’d like the notes left as a housewarming surprise — a baton pass of love and history.

If you made “The Worry List I’ll Laugh About Later” in Part 1, add a page called “What I’m Taking With Me.” List the feelings, values, and routines you want to carry into your next home – the Sunday pancakes, the open-door policy, the quiet mornings by a sunny window. Homes change. What matters most can come along and that doesn’t just mean possessions.

Moving On To What’s Next

Give yourself permission to grieve the goodbye. It doesn’t mean you’re not ready – it means your home mattered. When you’ve honored that chapter, you’ll have more space (emotionally and literally) to start the next one. And be sure to reach out to our Corcoran McEnearney agents. Many of the ideas here came from them and they have more to help you make this emotional journey one that has lots of high points along the way!

Up next in Part 3: Turning Reflection into Readiness — how to align your next home with the life you want, set realistic expectations around price and timing, and prepare for a move day that’s human, not heroic.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Passive House Design Tenet 3: Speaking of Tongues – Eliminate Thermal Bridging

This is the fourth essay in a series by Peter VanderPoel, AIA, to help explain the fundamental principles and science of Passive House design. Read the first essay outlining the basics here, followed by the article on super insulation here, and air barriers here.

Imagine being outside with Grandmother’s blanket wrapped around you and a sturdy windbreaker from head to toe. Having heard of the legend of flagpoles tasting sweet on bitterly cold days, you press your tongue against one to find out the truth. Grandmother would not be proud. All the efforts put into the thermal barrier and air barrier have been defeated by a conductive failure and an embarrassed, garbled cry for help.

Thermal bridging at its worst.

To be effective, thermal barriers created need to be strictly continuous, and any interruption is considered a thermal bridge. Like myriad holes in an air barrier, these seemingly minor interruptions can add up to substantial energy losses.

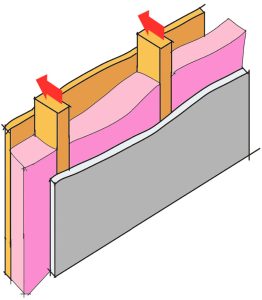

Perhaps the most common and easily recognizable thermal bridging happens with wood stud construction. The 2x4s are normally spaced every 16 inches. A 2×4 is actually 1.5 inches wide, with a typical wall consisting of drywall attached to the inside face and plywood to the outside. But, a 2×4 is not a good insulator – it has an R-value of about 4.5 total and represents the infamous “path of least resistance” for heat loss. (R-values were discussed in the article on Tenet 1: Super Insulation.)

Thermal bridging at wall studs.

We can calculate the degraded R-value in a typical wood stud wall: A stud bay of 16 inches will have 1.5 inches of that distance given over to wood studs. If we include the extra studs at the corners and top and bottom plates, nearly 10% of the wall is solid wood.

Thermal bridging at roof rafters.

Perhaps the easiest place to see thermal bridging is after a light snow. Many roofs will develop a striped pattern where snow accumulates above the batt insulation, but has melted where the roof rafters are located.

A common design feature for large apartment buildings is to provide a cantilevered balcony without any columns or cables supporting the outer edge. This is accomplished through a structural material, usually steel or concrete, that is necessarily continuous with the interior floor system of the apartment. As mentioned earlier, most insulations are designed with pockets to hold air. This creates a low-density material (where density is measured in weight per volume, i,e, lbs/cubic foot). Steel and concrete are fabulously dense and, in the example of the cantilevered balcony, would transfer phenomenal amounts of energy to the outdoors. There are serious efforts to create an interstitial material that can eliminate the thermal break but maintain the structural continuity to accomplish a cantilevered balcony.

Thermal bridging at a balcony.

Although it’s possible to include the cantilevered projections in the thermal envelope, it is a difficult detail to accomplish. The most direct method is to have the balcony suspended (by cables) or supported (by columns) at the outer edge with the structural materials discontinuous with the interior floor structure. Some mechanically attached exterior cladding requires a “spot” calculation for “point” thermal bridging.

So, how do you design to reduce the effects of thermal bridging? WUFI (“Wärme und Feuchte Instationär,” which translates as “Heat and Moisture Intransient”) is a software package that allows designers to calculate and evaluate the performance of the design before construction begins. Although the goal is to avoid thermal bridging, there is a module in WUFI to calculate thermal bridging losses, accepting the energy losses while still receiving Passive House certification.

To combat the most common thermal bridging in wood stud construction, the easiest solution is continuous insulation. This method keeps the wood stud construction similar to what was mentioned before, but adds a layer of rigid insulation outboard of the standard wood frame to blunt energy losses of the wood studs. This method has now appeared as a required component in building codes.

Next Time: Tenet 4 – Eyes Glazed Over…

VanderPoel Architecture is located in Arlington, Virginia, and designs residential and light commercial projects throughout the Washington, DC metro area.

