Has COVID Changed Real Estate Consumer Behavior in the DC Metro Area?

Ripple, Wave or Tsunami – Part I

By David Howell, Chief Information Officer, McEnearney Associates

There has been much national conversation that the COVID-19 pandemic has caused a “flight to the suburbs” as urban dwellers seek more elbow room. Has that happened in the metro Washington, DC market?

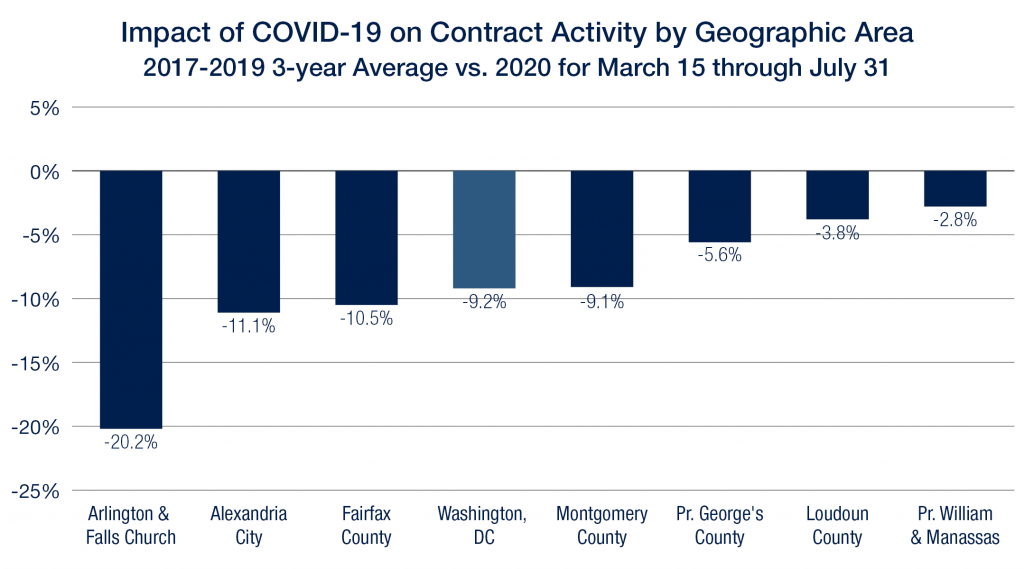

The region began to shut down in mid-March of this year, so we examined new contract activity from March 15 through the end of July for 2020 and compared that to the average activity of the same four-and-a-half-month time period for 2017-2019. As the chart indicates, there is no question that the outer suburban markets have fared better than Washington, DC and the close-in suburbs. Washington, DC contract activity is down a little over 9.2%, and Arlington is off over 20%, while Loudoun and Prince William Counties are only off between 3% and 4%. And in those areas most impacted by COVID, the condo market has been hit even harder. But there is nothing in these numbers to suggest that consumers are fleeing the city in droves. It’s not a tsunami – it’s somewhere between a ripple and a wave.

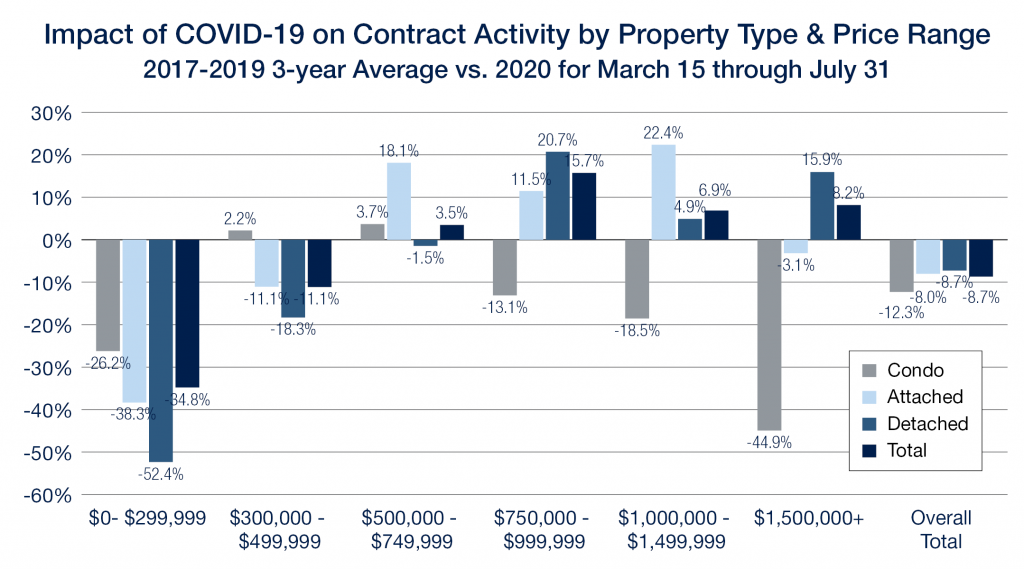

The impact of COVID has also been felt disproportionately at the lower end of the price spectrum. Job losses have been heavily concentrated in the service and hospitality sectors, and entry-level home purchases have been hit pretty hard. While the overall drop in contract activity in the region has been 8.7%, homes priced less than $300,000 have fallen by almost 35%, while activity for homes priced more than $500,000 has actually risen. Total new contract activity for condos is off 12.3%, while attached and detached homes are off 8.0% and 7.3% respectively. This is another indication that there has been some movement away from more dense living conditions, but it hasn’t been massive.

We are very encouraged by the rebound in contract activity since the middle of May, and the region’s real estate market is in far better health than we would have guessed just a few months ago. Yet a rebound and a recovery are not the same things. There is still an enormous amount of uncertainty about the future path of the COVID virus, and it will take a long time to fully replace the jobs lost and to climb out of the deep economic hole that COVID-19 has produced. We have been proud members of the Washington, DC real estate community for 40 years and continue to believe that this is the best place to live and work in the world. We are realistic in knowing that we are a long way from a full recovery, but optimistic that we will recover here better than almost anywhere.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Top Five Home Improvements to Enjoy Now That Pay Off Later

There are certain things that I always recommend to my clients if they are thinking of putting their home on the market in the next five years. Putting some money into updating your home now can make it more appealing to buyers down the line. It will also allow you to enjoy the updates before you finally take the plunge and move.

The following list is my top five recommendations on home improvements.

1. Spruce Up the Kitchen

Most of your time at home is usually spent in the kitchen. Between meals and snacks, the kitchen receives the most foot traffic out of any other room in the home. A full kitchen remodel can be very expensive. As an alternative, you can focus on some key areas. If your cabinets are older, but still in good shape, hire a professional painter to come and repaint them. After they have been repainted, update all the knobs and hardware to a more modern look.

Replace your old countertops with Silestone or quartz. It will bring a fresh look to the kitchen, and they don’t scratch easily, unlike granite.

If the floor is older, either replace it, refinish it, or add something on top. You might want to match the kitchen with the rest of the house. Which brings me to my next point.

2. Replace or Refinish Outdated Flooring

A general rule of thumb is to have hard surface flooring in all of the main areas of your home, especially the living room, dining room, and kitchen as most modern home buyers do not like carpet. You can choose a less expensive option like floating laminate flooring or a more expensive option like engineered or solid hardwood floors depending on your budget.

