What is Home Staging?

Staging is preparing a home for market by furnishing and decorating it specifically to attract potential buyers. Through the use of furniture and accessories, staging helps buyers envision how the space can best be used and makes the property appealing. It puts the home in its best possible light by accenting the home’s positive features and helping enhance the flow of the rooms.

Will the stager use the seller’s furniture or bring in furniture?

There are many different approaches to staging, depending on whether or not the seller has moved out of the property. In a vacant home, a stager will bring in furnishings, rugs and accessories. This is the most effective approach because the stager is working with a “clean slate” and is able to create a home atmosphere appealing to buyers with on-trend items that the stager has preselected just for that purpose.

A stager may also work in a home still occupied by the seller and use the seller’s furnishings. In this situation, the stager first goes through the home with the seller, removing and packing up as much of the seller’s belongings as possible. Off-season items, personal photographs, collections and infrequently used items are some examples of what is packed away. If there are packed items that the seller needs to use on a daily basis, the stager will ensure those items are accessible. Once the home is cleared out of excess items, the stager will rearrange furniture, rugs, window treatments and lighting to enhance the home’s atmosphere. Frequently, additional items are brought in from the stager’s inventory of furnishings to round out what is in the home and complete the staging effect.

Is the entire house staged or only certain rooms?

It depends on the size of the property and the staging budget. Standard rooms to stage are usually the living room, dining room, kitchen, family room, primary bedroom and a bathroom. The secondary bedrooms do not need to be staged unless one is to be staged as a home office. With everyone working from home in the last year, a home office is now also standard for home staging. Even if it is not a separate room, having a dedicated space for a desk and work area is an important feature.

Staging outdoor space is now popular as well. Outdoor spaces do not have to be full kitchens or outdoor wet bars as seen in luxury magazines and home television shows. Showcasing a patio off the kitchen with a table and chairs as an alternative dining area or highlighting a fire pit with Adirondack chairs in either the front or backyard as a gathering spot is appealing to buyers who value having that additional living space at their home.

How much does staging cost and what are the benefits to the seller?

Prices for staging vary widely in Northern Virginia depending on the company and services being used. On the lowest end, a staging consultation may cost several hundred dollars for a few hours of advice. For full service, a vacant home that has staging in the living room, dining room, primary bedroom and bathroom, home office, family room, and patio will cost approximately $3,500 to $5,000 for the first 30 days. Renewing for a second month will usually be slightly less.

Staging offers big benefits for the seller, including a higher sales price and fewer days on the market on average. Research shows that staged homes sell for 20% more than homes not staged, and they sell 88% faster than homes not staged. The seller must be willing to invest in the staging costs at the time of listing or be willing to pack up most of their personal belongings to realize these benefits.

What is virtual staging?

A budget-friendly alternative to in-home staging is virtual staging. Virtual staging is photographically staging a home for online viewing by potential buyers. To create the virtually staged home, the property is photographed empty without furnishings. After the photos are uploaded, furniture and staging items are virtually added to the photos. The property will remain empty for actual buyer tours, but the online virtual staging will help potential buyers envision a fully furnished space.

Kathy Hassett is a Realtor with McEnearney Associates and a partner with the MPH Home Team in Alexandria, VA. Kathy has lived in Alexandria for over 25 years and started her journey in real estate as a settlement attorney in 1993. With her in-depth knowledge of the local area and her real estate know-how she serves as a strong advocate for her clients’ best interests. She provides her clients with experience-based strategies to help them navigate real estate transactions, reduce their risk, and save time and money. She would love the opportunity to work with you. Contact her today at 703-863-1546.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Should I Rent or Buy?

When considering a move, sometimes there’s a dilemma. Is this the right time to buy, or should I rent again? In some areas of the country, it’s a clear choice. If mortgage payments will be consistently lower than rent, or at least close, there is an obvious opportunity to see appreciation in your investment and come out ahead in a few years. In our area, it can be a little tricker.

The first step in your decision-making process is to find a good Realtor who will be patient, answer all of your questions and see you through the process — whether you decide to rent or buy this year. Your Realtor will guide you through the process of shopping for homes that fit your situation and budget and will negotiate diligently on your behalf when the time comes. They also have great resources and can refer you to trusted lenders, which is your second most important step in making your decision about a home!

