What’s REALE Behind Renewable Home Initiatives?

Real estate agents across our region are working together to educate homeowners about the affordability and benefits of renewables while increasing home values, one property at a time.

In 2022, DC became the second major city in the country after New York City to enact a ban on natural gas in an effort to curb carbon emissions. Emissions from buildings account for 75% of the pollution in DC and residential properties are responsible for 33% of those greenhouse gas emissions, giving homeowners a stake in helping to bring pollution levels down by choosing high-efficiency electric appliances and incorporating renewable energy resources into both home improvements and new construction.

A study released by the National Association of Realtors (NAR) showed that agents report that 45% of their clients are very interested or somewhat interested in sustainability. But where can residents get information about how to take action to reduce their homes’ carbon footprint and get to net zero emissions?

Enter a collective of real estate agents from across the area who are working together to get their clients connected with the initiatives, resources, and funds to help homeowners take concrete steps to fight climate change in their own homes.

James T. Kim and Jane Crosby-Bartnick are two of the agents leading the way as part of REALE (pronounced “Really”), a group of real estate professionals from different brokerages and real estate-related companies who believe “agents, as trusted advisors to homeowners and renters, with strong connections to their communities, can lead the effort to decarbonize our neighborhoods, one healthy home at a time.”

Part of James’ interest in REALE was born out of the Inflation Reduction Act of 2022, which offered citizens a number of tax credits to be used with different renewable sources of energy. Specifically for homeowners, there are credits relating to solar and wind power, energy efficient home improvements, home energy updates, among many others. James realized that many of his clients weren’t aware of the IRA credits and wanted to find ways to connect them with opportunities to put these credits – often worth several thousands of dollars – to work in their homes.

James connected with his McEnearney colleague Jane over the innovative net zero renovation of a 100-year-old home, by one of James’ clients Vanessa Bertelli.. Jane, who has extensive eco-credentials and designations as a LEED Green Associate and TRUE Advisor certified through the U.S. Green Building Council and Green Business Certification, Inc. was very interested in the eco-upgrades of Vanessa’s home. Together, James, Jane and Vanessa co-founded REALE which became one of the initiatives of Electrify DC, a local nonprofit whose mission is to make it easier, faster and more affordable to decarbonize all homes.

“Real estate agents are the real grassroots when it comes to efforts to fight climate change at the local level,” said Vanessa who is Electrify DC’s Executive Director. “Their deep connections with their communities and the trust homeowners and renters put in them make real estate agents key in the necessary electrification of our homes.”

REALE offers collaboration across brokerages, allowing agents to share what they’re hearing in the market about clients’ questions and interests, and where the most education is needed. “We’re the ones guiding renovations. We’re the ones in touch with contractors,” said James. “We can be advisors in how homes can be focused on sustainability and affordability.”

REALE is growing its knowledge base, building a resource hub and connecting with lenders, appraisers, and builders who understand the growing desirability and demand for renewable housing features and how they affect home values. Electrify DC just hosted its inaugural annual Healthy Homes Fair, a free expo and interactive experience for homeowners, renters, home renovation professionals and career seekers to learn about sustainable products and services, increase comfort, and reduce emissions in the DC region.

“Clients see us as a resource and we can show them how to save money, make our homes healthier and add more value to their homes,” Jane adds. “Even if a client isn’t interested in environmentalism, we can help educate them in ways they can help.”

“If you can talk (to homeowners and buyers) about the ways that they can save money, offer a good return on their investment, improve their life and the lives of their kids, it’s worth having that conversation,” Jane said. “It’s not about politics. It’s educational and a real way they can improve their communities.”

REALE expects to grow beyond the DC-region as consumers look for guidance on making their homes more sustainable while increasing value. They continue to work with officials at local, state, and Federal levels to expand partnerships and initiatives aimed at educating the public while also bringing more agents into their ranks to spread the word.

“Agents know the market trends,” James explained. “Not just where those trends are going but how to take economic advantage of smart renovations and tax credits available.”

Reach out to a McEnearney Associates | Middleburg Real Estate | Atoka Properties agent to learn more about how to find or create a home that’s sustainable and healthy for your family and your larger community.

(Dig deeper in The McEnearney Blog: Meet Jane Ellen Saums, another Realtor® who is bringing sustainability knowledge to her clients.)

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Real Estate Appraisals in a Shifting Market

One of the most important players in a real estate transaction often flies under the radar: The Appraiser.

How do you know that your home was worth what you paid for it?

How did the bank determine if the loan was secured properly?

How did the seller and their agent come up with the list price in the first place?

The work of one person – an appraiser – answers the above and represents the grease that keeps the wheels of real estate turning. An appraiser is an independent, impartial, and objective professional in the mortgage transaction who develops a report which is a credible, reliable, and supported opinion of value. The work that they do has a direct impact on how much buyers might pay for a home and whether a loan may be approved at all for the property.

John Chapman, co-owner of Omni Appraisal Services based in Fairfax, VA who has over 30 years of appraisal experience, recently spoke to a packed audience of McEnearney Associates | Middleburg Real Estate | Atoka Properties agents who turned out to hear how appraisals may be affected by National Association of Realtors® (NAR) changes in how buyer agents are paid for their services, among other topics.

“Our job is to reflect what’s going on in the market,” Chapman explained. “We’re not creating the value, we’re just reporting what we see in the market.”