Peter VanderPoel AIA

703.725.4328

peter@pvanderpoel.com

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Emotional Side of Selling: What No One Tells You About Moving On

Selling a home isn’t just a financial transaction – it’s a deeply emotional event. (Part 1 in a three-part series.)

If you’ve ever thought about selling your home and immediately felt a knot in your stomach, you’re not alone. Even in the best of circumstances, selling a home is one of life’s most emotionally loaded experiences. It’s not just about signing paperwork or packing boxes – it’s about leaving a place tied to your memories, routines, and identity.

And the truth is, almost every seller feels some level of stress.

This summer, respected real estate media and marketing company 1000WATT released an original research report, “The Emotional Landscape of Homeselling,” that explored the feelings of home sellers to help real estate professionals better understand their clients. The study, based on a June 2025 survey of 1,000 U.S. adults who sold a home in the past five years, focuses on sellers’ perceptions of real estate agents, their fears, anxieties during the process, and emotional connections to their homes.

As the report’s authors noted, there is plenty of attention and reporting on a buyer’s journey on “the dream to homeownership.” This new report “seeks to explore the fears, strains, and joys of human beings selling the place in which they live. This is becoming more salient by the day as inventory swells, demand flags, and the market balance tilts towards buyers.”

The Top Worries Sellers Face

When asked about their biggest fears, recent home sellers admitted they were bracing for disaster, and their most common fears included:

- Not getting the price they wanted (25%)

- The home is taking too long to sell (22%)

- Last-minute deal collapse (18%)

- Inspection issues (16%)

- Not finding a new place in time (9%)

Sound familiar? But here’s something reassuring: most of those worries never came true. In fact, nearly 70% of sellers said their worst fear didn’t happen at all.

Why Stress Still Shows Up

Even if the worst doesn’t happen, the anticipation of it can weigh heavily. That’s because selling a home isn’t just a financial transaction – it’s a moment of exposure. Strangers walking through your rooms, judging the place you’ve loved, with feedback that feels personal, even when it isn’t. And the knowledge that one unexpected twist could delay your plans.

It’s no wonder so many sellers describe the process as overwhelming. Stress peaks not only at the obvious moments, like negotiations, but also in the smaller, surprising ones – overhearing a buyer’s offhand comment at a showing or realizing the inspector found a minor issue.

You’re Not Alone – And You’re Not Doing It Wrong

The emotional strain of a home sale doesn’t mean you’re unprepared or doing something wrong; it means you’re human. Selling a home means balancing both practical decisions and powerful emotions.

One way to ease the emotional load is to name your biggest worries at the start. Write them down (you can even make it fun, like “The Worry List I’ll Laugh About Later”) and share it with a trusted friend or advisor. Sometimes, just putting the fear into words takes away some of its weight. And when challenges do pop up, you’ll be better prepared to handle them. Here are some other steps you can take to keep the focus on what new opportunities await with a new home:

- Track What You Can Control – Circle the items on your worry list that are within your control (like decluttering or timing) and concentrate on that.

- Talk It Through – Have a 15-minute conversation with someone you trust about your biggest selling worry. Sometimes saying it out loud is enough to shrink it down to size and get different perspectives from friends and family who have been there themselves.

- Start a “Goodbye Journal”- Jot down favorite and funny memories from your home as you prepare to sell. This keeps the positive emotions at the center instead of only focusing on stress. (And maybe even have a page or two for “Things I Won’t Miss About Living Here!”)

- Visualize What Comes Next – Spend 10 minutes picturing what life will look like in your new home or neighborhood. What will the first holiday gathering look like? Will you have a better commute? Is there a new dog park nearby? What new restaurants have you been hungering to try out? Focusing on the future can help balance the weight of letting go.

And then schedule a “clarity session” with a professional Realtor®! One surprising finding in 1000WATT’s report was the anxiety that sellers reported choosing an agent, with one in three responding they found it stressful and 47% saying they didn’t know what to look for in an agent. Corcoran McEnearney agents have the expertise and hard-won wisdom earned by guiding clients through the emotional minefield that can come with selling a home. Let us help take some of that pressure off your shoulders so that you can focus on closing an important chapter in your real estate journey… and making joyful plans for the next adventure!

Next in this series: Part 2 — More Than a House: The Emotional Goodbye

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Gen Z and Homeownership: Challenges, Creative Strategies, and the Rent vs. Buy Debate

Gen Z is stepping into the housing market earlier than many expected, but they face hurdles unlike any generation before them.

For years, Millennials – the demographic born between 1980 and 1998 – were seen as the generation struggling to break into homeownership. Now, Gen Z – those born between 1999 and 2011 – are following Millennials and stepping into the market. Despite economic challenges, tight affordability, and low inventory, surveys show that Gen Z buyers are leaning into creativity, family support, and shifting lifestyle priorities to buy their first homes.