Whether you want to buy now, or even in a year or two, an experienced local lender will provide all the important financial information that you need to make your decision. They will look at your credit score, job history, income, as well as your assets and debt. All this information will help them to map out the best plan for your future, regardless of where you already are in the process. A good lender will give you options for loan programs, helping you create the most competitive offer when you are ready to buy, and they will show what your interest rate would be depending on how much you put down on your loan. They will also have guidance for you on how your tax savings may allow you to make a mortgage payment higher than what you would be comfortable paying for a rental. Your Realtor and lender should be identified early, as they will become your close advisors in this journey to decide whether to rent or buy.

Let’s talk about the upside of buying. Clearly, there are many reasons to buy. First, you can truly make your home your own. Remodeling, updating and even just painting are all your decisions and to your tastes. Second, your investment will grow and make money for you as home values increase. Third, depending on the mortgage program chosen, your payments will remain almost the same for many years, except for minor changes in taxes and insurance. Lastly, the cost of waiting will be higher interest rates — now at all-time lows — and more expensive homes. Your buying power will lessen the longer you wait.

A few years back, we met Margaret and Devon (names have been changed) at a rental in Alexandria where the monthly rent was $2,700. It was a 2-bedroom, 2-bath condo about a mile from the center of Old Town. They were newlyweds and expecting their first child. They mentioned to us that they didn’t think that it would be possible for them to own a home in this area. We suggested they talk with one of our favorite lenders, and they discovered that a mortgage payment for a home up to $550K would be about the same monthly payment. Also — they could get away with just 5% down. Like many newlyweds, they didn’t have quite that much to put down, so their parents gave them a tax-deductible gift of $25K. In this instance, it made much more sense to buy than rent, and this family was thankful for the information. Several years later, their $549K purchase is now worth $635K and growing.

Now, let’s talk about the cons of buying and why some are deciding to rent.

First, when you buy a home, the maintenance becomes your responsibility, so knowing exactly what you are getting into is important. How old are the systems in the home and the roof? What’s new, and what will need to be replaced in the next few years? Your realtor will help you evaluate the home and get the necessary inspections.

Secondly, it’s often competitive to get a home. This past year has been a seller’s market in much of the U.S., and Northern Virginia and D.C. have been particularly difficult areas for buyers. Many listings have had anywhere from 5 to 20 offers on them. Low interest rates and pandemic-induced cabin fever has caused people to reevaluate their space, and in many cases, look for a newer, larger home. The Amazon headquarters and new Virginia Tech campus on the Route 1 corridor created a lot of buzz about increasing values. All of this resulted in high demand and low inventory.