If you already have hardwoods in your home, and they are refinishable, it might be time to update the color scheme to something more modern. The current trend is to have darker, matte flooring. If you need ideas for colors or simply don’t know where to start, attend an open house at some new builds in your neighborhood and ask them what flooring they used. Model homes usually showcase the current trends, and builders always have a list of materials that they used.

A word of caution, if you are going to replace the flooring in your home, do not mix flooring types. At least not on the same level. The change between different flooring is like a full stop for your brain. It can make a room seem smaller than it actually is.

3. Update the Bathrooms

It is relatively inexpensive to replace the vanities and toilets in your bathrooms. Also, hiring a contractor to re-glaze the tile and bathtub, especially if they are older or an odd color, is a great way to get more use out of what you already have, while making your bathroom seem like new again.

4. Add Recessed Lighting

If your home is older, it might not have as much recessed lighting as more modern builds. Adding recessed lighting to your home will add to the overall mood and functionality of your home. Since it requires working with circuits and electrical wires, I would strongly recommend hiring an electrician. Not only do buyers like well-lit homes, but it will also help with your marketing as light is essential for great photographs. Most home buyers start their search on property websites like Zillow or Realtor.com, and professional photographs help make your home stand out while highlighting the best features to potential buyers.

5. Replace the Roof

If your roof is less than 10 years old, it is a huge selling point for the home. A new roof prevents leaking, water damage, and a host of other problems. I realize that this item can get very pricey, so consider contacting a roofing company to come out and take an assessment. If they find hail damage, they can work with your insurance company to get it replaced for the cost of your deductible.

Looking toward the future and starting now is the key to a smooth, easy home sale later. To get the most out of your home, consider making these improvements today so you have time to enjoy them. If you are thinking about making a move, reach out to me to discuss next steps.

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates, Inc in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Senior Law Day – Should I Stay or Should I Go?

When the punk rock band The Clash put a song with this title on their 1981 album release, they surely never imagined the classic lyric being used in a Senior Housing context.

Senior Services of Alexandria (SSA) along with the Alexandria Bar Association is proceeding with its annual Senior Law Day — only virtually this year. Instead of the usual half-day program, it will be broken into three virtual panel discussions. The overall theme, “Should I Stay or Should I Go,” addresses housing for older folks, financial concerns around housing and care, and estate planning. Experts from these fields will speak on three successive Fridays beginning September 11.

The first panel will address the big picture of housing, from Aging in Place to Downsizing and Home Modifications to Senior Communities — plus the legal documents that go with such options.

The second panel will address financial concerns such as long-term care, Medicare/Medicaid, what the different housing options may include, as well as tax breaks and funding home modifications.

The third panel will cover Estate Planning, from basic documents, powers of attorney and other “agents,” and the impacts of such documents — or lack thereof.

The first panel on September 11, features Rachel Baer, Esquire, to address legal documents related to housing, Heidi Garvis of Caring Considerations to address the costs of home care vs. community care, and myself — Pete Crouch, Seniors Real Estate Specialist at McEnearney Associates, Inc. to speak to housing options.

As for housing options, there are many, many choices to consider as we age. The first is clearly Aging in Place, which, as the name implies, means staying put in your current housing. It does require, however, making a plan for potentially changing health and financial considerations. Houses, condominiums and apartments can be modified to make them more compatible with such considerations over time, and a well-thought-out plan can make all the difference.

We are also very fortunate in our area to have many options for housing. A large number of older Alexandrians have chosen to move to condos and apartments. The idea is to lessen the maintenance burden of single-family dwellings, provide one-level living, and enhance social interaction, among other benefits. In fact, almost half of the members of our local Senior Village — At Home in Alexandria — have downsized to condominiums and are Aging in Place there. Again, financial and estate planning considerations can be crucial.

Another option is our local Senior Communities. These range from Independent Living to Assisted Living to Memory Care to Life Plan Communities (also known as CCRC’s — Continuing Care Retirement Communities). Each has its strengths and its appeal.

I encourage you to register for Senior Law Day(s), so you can learn about all of the topics covered in this article and more. Registering once gives you access to all three panel discussions, starting September 11 from 2-3 p.m. Take in your housing education from the safety of your home! Please join us!

Register here for 2020 Senior Law Day.

Pete Crouch has been a licensed Broker in Alexandria for over two decades. Pete also has a specialty in Mature Moves and he is a Board Member for At Home in Alexandria (AHA) Senior Village. He was the 2018 National Recipient of the “Outstanding Service Award” for work with Senior Communities. Text 703-244-4024 or email PCrouch@McEnearney.com for a copy of his Downsize Alexandria! Booklet about living more simply in Greater Alexandria.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Using Bridge Financing to Purchase a Home Without Selling First

Ask any real estate agent doing business in the D.C. metropolitan area, and they will tell you it is almost impossible to make a competitive offer to purchase a home if you must sell your existing home first. Contract offers contingent upon the sale of an existing home are often dismissed right out of the gate. And why wouldn’t they be?

If a seller has multiple offers to purchase, at or above asking price, and some of the offers are not contingent upon the sale of any other property, the seller would generally not give much — or any — consideration to a contract offer which is contingent. So how do buyers position themselves to purchase without first selling? Bridge financing may be the answer. Many lenders do not provide bridge loans, but some of us do.

Bridge financing is any type of borrowing that allows the purchaser to buy before selling. It could be a home equity line of credit on the existing home, a traditional short-term bridge loan secured by the existing property (or the new property), or temporary loans secured by each property.

It can even be financing provided by Great Uncle Fred. The type of bridge financing sought, to some degree, depends upon the borrower’s needs. The first thing consumers should understand is that while some people qualify for bridge financing, many do not.

Bridge financing is generally needed to provide the cash to meet the down payment and closing cost requirement associated with the purchase of the new home; the remaining financing is provided in the form of a traditional permanent mortgage loan. In some instances, purchasers plan to hold no financing associated with the new home, but the funds which would allow them to pay cash for their new home are tied up as equity in their existing property.

Bridge financing, more often than not, is the means of tapping into the existing property equity to generate the cash needed for the new home. So significant equity in the existing home is the first thing the borrower needs to qualify for a bridge loan. The maximum combined loan-to-value (CLTV) allowed under most institutional bridge loans is between 70% and 80%.

If the existing home has a value of $750,000 and the bridge loan lender will allow a 70% CLTV, the maximum bridge loan would be $525,000. If there is already a mortgage in place on the property, the maximum bridge loan would be the difference between that amount and the $525,000 number. For example, if the existing mortgage had a balance of $300,000, a bridge loan could be obtained in the amount of $225,000. If the purchaser was seeking to buy a new property at a price of $1 million, the bridge loan proceeds would provide the 20% down payment needed with some additional funds left to help cover closing costs.

In some cases, it may make sense to secure the bridge loan with the value of the new home. If, for instance, a purchaser had access to other cash to be used for a down payment and closing costs on the new home, and the desire is to carry no mortgage or even just a small mortgage on the new home, a bridge loan secured by the new home might provide the solution. Upon the sale of the existing home, the borrower would pay off the bridge loan secured by the new home and have no mortgage at all or obtain a new permanent loan in the amount desired.

In addition to needing significant equity in the existing home or other significant cash to purchase the new home, the purchaser must also have the income sufficient to allow them to carry any current mortgage plus the temporary bridge loan and any permanent financing which is being sought for the new home.

