And they knew I was coming over…

Realtors don’t judge, but we have seen everything . . . and we could write a book.

Tell-all books continue to be the rage, but the story you want to tell about the home you are going to sell or lease should be happy, not scandalous. Buyers or potential lessees should be delighted to see the space you are offering, not bombarded with unexpected situations.

Just this week I visited a lovely home to prep it for a spring sale. It offered an up-close look at the lingering impact of COVID donfinement. At the moment, this house takes real imagination to picture former bedrooms in their original state, littered as they are with ring lights, files, PCs, office chairs and more files.

Unwanted surprises can be the simple crunching of a Lego piece or ink pen under a boot, or shocking eyeballs out of their sockets with inappropriate “artwork” of unclothed subjects, animals mounted on the wall and framed political revolution flyers.

You would think that owners would put prescription drugs away, stash the cash and watches and hide their private correspondence, Social Security numbers and password lists. Unfortunately, in many cases you’d be wrong. Also, often in plain view are too many personal photos, knickknacks and geegaws distracting the visitors.

And, if not just distracting, you can unintentionally create worries. Obviously broken items, all-too-fresh paint and sticky notes claiming “as-is,” “plumber coming back,” “mold test underway” or “pardon the mouse traps” can raise concerns about the level of maintenance the house has received during your ownership. Reading any detailed brochure copy will be helpful, but a now-startled buyer may offer thousands of dollars less than originally considered or simply walk away.

Corral the pets, too, because hyper-amorous dogs or slinky cats in need of attention can literally trip up buyers or tenants. If you leave the house, take the four-legged ones along. Slow-moving tortoises in a glass terrarium are just fine, but keep the other animal life out of the tour. Even a screeching macaw makes just too much noise and suddenly the rooms feel small, I know from experience.

Under construction? Just removed those steps to the basement? Forgot to put up yellow “caution” tape? A dear real estate friend took a step through an unmarked doorway and broke both of her arms when she suddenly landed on the basement floor below.

Remember The Shawshank Redemption. “Why?” Think twice before plastering a room with posters, even if it is your personal shrine to Justin Bieber or Raquel Welch, because people might think someone is either hiding wall imperfections or an escape tunnel.

Humans are a tricky commodity, as well. Tenants may not “get with the program.” Even after giving hours and sometimes days’ notice, my compatriots and I have walked in to find bodies in the shower, racked out in bed, cooking some odorous food or smoking cigars and more. Lordy, you’d be surprised what Realtors see!

Owners can be careless, too. Good grief, they agreed to the appointment. You’d think they’d move the ragged pile of magazines from the den, announce the wet deck stain, clean up dog “bombs” in the yard or throw some mosquito poison pellets in the stagnant fountain to shoo away the flying carnivores.

Discretion is always the by-word and the goal is to have happy buyers and tenants thrilled by what they see when entering your residence. Boring as it may be, creating appeal for all simply means neutrality, fresh paint, good lighting and no nudes.

Wish we could leave this tome with gentle reminders, such as “do not wax the wood steps” or “sweep acorns off the steep driveway,” since I will absolutely fall on my “duff” again, but I have a public service challenge here – to keep you out of the annals of real estate lore or the book I might write!

Ann Duff is a licensed real estate agent in VA, DC and MD with McEnearney Associates, Inc. in Old Town Alexandria, VA. If you would like more information on selling or buying in today’s complex market, contact Ann at 703-965.8700 or visit her website AnnDuff.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Do I need to renovate in order to sell?

Home Sellers are bombarded these days with offers to buy their homes, ways to renovate to get the highest offer, and how to obtain the absolute highest price. It can be confusing, even paralyzing — the answer is a resounding “it depends.”

As in most elements of life, there is a spectrum of possibilities here. Essentially there are three ways to sell a home — it doesn’t have to be perfect.

“As-is, where-is.” This is often when a property has not had many updates or upgrades along the way, and now there is a need to sell. There may not be the funds or desire to undertake any work, and a sense of just wanting to be done with it. This is what the folks sending the postcards are looking for — to purchase a property well under market and “flip” it. They will even take care of contents left behind.

As you would expect, this produces the lowest monetary result for the Sellers. Many of these Buyers are looking to purchase that property for 50-60% of “ARV” — After Renovated Value. Rarely a good deal for the Seller.

Fully Renovated at Top Market Condition. At the other end of the spectrum, the houses which receive the highest prices are the ones fully updated, with all the new and modern features that appeal to today’s Buyers. They are often exquisitely staged, and clearly at the top of their game.

It is one thing, however, to have continually updated one’s property and arrived at this top condition just as it is time to sell. It is another to think of enduring a big remodel just to sell: braving potentially lengthy disruptions, risking supply chain issues, and spending tens of thousands of dollars? Is it worth it? Maybe. Maybe not.

