What Defines an Industrial Style Home?

Welcome to the industrial style of homes.

Characteristics of industrial style include:

-

Natural tones, such as earth tones and neutrals (grey, white, browns and black) that create a clean, minimalistic look.

-

Exposed materials, such as brick walls and concrete flooring, and the combination of wood, steel, aluminum or stone for furnishings.

-

Exposed features typically hidden, such as metal pipes and silver air ducts.

-

Use of natural materials, such as reclaimed wood and metal, or the repurposing of items and giving them a new function.

-

Industrial style homes tend to have flexible, open-concept spaces that lack definition by walls found in more traditional spaces and layouts.

If you’re looking for an industrial-style place around the DMV to call home, consider The Helicopter Factory (770 Girard St. NW, Washington, D.C.), the Wonder Bread Factory (641 S. St. NW, Washington, D.C.) or the Canal Street Malt House (1220 Bank St., Baltimore).

Contact your favorite McEnearney Associate to help you find your own industrial style home today!

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Don’t miss a post! Get the latest home inspiration and neighborhood news straight to your inbox!

What Does a Millennial Buyer Look For?

Clearly, my millennial mind was fueled by Spice Girls while writing this article…

Homeownership has been a cornerstone of the American dream for centuries. Despite the ever-changing landscape of urban and suburban lifestyles, it still rings true today. According to a 2019 Bankrate survey, 79% of Americans “still believe that owning a home is a vital component of achieving the American dream.”

Those Americans wanting to own a home are now from a different generation. It is the millennial generation that has surpassed baby boomers, reports the Pew Research Center. Not only have millennials taken the top spot in adult population size, but they make up the largest share of homebuyers. And, man, are they showing up in droves to the settlement table.

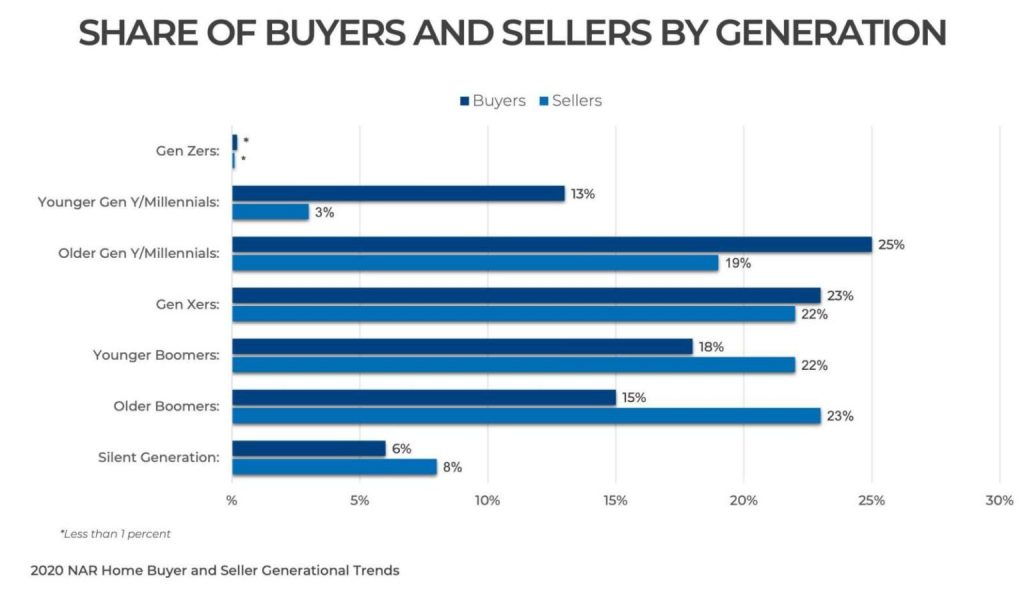

Over the past two years, millennials have held the top spot as homebuyers in the nation. According to the 2020 National Association of Realtors Home Buyers and Sellers Generational Trends Report, about 38% of buyers are born in the millennial generation (1981-1996) and roughly 69% are doing so for the first time. The majority of sellers are not in this generation. With a majority generation flooding the market as homebuyers, you start to see trend commonalities. Understanding what a typical homebuyer wants in their home can better position you as a seller to make your home desirable, thus making a larger profit.

Our area is in an inventory drought. Properties rarely stay on the market long enough to even make your scheduled showing the next day. With that being said, I still highly encourage sellers to envision their home through the buyer’s eyes. And, most often, that’s a millennial. I’ve listed a few of the hottest millennial buyer must-haves for sellers to consider in making their home stand out even more. Major renovations certainly are desired, but even minor tweaks can go a long way to get top value for your home.