Data used in an appraisal report is culled from various sources, the most important being information shared by agents. Chapman explained that appraisers are looking at previous comparable sales transactions, called “comps,” for as much detail as possible in the listing notes. Appraisers want to see hard data like plats, surveys, list of improvements/renovations, an array of pictures of the property, and whether there were multiple offers. But appraisers are also looking for insight agents may have gathered in their own research on the comps used to set a price. This could include details such as whether the home is being sold in a divorce (which could decrease sales prices), if there was an odor (such as from smoke or pets), what traffic noise could be heard from the property, and what concessions may have been offered to the buyer.

“Each situation is case-by-case,” Chapman said when asked about the deciding factors in creating a report. “There are all these little clues that I’m trying to piece together that come up with my value report.”

Beginning August 14, concessions from a seller could also include money to pay a buyer’s agent’s fee. Historically, those agent fees were paid through “cooperative compensation” whereby the seller’s brokerage shared a portion of the sales commission earned with the buyer’s brokerage, and this commission amount was advertised in a local multiple listing service (MLS). But recent NAR changes mean that all concessions – including home inspection repairs, closing costs, and other buyer fees – are negotiable between the seller and buyer within the terms of an offer and not determined at the time of listing.

Chapman is concerned that not all agents will report concession information the same way, potentially leaving out important comparable cost data that could help in more accurately determining the value of a subject property.

Some complicating factors in determining a home’s value are specific to our region, Chapman noted. For example, because of low inventory there may not be comps for a subject property and the appraiser will have to look further than the standard 3-6 months of sales to find a comparable property. This is especially true for unique properties and homes in the luxury market. There’s also the way that different jurisdictions count square footage, where some include basements and some do not, depending on how much of the basement is above-grade (it gets complicated!)

Chapman also shared that kitchens offer the most value to a property, followed by bathrooms. Green and renewable energy features are starting to become a factor in appraisals because of new lending guidelines to factor their value into a report.

Also of note: building cost increases due to post-pandemic inflation and supply issues. “It costs more on a per square foot-basis – labor, materials – to build a house now prior to (COVID-19),” Chapman shared. “What appraisers are adjusting for … has increased over the past few years to match the market.”

If you are considering selling or buying a home, here’s what your future appraiser would like you to know.

For Sellers:

- Review your tax record to check for errors or missing information.

- Provide your listing agent with a list of all home improvements and their dates.

- Document features that may not be readily observable, like hardwood floors under carpeting or an easement.

- Understand that what you have paid for home improvements may not equal the value these improvements are given in the appraisal report. A $100,000 kitchen renovation doesn’t necessarily equal $100,000 in market value.

- If you conduct a pre-listing appraisal, expect that it may be out-of-date by the time a buyer’s appraisal is ordered. While you can share that information with the appraiser, it may not have much influence on the final value.

- Be careful about “testing the market” and pricing higher than recent comps. Even if a buyer is willing to pay an inflated price, the home may not appraise at that price and the deal could be in underwriting jeopardy.

For Buyers

- Exercise your right to have an appraisal conducted, even if you are paying cash. This is likely your most valuable asset so you’ll want to know what you have!

- If you have an Appraisal Contingency, stay on top of the deadlines and communicate with your lender about any information you learn through the appraisal process.

- Be prepared that a home may not appraise for the contracted sales price and discuss a strategy with your lender and agent for next steps.

Pricing a home is often likened to “an art, not a science” given all the factors that are used to determine value. The appraisal process helps to put hard data into the mix to give buyers and their lenders the confidence that they are getting their money’s worth. Consult with one of our Associates to come up with a plan to value, price, and close on your home!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why Is Climate Change More Dangerous For Some Communities Than Others?

It’s been the hottest year on record. How are you and your home holding up?

There’s no other way to describe it: this summer’s heat has been brutal. The DC-Metro area has been crushed by oppressive heat – The Washington Post’s Capital Weather Gang reported “every metric used to assess heat ranks among the most extreme in records that date to the late 1800s” – while temperature records across the country and the world have similarly been broken. And we still have several more weeks of summer to get through.

Heat, humidity, strong thunderstorms, flooding, hurricanes, and air pollution caused by wildfires and smog are all dangers not just to residents but to properties as well, and some neighborhoods and their residents are more prone to the effects of climate change than others. Urban communities like Washington and its suburbs are particularly vulnerable and it’s important for homeowners and dwellers to do what they can to mitigate how climate change affects not just their health but their homes.

Who Is At Risk?

According to studies by the Environmental Protection Agency (EPA), certain groups are more vulnerable than others to the health impacts of climate change due to social and economic factors like income, age, education, health care access, and housing which can affect people’s ability to prepare and cope with climate hazards. Socially vulnerable groups in the United States include communities of color, low-income groups, certain immigrant groups, and those with limited English proficiency. These groups may be more at risk because:

- They may live in locations that are prone to climate-related health hazards, such as flooding, extreme heat, and air pollution.

- They can have greater rates of existing medical conditions, such as physical disabilities, poor mental health, kidney disease, diabetes, asthma, or heart disease, which can be worsened by climate change impacts.

- They may live in urban and rural areas with poorly maintained or aging infrastructure that may not be able to handle climate-related events. Such infrastructure can include buildings, utilities, and transportation and health care systems. Individuals in these communities may also struggle to access resources and care during and after extreme weather events.