There are plenty of homebuyers who have that level of income, but there are certainly many who do not. Most of us cannot afford to carry that level of debt, even for a temporary time period, but many are able, and they are the candidates for bridge financing to help navigate the current real estate home buying market.

As mentioned earlier, many lenders do not provide any type of bridge financing, but some of us do with multiple creative ways to structure the financing. The pandemic required many, if not all of us, to temporarily suspend our bridge loan programs, but as our local economy shows signs of relative stability, some of us are slowly bringing the programs back.

As consumers consider the purchase of a new home and the sale of an existing home, it may be well worth it to them to consult a lender who provides bridge financing.

Brian Bonnet | Senior Loan Office

Brian Bonnet | Senior Loan Office

Atlantic Coast Mortgage, LLC

e: bbonnet@acmllc.com | t: 703-766-6702

A lifelong resident of Northern Virginia, Brian brings twenty-five years of lending experience to the group. After graduating from The Citadel and serving as a Naval Officer, Brian transitioned to the United States Senate Veteran’s Affairs Committee where he served as a Professional Staff Member and had the responsibility of overseeing the VA Loan Guaranty program. After leaving Capitol Hill and the political world, Brian entered the mortgage banking industry. Keeping abreast of the myriad changes in the lending industry over the years has given Brian a unique perspective and the ability to successfully serve his clients regardless of the current market conditions. With his extensive knowledge about the VA and its loan guaranty program, Brian is widely recognized as a specialist in VA financing. He enjoys sharing his knowledge and experience with others and is certified to teach Financing Continuing Education in Virginia, DC, and Maryland.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Renting – What Happens When Your Ducks Won’t Stay in a Row?

Some of us are planners, and some of us are part-time planners and part-time “Winging-it”-ers.

Even planners have been thrown for a loop by 2020. This past spring/summer has made the most organized people I know distracted and upended by events.

The strategic thinkers in the rental world today are a good example. They are the ones looking ahead and getting “their ducks in a row,” for the next stages of life — a different rental or possibly even an eventual purchase. They have tracked and improved their credit scores, made sure to have a good relationship with their landlords, paid rent on time and kept their pets calm and quiet. What could go wrong for them? They have “The Plan.”

Well, how about the recent rain and wind storms? Flooding in their apartment three times in the last three weeks made M & C’s* apartment uninhabitable and they had to move immediately. Landlord relationship intact? You bet, he even put them up in another property he owned and let them out of the existing lease. With the immediate help of a realtor, a great new place was found, though there was competition for the property.

The flood meant they could take the lease in days, not weeks, so they prevailed, but couldn’t get a mover — during these COVID-19 times, end of the month and packed schedules meant all hands on deck. We had everyone calling everywhere and, at last, found a small company suggested by a big company willing to work on their normally off day of Sunday.

Not so lucky were R & T*, who learned they really did not know each other well. He had stellar credit and was proud of it, but learned that she, shall we say, had a rocky financial profile. True love was being tested when they applied for their rental and they were turned down by the owners based upon her very poor credit.

Those owners were worried about getting into “issues” with non-payment down the line. Lesson learned, R & T changed course and leased a smaller place using only his income and started working to raise her scores. A larger place will have to wait, but, by then, they may be able to purchase because a great loan is based on high scores for both buyers.

Meanwhile, recently recorded leaps of faith — two families rented big townhouse listings in Old Town and Arlington, sight unseen, except for FaceTime. Walking around with my iPhone and relying on professional online photos, these normally cautious people connected from California, went way outside their comfort zones and leased them using our online application system. Whew, luckily, they were delighted when they showed up with their moving trucks.

Finally and briefly, cash-strapped but gainfully-employed potential tenants, held significant, though low-paying jobs, turned down twice for not meeting the magical criteria for a rental, they were stressed. Doing noble work wasn’t enough to get them over the goal line, but they called and we started brainstorming. Lo and behold, they shared that their $35,000 savings account had never noted and was calmly sitting there. It made a huge difference in our try with their next application.

Again, lesson learned, remember to note proven savings in accounts, retirement plans, etc. so the processor or owner can see the whole picture. (Or put that “duck” on the menu!)

Alternatively, as Herman Wouk reminded us in The Caine Mutiny — “When in danger, when in doubt, run in circles, scream and shout!” (Though that won’t get you anywhere, Karen.)

This week’s Q&A column is sponsored and written by Ann Duff of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Ann at 703-965-8700 or email aduff@mcenearney.com. You may also submit your questions to McEnearney Associates via email for response in future columns.

Your positive advantage for Residential and Commercial properties throughout the area. Experience and Energy, Negotiations and Knowledge — All with a splash of fun! Let’s Get Busy!

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

17 Dreamy Patios and Delightful Gardens On the Market Now

The temperature is up and the sun is out! This means Washingtonians are out looking to enjoy the best of summer – from relaxing or grilling on patios, to water recreation spots in our region, and any number of delights in between. Coronavirus has people looking more than ever for their own private outdoor space, even the demand for homes with private pools is increasing. For many Washington area residents, this is the best time of the year – especially when all the seasonal delights can be enjoyed from the comfort of an outdoor space right at your own home.

Whether you are searching for a private oasis to host friends and family or a perfect place to plant your own garden, these homes on the market now will inspire you to savor summer from home.

217 S Fairfax St, Alexandria VA

Listed by Mary Ellen Rotondo // 703-472-5454

[smartslider3 slider=”45″]

About this home: Welcome to 217 South Fairfax, one of Old Town’s most outstanding and desirable historic properties. This in-town estate offers modern luxury and enduring craftsmanship. Built Circa 1780, the home has been masterfully expanded and updated to modern luxury standards. With over 8,000 sf of luxe living space, the home has 6 bedrooms, 6 and 1/2 bathrooms, and impressive rooms for entertaining and comfortable living. An oversized garage and expansive driveway offer private off-street parking for 5 cars. Additional special features include a subterranean media center, large chefs kitchen with catering pantries, a guest suite with its own kitchen, bath and living rooms, and an historic smoke house recently converted into a SMART office. Extensive custom moldings, original wide-plank hardwood flooring, and six fireplaces with hand-carved limestone mantles set this home apart. The property has been upgraded to modern technical standards with cat 5/cat 6 cabling, cameras and Mobotix panels throughout the house for one-touch controls for Savant and smart home automation. Located only 2 blocks from King Street and the waterfront, the house sits in a prime location and on a spacious double lot. The quarter acre lot is graced by lush lawns, manicured specimen gardens and a lovely patio for outdoor living and entertaining . 217 South Fairfax — Old Town’s finest address.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

27884 Dixon Creek Ln, Easton MD

Listed by Joan Reimann // 703-505-5626

[smartslider3 slider=”42″]

