The Benefits of Relocation Services

Buying and selling a home can be exciting and stressful all at the same time. Locally, most people know at least one real estate agent; whether an agent they have used before or someone they are acquainted with. If not, recommendations from a friend, family member, or trusted advisor are a great place to start. However, there may come a time when you have a real estate need outside of your local real estate market. When looking for an agent, you have to remember that anyone can build a beautiful website and hire a professional marketing team to support them, that doesn’t guarantee they are experienced or the best agent for your needs.

Knowing a Realtor who is part of a truly global network of vetted professionals is key. At McEnearney Associates, we are fortunate to be a member of Leading Real Estate Companies of the World® (LeadingRE). LeadingRE is home to the world’s market-leading independent residential brokerages in over 70 countries, with 550 firms and 136,000 sales associates making 130 client introductions, producing 1.2 million global transactions in 2021. Our by-invitation-only network is based on the unparalleled performance and trusted relationships that result in exceptional client experiences.

Why is this important to you?

We want to ensure that you receive the same professional service anywhere in the world that you receive from us. The three most common reasons clients reach out for recommendations outside our local area include: job relocation, family needs, and life-style changes.

Job Relocation

Many employers offer a variety of packages from full relocation to flat-fee services, while other employers are not equipped to provide relocation services. If Realtor recommendations are part of your relocation program or suggested by a co-worker, you should still do your research. Job relocations add an extra level of stress due to time constraints of the position start, selling your current home, relocating family, and more. The right Realtor is experienced in your market but also “relocation best practices,” fully understanding the relocation processes, additional paperwork, and requirements of the employer so that you can take full advantage of all relocation benefits. When you are not offered relocation benefits by your employer, you must find the right agent on your own; not just an experienced one, but an agent with a true relocation background, because it will make all the difference in your move.

Family Needs

From growing families to downsizing, inherited homes to vacant land, relocation trained agents are equipped to assist with all types of family situations as they arise. For example, when parents are no longer able to age in place, relocation agent services can include: complimentary market analysis noting as-is and repaired/improved values; supplier introductions from repairs to improvements and cleaners to movers. A relocation trained agent is a full-service Realtor who specializes in the area and type of transaction you are navigating, as well as proficiency in working with out-of-town clients.

Life-Style Changes

Often buyers are comparing multiple areas as a potential destination for retirement, investment property or even a second home. Relocation specialists offer more than housing information; they provide cost of living comparisons, area tours, local life-style information, and market trends to assist you in decision making.

The best Realtors are more than local, they can also provide global real estate services. When you need an agent recommendation, anywhere in the world, McEnearney Associates are happy to help. We are your Trusted Relocation Resource.

Relocating With McEnearney Associates

Trudy McCullough & Britni Spurlock

Relocation & Referral

McEnearney Associates would be delighted to help you navigate through a very exciting transition in your life whether you are moving to or from the Washington metro region. McEnearney’s award winning and experienced Relocation Team is dedicated to personally selecting the best agent to represent you before, during, and after your move.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why Downsizing Can Be So Satisfying

A few years ago, I downsized. We moved from a single-family home to a townhouse. The kids were out of college, and the question was, do we need this large house? Plus, my business here at McEnearney Associates/Crouch Realty Group is all about downsizing, helping older folks transition, and working with estates, so I wanted to practice what I preached.

The real final straw in making the decision was that, as I was mowing the lawn one day, a friend stopped by and asked me to go fishing. My reply was that I was busy, and that I would take a rain check. Later, it occurred to me that one of the things I had been looking forward to through the years of trekking to sports events, band concerts, art shows and the like, was indeed the time to go fishing. And I had passed it up to mow the lawn. Yes, the lawn was a source of pride, and mowing was a source of exercise, but was it fulfilling? It was nowhere on my “bucket list,” so why spend that time on it? Sure, I could hire it out, but why even have a big lawn? Some of the answers were so the kids would have a place to come home for a visit. So I could preserve some of the antiques of past generations handed down to me. So I could host gatherings of friends/family visiting the Metro Area. So we could be near friends whose kids hung out with ours.

Nothing, however, about refocusing on things I/we wanted to do. Instead, we downsized into a townhouse. We considered a condo, but still wanted a little yard.

How are we a few years later? The kids are here all the time. They do not miss the house – it is the FAMILY they want to be near. Out-of-town guests still use us as home base for tours. The Big Brown Furniture (BBF) of past generations no longer defines our decor. (We kept smaller reminders of our wonderful heritage). I am not consumed with maintenance of a big house for, essentially, diminishing returns. And I no longer own a lawnmower.

So, give it some thought and ask yourself:

- Do you want family to come hang out with you, or with your house?

- Do you want to preserve the Museum of Past Generations, or rather smaller mementos of them, plus add your style to your house?

- Do you want to keep up with the maintenance, whether by yourself or contracted out?

- Do you want to focus on the activities that bring you satisfaction, or the unending chores?

Anyone who wants to go fishing, give me a call. I won’t be mowing the lawn.