- They may have limited financial resources or cultural, language, or citizenship barriers that restrict their access to health care, social services, and safe, nutritious food.

How To Determine Risk

One comprehensive resource is the Climate Mapping for Resilience & Adaptation site (CMRA), which was developed in 2022 as part of an interagency partnership working under the auspices of the U.S. Global Change Research Program (USGCRP) and with guidance from the U.S. Federal Geographic Data Committee (FGDC). It is funded by federal grants and compiles information from various sources, including the Department of the Interior, Department of Energy, the National Oceanic and Atmospheric Administration (NOAA), and NASA among many others.

At the heart of the CMRA portal is the Assessment Tool, an interactive application that provides statistics, maps, and reports on climate conditions for every county in the United States, while the Climate Resilience Toolkit helps residents determine their specific risk not just to themselves but to their assets, like a home or a business.

Another option from Realtor.com offers homeowners risk assessments on a specific property for flood, heat, wind, air quality, and wildfires through FirstStreet.org, a research and technology nonprofit with expertise in assessing physical climate risk at the property level in the United States.

How to Combat Risks

Local, state, and civic authorities are the frontline for promoting Environmental Justice, a movement that calls for the “just treatment and meaningful involvement of all people, regardless of income, race, color, national origin, Tribal affiliation, or disability, in agency decision-making and other Federal activities that affect human health and the environment.” The EPA cites several ways for citizens to get involved via grants and resources, strategic and community planning, and collaborative resources.

Here are ways individuals can also identify, assess, and combat climate change risks:

- MyMoney.gov offers a roster of governmental resources in an easy-to-navigate format, and includes not only education about environmental hazards but also how to develop a disaster plan, what resources are available after a natural disaster, how to avoid fraud and scams, and how to modify a home to mitigate climate risk.

- The United Nations offers 10 Actions that individuals can take to limit their contributions to climate change and how to get involved on a global level.

- The World Economic Forum offers tips on climate-proofing homes.

- The Consumer Financial Protection Bureau offers guidance specifically on housing, breaking it down for buyers, renters and current homeowners.

Check out these local organizations who are working on education, prevention and policy in our region:

- DC’s Commission on Climate Change and Resiliency

- Maryland’s Commission on Climate Change

- Northern Virginia Regional Commission (a division of Virginia’s Department of Environmental Quality)

- Fairfax County’s Office of Environmental and Energy Coordination

- West Virginia University’s WV Climate Link

- Climate Change Resources (choose your location)

It can feel overwhelming as an individual to mitigate the effects of climate change, especially if you are part of a community that is bearing an unequal burden caused by climate disasters. Learning about the resources available is the first step in protecting your health and your home for what will come next.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Industry Changes Will Impact the Homebuying Process

Changes are coming to common real estate practices. Find out what they are before you buy or list a home for sale.

If it’s been some time since you bought or sold a home, there are recent changes to the selling process you need to be aware of. These are part of nationwide changes from the National Association of Realtors® (NAR) and how homes are promoted in Multiple Listing Services (MLS) – regional databases across the country that compile information about homes for sale and sold, as well as rental properties that use an agent during the leasing process. Updates are designed to give consumers a better understanding of how they can negotiate fees associated with buying or selling a home and will take effect August 14.

It’s important to know that in our region Realtors® have been following these practices for decades, allowing for a clear and fair sales process that encourages both buyers and sellers to have their own representation in a sales transaction and negotiate their agent’s fee for service. What has changed is that a broker’s fee is not only more clear to the buyer but can now be a potential negotiating item of the buyer-seller contract, rather than being listed in an MLS as a co-operating fee between brokerages.

Here are some things to be aware of:

Buyers

- Your first step will be to sign a Buyer Agency agreement that will outline the ways your Realtor® will represent you in your search for a new home and how they will be paid for their professional services.

- Buyers can negotiate many terms in their offer to purchase, including cash concessions from the seller to help cover different costs associated with buying a home. This now includes negotiating for the seller to pay a buyer broker’s fee.

- The Department of Veteran Affairs (VA) announced a temporary policy allowing VA buyers to compensate their real estate agents directly.

- Not all sellers will consider financial concessions so it’s important to set your home purchase budget to cover all costs associated with the sale, including your agent’s fee.

- Read more at NAR’s resource page for homebuyers.

Sellers

- Your first step will be to sign a Listing Agreement that will outline the ways your Realtor® will represent you in the sale of your home, including how they will be paid for their professional services.

- Your Realtor® will advise you on current market conditions and what will make your home attractive to the greatest number of potential buyers.

- Sellers can indicate if they will consider concessions to a buyer but they are not obligated to do so. Sellers should evaluate offers to purchase their home based on all specific terms and conditions, which may include a request for cash concessions to cover a buyer’s costs, including their broker’s fee.

- Read more at NAR’s resource page for sellers.

A professional Realtor® is your best advocate and will work with you to develop the strategy that works best for your goals. Reach out to one of our agents to get started on your next move!

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Building Better Communities With Housing Sustainability

One agent’s firsthand report at how NAR’s focus on sustainability is preserving housing inventory and the land it sits on.