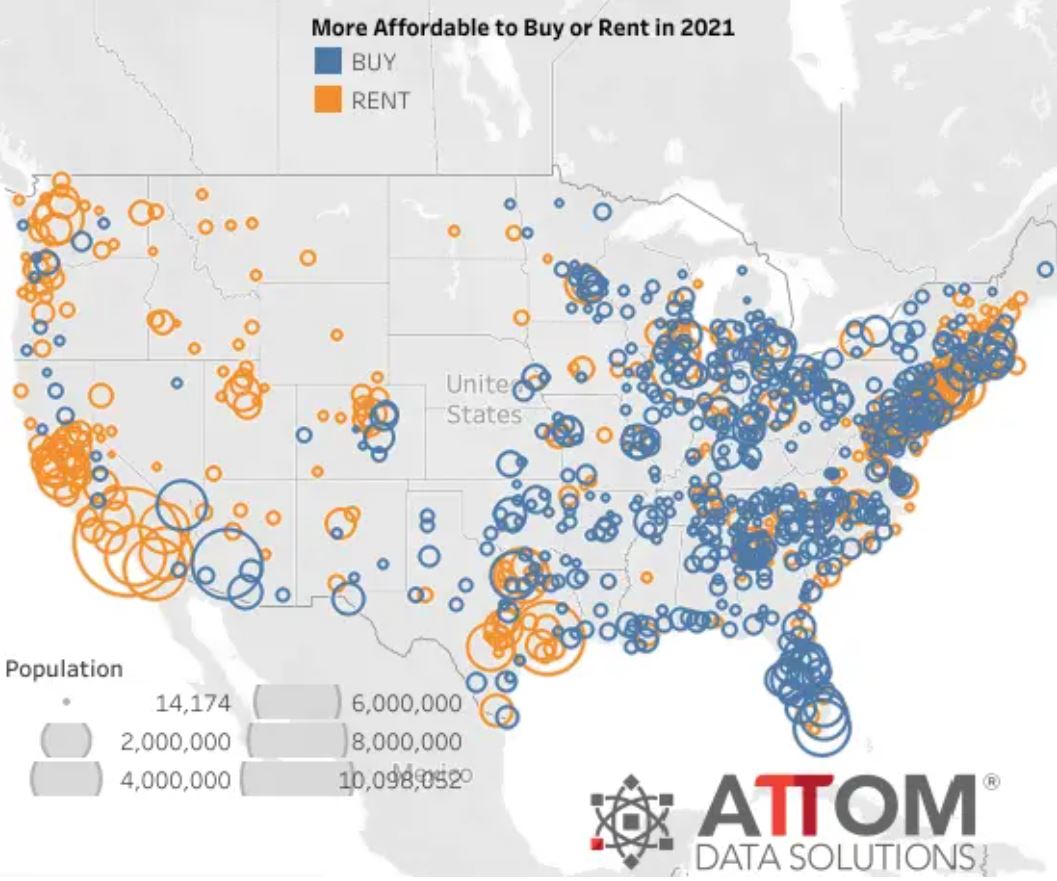

Photo Courtesy Of: Attom Data Solutions

According to ATTOM Data Solutions, a property database company, “owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 63% of the 915 U.S. counties analyzed for the report.”

The bottom line is, your decision on whether to buy or rent will be unique to your situation. You should talk to a Realtor and a lender, sooner rather than later. They will help you with a full evaluation of the market and of your buying power so you can make an educated decision on whether to buy a home this year or to wait.

And, of course, if we can be of assistance, we are always happy to help! We would never try to convince someone to get into a situation that they cannot afford. However, we would also never want someone to miss opportunities that they can afford because they didn’t know their options. Homeownership is often more attainable than people realize. Simple education, guided by the experts, is the key to not missing out on your chance to invest in your future! For a confidential meeting, reach out to Hope and Kim Peele at 703-244-5852.

Kim Peele is a licensed real estate agent with McEnearney Associates, Inc., lives in Old Town and works in Virginia, D.C. and Maryland. She and her daughter Hope Peele are The Peele Group. Kim is a second-generation Realtor and fourth-generation Washingtonian and is dedicated to helping owners through the challenges of selling their home.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How To Say Goodbye To Your Home

Selling your house and saying goodbye to the home that you lived in can be a very emotional experience for a lot of homeowners.

If you have lived in your home for a long time, you probably made many unforgettable memories with your family, friends and loved ones that it will be hard to let go of when the time comes to move. Whether you realize it or not, you have an emotional attachment to this home, and as you think about moving, you can be overcome with feelings of sadness and hesitancy.

I would like to introduce you to the three transition methods I use with my clients to help ease their minds about their upcoming move.

1. Make Memories Before You Leave

Begin by taking pictures of your home inside and out, even before you begin the moving and packing process. Every crayon scribble, crooked picture and misplaced sock is a sign of a well-loved and well-lived home.

Take photos with your favorite neighbors and caption them with their names and dates. Hopefully you will keep in touch after the move, but you will never have the same kind of relationship when you no longer live next door to each other. You can also say goodbye to your favorite cashier at the local grocery store, or the pharmacist who always refills your prescriptions. It helps create closure for you and it makes them feel like you’ve noticed their hard work over the years.

Have dinner one last time at your favorite restaurant if you are moving very far away and take a commemorative photo. Write down your usual order on the back so that you can always remember your times spent there.

2. Take Something with You

Just because you are leaving doesn’t mean you can’t take something with you! Create a memory box of items around your yard. Leaves from the trees, presses of the flowers from your garden or a watercolor sketch of what your home looked like in full bloom. Many talented artists can create works of art based on your old home that you can display in your new one.