Pete Crouch is a Seniors Real Estate Specialist, which means he is well-versed in all aspects of moving as we age. His own downsize gave him tremendous insights into what is involved, from emotional matters to real estate considerations. Pete is a Board Member of At Home in Alexandria (AHA), our local Senior Village, and was the 2018 National Recipient of the “Outstanding Service Award” by the National Association of Realtors for his work with Senior Moves. Text 703-244-4024 or email PCrouch@McEnearney.com for a copy of his Downsize Alexandria! Booklet about living more simply in Greater Alexandria.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How to Be Smart About Septic and Well Systems

September 19th – 23rd is SepticSmart Week! When my husband and I bought our home in Vienna in 2001, we had never previously considered that we would ever own a home with a septic system. We were a bit apprehensive but took the plunge and have never looked back. To some, the idea of purchasing a home with a well or septic system can seem overwhelming, but many attractive DC area homes have one or the other, and sometimes both! While Washington DC itself is one hundred percent public water and sewer, wells and septic systems are far more common than you would think in the greater DC suburbs.

Source: Environmental Protection Agency

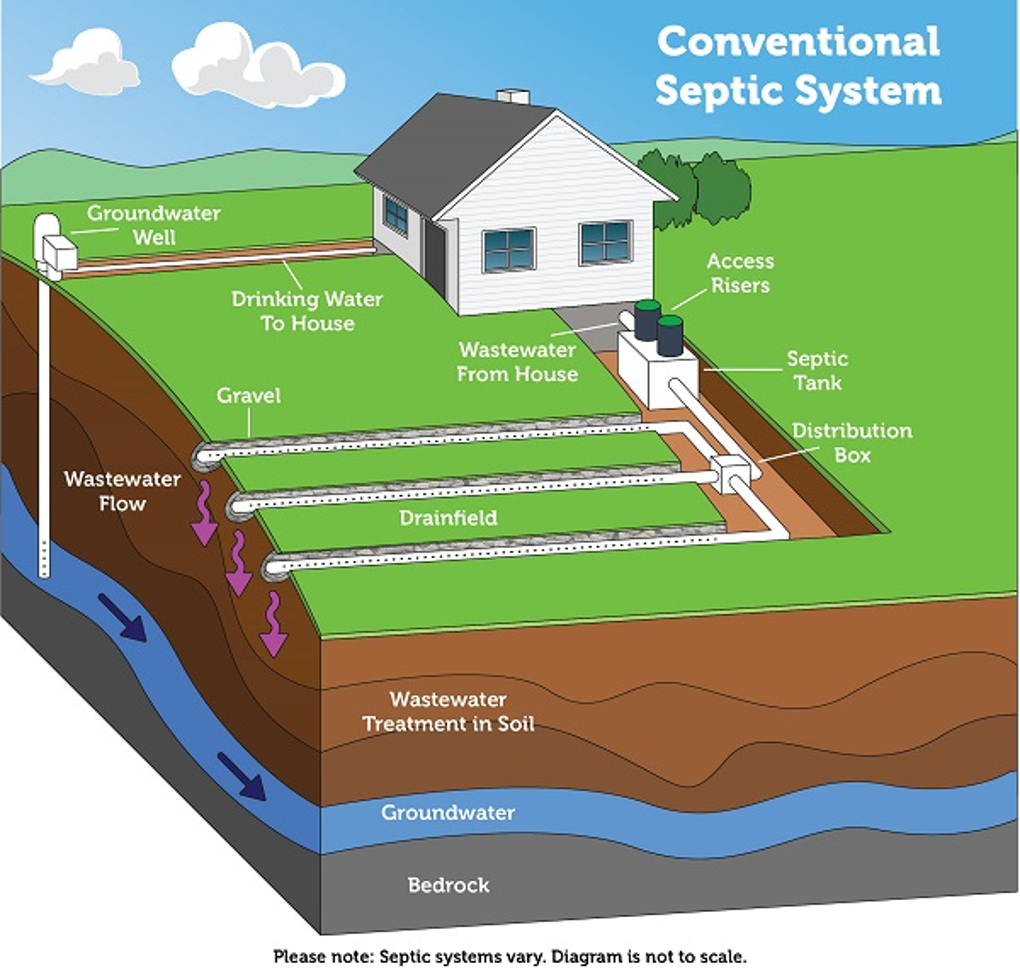

What is a septic system? A septic system is a way to dispose of household wastes on an individual level. Over the course of the life of a septic system (about 40 years) the cost can often be far less than paying a monthly or quarterly sewage bill. Replacing a gravity system costs approximately $10K while an alternative system can cost up to $85K to replace. If you take certain precautions, you will have few to no issues with your septic system. Here are some quick septic reminders:

1) Every home’s pumping schedule is different. Usually, a septic tank will need to be pumped once every three to five years. However, pumping frequency depends on a variety of factors including tank size, usage, and age of the system. The county will usually send you a reminder when it’s due.

2) You can’t flush everything. Flushing items that are not biodegradable will lead to big problems in your septic system. This includes dental floss, feminine products, pet waste, as well as baby wipes. These items can interfere with your system’s ability to break down waste.

3) Your system involves more than toilets. Every sink, tub, and pipe in your house will drain into your septic system, including your kitchen sink! Unlike homes on a sewer, food items should not go down the sink. Composting food waste is a great way to help your septic system, and your garden! Other items that should not go down the drain include oils, grease, chemicals, paint, and medications.