The National Association of Realtors® 2024 Sustainability Summit was held in early June in Minneapolis with a focus on initiatives to upgrade our nation’s housing stock, add client value, increase business, and lead on an urgent global issue. As an agent who is committed to helping my clients find new and innovative ways to increase value in their homes and build more resilient communities, I was excited to hear what’s coming to the sustainability market from those working in the sustainability industry.

Realtors® work to help our buyers and sellers navigate myriad changes in an accelerated landscape, something the Sustainability Summit reinforced with each panel discussion. As the organizers laid out in the mission of the conference, “(Agents) understand that sustainability isn’t a box to check, but a fundamental part of our job. Our inventory requires stewardship. The properties we help people call home must be maintained, protected, and updated to grow in value.”

The summit had an emphasis on high-performance homes, which are properties with features that increase energy efficiency, prioritize climate resiliency, and reduce emissions while reinforcing comfort, durability, and a healthy indoor environment. Mentioned throughout the meeting were organizations and resources that provide standards to measure these features, like the non-profit Passive House Institute US, Inc. (PHIUS) and the Department of Energy’s Pearl Certification. These provide savvy agents and their buyer-clients quantifiable ways to compare properties and interpret results. These standards will also help seller-clients leverage these features when marketing their homes.

Forward-thinking speakers dominated the panels, including Rohit Bhargava, the summit’s keynote speaker and best-selling author of How to be a Non-Obvious Thinker (And See What Others Miss), the newest addition to his Non-Obvious Thinking book series. In his presentation he shared, ““Obvious Thinking is the inability to imagine something different, think bigger, be open minded, or shift your perspective” and challenged participants to invest in unconventional thinking to inspire change within the industry and serve the public.

Bhargava’s presentation resonated because while real estate has always been a dynamic field, factors like fluctuating interest rates, reduced inventory, and rising prices are affecting housing sales nationwide. Other influencers such as technical innovations and climate change, and developments in related industries like public utilities and insurance companies, are all moving parts that affect housing and sustainability advances.

Sustainability, stewardship, and home ownership go hand-in-hand, and as housing professionals we work to educate our clients, help them navigate industry changes, avoid expensive or unnecessary pitfalls, and maximize not only a property’s environmental benefits but its investment value as well.

If you are interested in working with a Realtor® who has advanced knowledge about these initiatives, look for agents with NAR’s GREEN or a LEED Green Associate designation as they have completed additional training in issues of energy efficiency and sustainability in real estate. There are many within our McEnearney | Middleburg Real Estate | Atoka Properties family and we’re excited to share our passion for building great communities!

Since permanently moving back to Northern Virginia, JaneEllen McLaughlin Saums developed an intimate knowledge of its diverse communities, and thanks to her teaching background, JaneEllen has always educates her clients on the area’s market and housing options, to make sure that they find the best place suited to them to call home.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why Homeownership is a National Priority

Owning a home doesn’t have to be a dream. Check out these initiatives and resources to get buyers in a position to make homeownership a reality.

June is a month for graduations, weddings, and summer dreams. It’s also the month when Realtors® and housing advocates promote various pathways to homeownership, a goal for those who want to build generational wealth and create a place to call their own.

But the truth is that buying a home in 2024 is challenging, and it is harder for some groups to take that first step to homeownership. According to Realtor.com research, low-income earners are 22% more likely to be denied a loan, LGBTQ+ are 25% less likely to own a home compared to all Americans, one in four Hispanic individuals complete the home-buying process entirely in Spanish, seven in 10 veterans are unaware they qualify for a zero-down home loan, and the gap between Black versus white homeownership is worse today than in 1968 when the Fair Housing Act was passed.

The Census Bureau’s quarterly report for Q1 2024 showed the latest homeownership rate is at 65.6%, down 0.1 percentage points from Q4 2023 and the lowest rate in two years. On May 31 the Biden administration issued a Proclamation on National Homeownership Month 2024, calling upon “the people of this Nation to safeguard the American Dream by ensuring that everyone has access to an affordable home in a community of their choice.”

Put simply, the proclamation states, “Whether they rent or buy, Americans deserve a safe place to call home.”

Some of the proposed initiatives to make homeownership more accessible include:

- A tax credit of $5,000 per year for the next 2 years for any family earning under $200,000 — money they can put toward a mortgage when they buy their first home or trade up for more space.

- My plan would also provide first-generation homebuyers with $25,000 for a down payment.

- A pilot program run by the Federal Housing Administration (FHA) to make it more affordable to refinance a home by eliminating title insurance fees on certain federally backed mortgages, which would save buyers $1,500 at closing.

- The FHA is now considering positive rental history when making decisions about creditworthiness — ensuring that the people who could qualify for mortgage financing receive it.

- Advancement in fair housing practices, including by rooting out bias in the home appraisal process, which keeps too many Black and Brown families from enjoying the full financial returns of homeownership.

Homeownership In Our Region

Let’s start with a look at what local buyers are up against. Overall, Realtor.com statistics shows the Washington, DC/Northern Virginia/Maryland/West Virginia region with a median listing price of $640,000 (unchanged from May 2023). The District, which is not a state, ranks the lowest in both our region and the nation at 43.9% for homeownership. There are many factors that contribute to this lower rate of homeownership, including a higher transition rate of people moving in-and-out of the region (9.8% for DC compared to 2.5% nationally). This is partly explained by the number of universities, embassies, research facilities and government contract work that brings short-term residents to the area, but high housing costs are another factor. According to Realtor.com the median listing home price in Washington, DC was $614,900 in May 2024 (trending down -5.4% year-over-year) while the median home sold price was $697,500.