Today there are options to have the renovation work completed by companies who specialize in quick turn-around renovations just before a sale. Some will even front the cost and are paid when the house sells/settles. The McEnearney Advantage features a partnership with such a company, Curbio, and that type of renovation can absolutely be accomplished for a Seller. It works best when the house is empty, but it can also be done around residents. We are happy to help obtain estimates to see if it is right for you. Often, when the dust settles, you can reap very nice returns on the time and money spent. If it is the right approach for you.

In the middle of the spectrum: Clean, Fresh, Nothing Broken. In this approach, a home is decluttered or emptied (depending on whether it is occupied or not), then cleaned, painted, the flooring replaced/refinished, and any items fixed that are worn out or broken.

In many cases, the cost can be fronted and paid at settlement. This not only keeps the preparation time and cost down, it allows the Buyers to put some of their own personal touches into the house after settlement. This approach, in this market, usually yields a price a little below Fully Renovated.

In reality, most houses are prepared for market at a level somewhere between Clean, Fresh, Nothing Broken, and Fully Renovated. Perhaps a powder room near the entrance foyer gets a new pedestal sink, faucet, light and mirror. Or new light fixtures in the kitchen or primary bath. Or new appliances. These relatively minor items can be among the most cost-effective a Seller can undertake.

At McEnearney Associates we believe that preparation for the market, to the extent that works best for our clients, is one of the great values we add. And no, it doesn’t have to be perfect.

Pete Crouch is a Seniors Real Estate Specialist, which means he is well-versed in all aspects of moving as we age. His own downsize gave him tremendous insights into what is involved, from emotional matters to real estate considerations. Pete is a Board Member of At Home in Alexandria (AHA), our local Senior Village, and was the 2018 National Recipient of the “Outstanding Service Award” by the National Association of Realtors for his work with Senior Moves. Text 703-244-4024 or email PCrouch@McEnearney.com for a copy of his Downsize Alexandria! Booklet about living more simply in Greater Alexandria.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

The Real Estate Market in the Metro DC Region Remained Hot Through 2021

In our semi-annual Market Report, we take a comprehensive look at sales data for the second half of 2021, analyze the impact of tight inventory on Washington, DC and the Maryland and Northern Virginia suburbs, and look ahead to the first half of 2022 to help you make the most informed real estate decisions. This market report is a must-read!

Q&A with Maureen McEnearney Dunn, President McEnearney Associates REALTORS

It’s hard to believe that we’ve been dealing with COVID for almost two years. Are things getting back to normal?

We have been in a sustained seller’s market for several years, so I’m not entirely sure what “normal” is anymore. If “normal” means balanced, then we’re not back to normal. The scales are still tilted in favor of sellers in most of the metro DC area. The market certainly paused for about 6 weeks when COVID first hit in the spring of 2020, but it came roaring back. As we have discussed in previous Market Reports, there were lots of people who wanted to change their living arrangements to accommodate working – and schooling – from home which created much higher demand in the suburban markets, while close-in condos struggled a bit.

How did the market fare in 2021?

It started off very strong and stayed that way. 2020 was a record year, and 2021 was even busier. In 2020, COVID shifted the usually strong spring market into the summer and fall, but we saw a bit of seasonality return in 2021. The spring market was the best, and there was an expected and modest cooling as we went into the third quarter. About the only thing that kept 2021 from being even stronger was the one-two punch of the emergence of the Omicron variant and holiday travel. So many people stayed home over the Thanksgiving and Christmas holidays in 2020, but huge numbers of people traveled at the end of 2021. That, along with renewed concerns over COVID, really hurt contract and listing activity in December.

What do you think the market will look like in 2022?

Particularly because of the limited number of new listings in December, we have entered 2022 with a significant deficit in listing inventory – probably the most acute shortage of any period since the onset of COVID. Buyers have returned to the market a bit more rapidly than sellers, so we are seeing a real frenzy right now. But, we believe this will calm down as we head into the spring market for two significant economic reasons that we discuss in detail in the community commentaries in this report. The first is rising mortgage interest rates, and the other is inflation. Homes will become less affordable as rates rise, and inflation in consumer goods and energy prices will further reduce the buying power for most purchasers. The pace of price appreciation will moderate, and we expect overall appreciation to be in the range of 5% – 7 % for much of the region, with lower appreciation for urban condos.

Are you at all concerned about a “bubble”?