4) Proper maintenance extends its lifespan. Just like any other appliance in your home, your septic system will break down eventually. However, by sticking to a routine pumping and maintenance schedule, you can extend the lifespan of your system. Make sure to maintain plants and vegetation near the system to ensure roots do not block the drains. Keep cars and heavy vehicles parked away from the drain field and tank. Prevent system freezing during cold weather by inspecting and insulating vulnerable system parts.

Source: Circle of Blue

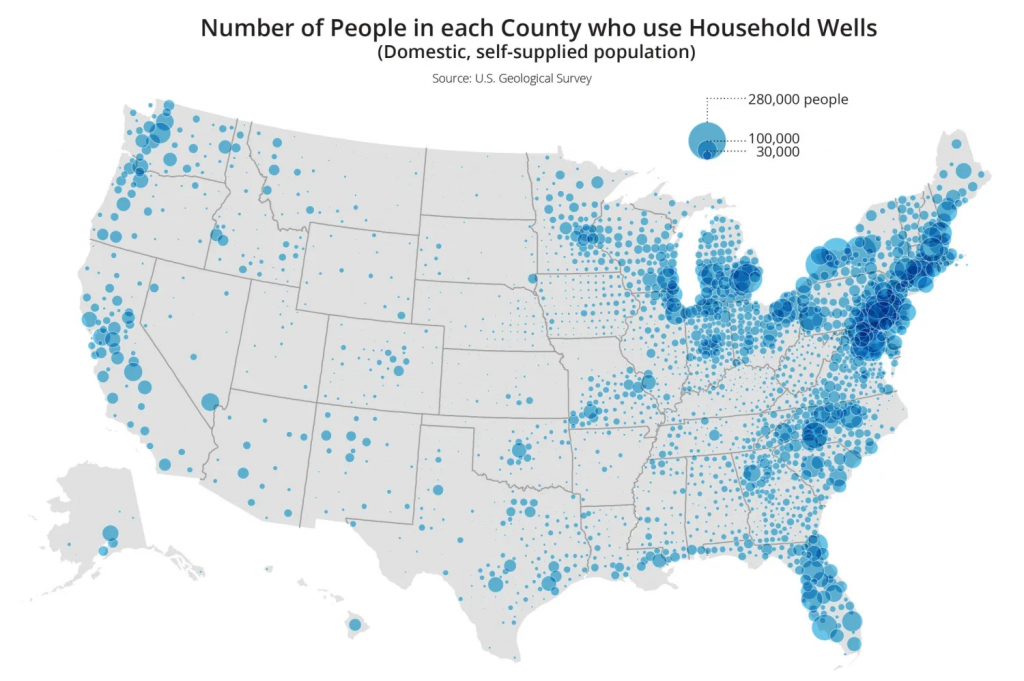

I clearly remember drinking a glass of well water from the tap for the first time at the home of a good friend. It tasted amazing! Pure, clean groundwater not contaminated or chlorinated. 1/5th of Virginia’s population depends on wells, approximately 1.6 million Virginians. Since Virginia is a buyer-beware state, there are no requirements on the seller’s end to disclose any known problems or defects. Laws concerning wells have only been in place since 1990, so if the house you are looking to purchase was built before then, you might consider having a Private Well and/or Septic Addendum added to your contract.

Overall, the state of Maryland has 420,000 homes on septic and 13% of the population is on well water. Prince George’s county has the largest percentage of people on wells in the country! Laws and regulations in Maryland vary depending on the county of residence in terms of permitting and other requirements, but all of Maryland requires at least 10,000 square feet of property for the initial drainfield and three reserve drainfields for a typical single-family home. These backup fields are built and put into service only when the main drainfield fails.