On the other end of the scale is West Virginia, which ranked highest in the nation at 74.7%, thanks in part to home values that are less than half that for the entire country. Again from Realtor.com, the median listing home price in Charleston, WV was $182.500 in May 2024 (trending down -13.1% year-over-year) while median home sold price was $181.900. Comparing the two areas, it’s clear that a buyer’s dollar is going to go much further in West Virginia than DC.

Rounding out the homeownership review is Virginia at 69.9% and Maryland at 70.9%. The average sales price in Northern Virginia in May 2024 was $882,180, up 10.2% the previous year’s average of $800.427, while the median sales price was $760,000 in May 2024, up from $715,000 in May 2023. Meanwhile, the average Maryland home value was $421,804, up 4.0% over the past year.

Where To Start?

Buyers in the DC-Metro area need a strong and strategic game plan to succeed in our competitive and expensive local market. The first step a buyer should take is to hire a Realtor® to assist in their search for a home. Agents have the resources, connections, insight to help buyers navigate the buying process and save their clients from the pitfalls of going into a major financial negotiation unprepared and unrepresented. An agent will connect buyers with savvy lenders who know the best financing and grant programs available and can guide buyers through complicated scenarios with many moving pieces.

First-time home buyers have it the hardest in this current market, with interest rates higher than they’ve been in decades (although still relatively moderate in the 6-7% rate range), high home prices, and limited equity. But a little bit of research and preparation goes a long way! Both Realtor.com and the U.S. Department of Housing and Urban Development (HUD) have extensive resources to tap, in addition to the advice their agent will offer.

Putting It All Together

Deciding to buy a home is a personal, economic, and logistical process. It’s not always the right choice for everyone, but for those who have a goal to become a homeowner, put down roots in a community, and begin building financial security through home equity, there is a way forward. Start with a conversation with an experienced McEnearney | Middleburg Real Estate | Atoka Properties agent and see which path is right for you,

Additional Resources for National Homeownership Month:

- PropertyAction.Realtor

- Northern Virginia Association of Realtors®

- American Property Owners Alliance

- Greater Capital Area Association of Realtors®

- West Virginia Housing Development Fund

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why FSBOs Don’t Deliver For Sellers

No matter how hot the market is, homes listed with a Realtor® garner higher prices and faster closings than those sold directly by owners.

In a hot seller’s market like what the DC-Metro region has experienced for several years, it might seem like all owners have to do to sell a property is to stick a sign in the yard and wait for buyers to stream in. But, according to NAR’s research, For Sale By Owner (FSBO) transactions accounted for just 7% of home sales in 2023, a historic low that tied with 2021 for the fewest number of FSBO listings.

Even more striking is that the typical FSBO property sold for a median of just $310,000 compared to the median of $405,000 for properties sold with the assistance of an agent – almost $100,000 and 30% less.

To paraphrase “Field of Dreams,” it would appear that selling a home is a lot more challenging than simply intoning, “If you list it, they will come.”

What these FSBO owners discovered is that a buyer liking a home is just one of many steps on the path to closing a deal, and without a professional Realtor® who understands not only the real estate transaction process but also the local market dynamics that shape how deals come together, it can be a long, lonely, and costly process.

Not All FSBOs Are the Same, Except When They Are

There are some circumstances where a FSBO can make sense, for example in rural areas which make up 14% of FSBO sales compared with 3% in urban areas. Or, if the seller and buyer know each other like a neighbor or family member; 54% of eventual FSBO sellers knew their buyer.

But by and large, FSBO sellers found it difficult to reach the widest selection of qualified buyers and then manage the work that came once a buyer was interested. FSBO sellers must manage multiple methods to market their home through “word-of-mouth” to friends, relatives, and neighbors making up the majority (20%) of how properties are promoted and a yard sign running a close second (19%). Only 5% of FSBO properties were promoted on a Multiple Listing Service (MLS), meaning a huge number of buyers and their agents would likely never even know that FSBO property existed because site aggregators like Realtor.com, Zillow, or Homes.com pull listing data from MLS feeds.

For FSBO sellers lucky enough to land a buyer who found their needle-in-a-haystack property and then would agree to work with an unrepresented seller, that’s when the real work kicks in. NAR’s report showed that some of the most difficult tasks for FSBO sellers were:

- Getting the pricing right (15%)

- Understanding and completing/performing paperwork (7%)

- Selling within the planned length of time (7%)

- Helping buyers obtain financing (5%)

- Preparing/fixing up home for sale (4%)

- Attracting potential buyers (4%)

Why a Realtor® Matters

With so much stacked against FSBO sellers, why attempt to go it alone? The obvious answer for most FSBO sellers is that they want to save money by not paying a Realtor® fee. However, 75% of all sellers paid a fee to a Buyers’ Agent regardless of whether they used a listing agent to sell their home. So if a FSBO seller is likely paying commission fees while also receiving a lower sales price and carrying costs, the value of hiring a listing agent becomes a lot more clear.