Outdoor Space

As Mark Twain said, “Buy land — they’re not making it anymore.”

Although lot size can vary, it’s what you do with the space you have that matters. Many millennials are moving from a rental apartment that comes with none or very little outdoor space. They are seeking space and its versatility — a place for the dog to run, a space for small social gatherings, a patio to take work calls, etc. Some ideas to spruce up an outdoor space regardless of size are:

- Refresh your landscaping to the correct season and make your curb appeal pop.

- Power-wash your siding, windows, walkways, etc. to brighten your space and make it appear larger.

- Replace window screens if your outdoor space is limited so you can bring the outdoors in.

- Stage the outdoors! People want to see how a space could function.

Open Concept

The first option, of course, is to tear down the walls. However, that can be a huge expense for your budget and time. If that’s not in the cards for you, seller, the right staging can go a long way. Believe it or not, many millennials actually want space for a dining room table. To play up the space you have:

- Draw the eyes up to make the space feel big by adding open-air shelving all the way to the ceiling or installing curtains rods higher on the wall above the windows.

- Know that mirrors are your friend.

- Brighten up the room with a fresh, light color of paint or simply replace all your light bulbs to a brighter, cohesive voltage.

Upgrade the Heart of the Home

The kitchen is a room you go in every day. I’d argue it’s the most used room in the house and, also, usually the room with the most wear and tear. Without breaking the bank, try the following:

- Hire a professional to paint your cabinets — buyers can tell the difference!

- Replace your faucets and/or hardware for a more contemporary style. (Matte black is very popular!)

- Freshen up the backsplash.

- Revitalize island lighting fixtures.

- Meet a buyer halfway by installing modern appliances.

Bathroom Retreat

‘Like a trip to the spa’ is a very common mentality when a millennial is thinking about their bathroom. From a double vanity to heated bathroom floors, a luxurious bathroom is on their wish list. To achieve that mindset on a budget, try:

- Installing a new vanity with plenty of storage.

- Reglaze your old tile shower/tub.

- Re-caulk your bathtub for clean lines and low buyer maintenance.

- Swap out your old showerhead — match the style to your kitchen fixtures for cohesiveness.

Flex Space

Do you have a room or a nook in your house that’s not being used to its full potential? Millennials are looking for any space that could be used as multi-purpose. Here are a few suggestions to make that area come alive to a millennial buyer:

- Working from home is now synonymous with living at home — set up a desk.

- Put your exercise bike, yoga mat and/or dumbbells there.

- Drinks are poured! A funky cut-out in your basement could be the perfect space for a bar top.

- However, at the end of the day, most millennials entering the market have one thing in common… “They wanna really, really, really just buy their first house.”

As a fifth-generation Realtor and the granddaughter of an architect and builder, Sallie has deep roots in real estate. She is passionate for the charm, history and architecture of Alexandria and its surrounding communities. If you would like more information on selling or buying in today’s complex market, contact Sallie today at 703-798-4666 or visit her website SallieSeiy.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Important is Pricing Your Home Correctly?

There is a delicate balance in the real estate industry when it comes to pricing a home. If a home is underpriced, you might feel you were cheated of your home’s true value. But in actuality, overpricing would be much worse.

We are currently in a seller’s market, and when a home is overpriced, it tends to sit on the market. This makes potential buyers wonder what is wrong with it. As soon as they walk through the door (if they even walk through the door at all), they start to pick apart every little thing that they see. When the time comes to make an offer, they will ask for a lower price and more concessions and contingencies than you bargained for.

That is why choosing an experienced Realtor who knows the market as your listing agent is key to getting top dollar for your home. A good agent can use the tools in her arsenal to study the market and give you a good estimate of your home’s value. Through CMAs or Comparable Market Analysis, she will give you a potential range of your house’s worth, and together, you can find the best list price.

The other way to ensure that you receive top dollar for your property is to make a great first impression. The three keys for a great first impression are clean, uncluttered, and depersonalized.

You might not always be able to afford to remodel your house prior to selling. So, if it can’t be brand new, it should be brand new clean, especially in those areas that tend to be forgotten in routine housework. The difference in light in a room with freshly washed windows would amaze you!

As for decluttering, unless you live an austere lifestyle, half of the things in your home need to be removed prior to selling. This means half the clothes in your closet, half of the appliances in your kitchen, and half of the furniture in your rooms. In this case, less really is more. Hiring a storage unit for a couple of months will yield a much greater return on your investment.

Finally, your house needs to be depersonalized. Unfortunately, this means that all family photographs and religious artwork should be removed. Those items have a very personal meaning to you, but they don’t mean as much to the people who enter your house. You want potential buyers to be able to see themselves living in that space, and taste-specific items make that difficult.