About this home: Capture the essence of understated Eastern Shore elegance in this waterfront contemporary designed by renowned architect Alan Meyers. Built to highlight the water views and the lovely 3.5 acre landscaped grounds, the home is a showpiece of quality craftsmanship and unparalleled style. This stunning residence is located in exclusive Ratcliffe Farms, an enclave of custom luxury homes just minutes from downtown Easton. Sited on the shores of Dixon Creek, a tributary of the Tred Avon River, this quality residence offers easy access to the famed cruising and fishing waters of the Chesapeake Bay. Thoughtful design prevails both inside and out offering a desirable main level master suite, a separate guest wing, a chef’s kitchen with top of the line European appliances, a large open concept living area and an inviting sun porch. The luxury finishes extend out to the 1,000+ square foot patio with outdoor kitchen and hot tub. The property has been expertly landscaped with meandering paths and walkways to enjoy the peaceful waterfront setting with ample room to add a pool. Additional amenities include an 80 foot pier and dock with 10,000lb lift, and a 3 car garage with high-end epoxy flooring. Adjacent Lot 2 is available for purchase as a separate parcel. Come escape to Ratcliffe Farms, your private waterfront paradise, yet just minutes to the shops and restaurants of Easton.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

317 Saint Asaph St, Alexandria VA 22314

Listed by Babs Beckwith // 703-627-5421

[smartslider3 slider=”43″]

About this home: Circa 1750, this 4/5 BR flounder house on a double lot offers 5 wood-burning fireplaces, spacious rooms for entertaining, original pine floors and moldings, 2 staircases, and a sunny eat-in kitchen. A second-story Charleston-like porch overlooks the lush garden. 3 off street parking spaces.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

8720 Plymouth Rd, Alexandria VA

Listed by Tracy Dunn // 571-212-3658

[smartslider3 slider=”47″]

About this home:Beautiful Craftsman with the most pristine and impeccable yard in Plymouth Haven! This 5 bedroom, 4 and a half bath “Jefferson” model was built by Wakefield Homes in 2014. Since that time, the owners have thoughtfully improved the front and back yards with extensive landscaping and hardscaping, outdoor lighting and an irrigation system. The backyard is an absolute oasis of natural beauty. The large patio with a wood-burning stone fireplace is a perfect spot to entertain or relax . The interior of the home has been carefully and attentively maintained and upgraded as well including: custom bookshelves & workspaces in the two main level offices, lockers/cubbies as you enter the home from the garage, a generous sized bedroom with ensuite on the lower level, plantation shutters throughout, new carpeting, recessed lighting, an alarm system, and more! The home boasts 9ft+ high ceilings, fabulous moldings/trim detail, solid core doors, uniform hardware & fixtures, and wonderful lighting on all levels. The main level flow mixes formal and casual spaces and feels airy and open. The kitchen has stainless appliances, granite countertops, a large island, and a walk-in pantry. The master suite is sun-filled and roomy with a sitting room, two walk-in closets, and a substantial sized master bath. All bedrooms have bathrooms attached and are all of good size and scope. The basement is spacious and has two additional unfinished storage rooms, along with a bedroom and bathroom. The screened-in porch and covered front and side porches are wonderful spaces to enjoy the lush yard in a comfortable and cozy setting. This home is a jewel. Move in ready/3 car garage.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

7007 Springville Ct, Springfield VA

Listed by Annette Hinaman // 571-216-4411

[smartslider3 slider=”44″]

About this home: Welcome to 7007 Springville Court, an immaculate, like-new and lightly lived in Colonial style home built in 2014 on a cul-de-sac at Spring Village Estates. This meticulously maintained light and bright 5935 sq. ft property offers 6 bedrooms, 4 bathrooms, an elegant living room with gas fireplace, separate formal dining room with butlers pantry, study, breakfast area, oversized luxury kitchen and pantry, separate laundry room, main level bedroom and bath, lower level recreation room, game area, two large storage rooms and a two car garage. Highlights include gleaming hardwood floors on main level, extra-wide staircases, extensive cherry kitchen cabinetry, stainless steel appliances (GE Profile, Samsung) kitchen and bathroom granite countertops, plantation shutters and wood blinds throughout, front loading LG washer and dryer, recessed lights, fitted closet systems, new architectural shingle roof (2019), new HVAC systems (2018 and 2020), and a 3 level elevator shaft currently fitted out as walk-in storage closets. In addition to the stunning wooded views and privacy from the backyard, exterior features on this 1/3 acre lot include a main level covered porch off the kitchen, stairs leading to a hardscaped terrace, beautifully maintained lawns surrounding the house, wood fencing, 6 zone irrigation system and a Dutch garden shed. At just 1 mile from the HOV lane straight into DC and 2 miles to the metro and shops and restaurants of Springfield Town Center, this property enjoys an unbeatable location for easy living and commuting.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

212 Green St, Alexandria VA

Listed by Lauren Bishop // 202-361-5079

About this home: This fabulously renovated Yates Gardens townhouse offers an open main level living area with gorgeous kitchen, island seating, abundant storage including a custom pantry, wood burning fireplace, large windows allowing generous natural light and a main level half bath. The spacious lower level includes a family room, additional wood burning fireplace, built-in bookcases, separate laundry, chic renovated full bath and access to the private and serene bricked back patio and garden. A wonderful layout on the upper level with 3 bedrooms and hallway skylight contributing to additional sunlight. Off-street parking for 1 car and easy street parking for additional vehicles. HVAC, hot water heater and furnace replaced in 2018 and added an air filtration system (Air Scrubber Plus with ActivePure technology removes up to 99.9% of the harmful contaminants in your home). Just steps to the Potomac River, Jones Point Park, Windmill Hill Park, Lyles Crouch Elementary and a few blocks to the shops and restaurants on King Street. Easy access to King Street Metro, National Airport, DC, Amazon HQ2 and major commuter routes.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

315 S Lee St, Alexandria VA

Listed by Sally Harper // 703-517-2849

[smartslider3 slider=”41″]

About this home: Historic semi-detached 2.5 story 1852 clapboard townhouse exudes simple elegance and character. The front door opens to reveal an unusual feature: a lovely long hallway floored with 28-foot pine boards cut to exact length, laid without joints. Original floors and woodwork throughout. Double parlor with built in bookcases, formal dining room, and eat-in country kitchen make an attractive setting for family life and entertaining. Five bedrooms, including two under third floor eaves that are perfect for children or au pairs, five working fireplaces, half -basement with front and rear access, and a lovely secluded rear garden, where a wrought iron gate leads to a large (over 1200 square feet) private parking area with space for up to 5 -6 cars, a rare asset in Old Town that offers numerous possibilities. Access flows from Lee Street through the gated” horse alley”, into the garden and out the rear alley to Fairfax Street. Two blocks to the waterfront and the lively ambiance of King Street. A Must See!!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

6516 Lakeview Dr, Falls Church VA

Listed by Susan Tull O’Reilly // 703-509-7222

[smartslider3 slider=”46″]

About this home: Here’s your chance to own a waterfront home in Lake Barcroft. Go swimming/boating/fishing/ice skating from your own back yard! Plus, this unique home has an enormous level lot – very rarely found here! Add a pool if you wish, host a wedding – plenty of space here! Wonderful, welcoming home has all the Mid Cent features en vogue including paneled peaked ceilings, stunning full length porch and upper level deck, large picture windows, exposed brick walls and a flexible floor plan – use the rooms as you wish! Gorgeous gleaming hardwoods, updated kitchen, vaulted ceilings and built ins. This is a special home -add your personality and make it your own. Imagine owning a lake home – this summer! Go kayaking out your back door! Quick walk to the Women’s Garden – a beautiful retreat or Beach 2! Lake Barcroft is a private lake community featuring 5 sandy beaches. Nature abounds in this special respite located inside the Beltway. Relax…you’re home! Great little gem – lots of potential- come see it!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

