People vs. Policy

The answer is pretty simple: the impact of elections on our market is negligible, at least in terms of incoming and outgoing people. But the most recent election may give us a different answer when it comes to policies the new administration has in mind.

PEOPLE

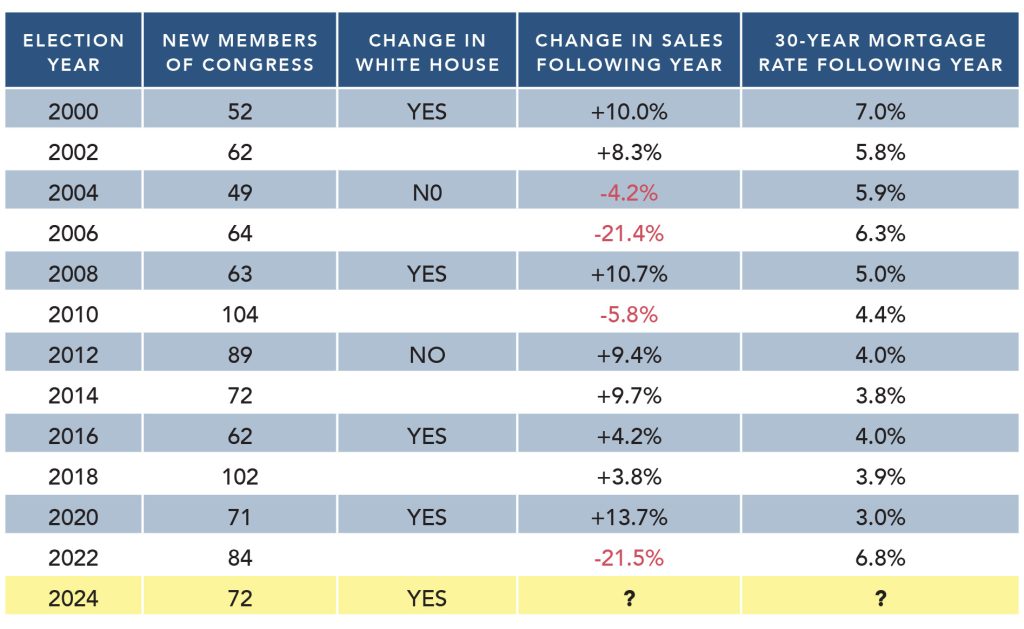

We have looked at every Congressional and Presidential election cycle since 2000, tracked the number of new members of Congress and whether there has been a change in the occupant of the White House, and then evaluated the change in the number of homes sold in the metro area* in the twelve months following the election.

*Sales data derived from BrightMLS for Washington D.C., Montgomery and Prince George’s counties in Maryland, Arlington, Fairfax, Loudoun, and Prince William counties, and the cities of Alexandria, Falls Church, Fairfax, Manassas, and Manassas Park in Virginia. Mortgage interest rates from Freddie Mac.

There simply isn’t any correlation between the number of new representatives in Congress or a change in the White House and real estate activity in our region. The most recent election brings 72 newly elected members of Congress and a new occupant in the White House. Although it may not feel that way, that’s actually typical. Since 2000, the average number of new congressional members is – you guessed it – 72. And the White House has had a new occupant 5 of the last 7 elections. The number of homes that sold in the year following the largest, recent “major change” election of 2010 fell by 5.8% in 2011, and sales rose by 3.8% after 102 seats changed hands in 2018.

Why is that the case? There are several reasons, and here’s a summary:

- There are roughly 8,000 politically appointed jobs, and related staff jobs, in the Executive Branch. Let’s assume that every one of those jobs changes after a Presidential election. The reality of Washington’s political job market is that many of the people who fill those jobs already live here – they cycle out of the public sector when their candidate loses and cycle back in when their party is back. But let’s assume that half of those jobs are filled by people who relocate to the region, and half of those people actually buy a home. Our experience tells us that’s a dramatic overestimate, but if it were to happen there would be 2,000 additional home sales spread over 12-18 months.

- There are 15,000 politically appointed jobs in Congress. When there is a large turnover in Congress – almost 20% of those elected in 2010 were new to the job – one could expect perhaps as many as 3,000 jobs to change hands. Yet many of the “new” staff already live in the area for the same reason we mentioned about Executive Branch jobs. Our area is a wonderful place to live, and people tend to stay when they move here. Further, Congressional staff salaries are barely enough for folks to find something to rent, much less to buy, and some newly elected officials even live out of their offices or share housing with others. But if half of the new staff people come from out of the area and half of those buy homes, there are fewer than 1,000 home purchases in the year after a major change election.

- These politically-related jobs don’t change all at once. As with any type of job, there is a natural turnover. The “churn” is hard-baked into the market and isn’t directly related to elections. Further, the new hiring that is directly related to the outcome of elections doesn’t happen overnight. It often takes a year or more for most new administrations to fill those politically appointed jobs in the Executive Branch. Are there some expensive purchases and sales that make headlines? Absolutely, but those really are the exceptions.

- The bottom line is that there are fewer than 3,000 home purchases or sales in the year following an election year as a result of a huge turnover, and far fewer when fewer seats change hands. With an average of more than 70,000 home sales annually in our region, that simply isn’t enough to move the needle on the market. And overall economic conditions, including mortgage rates, are far more impactful.

POLICY

There is understandable anxiety about the policy goals of the incoming administration. We really haven’t dealt with that before, and it’s almost impossible to predict the impact of those policies on our housing market and the regional economy. The stated objectives of the new Department of Government Efficiency (DOGE) include a return-to-office mandate for federal employees as well as the reduction of as many as 100,000 federal jobs. There are a lot of businesses in DC that would be thrilled with the return of those workers – and Mayor Bowser shares that enthusiasm. Yet with 30% or more of current, local federal employees eligible for retirement, how many of those would choose to stay home and not battle I-95, I-270, or public transportation? And if they retire, would they sell and leave the area and dump unexpected inventory on the market, seek civilian sector employment, or simply retire in place as so many do in this area? Those are open questions that do not yet have definite answers. There is talk of

eliminating entire Departments, and the possible job losses that would come with that. Let’s face it: federal employment has long been the bedrock of our local economy, and making no judgment about the contemplated policies, a significant loss of federal jobs certainly could impact our housing market and lots of other downstream economic activity. Experience tells us that every single federal dollar spent, every single program and department, has a constituency, and those constituents aren’t going to go down without a fight. Good or bad, these changes aren’t going to happen overnight.

We are fortunate to have a very resilient regional economy, and we’ll all be following these developing issues closely.