It is important to remember though that your house can be as pristine and magazine-like as it has ever been, but if it is overpriced, it will not sell. This is where you need to take a leap of faith, and trust in your agent’s advice about the list price. You hired them for their expertise, so you should listen to it.

In the current market if your home is listed in the sweet spot, a multiple-offer bidding war is sure to follow. This puts you in a much better position to get the price you want for your home without any concessions or contingencies.

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates, Inc in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Did the Challenges in 2020 Affect the Real Estate Market?

It is a good thing I had my two-week winter vacation in St. Martin right before the lockdown, because surprisingly enough it was extremely busy from the minute I got back in town.

Everyone, both in and outside of the industry, speculated about whether the market would take a nosedive, be similar to 2019 or increase over the year prior. With record-breaking low-interest rates as one of the motivating factors, it turned out to be an incredible year.

The year-end numbers in the City of Alexandria showed us that, for the most part, detached homes and townhouses were very much a seller’s market, with a continued lack of inventory and more buyers in the mix. Multiple offers were not uncommon on properties under $1 million. Condo sales were more of a balanced market, with some price points dipping into a buyer’s market. Some say condo dwellers were motivated to move away from residences where they would need to share common spaces, especially elevators.

The concerns for the health and safety of buyers, sellers, and agents required significant modifications in the sales process. Virtual and 3D tours and videos replaced the traditional Sunday afternoon live open houses. Social media, agent networking, and alternative advertising became key components of a property’s marketing strategy. If a live open house was held, they were either by appointment or scheduled in a way to provide social distancing with everyone wearing masks, taking off their shoes, and using wipes to open doors and cabinets.

For McEnearney, and for me personally, 2020 was an excellent year! The company as a whole exceeded the $2 billion mark in sales, while the Alexandria office was up 22.7% over 2019. Alexandria City increased by 15%, with ZIP code 22314 up 24%. Listings in the Alexandria office ranged from $137,000 to $4,825,000.

When I evaluated my numbers for 2020, I was thrilled to have achieved my best year yet by tripling my volume over 2019. Buyers made up 39%, sellers 61%, and townhouses made up 72.7% of my business. While in most years, referrals from past clients, friends, and neighbors make up over 75% of my annual sales — my friends and neighbors themselves were the buyers and sellers of over 50% of the transactions in 2020.

Special thanks to McEnearney for providing the support, guidance, and training needed for agents to modify their marketing plans as the months accumulated. Even with the offices closed for a good part of the year, we had access to the management team, marketing and support staff, and tools required to continue to exceed our clients’ expectations.

Lisa Groover is a licensed real estate agent with McEnearney Associates, Inc. in Old Town Alexandria. As an active member of the community since 1989, Lisa specializes in Alexandria and is thrilled to have the opportunity to work closely with her friends and neighbors in Old Town Village.

In addition to enjoying the Old Town lifestyle and the art-related events and activities, she is a member of a number of volunteer organizations. Having had eight golden retrievers, she is dedicated to helping other dog owners through the challenges of renting, buying, and selling their home.

Lisa Groover is a licensed real estate agent with McEnearney Associates, Inc. in Old Town Alexandria, VA. Having had seven golden retrievers since moving to Alexandria in 1989, she is dedicated to helping other dog owners through the challenges of renting, buying and selling their home..

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

9 Enviable Fireplaces On the Market Now in Washington, DC, Maryland, and Virginia

During cold months, between polar vortexes and “bomb cyclones,” we are always looking for ways to stay warm in style. One sure way to stay happy and beat cabin fever is to light up a fire.

Though a fireplace is on the wishlist for many homebuyers, many residents do not actually use them as often as they could. There are some surprising benefits that should stoke our interest in using these features. For example, a recent study by anthropologist Christopher Lynn has shown that even watching a fire video can reduce blood pressure– an effect which is sure to be heightened with the full multi-sensory experience of gazing into a fire.

But why stop there? Relax with a book fireside, invite friends over for warm drinks and treats in adjoining entertaining rooms, or plan a movie or game night with a fiery flare. Whatever activity you choose, we know you’ll find the perfect fireplace inspirations in these Washington area properties.