8732 Plymouth Rd, Alexandria VA

Listed by Sandy McMaster // 571-259-2673

[smartslider3 slider=”48″]

About this home: Finally, a luxury home that showcases thoughtful and refined elegance. This gorgeous home was custom designed and built in 2001. The original owners have taken impeccable care and pride in the curation of the property. They took the time to nurture extensive exterior landscaping that provides a beautiful backdrop to this stunning home. Today, the premium (flat) lot features a striking slate patio (perfect for entertaining), in-ground sprinkler system, manicured mature plantings and a detached garage. An additional stand-alone shed keeps the yard looking neat and organized. While the grounds are breathtaking, the mahogany front porch makes an amazing first impression. The extra wide serene front porch was specifically designed to be a spot where conversations can linger and friendships grow deeper. Stepping inside you’ll be struck by the dignified and elegant finish. A lovely center hall foyer opens to a stunning formal dining room, home office space, formal living area and more. A full kitchen renovation in 2017 will satisfy any chef. Granite and stainless steel appliances sparkle under loads of natural light. Those with the most discerning palate will revel in this kitchen. The food may actually taste better when using such a fantastic space. For the baker, the custom kitchen aid cabinet lift means easy access for that handy appliance! This true “open concept” kitchen lives large. A cozy seating area as well as a casual dining space surround a gorgeous kitchen island. For those of you who love the sound of music, sonos speakers have been built into the patio, porch and main level. A home with this much style, space and refinement is rarely offered.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

6306 30th St N, Arlington VA

Listed by Betsy Twigg // 703-967-4391

[smartslider3 slider=”49″]

About this home: Located in the Nottingham, Williamsburg, Yorktown school district, this home is sited on a sought after street, and is walkable to the schools, Tuckahoe Park and Playground, Williamsburg Shopping Center, and the East Falls Church Metro Station. In addition to the traditional living room and dining room, the home offers a large private office, family room with vaulted ceiling, and stone fireplace. The refreshed kitchen features crisp white cabinets, granite countertops, Viking appliances, and a breakfast area with built-in cabinetry. Doors from the breakfast area lead to the refurbished deck and stairs to the level, fenced rear yard. An expansive flagstone patio was added in 2015 and is surrounded by mature landscaping, enhanced by uplighting. The outdoor space is ideal for social distance entertaining. The yard also provides space for a swingset (which conveys), sports, and gardening. Lighting accents landscaping in the front yard of the home, too. With doors leading to the back yard, the home has excellent flow for entertaining and daily living. A spacious home in pristine condition and in an enviable location.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

6512 Cygnet Dr, Alexandria VA

Listed by Cindy Clemmer // 703-966-0403

About this home: Belle Haven Terrace Beauty! All Heavy Lifting Has Been Done! 3 BDRS/2.5 BA, Custom Closets done in 2019, Updated Kitchen & Baths, Gorgeous Hardwoods on Main Level, Sep Dining Room Just off of Kitchen. Perfect Deck and Outdoor Patio is an awesome retreat! Landscaped and Hardscape to owner’s delight! Property is located next to land owned by National Wildlife Federation. LL is Partially finished w/large full bath. Basement has full utility room, washer/dryer, walk-out to backyard, also has entrance to Garage. Tons of Storage.What’s New? Roof & Skylights March 2020, New Windows -2017,New HVAC Furnace/A/C-2018 May, New Garage Door & Motor -2018, Washer/Dryer -2016, New Kitchen Door w/Windows – 2017, LL New Exterior Doors – 2019, New BDR Closet Doors -2019, Attic Fan – 2016. Virtual Open House Face Book – August 1, 11:00 AM. https://facebook.com/clemmerandschuckhomes Live.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

4512 Dolphin Ln, Alexandria VA

Listed by Kate Patterson // 703-627-2166

[smartslider3 slider=”50″]

About this home: SPECTACULAR CUSTOM CONTEMPORARY ON BEAUTIFULLY LANDSCAPED LOT WITH EXTENSIVE GARDENS, IN GROUND POOL AND OUTDOOR KITCHEN! VACATION AT HOME IN A TROPICAL PARADISE in Yacht Haven, just minutes from Old Town! This home is incredibly well designed and well articulated, with outdoor entertaining spaces and cozy interiors with a dash of Florida and California! Enjoy living and working at home, with your own private in ground pool, with waterfall, gorgeous lush landscaping and outdoor kitchen in a custom designed contemporary home with open living spaces, gourmet kitchen, designer baths and fabulous family room with gas fireplace, guest quarters or home office and wine cellar. The dining room is styled as a Billiards room, with koi swimming around the central platform of the room in an enclosed moat. The lower level opens to an open air covered patio with hot tub, leading to a fabulous deck with koi pond and fire pit, just steps from the outdoor kitchen and pool! As an added bonus there is a separate over sized two car garage with full bath, guest area, and enormous party room above with fully equipped bar steps from the outdoor kitchen and pool, inviting summer parties and family gatherings!Living at home is a joy when you can live in a PARADISE like this just minutes from DC!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

17641 Raven Rocks Rd, Bluemont VA

Listed by Geri Deane // 703-615-4126

[smartslider3 slider=”51″]

About this home: Looking for a COVID FREE Retreat to call your own…. Look no further…. 2 Spacious bedrooms, 2.5 Full Baths, Approx 2,500 sq. feet, 1.73 acres, beautifully appointed both inside and out. The minute you pull in the circular driveway, lovely landscaping greets you, multiple outdoor living spaces, private and peaceful you will never want to leave. Original cabin established in 1936, then updated over the years to include Kitchen/Dining and Upper Guest Retreat w/ensuite full bath & walk-in closet, Master Retreat, and lower-level Office. Interior Features consist of Australian Cypress Floors, Sub-Zero Refrigerator & 4 Burner Wolf gas range with griddle and infrared searing, Frankie Villeroy & Boch farm sink below your kitchen window… Granite counters & island, 6 ft. Rumford Fireplace in Dining Room with handmade bricks, luxurious Master Bath and Guest Bath & MORE…. The exterior is perfect for a STAYCATION… multiple outdoor living areas (bar, stone patio w/pergola, fish pond & waterfall, BBQ Grill deck area, and 2 firepits to enjoy and take advantage of throughout the year…. Studio, Potting & Tool Shed, Wood Shed & Storage Shed are also a plus. Directv for Cable and AT&T mifi for internet. New Central Air Conditioning and Shake Roof just installed. Check out the walking video tour which showcases all of the fantastic features this beautiful Bluemont retreat has to offer….https://player.vimeo.com/video/440618864 Minutes from Rte 7, the Appalachian Trail, Wineries, Breweries, Shenandoah River

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

1904 Belle Haven Rd, Alexandria VA

Listed by Susan Craft // 703-216-4501

[smartslider3 slider=”52″]