Source: familyhandyman.com

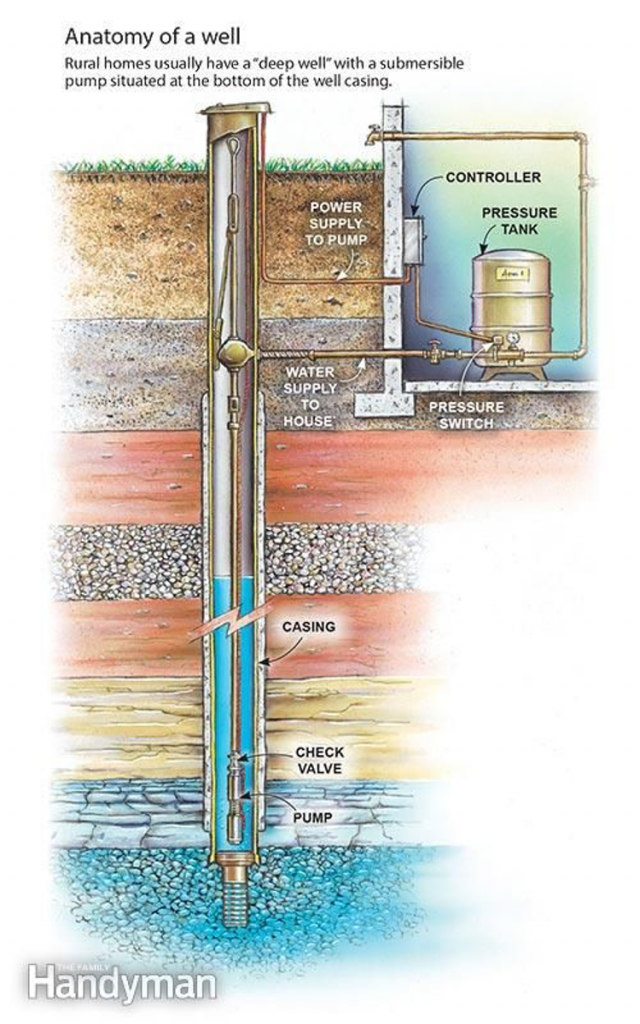

As with anything home related, it’s important to take care of your well. Well maintenance is similar to having your annual physical at the doctor. It is recommended by the CDC and Well Owner that your well and well water be inspected annually. Water testing looks for harmful bacteria and hard substances like total coliform bacteria, nitrates, total dissolved solids, and pH levels. Any found defects can be treated or remediated by an expert.

When looking at homes with a septic system and well water, some things to keep in mind would be that the septic field and well head need to be at least 100 feet apart in order to prevent contamination in the drinking water. The well head itself needs to be at least 50 feet away from the corner of the house. Another good rule of thumb is that a home should have at least 2-3 acres of land in order to support a well and septic system and still have enough land for a new field or well should one or the other fail.

Now that you know a little more about wells and septic systems, in your next home search don’t automatically discount a home for this reason! A home with a well or septic system has a well or septic because they have land and with land comes beauty. A good Realtor can help answer your questions and advise you on the next best steps!

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates Realtors® in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Paying Points to Buy Down Your Interest Rate

Historically, and on average across the nation, most consumers have paid just under one discount point to obtain the rate for their mortgage. One point is 1% of the loan amount. In the Washington metropolitan area—where the average length of time a consumer owns their home is lower than the national average—buyers have typically paid zero discount points at closing for their mortgage interest rate. During the past decade (with interest rates truly at historic lows), there was little incentive for borrowers to increase closing costs by “buying down” their rates. As home prices rose, down payment and closing costs also increased, and most consumers saw little benefit of increasing their cash requirements further by paying points to secure an even lower rate.

With a shift in the housing market and with rates on the rise, there is renewed interest in the potential benefit of buying down the interest rate. First, there is the psychological impact of securing a lower rate. If a buyer is flush with cash, they may choose to apply some of that toward obtaining what they perceive to be a more palatable rate, but available cash is still an issue for many buyers. Here is where the market shift comes into play. Sellers have had no incentive to offer or agree to concessions over the past number of years. With multiple offers on the table, sellers did not need to sweeten the pot for buyers. As the market changes, however, sellers may see more offers where the buyer is asking for closing cost assistance which can be used to buy down the purchaser’s interest rate. Depending on how anxious the seller gets, they may be inclined to agree to such a request.

The decision to pay points is really a cost benefit decision. The buyer should consider the additional upfront cost of buying down the interest rate against the benefit of the lower monthly payment associated with the lower rate. Those costs and benefits shift as rates move up and down, but the analysis process is always the same. Today for instance, the rate for a 30-year fixed rate loan of $750,000 with zero points would be 6.625%. The monthly principal & interest payment would be $4,802. If the borrower pays one discount point and buys the rate down to 6.250%, they will lower the payment to $4,618 per month. The cost of that buydown would be an additional $7,500 at closing and the benefit would be a monthly savings of $184. The borrower would break even in 41 months, not taking into account the tax deductibility of paying points when purchasing a primary residence. Paying two discount points would drop the rate to 5.875% and lower the payment a total of $365 per month with the same break-even period of 41 months. The real benefit comes every month after the break-even point. There are some federally-imposed limits on how many points a buyer can pay and still obtain a mortgage the federal government classifies as a qualified mortgage. Generally, a buyer can pay no more than 3 discount points, and often, the calculations end up limiting the points to just under 3.

For a seller, there may be benefit in offering to assist a purchaser in buying down their interest rate. It may make a seller’s property more attractive to prospective buyers. An alternative to lowering the asking price for a property may be to offer a buyer closing cost assistance which can be used to lower the rate. Closing cost assistance from a seller—if used to lower the interest rate—can have a larger impact on the buyer’s monthly payment than a reduction in the sales price of the same amount. Take for instance the example of a $750K mortgage and assume that represents 80% of the seller’s asking price of $937,500. We have already seen that paying 2 discount points to buy the rate down will lower the payment $365 per month. The cost of that is $15,000 at closing. A reduction in the sales price of $15K with a loan equal to 80% at the zero-point interest rate of 6.625% would result in a monthly payment of $4,725. That is only $77 per month lower than the payment on the higher sales price. .

If you are in the market to purchase a home, discuss the costs and benefits of paying points with a qualified mortgage professional. It can be an important tool in today’s market.