19725 Ridgeside Rd, Bluemont VA

Listed by June Hambrick, 540-878-8220

About this home:Priceless views from mountainside location clear to Tysons corner, Dulles area and metro D.C. Pristine Loudoun countryside. Privacy and serenity. Zoned A2, Shows very well.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

3A N Ridgeview Rd, Arlington VA

Listed by Lisa Joy, 703-408-3450 and Leo Watts, 202-525-7156

About this home: New Construction Opportunity on Quiet Cul de Sac with Soaring Views of City Nightscape. Large Lot with Timeless Stucco Elevation and Interior filled with Craftsmanship and Light. Still time to be part of the Finish Selections. Three Available Lots and Floor Plans. OPTIONAL Elevator Available. Main Level Library has Full Bath and Walk In Closet so can be used as Main Level Bedroom. Joy Custom Design Build is an Award Winning Custom Builder with Large Portfolio of Finished Residences.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

14 Caton Ave W, Alexandria VA

Listed by Jen Walker, 703-675-1566

About this home: Expert craftsmanship, fine details and top of the line finishes are evident in every room of the beautiful Del Ray gem! Southern style porch welcomes you to 6 spacious bedrooms, 4 full baths and 3 levels of grand living space. Gourmet kitchen overlooks the large living room with gas fireplace. Take advantage of this excellent location, walkable to “The Avenue” in Del Ray and easy access to metro.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

211 Prince St, Alexandria VA

Listed by Kate Patterson, 703-627-2166

About this home:This outstanding example of early American architecture, located on historic Gentry Row, was built circa 1784 by Captain John Harper. It is almost certain that George Washington visited here and may have attended parties in the gracious formal rooms and danced in the beautifully appointed ballroom, as an early resident, Dr. Elijah Cullen Dick, was amongst his friends. The curved stone steps lead into the elegant entry hallway, opening to the formal living room and dining rooms, separated by a gorgeous keystone arch. Each of these spacious front rooms is graced with wood burning fireplaces, deeply articulated moldings, gorgeous heart pine floors and high ceilings. The eat in kitchen features new custom cabinets, granite countertops, stainless steel appliances and newly installed flooring, a gas fireplace on a raised hearth and French doors to the brick walled garden. On the second level, sunlight streams into the grand ballroom from the three windows across the front of the house, enhanced by a stately fireplace on the west wall. The third floor offers a sun drenched master bedroom with en suite bath and fireplace, as well as a third bedroom and hall bath. The fourth floor opens to a fabulous bright and airy fourth bedroom, with arched faux stone feature, resembling a massive fireplace bracketing the bed in this room. The seven wood burning fireplaces are located in the living room, dining room, ballroom, library, master bedroom, second and third bedrooms. There is an additional gas fireplace in the kitchen, adding warmth and ambiance to the kitchen eat in area. The Dr. Dick house is an outstanding example of early Alexandria architecture, built to last for centuries and perhaps even more charming today than in the 1780’s

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

221 N Royal St, Alexandria VA

Listed by Ann Duff, 703-965-8700

About this home: Satisfy your keen appreciation of history and early Alexandria life with this striking and solid 4-bedroom, 3.5 bath, brick Federal home offering gracious rooms with tall ceilings, time-honored floors and exquisite woodwork. A rarity lies in the Southern open-air sleeping balcony that embraces the deep side and rear gardens and quiet library refuge while the brick floored eat-in kitchen evokes tales of whispered history and bustling life. Even the lower level with 2nd kitchen and recreation room is ready for another century of your new stories and adventures. Detailed brochure with history and room dimensions available at the home and on Ann’s website.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

735 N Fayette St, Alexandria VA

Listed by George Myers, 703-585-8301

About this home: Spacious Contemporary 4 level luxury town home with attached two car garage in the heart of Old Town! Three bedrooms, two full, and two half baths plus a large rooftop terrace overlooking the city complete the package. The entry level room serves as a separate office, guest suite for au-pair, parents, or out-of-town guests. Discreet custom wine storage under the stairs. The second level gourmet kitchen includes extensive updates and upgrades – new appliances, wine and beverage storage, an expansive island for entertaining and a living area boasting a beautiful custom gas fireplace. High ceilings on all levels flood this end-unit south-facing home with light from three sides; south, west, and north. The third level primary bedroom includes an en-suite bath with upgrades, whirlpool tub, and separate rain shower. A second bedroom offers private bath and closet space. The open upper fourth level offers flexible space for third bedroom, family living or entertaining. Located just two blocks to the Braddock Metro, the commuting options are unparalleled. Local eateries abound with Bastille, Mason Social, Chop Shop Taco, Lena’s Wood Fired Grill and Lost Dog Cafe are among the numerous options.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