A 2025 report from the National Association of Realtors® highlights the generational breakdown of recent homebuyers, showing that Gen Z represents the smallest group:

- Gen Z (18–25 years): 3% of buyers (and just 2% of sellers)

- Younger Millennials (26–34 years): 12% of buyers

- Older Millennials (35–44 years): 17% of buyers

- Gen X (45–59 years): 24% of buyers

- Younger Baby Boomers (60–69 years): 26% of buyers

- Older Baby Boomers (70–78 years): 16% of buyers

- Silent Generation (79–99 years): 4% of buyers

But despite hefty competition from older buyers who often have higher incomes, more equity, and stronger borrowing power, and the fact that most younger buyers are carrying significant educational and credit card debt, Gen Z is showing resourcefulness in finding paths to ownership.

Advantages Working in Gen Z’s Favor

While most buyers are laser-focused on interest rates and rising home prices, there are other factors that influence home affordability. Local Gen Z’ers are entering the market as it starts to shift from a white-hot seller’s market to a more balanced market, with longer days-on-market and price adjustments, and there are other trends that are helping Gen Z find a way to win.

Co-buying on the rise

One growing trend is co-buying. Instead of waiting until they can afford a home alone, some Gen Zers are pooling resources with friends, siblings, or parents. These arrangements spread the financial burden and allow young buyers to start building equity earlier. Legal agreements and clear exit plans are critical, but the approach is gaining momentum.

Family support and creative financing

More buyers are turning to family for down payment gifts, or moving back home temporarily to save faster. Others are tapping nontraditional assets, like stock or even cryptocurrency, to fund a purchase. While unconventional, these strategies highlight Gen Z’s willingness to adapt.

Tech-savviness, research skills, and remote flexibility

Gen Z has grown up with smartphones, social media, and tech lingo and they use technology to their advantage. They’re adept at comparing mortgage rates online, tracking market trends, and even leveraging social media for tips on affordable neighborhoods. This fluency gives them an edge in finding opportunities older buyers might overlook.

Meanwhile, a preference for remote work has untethered many young professionals from city centers. Some are choosing to buy in more affordable outer suburbs of Northern Virginia and Maryland, and for those who can work from anywhere this affordability expands dramatically.

Values-driven buying

Gen Z buyers are also seeking homes that align with their values: sustainability, energy efficiency, and smart-home technology are often top priorities. Smaller, more affordable homes that deliver these features are increasingly attractive, and may offer better resale potential in the future.

Renting vs. Buying: What Gen Z Needs to Consider (and How to Get Ahead)

There are times when renting makes more sense than buying: an unstable job situation, short-term plans to stay in an area, a high-interest lending environment, limited funds for a downpayment, or a desire for flexibility in where to live or what type of property to live in.

But waiting too long to buy can have significant costs of its own, especially as the market shifts in ways that favors buyers. The average rental rate in Washington, DC is $2,300 – $2,450, totaling $27,600 – $29,400 over a year, all of which goes to increasing the equity of the landlord – not the renter.

Buying becomes advantageous with a plan to stay put in a property for 5-7+ years, which offers the potential to build equity and tax benefits. Housing affordability is being addressed in significant ways through various lending programs and grants to help new homeowners enter the market prepared and start to build financial wealth and security for themselves. Here are ways Gen Z buyers can move that process along quickly.

- Start saving early, even if small: Even setting aside a modest amount each month can build momentum toward a down payment. Try automating transfers into a separate savings account dedicated to your future home.

- Explore first-time buyer programs in DC/VA/MD: Each jurisdiction offers valuable resources that can reduce upfront costs. For example, DC’s Home Purchase Assistance Program (HPAP) provides interest-free loans and closing cost assistance. Virginia Housing offers down payment grants and loan programs, while Maryland Mortgage Program helps with competitive financing options and West Virginia’s Homeownership Program offers assistance to first-time buyers.

- Put it in Writing: Pooling resources with friends or family can make homeownership more attainable, but it’s important to put everything in writing. A co-buying agreement outlines ownership shares, responsibilities, and an exit strategy.

- Strengthen credit: A higher credit score can unlock lower mortgage rates and better terms. Focus on paying bills on time, reducing credit card balances, and limiting new debt. You can check your score for free at AnnualCreditReport.com.

Though affordability and finance hurdles remain intense, Gen Z’s adaptability, openness to unconventional strategies, and evolving lifestyle preferences position them to gradually stake their claim in homeownership.

If you’re a Gen Z renter wondering whether to keep leasing or to take the plunge into buying, now is the time to explore your options. Reach out to Corcoran McEnearney for guidance on how to start the journey — whether renting today or buying tomorrow.

Karisue Wyson

Karisue Wyson is the Director of Education for Corcoran McEnearney and was previously a Top Producing Realtor® in the Alexandria Office.

Visit corcoranmce.com to search listings for sale in Washington, D.C., Maryland, Virginia, and West Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link