We’re fortunate to have been in a strong sellers’ market for a sustained period of time, and even more fortunate that it hasn’t been as overheated as some other areas of the country. We don’t even make the top 20 metro areas for price appreciation – and that’s a good thing. We’d be a bit more concerned if prices had been rising 20% – 25% annually because that simply isn’t sustainable. We have a solid regional economy, and the overwhelming majority of homeowners have equity in their homes. Even those people who have a change in personal circumstances that might force them to sell their homes will have a high probability of being able to sell without highly negative consequences. And in the event there are foreclosures, there is such a significant inventory deficit that the market should be able to absorb them. There’s nothing about this market that resembles the conditions that caused the real estate bubble to burst in the Great Recession.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

This might be a silly question, but…?

“I have a silly question” is something that I hear far too frequently and usually followed by something that I’ve been asked before and isn’t silly at all. Frankly, in my opinion, there are no silly questions.

Before I went full time into real estate, I taught health to 6-12th graders. Like real estate, the stakes were pretty high if questions went unasked. Believe me when I reiterate my opinion that there are NO silly questions. If there is something that you want to know about one of the largest purchases you will likely make — don’t be afraid to ask!

In the meantime though, here are a few of the most commonly asked “silly” questions that I get all the time!

Does the seller have to tell me if there is a ghost in their home? AKA, What must be disclosed?

To me, this is the epitome of a “silly question” and when I say that I mean: something everyone wants to know but doesn’t want to ask. Just further proof that a silly question doesn’t exist. Anyway, to answer the question in short — not in Virginia they don’t.

Sellers are only required to disclose material facts that would affect the value of the home, but ghosts are definitively non-material. Virginia is a “caveat emptor” state, which means “buyer beware”. In fact, the Virginia Residential Property Disclosure is a document listing sixteen items, from “Condition” & “Defective Drywall” to “Sexual Offenders” & “Historic District Ordinance”. All sixteen begin with the verbiage “The owner(s) makes no representations…”

While this may sound disheartening for those looking to buy property in the future, don’t worry — there are many opportunities for you to find out most of this information. Your Realtor will help you with resources and inspectors to ensure that you are well aware of what you are getting into before moving in.

Can I look in the closet? AKA, How up close and personal can I get with a home I want to buy?

As a general rule of thumb, I’d say treat a home that you are viewing the way you would want a visiting friend to treat your home, but maybe just a little nosier. Sellers will expect potential buyers to open a closet, go in an attic and poke around in the basement. However, things like adjusting the thermostat, turning on appliances, touching personal items, and forcing open something that’s been painted shut are definitely things to avoid.

A home showing is a time to see if you like the home. An inspection is the time to check if things are in order since inspectors are licensed and insured.

Who pays who? AKA, ANY money questions

If we haven’t gotten real enough — let’s get REALLY real. No one likes to talk about money, especially in the terms of “how much am I paying you?” But, it is a very valid question and one that must be addressed.

As a home buyer, all of the money you pay will go towards your home purchase. In addition to your down payment, there are closing costs that you will owe, mostly to the lender and settlement company in order to process your loan and title work. The Realtors however, are paid by the seller.