1834 Connecticut Ave NW, Washington DC

Listed by Gerry Gretschel, 202-494-7918

About this home: Built in 1906 by prominent Washington builder, John H. Nolan, as his primary residence, this Kalorama home was thoughtfully renovated restoring all of the original woodwork throughout. A grand staircase, hardwood floor inlays, gorgeous trim details and crown moldings, and 7 beautifully detailed fireplace mantels grace this 6,400+ square foot home over 4 expansive levels. Featuring 10 bedrooms, 7 bathrooms, 2 spacious main level living areas, an oversized dining room, and plenty of storage, the home also offers rear onsite parking for 3 cars. 1,600+ square feet of lower-level living space includes its own kitchen, laundry, one full bath, one-half bath, and separate entrances onto Connecticut Avenue and the rear alley…the perfect 1-bedroom apartment. Roof, electrical, heating, and cooling systems were replaced in the last 10 years. The RA-4 zoning designation offers the opportunity to use this property as either a premier residence, live/work space, or as condominiums in one of the most coveted and prestigious neighborhoods in the city. Owner related to agent.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

5214 11th St N, Arlington VA

Listed by Betsy Twigg, 703-697-4391

About this home: *** Quality built by A&N Homes, this new 5 bedroom, 4.5 bath home has an open main level with French doors leading to a large deck. The level, fenced yard has been sodded, screening trees have been added, making it ready for a swing set and fire pit.*** Desirable details: Pella double hung, Low E windows; sturdy, non combustible HardiePlank siding; moisture and rot resistant, low maintenance MiraTEC exterior trim; architectural shingle roof***two zone heating and cooling for comfort and energy efficiency; both gas fireplace and range hood vent to the outside;***solid hardwood floors, stained and finished in place, on the main and upper levels; ceramic tile bathrooms;***sleek Bertazzoni appliances with professional gas range; Shrock cabinets with silent close drawers; insulated, drywalled, and painted garage has high ceilings, a window, and opens directly to main level mudroom –so convenient for bringing children and groceries into the home***walk in pantry and two large, finished storage closets in the lower level;***Lower level has multiple large windows, scratch, child, and pet resistant Coretec LFV flooring; high ceiling, recessed lighting*** A home of enduring value in a most desirable location.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

38780 Chelten Lane, Middleburg, VA

Listed by Bradley Clarke, 703-220-5707 & Elizabeth Coopersmith, 703-328-5430

About this home: Design based on Southern Living’s 2004 House of the Year. With separate guest house total of 5 baths, 5 half baths, and 10 garages. Guest house w 1 1/2 BA. Greenhouse. Extensive landscaping. 30 acres east side of Middleburg. Orange County Hunt. Outstanding views across a very private valley. Horses Cattle livestock allowed. W/guest house there are 5 BR, 5FB, 5 half Baths. GARDENS ARE STUNNING IN SPRING AND SUMMER!! Awesome setting in a very private valley. Come home to a vacation every day.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

For all of our incredible homes on the market now, click here.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

10 Steps to Keep in Mind if You are Thinking of Renovating / Remodeling

According to Merriam-Webster, “remodel” is “to alter the structure of; to remake.” Whereas “renovate” is “to restore to a former better state (as by cleaning, repairing or rebuilding).”

So, I hear they aren’t making any more land. Maybe that’s why it’s so expensive. It must also be why some people find themselves looking to remodel or renovate an “improvement.” Did you know that’s what a building structure, like a house, is? If you look at your tax record, there is a reference for tax on the land and one for tax on the improvement. That improvement is your house. And, let’s face it, some “improvements” are in serious need of a remodel or renovation!

Not sure you want to buy, or can’t afford to buy the kind of home you want now? Consider remodeling or renovating. It can be a good strategy and longer-term plan particularly well suited if you love where you currently live or if there is a particular area you like but you can’t find a home that meets your needs. Buy one that COULD suit your needs later – and plan to remodel or renovate. Create the home you want – tailor it to fit your needs. Buy the rambler and in five years “pop the top” to create a colonial! Add a new roofline to that Cape Cod making true, usable rooms in the attic… You get the idea.

I recently visited a client named Jill and was reminded what a great strategy this can be. Jill and her husband love their neighborhood and don’t want to leave but are out of space and tired of the style of their home with its dated features and what seems to be an unusable hillside yard. Moving to a bigger and more contemporary home is cost-prohibitive. So, we strategized and discussed staying and remodeling, adding, and maximizing that hillside. If this sounds familiar, you’re probably wondering, what should I consider?

1. Make sure you really like what the home could be and the overall location.

2. Make sure that the neighborhood can support a big remodel or renovation.

Realtors always think future resale! Will your planned updates make sense?

3. If there is a homeowners association, will the project you’re considering be allowed?

You’ll need to check the community by-laws carefully.

4. Set a budget.

While often not as expensive as buying, renovating is not cheap – especially since the recent pandemic has disrupted supply chains.