One of the best tools an agent will share with their seller is a smart pricing strategy. Realtors® live and breathe local statistics and use them to tell a story, one that helps sellers understand where their home sits in comparison with other homes in the market. An agent’s pricing knowledge can be the difference between a property that goes under contract in a week and one that “tests the market” and sits unsold for a month or longer, costing the seller money in the long run.

The guidance a Realtor® provides can also ensure that oversights don’t become lawsuits. Agents use contracts, addenda and other sales paperwork that has been vetted by local Realtor® associations, allowing for clear understanding of terms and conditions. Realtors® are governed by NAR’s Code of Ethics and uphold the highest standards of conduct in working with clients, customers, and colleagues, ensuring that everyone is treated fairly and in the clients’ best interest.

But the most important role a Realtor® can play for their seller clients is to be a Trusted Advisor who understands the value of a home, both in market dollars and as a significant personal investment. Selling a home is a huge undertaking, both in the logistical and emotional sense, and it’s not easy to navigate a process with so many moving pieces. It’s also why many Realtors® refer to what they do as a “calling,” a deep satisfaction in helping others achieve their real estate goals and pride in building stronger communities with each new sale. It’s what they’re trained to do, it’s what they love to do.

Learn the lesson from many regretful FSBO sellers: to earn more money and have fewer headaches, consult a McEnearney Associates | Middleburg Real Estate | Atoka Properties Realtor® and let their expertise guide you to your next real estate adventure.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Your Realtor® Wants You To Know About Fair Housing (Part 2)

Each April, Realtors® commemorate the passage of the Fair Housing Act of 1968 which provides protections against housing discrimination and segregation. Here’s Part 2 of a two-part overview of what consumers should understand about their rights and obligations under the law.

In its 2023 Fair Housing Report, the National Fair Housing Alliance reported that in 2022 there were more than 33,000 housing discrimination complaints, the highest number of complaints filed and an increase of nearly 6 percent over 2021. However, some estimate that could be only 1 percent of actual fair housing violations that occur.

Last week we looked at the history of the Fair Housing Act and those who are protected under federal, state, and local regulations, including race, color, religion, sex, national origin, familial status, and disability. This week we highlight some protected classes that housing providers may not know are covered under the Fair Housing Act, including some cases discussed at an education session for our Agents earlier in the month, led by Keith Barrett of Vesta Settlements.

Barrett noted that housing providers have to make individual decisions based on complex issues, creating questions about what qualifies as a protected class and complicating attempts to make those accommodations. Here are a few examples of emerging issues that Barrett cited as areas that housing providers should consider.

Service Animals and Assistance/Emotional Support Animals

- As defined under The Act, an assistance animal is an animal that works, provides assistance, or performs tasks for the benefit of a person with a disability, or that provides emotional support that alleviates one or more identified effects of a person’s disability. An assistance animal is not a pet and housing providers cannot refuse to make reasonable accommodations in “rules, policies, practices, or services when such accommodations may be necessary to afford a person with a disability the equal opportunity to use and enjoy a dwelling.” In short, rules such as a “No Pets” policy do not apply here.

- Service animals are categorized as animals trained to do a specific task for their owner (such as a guide dog) and are allowed in public accommodations because of the owner’s need for the animal at all times. Assistance animals need not be trained to perform a service and the emotional and/or physical benefits from the animal living in the home are what qualify the animal as an assistance animal. A letter from a medical doctor or therapist is all that is needed to classify the animal as an assistance or emotional support animal.

- Specific guidelines can be found here for DC, Maryland, Virginia, and West Virginia.

- Barrett shared two cases that involved violations of reasonable accommodation for service and support animals. In 2016’s Arnal v. Aspen View Condo Association, et al., the condo owner plaintiff alleged that his Colorado condominium association improperly denied a reasonable accommodation to its “no dogs” policy to allow his tenant to keep a service dog that assisted with her epilepsy, and that the association retaliated against him for allowing his tenant to keep the dog by issuing fines. In 2019’s Calvillo, et al. v Baywood Equities, L.P., et al., the plaintiffs alleged that the managers of California’s Baywood Apartments complex discriminated against the tenants on the basis of disability when they denied a request for an emotional support animal while also making intimidating statements. The defendants were judged to pay $32,500 to the plaintiffs, while also requiring the defendants to implement new policies, training, and reporting practices.

Source of Funds

- Under state Fair Housing laws in DC, Maryland, and Virginia, buyers or renters who receive assistance or subsidies for housing payments cannot be denied accommodations. This includes housing vouchers (sometimes referred to as Section 8 funds).

- Housing providers can still require a minimum income threshold to qualify to rent, but when calculating the minimum requirements the fund amount should not be added to a person’s income but rather deducted from the rent being charged.

- For example a prospective tenant wants to rent a property of $1,000, has an income of $800, and a housing choice voucher of $750. The landlord requires an income threshold of three times the rental amount to qualify to rent the property, or $3,000 (3 x $1,000). The correct calculation is to take the $750 amount and subtract it from the $1,000 rent, resulting in a $250 difference. Taking $250 x 3 = $750 as the minimum income threshold to qualify and the tenant meets that requirement with their income of $800.

Hoarding

- Hoarding is the excessive accumulation of items along with the inability to discard them even if they appear useless. It was qualified as a disability in 2013 when it was added to the Diagnostic and Statistical Manual (DSM) psychiatric diagnosis, offering protection under the Fair Housing Act.