As long as you remove them before your home goes on the market, you can replace certain fixtures in your home and bring them along with you to your new one. For example, I had clients that loved the specialty billiard light fixture they kept over their pool table. They removed the fixture and put it into their new house and replaced it with something less unique for the new buyers.

Make sure you do replace anything you take with you though, otherwise the market value of your home will go down.

3. Look Toward the Future

Instead of dwelling on the past, look toward the future! Focus more on the upside of where you are going and the wonderful opportunities that your new home will provide you. You can do a Google search on the new area where you will be moving to and find new restaurants you want to try, new stores to shop at, as well as look up your kid’s new schools.

Look into local classes at the community center or Facebook events that are coming up in your town so that you can meet the people in your new neighborhood. There is something exciting about a fresh start and new opportunities to find new things to love.

Saying goodbye to your home can be difficult, but there is always a reason to be hopeful and optimistic about where you are going. A trusted Realtor can help guide you through the process.

Jean Beatty is a licensed real estate agent in VA, MD, and DC with McEnearney Associates Realtors® in McLean, VA. If you would like more information on selling or buying in today’s complex market, contact Jean at 301-641-4149 or visit her website JeanBeatty.com.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How Do I Make Sure Our Next Move Isn’t Too Stressful For Our Dog?

We’re in the Dog Days of Summer. Even in this heat, a dog’s love is never wavering. Mine have certainly made my life whole and have made my home a happy (albeit 80% chaotic) place! I moved earlier this year, and it’s taken quite a bit of time for my dogs to adjust.

Whether you are a new or seasoned homeowner, the stress of moving is always there. That stress doesn’t go unnoticed by your four-legged family members. In preparation for National Dog Day (Aug. 26), I wanted to provide you a few tips for making a move a little less overwhelming for you and your dog(s).

Bring in moving supplies early on. Make a couple of boxes and leave them out for your pup to start to sniff and recognize. When I moved, I threw a few treats into an empty box to make the “intruder” more friendly and fun! In my experience, dogs can get anxious with the new scent, schedule and disruption to their space. Prepping them with enough time can make the amount of time you have left in your current place more enjoyable.

Head over your new neighborhood and walk around. Let your dog get used to the new smells and sounds. And, hopefully, meet a new neighbor or two! It’s less overwhelming to them if they can sniff out the new spot and then return home to their comfort zone. It will make the transition of moving that much easier.

Update your vet records and change your address on your dog’s microchip (if applicable). In case your pup is the wandering kind, it would be a good idea to tell your vet the new address sooner rather than later. If you’re looking for vet recommendations for your new neighborhood, check out the local Nextdoor page, or you may find a neighborhood pet page on Facebook.

Organize a playdate or make a doggy daycare appointment on the day of the move. Less stress and your dog can have fun! They’ll also be really tired when they go to the new place.

Set up your pup’s own special space in the new house before bringing them home. Make their crate or put together their special spot with all their favorite blankets, toys, and maybe even a treat or two.

Stick with some of your original, familiar furniture. Even though you may need a new sofa or a new chair, it’ll help your dog — and your wallet — feel more at ease.

Keep the routine. When you move to the new home, try to stick to the same times of feeding and walking. Don’t be discouraged if they don’t sleep well, aren’t eating or just aren’t feeling their regular self. It’s a lot to adjust to!

If you and your pup are looking to make a move, please give me a call!

As a fifth generation Realtor and the granddaughter of an architect and builder, Sallie has deep roots in real estate. She is passionate for the charm, history and architecture of Alexandria and its surrounding communities. If you would like more information on selling or buying in today’s complex market, contact Sallie today at 703-798-4666 or visit her website SallieSeiy.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

How do I get a house ready to sell when I live out of town?

Funny you should ask… I have had the opportunity to help five sellers in the past year in this very same situation. One couple had been renting their home for over 10 years — they live in Canada. The second rented his townhouse for about 15 years — he lives 1.5 hours away. I am working on three more now. One is an estate with the executor living in South Carolina. Another is a large single-family home, and the owners have already moved to their farm in Tennessee. And one will close this week with the sellers signing remotely from California.

I cannot say that it is easy; however, working with an experienced team of professionals who can lessen the burden of getting a home ready for market makes a big difference in an already stressful situation.