5. Consult smart, experienced professionals.

Do you need an architect? Builder? Class A contractor? Landscape architect? Interior designer / space planner? Yes, you will spend some money, but I have learned, first-hand, that you will make up for it in errors you would have made without the assistance of these qualified professionals. They can save you costly mistakes and time, not to mention stress! Another bonus is they often get discounts on materials, furniture, finishes, or services that you would not get as a member of the general public. Professionals can help you realize goals that are important to you. Do you want to build green or use recycled or reclaimed material? Carry along a certain style or theme throughout? Maybe you want designated spaces for your hobbies? They can help you achieve all of this. As a Realtor, I can’t tell you how often I’ve heard, “I wish I would have consulted with someone…” about some perceived mistake. You will have a better product and more enjoyable space in the end, if you consult with quality professionals.

6. Come up with a game plan and be specific and realistic

What can you do when? How long will it take?

7. Consider unforeseen costs.

Will you have to move out of the house for a while and will you need movers to help? What about storage costs for your belongings?

8. Make sure you have the appropriate insurance on your property if you will have people there working.

9. Don’t spend all of your money on the inside and leave no funds for the outside.

We have all seen the giant castle on a barren piece of land! Landscaping sets the stage, frames the home, invites and welcomes, and softens hard edges… These days, our outside spaces have proven to be more important than ever. They are our escape from home school, Zoom meetings, and a safer space to visit with friends.

10. When it is done… ENJOY your improved “improvement”.

As we have learned this year – there may come a time when you spend more time in your home than you would have ever imagined!

Ann McClure is a licensed real estate agent in Virginia and Maryland with McEnearney Associates, Inc. in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Ann at 301-367-5098 or visit her website AnnMcClure.com.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Today’s Buyer Concerns – Fear of Missing Out?

I recently asked a first-time buyer client what she was most concerned about in terms of her home purchase process. She told me it was FOMO – Fear of Missing Out.

This had not even occurred to me. I was thinking that it might be concern over purchase price or payments or the condition of the property (missing something on home inspection) or selecting an area that would later turn out to not to be as good as she might have hoped. But, FOMO? Not even on my radar…

And, then I gave it some thought… We have such a tight, low-inventory market right now – throughout the region (maybe with the exception of many condos). It’s been that way since before businesses started opening up again.

In fact, according to Bright MLS, we came into 2020 with the lowest inventory (available homes) and strongest contract activity that we had experienced in a decade. And, that was coming off of a very strong 2019. So, my buyer’s fear was well-founded. When there are multiple offers on, seemingly, every decent property (and some not-so-decent ones), only one party can win a bidding war and this means a handful (a few? a dozen? a score? or more…) would-be buyers go away disheartened and prices continue to rise. Many parties will miss out.

Why is it so tough for buyers right now?

People are holding onto their homes – maybe it’s pandemic-related (home is safe – but that retirement community with less space between people may not feel that way). Households are changing, too. Adult “kids,” are back at home – parents aren’t downsizing as they once might have. Multi-generational households are on the rise – people are staying in and modifying their homes to accommodate other family members and new needs in terms of work and school (have you noticed how busy contractors are?).

And, then there are the low interest rates – almost free money. One day, we will look back on this time in awe and disbelief that rates were once “this low.”

While the DC Metro area enjoys a strong market, this is not just a regional phenomenon… If inventory remains low in 2021, prices may continue to climb. Across the country, the median asking price for properties in September 2020, according to Realtor.com, was $350,000 – an 11% increase compared to last year. And, inventory has declined 39% year-over-year. Increased demand and a dwindling supply are great for sellers, but not so for buyers.

In our region (which includes the jurisdictions of Fairfax, Arlington, Prince William and Loudoun counties and the cities of Alexandria, Fairfax, and Falls Church) for the week of Nov. 29-Dec. 5 new contract activity was down 3.7% from the previous week, but was a remarkable 48% higher than the same seven-day period last year for the six jurisdictions we track. Homes also sold almost three weeks faster than the same period last year.

All six areas posted solid increases in the number of newly ratified contracts since the same time last year. Northern Virginia (Fairfax, Arlington counties and cities of Falls Church, Fairfax & Alexandria) had the best week with an amazing 76.4% jump. Loudoun County was up 56.3%, and Prince William was up 34.8%.

But, even with all of this, contract activity – week over week – is declining, following patterns we’ve seen before, as the year draws to a close and the holiday season gets into full swing. According to David Howell, EVP and CIO at McEnearney, “Inventory is blossoming in almost every jurisdiction and the outer suburbs are outperforming the closer-in areas.”