- Housing providers must offer reasonable accommodation even if the resident doesn’t ask for an accommodation, admit to having a disability, or agree that the unit needs cleaning.

- Housing providers should instead set goals, create a plan with a defined timeline, and schedule follow-ups with the resident.

Former/Recovering Addict

- Addiction to alcohol and the illegal use of drugs are treated differently under the ADA. Alcohol addiction is generally considered a disability whether the use of alcohol is in the present or in the past. For people with an addiction to opioids and other drugs, the ADA only protects a person in recovery who is no longer engaging in the current illegal use of drugs.

- If a person is prescribed medication to treat a substance use disorder, the ADA and/or the Fair Housing Act may require housing programs to admit the individual. The ADA also requires that state-funded housing provide “reasonable modifications” to individuals with disabilities, including those in recovery.

It’s important to note that Realtors® are bound by professional ethics and have a higher standard of service to the public than their clients regarding Fair Housing requirements and will advise their clients on federal, state, and local laws regarding housing. If a Realtor® finds that a client or customer is violating Fair Housing laws they can decline to work with the housing provider and report them to appropriate authorities. Those who believe they have been impacted by or wish to report housing discrimination can file a complaint to the US Department of Housing and Urban Development (HUD), the National Fair Housing Alliance, and local governing authorities (DC, MD, VA, WV).

Barrett’s final advice for anyone involved in providing housing or a dwelling to the public: “Treat everyone fairly and consistently.”

For guidance on Fair Housing Rights and Requirements, consult a McEnearney Associates | Middleburg Real Estate | Atoka Properties Realtor® to help navigate your individual housing situations. We’re here to help!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Your Realtor® Wants You To Know About Fair Housing (Part 1)

Each April, Realtors® commemorate the passage of the Fair Housing Act of 1968 which provides protections against housing discrimination and segregation. Here’s Part 1 of a two-part overview of what consumers should understand about their rights and obligations under the law.

Have you ever felt discriminated against or “othered” when trying to buy a home, rent an apartment, or even stay at a hotel? If so, you may have been a victim of a violation of the Fair Housing Act. But what qualifies as a violation and how can housing providers ensure that they are not making decisions to restrict housing of a potential resident or customer based on a protected class?

Keith Barrett, Attorney and Founder of Vesta Settlements, recently held an overview for our McEnearney | Middleburg Real Estate | Atoka Properties Associates about Fair Housing, specifically ways in which discrimination is still prevalent in real estate and dwelling transactions and how agents should conduct their business to avoid violations and educate their clients about the law.

“Every single person is protected by the Fair Housing Act even though its genesis came from protecting against racial discrimination,” Barrett shared.

Background on The Act

The Fair Housing Act was enacted in 1968 and amended in 1988 to “prohibit discrimination by direct providers of housing, such as landlords and real estate companies as well as other entities, such as municipalities, banks or other lending institutions, and homeowners insurance companies whose discriminatory practices make housing unavailable to persons of specific protected classes including: race, color, religion, sex, national origin, familial status and disability.” The Civil Rights Act of 1866 can also provide relief although its scope is limited to racial discrimination.

The Fair Housing Act covers most housing and in very limited circumstances the Act exempts “owner-occupied buildings with no more than four units, single-family houses sold or rented by the owner without the use of an agent, and housing operated by religious organizations and private clubs that limit occupancy to members.” In addition to homes, rental units, and land to be used for development, dwellings covered by Fair Housing may include nursing homes, hotels, dormitories, temporary migrant housing, and homeless shelters.

Federal laws provide the minimum level of protection while state and local governments can add further protections.

- DC’s Fair Housing protections include age, personal appearance, sexual orientation, gender identity or expression, family responsibilities, political affiliation, matriculation, source of income, place of residence or business, status as a victim of an intra-family offense, sealed eviction record, and homeless status.

- Maryland’s additional protected classes are marital status, sexual orientation, gender identity, and source of income.

- Virginia adds additional protections for elderliness (55+), source of funds, sexual orientation, gender identity, and military status.

- West Virginia’s additional protections include ancestry, age (40+), and blindness.

- Local jurisdictions within the DC-Metro area can include even more protections.

How The Act Combats Discrimination

“Overt discrimination is alive and well in the United States,” observed Barrett, citing several examples of cases of Fair Housing violations across a broad range of protected classes.

Barrett noted that following the law’s enactment most claims were about race, but currently, 53% of claims made were on the basis of disability, primarily in rentals. Many Fair Housing violations come from not making reasonable accommodations for persons with disabilities, which can cover a wide range of physical, mental, and psychological conditions and may not often be outwardly visible.

At every level, Realtors® work with their clients and communities to educate housing providers and empower consumers to understand their roles and responsibilities in adhering to Fair Housing guidelines. Read more about those initiatives at the National Associations of Realtors® (NAR).

In Part 2 next week, we’ll look at several Fair Housing categories and real-life scenarios that both housing providers and those seeking housing should be aware of to ensure equal treatment of all. For guidance on Fair Housing Rights and Requirements, consult a McEnearney Associates | Middleburg Real Estate | Atoka Properties Realtor® to help navigate your housing situations. We’re here to help!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Where Have All The Listings Gone? And Are They Coming Back?!?

It is no secret that there is a national shortage of homes for sale on the market, and with a few exceptions, that dearth of inventory is especially acute in the metro Washington, DC* area.