Brian Bonnet | Senior Loan Officer

Brian Bonnet | Senior Loan Officer

Atlantic Coast Mortgage, LLC | NMLS ID 643114

e: bbonnet@acmllc.com | t: 703-766-6702 | NMLS ID 224811

A lifelong resident of Northern Virginia, Brian has more than twenty-five years of lending experience. After graduating from The Citadel and serving as a Naval Officer, Brian transitioned to the United States Senate Veteran’s Affairs Committee where he served as a Professional Staff Member and had the responsibility of overseeing the VA Loan Guaranty program. After leaving Capitol Hill and the political world, Brian entered the mortgage banking industry. Keeping abreast of the myriad changes in the lending industry over the years has given Brian a unique perspective and the ability to successfully serve his clients regardless of the current market conditions. With his extensive knowledge about the VA and its loan guaranty program, Brian is widely recognized as a specialist in VA financing. He enjoys sharing his knowledge and experience with others, and is licensed in Virginia, Maryland, and Washington, DC.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Audio & Video Recording Laws in Washington, DC, Virginia, and Maryland

“This call may be recorded for quality assurance and training purposes.” Almost all of us at some point have called a bank, a hospital, an airline, a department store, or any other commercial institution, and heard a variation of this. While it is true that they are oftentimes using these calls for training purposes there is actually more to it than just helping improve the quality of their customer service. The fact is there are audio recording laws in place in all fifty states and Washington, DC, and to record the call they have to tell us they are doing so.

While the use of audio recordings for customer service and call centers, and video recordings for brick and mortar businesses have been quite common for many years, the rise in popularity amongst homeowners has gone up exponentially in recent years. With the introduction of video doorbells and easy to install surveillance systems, more and more homeowners are opting to record what is happening in and around their property. With this increase in home video and audio recordings, it’s important to know what a homeowner’s obligations are when they are listing their property for sale or for rent.

As one might expect, the laws surrounding electronic recording devices in residential properties do vary depending on the state where the home is located. One thing common in every state is that it’s illegal to record a person in a situation where they would reasonably expect to have privacy, such as bathrooms and bedrooms. Recording them without their consent in these situations is against the law.

Let’s take a look at the differences in audio and video recording laws in Washington, DC, Virginia, and Maryland.

Washington, DC

When it comes to audio recording the District of Columbia, like many places in the country, follows the one party consent rule. This means that you do not need the consent of the other party to record any conversation in which you are involved. If you want to record a conversation that you are not a part of, you will need the consent of at least one of the parties involved. For video recording, if your intent is the safety and security of your property, there should be signs clearly located stating that the property is under video surveillance. If a person continues onto the property that qualifies as consent.

Virginia

Like 35 other states including the District of Columbia, Virginia is a one party consent state which means you can legally record any conversation to which you are a party. However, Virginia law does grant an exception – if a person’s communication was in a place where there would not be a reasonable expectation of privacy, such as walking down the street, it can be recorded. As for video surveillance, like the District of Columbia it comes down to intent. It is legal in the state of Virginia to record someone if your intent is the security and safety of your property and your family.

Maryland

Unlike Washington, DC and Virginia, Maryland is one of twelve states that requires the consent of all parties when it comes to audio recordings. However, when it comes to video recordings Maryland takes a very different position. In Maryland you do not need consent from any party to use video recording in your home which also includes your front porch.

As you can see, the laws when it comes to audio and video recording can be quite complex and do vary from state to state. When listing your property for sale or for rent, it is imperative that you know what your rights and responsibilities are as the property owner. Conversely, if you are a prospective buyer or tenant, it is also important that you know what level or privacy you should reasonably expect when touring properties. Regardless of the jurisdiction make sure to ask your trusted McEnearney Associate about the specific laws so that they can guide you through your obligations and/or expectations.

Andy Hill is Executive Vice President and Managing Broker for the Washington, DC and Maryland offices of McEnearney Associates.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Much Do Cosmetic Fixes Cost?

This is a common concern for both buyers and sellers! Lately, my team and I have had lots of experience with getting homes show ready and with helping buyers who have purchased a home in need of a bit of TLC before move-in. While every situation is unique, there are some standard costs that we are seeing – which of course are subject to change – but knowing the numbers can help you put these costs into perspective.

As a seller, it’s normal to worry about the costs associated with getting your home ready for sale. We understand that it may seem as if the money could be wasted, especially if buyers want to move in and change things to their liking anyway. However, most buyers overestimate the costs involved in painting, replacing carpet, and other cosmetic fixes. Your final sale price will reflect those worries because buyers are less likely to compete for your listing if it’s viewed as a “fixer upper.”

As a buyer, it can seem daunting to have to spend even more money to make the home move-in ready. After saving up for years to come up with a down-payment and closing costs to buy your new home, the thought of having to spend a bunch of extra money to make a “fixer upper” move-in ready can be scary.

So, let’s talk about some real examples of recent work. This will give you have a better idea of just how expensive it really is to paint and spiff up a home – whether you’re buying or selling.

One of the first things that many people do to make a new home “theirs” is fresh paint! We recently had a home painted in South Arlington that was a bungalow with 1,209 square feet. The cost, including paint and labor, was $4,500. Another home that we are currently working on is in Old Town and it is historic with 1,182 square feet of character, lots of ornate woodwork, and some walls and ceilings to repair. That paint quote was $5,800, due to the extra prep work. Painting costs will also vary depending on whether you want to paint all the ceilings, closets, and woodwork, as we did in those two instances, but this is a good estimate for planning purposes.