Selecting a real estate agent who has long-standing relationships with contractors, painters, hardwood and carpet experts, plumbers, and decluttering and staging professionals will make your task more manageable. I have worked with long-distance sellers on projects from completely gutting and remodeling kitchens and bathrooms; selecting all new appliances, vanities, mirrors, window treatments and lights; to having the house painted and hiring contractors to make repairs and updates.

My list of contacts includes companies that specialize in clearing out unwanted furniture and taking items to donation sites and to the dump. I met with a decluttering and staging expert today to decide what to pack away or move out of the house and what items to use for staging. I am walking through a property with a landscaper later this week to discuss an expansive yard clean-up and ways to create more curb appeal.

I asked a current client to share some of her thoughts about working with me from another state, and she responded: “You managed the entire process of getting the house on the market so that I did not have to travel to Virginia at all. I also appreciated the way you handled the sensitive situation where the children had a difficult time going through their mother’s personal belongings.”

Here’s an example of the difference a powder room renovation can make. The old vanity was dated with a dark wood whereas the new one is crisp and bright.

In another situation, the seller initially said he did not want to do any updating to an older townhome. Once we explored a variety of options and compared the price of the renovations and the potential increase in value, he decided to do quite a bit of renovating. In the end, he made the decision to modernize his house, resulting in over $100,000 more in the sales price!

“In just several months Lisa valued my townhouse in relation to the market; made recommendations to help its presentation; suggested a pricing strategy for optimum positioning; and on an almost daily basis, managed, coordinated and communicated all the work being done,” the seller said. “Lisa has trusted loyal professionals she recommends, including painters, carpenters, plumbers, electricians and cleaners, and it seemed as though whatever needed to be done, she was able to make it happen.”

Check out some of these before and after pictures of the dining room and kitchen renovation that was done to list this home for sale.

Before the renovation, the dining room and kitchen were separated by a wall and the kitchen was very tight for food preparation.

After removing the wall, the ever-coveted open concept dining room and kitchen will elegantly play host to gatherings large and small.

Whether you are thinking of buying or selling — or just need suggestions for updating your home — I am happy to provide suggestions and ideas or recommend contractors for your specific projects. I am a resource for the duration of homeownership, not just the buying or selling process. Feel free to reach out anytime!

Lisa Groover is a licensed real estate agent with McEnearney Associates, Inc. in Old Town Alexandria, VA. As an active member of the community since 1989, Lisa specializes in Alexandria, and is thrilled to have the opportunity to work closely with her friends, neighbors, former clients, and their referrals.

In addition to enjoying the Old Town lifestyle and the art related events and activities, she is a member of a number of volunteer organizations. Having had eight Golden Retrievers, she is dedicated to helping other dog owners through the challenges of renting, buying and selling their home.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What is title insurance and why might you need it?

Many of my buyer clients ask what title insurance is, and why they may need to purchase it at the time of closing on their new home.

Simply put, title insurance is an insurance policy that protects you against loss due to an unknown defect in title or an interest in your home. (Real estate title is a legal document stating you are the rightful owner.) It’s a one-time payment; the cost is about 1% of the home’s value, and if you need to make a claim, there is no deductible to pay. Additionally, it covers you for the entire time you own the home. Claims from previous owners or their heirs, judgments against prior owners or permanent easements from utility companies can be extremely costly to the new buyer!

Most common uses of title insurance:

1. Judgment against the prior owner: If the title search didn’t find the judgment or if a new judgment has been issued against the previous owner and the court indexes aren’t updated, a judge can order a lien be put on the home, which you could be responsible for paying. The most common example is a lien put on the property due to costly unpaid medical bills the prior owner has incurred.

2. Easement on the property: Title insurance protects against easements/rights of way that are not recorded properly and can diminish your property value. For example, a cable company could have a permanent easement on your land and have the right to dig large trenches in your yard. If you have title insurance, the company will send you a sum of money based on the purchase price and the type of easement.

What if I chose not to purchase title insurance and an issue arises?

1. You can hire an attorney to help you clear the lien in court and correct the title on your home. Most attorneys charge a $10,000 retainer for such a service.

2. You can simply pay the lien, which can be extremely expensive, and you would still be responsible for clearing/correcting the title at the courthouse.