About this home: LUXURY VIDEO: bit.ly/1904BelleHaven Modern design meets Historical Architecture to include $200K (Brand New HVAC) in gorgeous renovations in this traditional 4 BR, 3.5 BA brick Georgian colonial home in prestigious Belle Haven community. 3,000 sf HOME PLUS 528 sf GARAGE. Gorgeous Master Suite, walk-in CA closets, hardwood floors throughout, Palladian bookcases, dentil molding, finished lower level recreation room comes fully furnished, large 2 car garage. Great for entertaining. Private beautifully landscaped backyard with Trex porch, hardscape patio and fire pit. Awesome Location. Easy access to Rt. 1, GW Parkway, Ft. Belvoir, Old Town, National Airport, National Harbor, DC and 5 miles to Amazon HQ. Alexandria VA, and excellent Fairfax County Schools. Move in Ready! What I love about this house: Rooms are open and easily interchangeable for HOME SCHOOLING or HOME OFFICE as HOMEWORK/OFFICE furniture & Recreation Room Furniture Convey. Dining Room can also function as CONFERENCE ROOM/HOME OFFICE. Fully or partially furnished home an option. Convenient location, yet the community and house feel like home. You can walk the Belle Haven hills and admire the homes and beautiful landscaping, play golf, tennis or swim at the Belle Haven Country Club, hop on the trail for a bike ride to Old Town, Washington DC, Mt. Vernon. Walk to the cozy eatery, DRP Belle Haven and enjoy the convenience of the Belle View Shops, Dog Park and Recreation Center.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

3205 McKinley St NW, Washington DC

Listed by Anslie Stokes Milligan // 202-270-1081

[smartslider3 slider=”53″]

About this home:Welcome to 3205 McKinley ST NW; a completely renovated Dutch Colonial, with timeless curb appeal, just two blocks to Lafayette School & Park and three blocks to Broad Branch Market in the heart of Chevy Chase, DC. After an extensive renovation in 2016 this home now features four fully finished levels with five bedrooms, four and one half beautiful bathrooms, a stunning gourmet kitchen and fully fenced front and rear yards. Additional features include: a wood burning fireplace in the living room and owner’s bedroom, hardwood floors throughout the main and second floor, replacement windows and exterior doors throughout the entire home, foam insulation for energy efficiency, two washers + two dryers, a wet bar in the lower level, excellent storage and a screened-in porch. Open House Sunday August 2nd, 12pm – 2pm (masks and sign-in required, only one party will be allowed inside the house at a time).

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

4325 Gingham Ct, Alexandria VA

Listed by Dan Muller and Susan Minnick // 703-883-7550

About this home: Turn Key, You’ve been waiting for this one! Beautifully maintained & updated beginning w/ Roof & Windows 09′, A/C 16′, Paint, Carpet, Lighting & Ceiling Fan, Patio all in 17′, Kitchen Remolded 18′, Master Bath & Powder Room 18′, GE Profile Stainless Steele Appliances installed July 25th 20′. Over sized Ceramic Floor entry, Hardwood Din/Liv, En suite Master Bath, LL-Full Bath, Wd Burning Frpl. Welcoming Foyer enhanced w/updated powder room, from there you find yourself in a lrg dining room w/hardwood floors (Brazilian Cherry), step down to a gracious Liv room with SGD to a cozy patio w/ landscaped yard fully fenced with lrg shed & gate. Don’t miss the beautifully remodeled white kitchen. Upstairs freshly painted w/Agreeable Grey, tasteful lighting & Updated baths, Cozy Lower level w/full bath, rec room w/wood burning fireplace, lrg storage room & laundry. Abundant parking with one assigned space , easy access to Old Town Alexandria, Van Dorn Metro Station and I 495

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Hot is the Summer Real Estate Market?

Short answer: Like the weather, it’s really HOT!

The last time I wrote an article for InsideNoVa, it was March, and we were at the beginning of closures due to COVID-19. We were all very nervous about what lay ahead for our health, wealth, and employment. For some, it has been a very challenging and heartbreaking time; for others, it has been OK.

Here we are, four incredibly unusual and stressful months later. So what happened in the real estate market? And what does it look like now?

The Northern Virginia real estate market saw a very quick slowdown at the end of March. The bottom of the market for contract activity over the same week the year before occurred during the week of April 5 – April 12 in the Washington metro area with a drop of 44%. The following week, Northern Virginia contracts bottomed out with a 40% drop over the same time last year. Surprisingly, only three weeks after the shutdown, the market started to show signs of rebounding. This made sense, as the beginning of 2020 started strongly.

Since the beginning of July, we have seen an incredibly active and extremely competitive market. The biggest part of the story is the lack of inventory. Active listings are down 35% from this time last year and a whopping 52% down from same time in 2018. With spring level demand and exceedingly low summer inventory, we have ourselves a very strong seller’s market. In some pockets, we are seeing 15 or more offers on a property. Contingencies are being thrown out the window. It’s very challenging for buyers.

So what to do? Sellers thinking about listing, PLEASE do! We know there are still some sellers nervous about their health and safety and therefore are holding off putting their homes on the market. Our industry has done a fabulous job of trying to make seeing properties as easy and as safe as possible through such avenues as online showings, virtual showings, 3D floor plans, FaceTime Live, and more. If you search through previous McEnearney posts on InsideNoVa or visit our company website, you will see all the wonderful things we are doing as a community to keep you safe.

Buyers, buckle up! It’s going to be rough. Here are a few things you can do in order to put yourself in the best position to make an offer.

First, and this is true in any market, get pre-approved! Know what you can afford. Don’t just look at properties at the top of your price range either. If the homes are good, you should expect the price to escalate. If you’re making a cash offer, that’s wonderful, but make sure you have proof of funds to submit along with your offer.

Understand what an offer looks like. What are the various contingencies? What impact can they have on an offer? One contingency that is critical in a competitive market is the appraisal contingency. In some offer situations, you may be up against buyers who can waive appraisals. Meaning that, if the appraiser doesn’t value the home at the sales price, you will have to make up the difference of the shortfall. Maybe you can’t do that; if not, don’t waive the appraisal.

Be prepared to invest a few hundred dollars for a pre-offer home inspection. In a competitive situation, offers waiving a home inspection will be stronger than those that still have an inspection contingency. If you’ve done the walk-through with the inspector, you’ll know if the home is in suitable condition before you to make an offer.

As always, the best way to arm yourself in this market is with a knowledgeable agent who has a good reputation for being easy and professional to work with, and listing agents pay attention to that. The thought of winging it without an agent may sound appealing but will hurt you in a tough negotiation. A good agent is one who knows the market well, has extensive experience negotiating offers and can protect you from unexpected contract mishaps. Those agents will almost always out negotiate an unrepresented buyer trying to save a few dollars.

Also, agents know when homes are coming soon to the market. Marketing websites like Realtor.com and Zillow can’t post those. By the time you may see these listings on Zillow, represented buyers will have been mulling over the properties for days and be fully prepared to do a pre-market inspection when the property is active. Sometimes, there are deadlines for offers giving buyers some time, but not always. The early, prepared bird may definitely get the house in this case!

Finally, more good news. There is no sign that activity is slowing down. Stagers are busy! This is a good sign that there are lots more listings to come. And just when we don’t think interest rates can go any lower, they do. It’s really a great time to buy and sell! Northern Virginia’s appeal may be even stronger down the road as people work more from home, and the freedom to roam and play in suburbs becomes more desirable.

Happy house hunting!

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

9 Amazing In-Ground Pools on the Market Now

It’s official, summer is here! The pool covers are off and the water wings are out. With the start of summer also comes the sweltering heat that us Washington metropolitan area residents are all too familiar with. What better way to beat the heat than to dive into your brand new pool?! Whether you’ve always wanted a pool or you are considering a home upgrade, here’s a look at nine of the coolest in-ground pools on the market now!