Aside from the walls, floors are another concern for many moving into a new home. For some, a “worst case scenario” would be old, dirty carpet that needs to go away, but even hardwood floors can sometimes need some TLC or even replacement. Raul Vasquez, owner of Federal Contracting, has worked with many of our sellers and buyers, and has recently given us some ballpark quotes for several different approaches to flooring. In a basic 20×20 family room, it would start at about $675 to replace wall-to-wall carpet. Nowadays, many are opting for luxury vinyl tiles (LVT) which is a nice option that looks like hardwood but is much easier to care for and maintain. For the same size room, you could install LVT instead of carpet starting around $2,500. Although more expensive initially, it may make sense long term.

If the existing hardwood is in relatively good shape but just needs to be refinished, it can get a little pricier. One recent home that we worked on had all the main level flooring refinished, which was just over 1,500 square feet, and this cost $5,250. Another option is a professional grade polish – this can be a great, lower-cost option that conditions and refreshes the wood to a lovely shine. Pricing for this will be significantly lower than refinishing but will depend on the condition of the wood.

Another big thing that many new homeowners don’t realize is that reglazing a bathtub is easy. Many tubs don’t need to be replaced, just reglazed – and that is much cheaper! A standard bathtub reglazing costs about $400, whereas a new porcelain-enameled cast iron drop-in tub is running anywhere between $1,348 and $3,810 on the local HomeDepot site today, and that doesn’t even account for the installation work.

Now let’s talk about that final cleaning! Even when a home seems to be in tip-top shape, especially since the emergence of COVID, many buyers are opting to have a service come do a thorough cleaning before moving in. While many sellers have their homes cleaned before going on the market, the process of showing the home and can sometimes track in dirt so the new homeowner may want their own service. For a home of about 2,000 square feet a cleaning would start around $450, including appliances.

Federal Contracting provided several of these quotes, and is a Class A contractor, licensed and insured and serving Northern Virginia and DC since 2005. They offer all the above work and more. Please note that the specific numbers quoted here are estimates for work done in the spring and summer of 2022. Exact quotes will, of course, be subject to timing and your specific needs.

I hope these “guesstimates” have helped! Ideally, a seller is putting their home on the market move-in ready. This is usually reflected in the sale price. However, if you need to do some work before moving in, I can provide some guidance while you are shopping for a home, so that you can make informed decisions. Helping you to get quotes for work needed is just one of the many services we offer.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many faceted process of buying or selling a home. Contact Hope at 703-244-6115.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Accessorize Your Home with Square Footage & Income

Homeowners have been using their properties to earn additional income or expand their living options for as long as there have been shared living spaces. Whether they are over-the-garage studios, garden or “English basement” apartments, in-law suites, “granny flats,” or stand-alone carriage houses, Accessory Dwelling Units (ADUs) offer passive income while also easing limited inventory in the rental market.

But what qualifies an ADU, how are they regulated, and what should ADU-aspirers watch out for as they begin the process of expanding their property management?

Simply put, an ADU is a second residential area on a homeowner’s property. It can be detached from the main home or built within the primary as an attached but separate or walled-off living space for the privacy of the residents. An ADU will have its own bedroom(s), kitchen and bath, and usually have a separate entrance, allowing residents to function independently of the main property.

As with most residential real estate, ADUs are subject to zoning regulations and homeowners can expect applications, permits, inspections, and tax assessments when establishing or building an ADU (helpful local links are provided below). Homeowners should be sure to follow local guidelines and laws when establishing an ADU.

ADUs can require significant financial investment and can be as utilitarian or luxurious as desired, and homeowners should budget anywhere from $300-$500/SF or about $125k-$400K for renovations, excavations, and construction. How an ADU will be used – for living, home office, working out, etc. – will determine how much space you need, what utilities are required, necessary parking, accessibility needs, and other logistics. Depending on zoning requirements and the size of the lot, ADUs can be as custom and expansive as “Tiny Homes,” new or pre-fab construction of completely independent homes with a very small footprint. More often in a dense metro area like ours where buildable land is scarce, ADUs are converted spaces, usually in basements or garages and can be creative challenges.

How the ADU is used is up to the homeowner and can become additional living space for family members or as an income-generating property for long- or short-term rentals. Pandemic living has shown us the ways the home is the center of our world and ADUs offer flexible family living, whether it be for multi-generational members co-existing under one roof, childcare or eldercare staff, age-in-place parents, work/school-from-home refuge, or an artistic escape.

Rentals, quickly becoming one of the fastest growing uses of ADUs, are subject to local regulations for short-term offerings (less than 6-months) like AirBnB or VRBO. For example, in Alexandria an ADU can’t have more than three people living in it and the ADU can’t be rented at the same time as the primary home. Homeowners should check their local jurisdiction to see if there are any grants or benefits for adding affordable rental units on their property.

One of the most promising – but hotly debated – outcomes of the popularity and proliferation of ADUs is their impact on the local housing market. At a time when rental inventory is historically tight, ADUs allow homeowners to earn income while also alleviating rental pressure with affordable housing. Many people believe this is a win-win for communities – enriching homeowners at a time of rising inflation while also providing much needed independent rental inventory at a price range that is often non-existent in urban markets. But detractors across the nation (including, currently, in Arlington) say that density housing, including ADUs, are crowding single-family neighborhoods and putting additional pressure on parking and utilities and lead to noise, crowding, and increased taxes.