About 90% of buyers elect to purchase an Owner’s Title Policy to protect them against the risks of an issue arising, and title insurance companies are paying $100 million per year in title insurance claims.

If you have further questions, please reach out to me.

Lynn Cooper is a licensed REALTOR in Virginia with McEnearney Associates in McLean. Whether buying or selling, Lynn is 100% committed to her clients before, during, and after the transaction. Connect with Lynn at 202-489-7894, lcooper@mcnearney.com.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

7 Steps to Home Ownership for Veterans and Military Personnel

Written by: Jackie Waters

Active military personnel move often, and buying new homes in areas of reassignment tends to be part of the job. Once you’ve fulfilled your military service obligation, purchasing a home to settle in may be one of your top goals. Here’s a guide to help you through the process.

McEnearney Associates can help you find that perfect home. Call our office today at 877-624-9322!

Reduce Debt and Improve Your Credit Score

Focus on high-interest debts first; these include credit card debt and payday loans. Any loan with an interest rate greater than 8% may stand in the way of a good mortgage loan. Don’t use credit, steadily reduce your debt load, and keep an eye on your credit score.

Look for Programs That Help You

There are a number of programs designed to help veterans find the home they’re looking for. So, when you begin the house-hunting process, look into programs like U.S. Military on the Move, which joins forces real estate companies (including McEnearney Associates) to give credits or rebates to veterans looking to buy a home. You can learn more about this program by clicking here.

Save Aggressively

As you work on eliminating debt, put the same energy into saving. Try one of these aggressive savings strategies:

- CD laddering allows you to take advantage of the higher annual percentage yields of long-term CDs without committing money for several years at a time.

- Gradually increase the percentage of your income that you put toward savings. Even a 1% increase can help you raise your savings. Be intentional about reducing expenses, especially any “wasteful” or spontaneous spending.

- Reframe your thinking about consumerism and spending money. You may be handing over valuable funds without thinking much about it.

Get Pre-Approved

Secure loan pre-approval. This means your finances and other qualifications have been reviewed. The process also helps you understand how much a home you can afford and what interest rate you should expect.

Choose Your Loan Type

A VA loan has several benefits, including the lack of requirement for a down payment or a monthly mortgage insurance amount. Additionally, the credit requirements for the VA loan are more flexible than those for other loans. There are other options as well, such as Federal Housing Administration loans, down payment assistance programs, and the Specially Adapted Housing grant.

Veterans can also look into VA 30-year fixed mortgage loans, which require no down payment and low interest rates. Though the rates are subject to change, today’s rate (which is based on the purchase of a single-family primary residence in IL) is 3.106% with no discount points, a middle credit score of 680 and the assumption that the loan will have an escrow account, according to Rate.com.

No matter which type of loan you opt for, it’s important to carefully consider certain vital details. Learn mortgage language to negotiate a good contract:

- Mortgage interest rates are determined by many factors, including county and state, the size of the down payment, the duration of the loan, and its type.

- The annual percentage rate on your loan is how much you will pay for the loan. The APR is the cost of borrowing money.

- The term of the mortgage is how long you’ll take to repay the loan. Remember that the longer you take to pay off the debt, the more you will pay in interest.

- Projected payments are the estimated amount you’ll pay each month with your mortgage payment and mortgage insurance combined.

Find Your Home

The natural fifth step is finding your dream home, within your realistic home budget. Create a list of the things your new home must have, such as proximity to great schools, a positive location, size of the home, or amenities such as central air conditioning. Make a list of other things you don’t mind compromising on, such as multiple garages. A real estate agent can offer valuable resources and information, such as the best time of year to buy a home and how to negotiate costs.

Close and Move In

With the help of the realtor, your final step is closing on the home. This includes settling on a good offer, completing paperwork, and paying relevant fees. After your hard work, this moment should be very satisfying.

Approach the purchase of a new home with the same patience and attention you devoted to other missions during your military career. Stay on course, stick to your priorities, and keep your eye on the end goal.

Author

Jackie Waters is a mother of four boys, and lives on a farm in Oregon. She is passionate about providing a healthy and happy home for her family, and aims to provide advice for others on how to do the same with her site Hyper-Tidy.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

What Can Ted Lasso Teach Us About Real Estate?