This is good for buyers but likely short-lived. David Howell also shared that we expect to see a drop in the number of properties going under contract every week (at least for a few weeks).

So, FOMO… Yes, it’s a tough market for buyers. But, the surest way to not get a home or win a bidding war is to not even get in the game. The benefits of pushing past that fear and, maybe missing out a few times, but ultimately succeeding means you get a home that is YOURS. It means capturing these incredible interest rates (the Fed has signaled their intention to keep rates low for the foreseeable future), potential tax benefits, equity over time, and privacy immediately (more safe spaces in uncertain times). So, meet with a reputable Realtor, craft a strategy, and change FOMO to TGIB (Thank Goodness I Bought!).

Ann McClure is a licensed real estate agent in Virginia and Maryland with McEnearney Associates, Inc. in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Ann at 301-367-5098 or visit her website AnnMcClure.com.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Is It Important To Stage My Home Before Listing It?

Everyone thinks they have good taste, but honestly, no one’s taste matters more when selling your home than the buyer’s. The goal is to showcase your home’s many features, while allowing the buyer to create their own vision for the home and to see a future for themselves in it.

Staging can seem overwhelming. In my experience, one of the main misconceptions about staging is that you need to be entirely moved out for someone to come in with new furniture to stage your home in boring colors and design. The fact is, stagers can offer a range of services, and the majority of my clients who sell their homes use mostly their own décor, just less of it and rearranged a bit. Many of my clients who sell their homes also choose to live in it while it’s on the market — so, of course, they still need their furniture. Many realtors are partnered with stagers who can stage the home with the owner’s existing belongings.

Typically, when someone decorates, the aim is to make their living space a reflection of their personality and lifestyle. Home staging is different from decorating in that it is actually DE-personalizing the space, so a wider range of personalities (buyers) can imagine themselves enjoying the space.

One of the biggest mistakes a seller can make is waiting too long to consult a stager. According to Kelly DeMaso, owner of Simplified Organizing and Staging, “You don’t get a second chance to make a first impression, and that’s the key to a quicker sale… The best time to stage your home is BEFORE you put it on the market.” The cost of having your home sit on market for too long could far outweigh the cost and energy of having a stager come over for an hour or two to offer advice — or even having them spend the day to do the work.

Your home is one of the biggest reflections of who you are, and if you’re like most people, you’re proud of it! You’ve probably curated the artwork on the walls with love and to suit your tastes. The fridge is covered in magnets you’ve collected, holding up shopping lists, sweet notes and drawings by your kids. You found the perfect area rug — large enough for your dining room with the perfect shade of red that matches your chair cushions. On your windowsills, tiny potted plants are proudly on display and you tend them daily.

How can someone else picture raising their family in a home that is filled with you and your style? The goal is to have potential buyers imagining themselves seated in the adorable breakfast nook with their art adorning the walls.

Imagine you walk into a house with a gigantic statue in the middle of the living room. What will you notice first — the beautifully redone kitchen or the gigantic statue in the middle of the living room?

Obviously not everyone has a statue in the middle of their living room, but almost everyone has something buyers would SEE as a gigantic statue — something that’s just so hard to look past. The problem is everyone is different. One person’s statue is another person’s statement décor.

As a buyer, it’s important to identify things that are just “statues” that might bother you but are easily remedied — bright paint on the walls, old light fixtures, an overgrown lawn. However, these types of things, along with a seller’s strong personal décor, can overwhelm a buyer. The longer a home stays on market, the lower the sales price is likely to be. Why not reduce the number of “statues” in your home, and make it easy for buyers to fall in love with your home immediately?

Rather than have everything in your home represent you and the life you have built in it, we suggest depersonalizing and creating a “blank canvas” for someone to feel like it could become their home. This can be a difficult process, so having a couple of other sets of eyes is important. Your realtor can come in and give the first round of advice and then bring in a stager with the expertise to transform your home into the next buyer’s blank canvas. We are happy to help at any point in your planning process!

For a professional, confidential evaluation of your home, please call or text us at 703-244-6115 for a no-obligation assessment of your home. We have a Dream Team of experts — contractors, staging advisors, photographers and more — to help make the right preparations, minimize stress and maximize profits!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. She and her mother, Kim Peele, are The Peele Group, serving Virginia and D.C. They are dedicated to helping owners through the challenges of selling their home.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Learn to Love Condo Living

This year we have seen very tight inventory for townhomes and detached homes as demand has increased. In many areas, the interest in condominiums is not as strong because of more communal aspects to the lifestyle, but we feel that is worth reconsidering.