4512 Dolphin Ln, Alexandria VA

Listed by Kate Patterson // 703-627-2166

[smartslider3 slider=”37″]

About this home: SPECTACULAR CUSTOM CONTEMPORARY ON BEAUTIFULLY LANDSCAPED LOT WITH EXTENSIVE GARDENS, IN GROUND POOL AND OUTDOOR KITCHEN! VACATION AT HOME IN A TROPICAL PARADISE in Yacht Haven, just minutes from Old Town! This home is incredibly well designed and well-articulated, with outdoor entertaining spaces and cozy interiors with a dash of Florida and California! Enjoy living and working at home, with your own private in-ground pool, with waterfall, gorgeous lush landscaping and outdoor kitchen in a custom-designed contemporary home with open living spaces, gourmet kitchen, designer baths and fabulous family room with gas fireplace, guest quarters or home office and wine cellar. The dining room is styled as a Billiards room, with koi swimming around the central platform of the room in an enclosed moat. The lower level opens to an open air covered patio with hot tub, leading to a fabulous deck with koi pond and fire pit, just steps from the outdoor kitchen and pool! As an added bonus there is a separate over sized two car garage with full bath, guest area, and enormous party room above with fully equipped bar steps from the outdoor kitchen and pool, inviting summer parties and family gatherings! Living at home is a joy when you can live in a PARADISE like this just minutes from DC!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

19729 Ridgeside Rd, Bluemont VA

Listed by June Hambrick // 540-878-8220

About this home: Ultimate opportunity for relaxed living, retreat. Exquisite panoramic views from Southern Fauquier to Tysons to Sugar Loaf and beyond. Kitchen features Viking 6-8 burner stove top, double convection ovens, 3 dishwashers, sinks, disposals. Marble and limestone countertops. Butlers pantry and back pantry. Loaded with upgrades. Hardwood flooring throughout, high-end solid wood doors throughout out. Marble bathrooms. 4 zone heat and air. Comfort and beauty combined near Middleburg, Upperville, Purcellville and Leesburg. Loudoun county AR2 zoning, 6-8 stall stable, paddocks, inground pool. Additional 64 acre lot available making total of 104 acres. Contact listing agent for more information, see: #VALO397222

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

40850 Robin Circle, Leesburg VA

Listed by Bay Buchanan // 703-994-2323

[smartslider3 slider=”35″]

About this home: Grab this rare opportunity to own one of only 16 custom homes, each unique, in the parklike setting of Dunrobin. A complete entertainment center on the lower level includes an indoor heated pool, indoor basketball/racquetball court, sports bar and game room. Only minutes from the charming town of Leesburg, this beautiful French Country Manor offers the privacy and serenity of a secluded resort. Set on 3.5 professionally landscaped acres of lush Virginia countryside, you can not escape the magnificent views offered by this remarkable home. The lower level includes 3,200 sq ft dedicated to having fun. All recently renovated, there is a Sports Bar, a game room, a heated indoor swimming pool with cabana and a racquetball court with a hoop for half court basketball games. Who needs a resort when you live at 40850 Robin Circle?

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

1201 Key Dr, Alexandria VA

Listed by Jodie Burns // 571-228-5790

[smartslider3 slider=”34″]

About this home: Invisible from the street and set on two and a quarter acres of woodland with American Elms, fig trees, pine, magnolia, wisteria and dogwood, this one of a kind property is a true sanctuary away from the bustle of modern Alexandria. With four bedrooms and four bathrooms, the low slung Main House, designed in 1939 by Frank Lloyd Wright-trained architect, Charles Callander, remains nearly unchanged from 1940. Designed for entertaining, the home features a variety of gathering spaces, inside and out, including a screened-in porch built around a giant sycamore tree, a second-story balcony overlooking the large expansive yard, and outdoor access from all main level rooms to brick seating areas and a covered patio. A separate 1700 SF two-story guest house overlooking a large swimming pool was designed by another Wright apprentice, Jone Thurmond, and compliments the design of the Main House with similar architectural details inside and out.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

5694 Winter Wood Ln, Bealton VA

Listed by Jonathan Kennedy // 202-750-4050

[smartslider3 slider=”36″]

About this home: The property offers multiple potential income streams, subdivision potential, and may be eligible for the National Register of Historic Places. Agricultural Best Management Practices (BMPs) are in place to include water piped directly to automatic livestock watering tanks.The star of the show, 5694 Winter Wood Lane is an early 1900s farmhouse with 3 bedrooms and 3 full bathrooms on 35 acres. The home was thoughtfully restored in the 1980s. Home and guest house are surrounded by beautifully manicured gardens complete with salt water swimming pool, doggie playpen, fenced in blueberry patch with 18 healthy bushes, and a run-in shed.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

If you’re in the market for something more extravagant or you just like to dream, be sure to take a look at these properties with in-ground pools offered for sale through our international member organization, Luxury Portfolio International.

Unique and Exceptional Opportunity, Sion, Switzerland

Listed by CI Exclusive Properties | +41 (0)22 319.89.15

[smartslider3 slider=”38″]

About this home: Unique and exceptional opportunity in the canton of Valais.

Situated in a residential area, this brilliant property enjoys an extraordinary view on the Alps and benefits from last technologies (home automation and sound system everywhere), by upper upscale arrangements, by a security system (outside cameras, been for imprints for the entrance, the alarm) and of a system of moistening and dehumidification in all the rooms, this property of 5 rooms in the vast volumes for a total surface of more than 1’000 square meters.

An internal swimming pool with a space SPA, but also a magnificent swimming pool outside overflowing, a sublime one landscaped and enclosed garden, two big courts of separate entrances, a place setting for two vehicles, as well as a garage complete it.

Be allowed seduce by the inescapable charm of this outstanding property!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Paradis Sur Mer Cayman Islands, Grand Cayman, Cayman Islands

Listed by Jeremy Hurst & James O’Brien, IRG – International Realty Group Ltd. | 345.623.1111

About this home: A truly stunning home and undoubtedly Rum Point’s most exclusive beach front Villa. Drive through ornate electric gates, hand-crafted in Africa, to a gated courtyard with double garages either side with Parking for 6-8 large vehicles. Above the garages are two guest apartment suites. Enter through the hand carved main door into the palatial living space with floor to ceiling windows and doors, presenting the gorgeous ocean views over the ultra-private pool/Jacuzzi and beach. Fully immerse oneself in the spectacular location of Rum Point, world famous for its crystal-clear cobalt waters and powdery white beaches. This beach front villa has too many luxury amenities to mention; there is a private dock with launch pad for water toys and large boats. The main house offers more than 11,5000 square feet of generous living space. There are six bedrooms all en-suite including a large master with majestic views of the ocean, pool and private beach. Hurricane-rated doors and windows enhance not only views but security too. This home is a fortress and every security detail has been carefully engineered seamlessly into its design. This is an energy efficient home, with mature tropical landscaping throughout, which does not require irrigation. ‘Paradis Sur Mer’ is a perfect destination to rival any other uber-luxury beachfront villa and destination globally.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Fabulous Estate in the Rose Valley, Kazanlak, Bulgaria

Listed by Unique Estates | +359 882600600

[smartslider3 slider=”39″]