One of the best things I discovered during the pandemic was “Ted Lasso” on Apple TV+, and I know I wasn’t the only one who connected with the sheer positivity that permeates each and every episode.

For the uninitiated, “Ted Lasso” is about an American football coach who is drafted to lead a ragtag U.K. football club (what Americans call soccer) and find a path to victory amid monumental challenges. It’s a classic fish-out-of-water trope that completely rises above expectations to deliver what viewers needed most in a time of doubt, loss and fear: a reason to hope and dream of bigger things.

I think about Ted Lasso, the leader, as I speak with people who are thinking about starting a new career in real estate or who are seasoned agents looking to elevate their business goals. In anticipation of the release of the second season of this delightful show (July 23!), here are a few of the parallels between sports and the competitive world of real estate and the lessons you can learn from Coach Lasso:

1. Be ready to step outside your comfort zone

When Ted Lasso arrives in the U.K., he has to learn not only a new sport but a new “language,” culture and rhythm. Even if you’ve had experience buying, selling or renting your own home, being the one in charge of ensuring the transaction goes smoothly for your clients is a whole new world.

Now, you are expected to know contractual language clearly enough to explain it accurately to others. Now, you are a part of a network of professionals who are each the CEO of their own startup companies, each with their approach to real estate and each with their own expectations of you. Now, you are an independent contractor who doesn’t necessarily have office hours or a “boss” to report to on a daily basis, but you have clients who deserve constant attention, other agents who are calling you for information at all times of the day and a brokerage that is invested in your success. AND, you have to manage your family, friends and business contacts in the process.

Be prepared for a steep learning curve and look for leaders who will help support you. There’s an oft-repeated statistic that 87% of new agents will be out of real estate by their fifth year. If you are taking the risk to embark on a challenging new path, make sure you identify brokerages with strong training, mentoring and coaching programs that are as invested in your career as you are.

2. Know yourself but also get to know others

One of the most endearing traits of Ted Lasso is his ability to connect with others, chiefly by leveling the field — he knows his skills and limitations and is not ashamed to own both — and by letting people know that he values them and what they bring to the table.

As a Realtor® you will meet many people who have a different approach to a transaction, whether that is a competing agent in a sale, a power-player client or a colleague who moves in the same circles you do. Take the time to know the people with whom you are interacting, and you will be rewarded greatly!

There are many books that will help you identify personality types and negotiation styles (some are listed at MCEReads on Amazon) that will help you understand motivation and sidestep potential roadblocks to a smooth deal. It’s also an important skill because real estate is a business built on RELATIONSHIPS. If you can’t find a way to connect with people, to listen to them and to hear them, it is going to be harder to build your business through trust and referrals, and you might strongly consider a different career path. Which leads to…

3. Surround yourself with people you want to work with

Ted Lasso can appear to cynics like he’s a happy-go-lucky doofus who isn’t really good at what he does. He ignores them. Instead, he stays focused on the people he knows will listen to him and help lead others to the successful outcome they all want.

While many agents do build their business via purchased leads — people you don’t already have a relationship with but have been identified by algorithms or a direct brokerage inquiry to be in the market to buy or sell a home — it takes a lot more work to get those leads to the “know-like-trust” client stage than the people you have already been interacting with on a personal and professional level.

When I was an active agent, I used this mantra: “I only want to work with people who want to work with me.” It sounds easy, but when you are new and hustling for every lead you can uncover, it pays to focus on those people ready to hire you as their trusted advisor in their real estate goals. This means developing a comprehensive Sphere of Influence (SOI) of contacts who will become the foundation of your business and refer new clients to you. Your SOI starts with a list of all the people you know — family, friends, former coworkers, those in your social and civic circles, your doctor/dentist/hairstylist/mechanic, your parenting groups, the list goes on! — and their contact information. You can then work with your Broker or mentor to categorize those groups into sections that will yield different approaches to outreach, marketing and referral requests. The important thing to remember is that each person on this list is someone you would want to have a relationship with even if you weren’t a Realtor®. As you build your business, you want to ensure that the people who are with you are cheering you on!