A decade ago our local leaders were debating the value of ADUs and the ensuing years have only increased the popularity and push for this type of supplemental housing. Local systems throughout the region have been updated and adapted to clarify qualifications, streamline applications, and ensure consistency throughout the process, making ADUs an attractive option for homeowners with the space, budget, and creativity to expand their homes and their real estate empire in the process.

For more information about ADUs, follow the links below and stay tuned for updates at our McEnearney Blog.

- Washington D.C. | Accessible Dwelling Units Homeowners Manual

- Washington D.C. | Accessory Apartments Zoning Handbook

- Virginia | Accessible Dwelling Units

- Montgomery County, Maryland | Accessible Dwelling Units

- City of Alexandria, Virginia | Accessory Dwelling Unit Policy

- Arlington, Virginia | Accessory Dwelling Permit

- Fairfax County, Virginia | Accessory Living Units

Karisue Wyson, Director of Recruiting & Agent Support at McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article, contact Karisue at 703-615-0876 or email kwyson@mcenearney.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Is a ‘new build’ right for you?

The past year’s red-hot residential real estate market, with its seemingly ever-increasing prices and razor-thin inventories, has led many buyers to consider whether a newly built home may be just the solution. For some families, this alternative may make perfect sense. Here are some factors to consider.

The supply of newly built houses on the market in the DMV does seem to be more buyer friendly. The “absorption rate” (the ratio of homes on the market to contracts being written) for existing houses is less than two months; for newly built homes the rate may be closer to six months. The looser supply means substantially more bargaining power, and potentially less chance of getting caught up in a bidding war, for a newly built home.

Builders sometimes also offer incentives to use a particular lender or settlement company — although an experienced Realtor will counsel you to shop among multiple lenders for the best rate.

Newly built homes are often more energy-efficient and require less maintenance, which can certainly result in substantial cost savings over time. A new build also usually comes with warranties on workmanship and materials like windows, roofs, appliances and HVAC systems. Some builders even offer extended warranties. Of course, warranties are generally available through third parties for existing homes as well.

The non-financial factors are more of a mixed bag. New subdivisions tend to be located farther from city centers, which can result in longer commutes and less ready access to urban amenities such as restaurants, museums and concerts. Existing homes will usually be in more established neighborhoods with more mature landscaping.

On the other hand, a newly built home may afford more customization options to fit your tastes and preferences, such as cabinets, flooring, backsplashes and paint colors. (Often, the best prices come from selecting one of the builder’s “design boards,” because the builder can negotiate supplier discounts for those options.) A buyer can also select custom options geared to help him or her “age in place.” Finally, many new subdivisions offer community features such as pools and clubhouses.

Timing can also be a major consideration. For an existing home, a transaction can move very quickly indeed. Once your offer is accepted by the seller, the closing and move-in date can often be within a month to six weeks. New builds can take significantly longer to be ready for move in. Depending on the stage of construction, and the completion and closing dates, it could well be six months to a year down the road, and, depending on supply chain issues, further delays could come up.

Moreover, new builds are also subject to comprehensive permitting requirements and inspections, which can result in further delays. During all that time, inflation could be causing construction materials prices to increase, and interest rates could be rising. Recently some builders have actually stopped pre-selling their homes because of the current uncertainty regarding costs and completion time.

Whether to add newly built homes to your search is a deeply individualized decision based on a number of financial considerations and personal preferences. Whether you are solely in the market for an existing home or a new build, an experienced Realtor can help you weigh the options and find the home and neighborhood that’s right for you.

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates Realtors® in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Mortgage Financing in a Competitive Market (Part 2, purchasing the next home before selling the existing home)

In April, Part 1 of our series on Mortgage Financing in a Competitive Market looked at preparing to make an offer. This month we discuss how to make your offer without a home sale contingency.

You may have heard the real estate market is starting to slow down. Recent sales data seem to support that notion. You should keep in mind, however, that slowing down does not mean a slow market. It means the frenetic pace at which residential real estate has been sold over the past several years is a little less frenetic now. Interest rates have risen significantly which does have a chilling effect on home buying. Consumer sentiment over the economy has turned sour and that has a negative impact on home sales as well. But the most important factor driving the current home sales market is the demand for housing relative to the supply. Demand continues to outpace supply which generally means there is more than one prospective buyer for every home available for sale. Many, if not most homes listed for sale are still likely to receive more than one offer, which means if you want to be successful, your offer needs to be more attractive than the other(s).

One aspect of a contract which may be less attractive to a seller is a home sale contingency. If you choose to or must sell your home before buying the next property, the seller may accept an offer from another prospective purchaser with no such contingency. Some purchasers have both the income and the liquid assets necessary to be able to purchase the next home without first selling the existing home, but many do not. Determining which category you fall into requires a conversation with an experienced and competent mortgage professional as part of the preliminary approval process. You should also know that many mortgage loan officers will suggest that a person cannot purchase without first selling because the mortgage company does not offer bridge financing, or the loan officer is not aware of methods of generating the cash required to complete a purchase. It is truly in a purchaser’s best interest to make sure they are speaking with the right mortgage professional.