About this home: Unique Estates has the pleasure of presenting to your attention this fairytale mansion, spread on land of 98 000 sqm., between Stara Mountain and Sredna Gora Mountain, in the famous Valley of the Roses. The park is beautifully landscaped with many Mediterranean plants and local trees. To the property can be added second property with land 21 600 sqm. Through the estate is running mineral water from own mineral spring, used for healing and for bottling. Big entertainment center with indoor and outdoor pools, additional water spaces. Additional house for staff and security. The total built-up area of all buildings is 5 982 sqm.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Villa Marine Lago, Terres Basses, St. Maarten

Listed by Sunshine Properties | (721) 544-4498

[smartslider3 slider=”40″]

About this home: Private Yacht Marina & 2 pools. With a superb waterfront location this beautiful villa is located in a very exclusive and secure residential community of only six villas in the heart of Terres Basses on the French side of St. Martin. With it’s own private marina Villa Marine Lago has dockage for all your water toys. The villa offers outstanding views of Simpson Bay, the Caribbean Sea and the islands of Saba, St Eustatius and St. Kitts. Situated on 2 acres this spacious open rooms, the home is centered round a generous pool and airy deck area. While the master suite enjoys it own enclave with an open deck area adjacent, with a pool . Leading from the main pool is a large open-plan living and dining area, a well- equipped kitchen. The tall patio door open to give the property extraordinary water vistas both during the day and at night time. The spacious bedrooms open off the pool area and each have en suite bath. The residence enjoys the use of a tennis court. The beautifully landscaped property is completely fenced and has an electronic gate.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Is It a Rowhouse? Is It a Townhouse? What’s the Difference?!

Colonial, split-level, Cape Cod… it’s no surprise that real estate has its own lingo, right down to the style of a home. In an effort to establish a deeper understanding of real estate home styles, in terms of how they’re built and what they seek to represent, McEnearney presents a series of articles to explore these differences. We’ll explain what makes a home a split-level versus a split-foyer, define traditional Colonials and Cape Cods; and learn to appreciate the subtleties of Art Deco and Victorian details.

First up we want to define very common structure types found throughout the DMV — understanding rowhouses versus townhouses.

Rowhouse vs Townhouse

The word “townhouse” traces its roots back to early England, where the term referred to a dwelling a family kept “in town” while their primary residence was in the country. The word stuck, and today, the term is used to describe residential homes that share a wall with the neighboring house.

In Washington, DC, the rows of homes lined up together that appear “attached” to one another are called rowhouses. In Virginia and Maryland, the same structures are referred to as townhouses. While the styles may look similar and the terms be used interchangeably, there are actually differences between a rowhouse and a townhouse.

Rowhouses often line a street and will extend the entire length of a block without a break. They will likely have a similar exterior front in terms of design, but could vary in color. Since rowhouses are unlikely to be part of a homeowners association (HOA), there is no set palette of colors to choose from when it comes to painting the exterior siding or bricks, doors or shutters.

From the outside, it appears as if the rowhouses share walls. Structurally, however, a rowhouse could stand on its own if the homes on either side were taken down. Rowhouses will commonly have room for parking behind the house that might be secured by a roll down garage door or a stand-alone garage.

Comparatively, townhouses are in smaller groups within the rows, and together, they will make up a subdivision or development that also has shared common space. Townhouses are also more similar in design and represent a set palette of colors because they’re typically part of an HOA. Additionally, the walls between townhouses truly are shared — one is dependent on the other and cannot stand on its own if the neighboring home was taken down. Finally, townhouses might have a one or two car garage as part of the structure or the neighborhood could offer parking in front of or near to the home.

Looking to buy or rent a townhouse in the DMV? Contact your favorite McEnearney Associate, and we’ll help you get there!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Why Do Design Trends Become Popular?

Question: Why do design trends become popular?

Answer: As a realtor, I see a lot of the same features in the homes I visit. Sparkling white subway tile — check. Main level powder rooms — check. Ooh, a porch? Check, check! No, wallpaper really isn’t a feature that buyers are looking for — please remove it and paint your walls a light, soothing color. Walking through my community, I see more and more Adirondack chairs being planted in front yards and porches are dressed as outdoor rooms. So, how did these designs become so ubiquitous?

Disease did it.

Subway Tile

In the 19th century, as germ theory was developing amid deadly tuberculosis and influenza epidemics, the most effective way to stop the spread of a disease was through cleanliness. Wallpaper and paneled wood absorbed moisture and odors and were made to hide the dirt. Hospitals and public buildings and shops installed the tiles as dirt was easy to see and material easy to clean. A butcher shop or fish market would have the tile to communicate how clean and fresh their product was.

In 1904, designers George C. Heins and Christopher Grant LaFarge created the 3″ x 6″ tile for the very first station of the brand new subway system in New York City. As often happens, the commercial design was transferred to the residential.

Plumbing and manufacturing advances meant the end of the coffin-like tub encased in wood and lined with tin and brought in shiny ceramic tubs, sinks and toilets that didn’t need to be placed in backyard privy. The new linoleum products replaced wood floors and were considered a modern, easy to clean esthetic. Tile was installed along the walls of kitchens and baths alike.

Have a Seat

Upstate New York saw the construction of the sanitarium industry to house and treat the patients suffering from tuberculosis. At least by Victorian standards, there were large and unadorned buildings and cottages set out in the dry healthy air of the mountains. Sunlight and fresh air were the treatment, so daybeds and chairs that were light enough to be moved out onto open porches or glassed in sunrooms provided comfort. With tilting backs and seats, wide arm rests for belongings or a rest to elevate the feet, these were the forerunners of the Lay Z Boy and of course, the Adirondack chair.

The Pit Stop

Daily deliveries of coal, oil and ice were messier than the FedEx and Instacart deliveries we have today. These items weren’t dropped at the door with no contact, they were brought right into the kitchen or cellar and if the delivery man needed to use the bathroom, a conveniently located place, away from the family baths was safer. Having a sink by the front or back doors allowed hand washing by everyone — a critical part of safe hygiene back then and now.

Porches

Back to upstate New York where the sanitaria porches were used daily and in all kinds of weather — imagine being on the porch in Saranac Lake in deep February? Sleeping porches became a trend that is still seen in older homes. When a turn of the last century home has an odd little room or porch jutting out from the second or third floor, chances are this was a sleeping porch. An unheated room furnished with beds so the sleeper could be out in fresh air throughout the night — it was better than an open window!

Now What?

With coronavirus, it’s too early to tell what design changes we will see coming into public and residential spaces. Is this the end of the open concept floor plan, now that we’ve been working and taking meetings, making calls, homeschooling children, fostering animals?

Will the desire for a home office or “Zoom Room” outweigh walk-in closets or home theaters? Will furniture design for the masses include the Capsule Chair by Kateryna Sokolova for Casala? Shaped like a Tic Tac with sound insulating materials inside and out, you can work out loud in the middle of an office or home without disturbing others or being disturbed by their noise. Perfect for those Zoom meetings.

Current guidelines of masks, distancing and sanitation will create new designs and ways of living in and building our homes. Disease is once again redesigning our lives.

Kate Crawley is a real estate veteran with experience in residential sales and administration, high-end commercial management and property development, and finance. Her professional work is fused with her love for Alexandria and its residents. If you would like more information on selling or buying in today’s complex market, contact Kate today at 703-888-8141 or visit her website KateCrawleyHomes.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link