Condo ownership is the most peaceful type of homeownership. You can live in a beautiful setting without needing to worry about mowing the lawn, trimming shrubs, planting flowers or handling other exterior maintenance projects because the association takes care of landscaping and maintaining the common areas for you.

Most condos association fees cover everything outside of the main walls of your home. If a sidewalk needs repair, the condo association takes care of it. Need a new roof? You don’t need to pay for it on your own. You can enjoy living in a park-like atmosphere without needing to buy single-use only tools or finding space for a lawn mower.

Condo fees will also include many amenities that you would have to pay extra for anyplace else. Studies show that people who have fitness equipment in their home are more likely to exercise. Nowadays, most condos have fitness rooms that homeowners can access 24/7. This eliminates the need for an expensive gym membership that you are never going to use, while still allowing you access to higher quality equipment than you could afford on your own.

Another common amenity in condos is a party room, which is an easy and inexpensive way to entertain. Party rooms allow for gatherings of various sizes and occasions. The best part is, there is no need to clean your house ahead of time! Some condos in the DC area even have rooftop decks available for rent for their members. The ones closer to the city have views of the monuments, while others as close in as Reston have mountain views with their breathtaking sunsets in the evenings. Your guests will love it!

When you live in a single-family detached home or townhome, you often need to take time off of work to have someone on standby to pick up packages or let in the maintenance person. With condo living, you no longer have to do that! With a concierge service included in your condo fees, someone will always be available to assist you whether you are out of town or out on the town by taking your packages, helping you with reservations, or letting service people into your apartment. You can travel and enjoy the nightlife without having to worry about missing an important package or a failed delivery.

If you want to simplify your life, consider investing in a condo. Contact me today to explore the possibilities!

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates, Inc in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Should I List My Home During The Holidays?

At this time of year, many people ask if they should list their home now or hold on until after the new year? As always, if you need to sell, list it.

However, in most years, if you have flexibility, we would be inclined to wait until the new year. Many potential buyers may be thinking there will be more to choose from in the new year. This is generally true – we often do see an influx of listings and buyers in January. There is definitely a cycle of January shoppers who bring February contracts and March closings. Then the cycle is repeated in April, May, and June.

However, 2020 – the year of COVID, working from home and social distancing – is truly unique. We have seen unusually high holiday season demand for detached homes, and decreased inventory. While not quite as “hot” as the pre-COVID market, there are more buyers than sellers leading this strong seller’s market. Multiple offers, while never assured, are not out of the question, and well-priced homes are selling quickly. For buyers, this is tough. For sellers, this is truly a “merry” circumstance. This year, in so many ways, is an anomaly.

So you decide to list… If you decide to list during the holiday period, you might wonder about holiday decor. Do you go full-bore holiday style, or keep the seasonal decor packed away? The answer lies somewhere in between: Nobody expects sellers to ignore the season, but this is likely not the year to go all out.

Keeping decorations simple and somewhat restrained, while still honoring your family customs, is perfectly acceptable. Subtle and understated is the way to go, always keeping the staging guidelines in mind. Remember: Accent the best features in your home. So don’t put the Christmas tree in front of the window with the best view, or cover up beautiful mantles and railings with too much greenery. Use the décor to accent areas of the home that you want the buyer to see.

This time of year is fabulous to emphasize the warmth in a home. The smell of fresh baked cookies, glowing flameless candles, and seasonal floral arrangements contribute to the ambience to make them want to linger.

Also keep in mind if you are launching your listing during the holidays when your home is decorated, photographs will include the seasonal items. If your home does not sell before the holidays are over, consider having new pictures done to promote the property. Note that seeing holiday decorations in mid-January will indicate to buyers that the home has been on the market for a while.

Photo trends… When it comes to photographs, one new trend we saw in 2020 is the twilight photoshoot. The images taken at this time of day create a charming glow from the inside of the house. They can really highlight some of the best features of your home, such as large bay windows, fabulous front doors, spacious patios. During this winter season, when trees are bare and the grass is brown, daytime photos may appear bland. Some carefully hung white outdoor lights accenting a patio, or pathway lighting highlighted in a twilight photoshoot can really make the drab appear fab!

In short:

Inside decor? Tasteful displays in selected places; less is more and be very intentional about what you’re calling attention to.

Outside decor? Think accent lighting and bows, and – you guessed it – less is more.

How about now? … 2020 may be the exception, so enjoy it! Buyers are looking, and there’s not much to look at. Be intentional with the decorations and you can blend your holiday highlights with the needs of a staged home. As always of late, make sure there are booties, hand sanitizer and masks for showings, and know that – like any other time of year – flexibility will be important.

Wishing you a successful selling holiday season!

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link