If you have the income required to carry the debt structure on two homes at once, there are multiple ways of generating the cash required to cover the down payment and closing costs on the next home. A traditional bridge loan secured by the property to be sold is one way to make it happen. Unfortunately, most mortgage lenders do not offer bridge financing. Some of us do, so make sure you are speaking with the right mortgage professional. A traditional bridge loan is secured by the property which will be sold and, by definition, is a temporary loan which will be paid in full upon the sale of the current home. The bridge loan usually takes out any mortgage which already exists on the property and will generally not exceed a loan-to-value of 70-80%.

An alternative to a bridge loan is a home equity line of credit (HELOC) secured by the current home. It is a good idea to have in place the largest HELOC possible on your current home to allow you to quickly access the equity for all eventualities. A HELOC can be used for emergencies, for investment opportunities, or to make the down payment on the next home without first selling the existing home. Unfortunately, if you have already found the next home it is too late to begin the process of establishing a HELOC. It generally takes most depository institutions 45 days to approve a HELOC and they won’t do so for a home which is to be sold or to be converted to a rental property.

Another common means of generating cash for a home purchase is to borrow against retirement plans. Most qualified retirement plans allow the plan participants to borrow funds for the purchase of a primary residence. The IRS allows plan participants to borrow up to 50% of the vested balance in the plan with a maximum loan of $50,000. A two-person household where both people are employed and have active retirement account balances in excess of $100,000 can generate $100,000 in retirement loans together to be used for the down payment on the next home. Retirement account loans are usually offered at very attractive interest rates and do not count as a debt when underwriting the mortgage for the next home. Retirement account loans are not distributions and do not have a tax consequence.

Gifts from family members are a common way of generating the cash for the next purchase. If a family member is able and willing to help but does not wish to provide an outright gift, they can be the source of a “bridge” loan secured by the existing home or even a subordinate mortgage on the new home.

The long and the short of it is there may be multiple ways to assist a homebuyer in generating the funds needed to purchase the next home without first selling the existing home. You simply need to explore the possible options with the right mortgage professional.

Brian Bonnet | Senior Loan Office

Brian Bonnet | Senior Loan Office

Atlantic Coast Mortgage, LLC

e: bbonnet@acmllc.com | t: 703-766-6702

A lifelong resident of Northern Virginia, Brian brings twenty-five years of lending experience to the group. After graduating from The Citadel and serving as a Naval Officer, Brian transitioned to the United States Senate Veteran’s Affairs Committee where he served as a Professional Staff Member and had the responsibility of overseeing the VA Loan Guaranty program. After leaving Capitol Hill and the political world, Brian entered the mortgage banking industry. Keeping abreast of the myriad changes in the lending industry over the years has given Brian a unique perspective and the ability to successfully serve his clients regardless of the current market conditions. With his extensive knowledge about the VA and its loan guaranty program, Brian is widely recognized as a specialist in VA financing. He enjoys sharing his knowledge and experience with others and is certified to teach Financing Continuing Education in Virginia, DC, and Maryland.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How will rising mortgage rates and low inventory affect buyers and sellers in the Washington Metro region?

For the last 24 months, the DC region’s real estate market has been the hottest we’ve seen in our 42 years in business. Fueled by record-low interest rates and record-low inventory, empowered buyers were chasing the relatively few homes on the market, driving prices higher. It was an incredible time to be a seller, a perhaps frustrating time for buyers — and it couldn’t last forever.

Rapidly rising mortgage rates combined with higher home prices mean that homes are roughly 30% less affordable today than this time last year, and it is clearly having an impact on contract activity. This means that sellers will have to adjust their expectations a bit, as there will simply be fewer buyers — especially first-time buyers who are most affected by higher rates. There won’t be as many multiple offers and homes will likely stay on the market longer. There still isn’t enough supply to meet even this lower demand, and it may take as long as another two years to get to a true balance between supply and demand. The important thing to remember is that this re-balancing in no way should cause worry about a crash. We’re talking about slowing price growth to normal levels of 3% – 5%.

30-year fixed mortgage interest rates have jumped two full percentage points in the last four months, from 3% to more than 5%, and that undoubtedly puts a pinch on homebuyers in what is still a very competitive sellers’ market. But as surprising and as swift as that rise has been, bear in mind that the average rate over the last 32 years is 6% – and it has been as high as 10.5% during that period of time.

The decision to purchase a home is personal, and shouldn’t be based on trying to “time” the market. Buy when you’re ready to buy. We know there is concern that rising rates will bring home prices down, and while it is absolutely true that buying activity will lessen because of higher rates, the biggest challenge in the market is the lack of inventory, not the lack of buyers. This spring, most of the region had less than a half-month supply – and we usually think of 3-to-6 months’ supply as balanced. Don’t defer a purchase decision because you’re waiting for prices to come down. The pace of rising home prices will ease in the face of lower demand, but they will still rise.

Your choice of an experienced Realtor and Loan Officer are key to navigating the changing market. If you are ready to buy or sell a home, reach out to a McEnearney Associate today for exceptional service. We are the trusted real estate resource throughout the DC metro area.

David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link