This has been coming for a long time. The average inventory at the end of February over the decade from 2005 – 2015 was right at 10,000 homes. At the end of February 2019 – just before the onset of the COVID pandemic – there were 7,600 available homes, and at the end of February 2024, there were less than 4,000. When you realize that the population of our area has grown 39% (1.5 million people) since 2000, that’s a staggering drop. Put simply, there’s 60% less inventory today with 40% more people.

But why is this happening? There are lots of reasons, and most are long-lasting.

Demographics – and the Silver Tsunami that’s more like a ripple

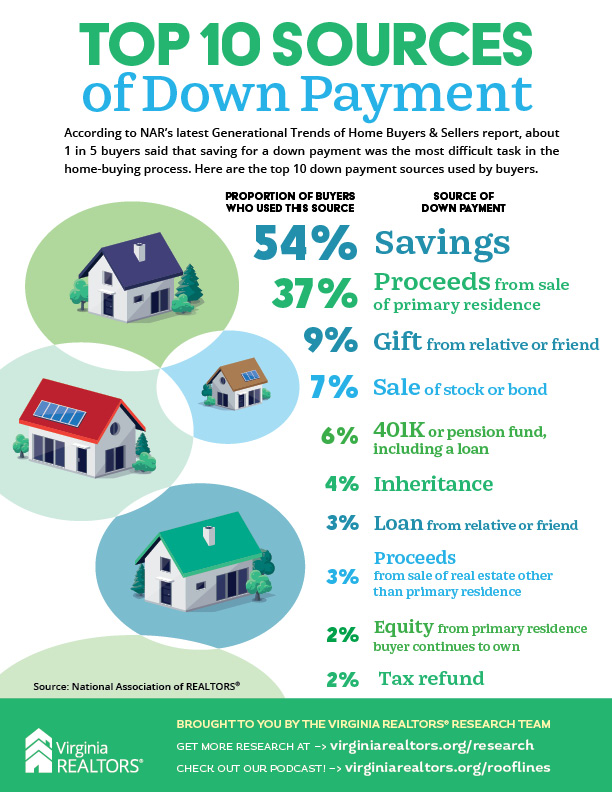

People are staying in their homes much longer. The National Association of Realtors tracks “seller tenure,” the median length of time a seller has been in their home before they sell. For a generation that stayed steady at 7 years – and it’s now more than 12. And while the Silver Tsunami, the big jump in population of aging Baby Boomers is real, the impact thus far on real estate has been a ripple at best. A recent study by AARP indicates that 60% of adults aged 65 or older have no plans to move from their current home – ever. That’s a lot of inventory that isn’t going to come on the market anytime soon.

Interest Rates and Tax Policy

We’ve never seen a time of such rapid increases in mortgage interest rates following record- low rates. Roughly half of all homeowners have a current mortgage at a rate of 4% or less – and many have a sub-3% mortgage. Consider this basic example: a homeowner with a $500,000 mortgage at 3% has a monthly principal and interest payment of $2,108.02. If that same homeowner sells and buys something with a mortgage that is just 10% more – $550,000 – their new monthly payment at the current rate of 7% would be $3,659.16. That’s a 74% increase in the payment for just a 10% bigger loan, and many sellers understandably won’t make that switch. On top of that, those sellers – like aging Baby Boomers – who have owned their home for a long time might face a tax hit if their capital gain exceeds $500,000. All of that has locked a lot of would-be inventory off the market.

High Cost of Land – and the High Cost of Regulation

Our region has battled this for a long time, and it really restricts affordable new home construction. As intensely developed as the close-in areas of metro DC are, much of the new construction is in the outlying suburbs, and that may not be where people want to live. There have been studies that indicate as much as 25% of the cost of new construction is involved with planning and compliance with federal, local, and state regulations. That contributes to driving home prices higher, another hill to climb for current homeowners who might consider moving.

There’s Inventory – and There’s Inventory That People May Not Want

There isn’t enough inventory – except for condos and co-ops in Washington, DC. It’s another indication that there isn’t just one real estate market, and buyers really do care about what they buy even when they don’t have many choices. Through most of the last 20 years, the inventory of condos and co-ops on the market in DC constituted about 7% of all available homes. Now, it’s 25%. Much of that inventory is in older buildings with few amenities, and that’s not what today’s buyers are typically looking for. Time isn’t going to make those units better. So even in a time of scarce inventory, market dynamics still matter, and a buyers’ market can exist when almost everything else tilts in favor of sellers. Those condos and co-ops will still sell, but they will be on the market longer and won’t command the higher prices that other property types do.

What Happens From Here?

Markets adjust over time. There is pent-up demand from people who would really like to sell their home, and we will see the typical increase in inventory this spring. But that rebound will be muted until interest rates come down substantially, and that’s going to take a while. And the demographic pressures really aren’t going to change. Be prepared for an extended time of inventory that is insufficient to meet the demand – and that means continuing higher home prices.

We also hear theories that the upcoming elections will have a major impact on the region’s housing – watch for our next MarketWatch where we will dispel that myth.

*Data derived from BrightMLS for Northern Virginia (Fairfax and Arlington Counties and Alexandria, Fairfax and Falls Church Cities), Loudoun County, Prince William County (including Manassas City and Park), Washington, DC, Montgomery County and Prince George’s County.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link