As you develop your skills and knowledge about real estate, you’ll have many wins and losses (and maybe even a few draws). Both Ted Lasso and I want you to take away from the experience is to BELIEVE: in the value of others as much as yourself, that you need a good team standing behind you if you’re going to get anywhere and that a positive mental attitude will get you further than you can imagine.

To join the winning team of McEnearney Associates — or just to talk about your favorite Ted Lasso moments — call me at 703-615-0876 and visit us at JoinMcEnearney.com.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Late Pandemic Mortgage Industry Status

The pandemic has had a significant impact on the residential mortgage industry. At the beginning of the public health crisis investors in mortgage-backed securities stopped purchasing the instruments which caused a liquidity shortage and a spike in the rates available to consumers. The Federal Reserve quickly stepped in and began purchasing Fannie Mae and Freddie Mac issuances, stabilizing the market and easing rates. Underwriting standards involving employment, income, liquid reserves, and credit scores were tightened by Fannie, Freddie, and jumbo loan providers. Some lenders in the jumbo space chose to stop making those type of loans until the economic impact of the pandemic was understood.

By late April 2020, conforming interest rates had dropped to the low three percentiles and the volume of refinance applications had reached record levels. Interest rates dropped further into the two percentiles and volume further increased. Lenders who had been able to turn purchase and refinance transactions in thirty days or less, found those processing times significantly slowed. Atlantic Coast Mortgage generally requested thirty days for purchase transactions and fifty-five days for refinances. Some lenders in the industry were slowed to as long as sixty days for their purchases and six months for their refinance transactions!

The record mortgage application volume continued throughout the year as rates dropped into the two percentiles and the nation experienced a robust residential purchase market. By late spring of 2021, the economy appeared to be stable and on the verge of beginning to expand. Interest rates moved higher which slowed the rate of refinance applications and provided some relief to the mortgage industry which had been operating at unprecedented levels for one full year.

This summer has seen rates for Fannie and Freddie conforming loans drop back into the upper two percentiles. Currently the maximum conforming loan amount is $548,250 across most of the country. In the Washington metro area, the maximum conforming loan amount is $822,375. As refinance applications have moderated, turn times for some lenders have returned to thirty days or less, and some of the tighter underwriting standards imposed last year have begun to be lifted.

One aspect of residential lending which has seen multiple changes has to do with property appraisals. At the start of the pandemic, appraisal requirements in many cases were modified to allow for exterior only inspections or “drive-by” appraisals. Now, in those cases where an appraisal is required, most lenders are requiring full appraisals with interior inspections. More and more, however, property inspection waivers (PIW) are being provided in the Fannie and Freddie automatic underwriting decisions. Both agencies are building their own property valuation data bases and based on the other strengths of the proposed loans, they are often not requiring any type of appraisal or inspection of the property.

Another change the industry recently experienced has to do with the maximum percentage of nonowner-occupied property loans which may be included in Fannie and Freddie securities. The new limits have had the impact of significantly increasing the rate and point structure on those types of loans.

As the economy heats up, increasing concerns of inflation, there is the possibility, if not likelihood, that mortgage interest rates will increase. But with rates still generally in the high two percentiles, even an increase of one full point generally keeps rates at very good historic levels for the balance of the year.

Brian Bonnet | Senior Loan Office (NMLS ID#224811)

Brian Bonnet | Senior Loan Office (NMLS ID#224811)

Atlantic Coast Mortgage, LLC (NMLS ID#643114)

e: bbonnet@acmllc.com | t: 703-766-6702

A lifelong resident of Northern Virginia, Brian brings twenty-five years of lending experience to the group. After graduating from The Citadel and serving as a Naval Officer, Brian transitioned to the United States Senate Veteran’s Affairs Committee where he served as a Professional Staff Member and had the responsibility of overseeing the VA Loan Guaranty program. After leaving Capitol Hill and the political world, Brian entered the mortgage banking industry. Keeping abreast of the myriad changes in the lending industry over the years has given Brian a unique perspective and the ability to successfully serve his clients regardless of the current market conditions. With his extensive knowledge about the VA and its loan guaranty program, Brian is widely recognized as a specialist in VA financing. He enjoys sharing his knowledge and experience with others and is certified to teach Financing Continuing Education in Virginia, DC, and Maryland.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link