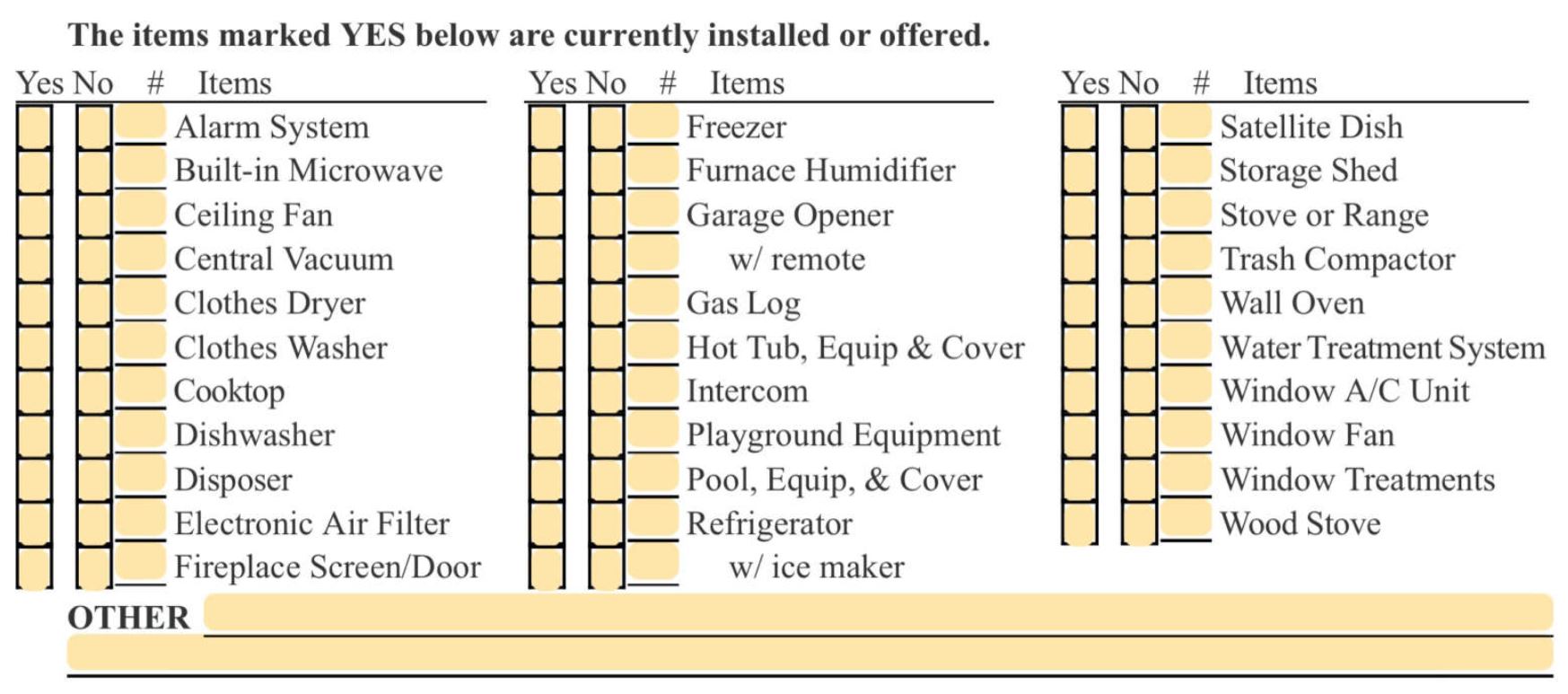

Will I need to buy new appliances? AKA, What comes with the home?

While it is typical in Virginia for all items attached to the home to convey (or come with) the home, this doesn’t always apply. The sales contract includes a list of conveyances, and it can typically be assumed that if a home has an item on the list, it will convey. However, there can always be exceptions.

Perhaps there is a light fixture that has been in the family for generations, or a hot tub that the seller already has plans for moving into their new home. In contrast, some homeowners have custom fit pieces such as bookshelves or custom rugs that would make no sense in their new home, so they leave it behind. While Realtors know what is “the usual” in their area, it is still important to double check each listing’s conveyances so that you aren’t disappointed.

For Sellers, I’d always recommend leaving the appliances. Most buyers would be disappointed to fall in love with a home that doesn’t come with any appliances, and they can tend to overestimate the amount they will cost. It is usually much more cost effective to simply leave the stove behind for the new buyer.

All of these questions above are actual questions I’ve been asked by more than one person. They’ve also all been qualified by the descriptive “silly question”. At the risk of sounding like a broken record, I will repeat — there are no silly questions!

Even if you think you know, but aren’t sure, ask! There should be a level of trust with you and your Realtor that you don’t feel silly asking the “silly questions”. Frankly, I’d venture to say that any professional who makes you feel silly after asking a question isn’t a professional at all.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many faceted process of buying or selling a home. Contact Hope at 703-244-6115.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Five Questions with Dave Hawkins of McEnearney Associates

1. What in the real estate market do you think has changed the most over forty years?

I would have to say technology has driven the greatest change. Look at the way we conduct our business today. Property information is available to everyone, agents and customers alike, at our fingertips. The internet, phone apps and QR codes give instant access in real time. Purchasers view photos and videos of homes for sale from their home or car. Contract offers are written, signed and presented to sellers electronically. The access to information makes everyone better informed. The systems and programs advanced through new technologies impact every aspect of the buying and selling process for real estate agents and their clients.

2. Why is it important as a business to be involved in the community?

Our communities support our business. It seems only right that we should give back to those who make our success possible. Because we are so connected our agents naturally become involved in the many organizations, charities, business and programs that make our communities strong. We sit on boards. We contribute dollars to sponsor events. We advertise programs and fundraising efforts. Our clients do the same and make us aware of ways that we can help. We recently championed an effort to improve a park in D.C. in an underserved neighborhood. We painted structures, built new ones, cleaned up trash and had a great time doing it. That day about 60 of our agents wore their blue jeans and t-shirts and felt like we had made a difference. Why get involved? It feels really good when we do.

3. How has the pandemic changed the way your agents conduct business?

Although real estate agents have been capable of working remotely for years, the pandemic forced us to fine tune our systems and skill sets. Instead of standard open houses we created virtual opens. Instead of on-site meetings we gathered on Zoom calls. We worked harder to communicate frequently with our fellow agents and our customers and clients. And we developed a greater appreciation for one another and longed to be together again.

4. What does your leadership role provide for clients?

At McEnearney Associates we have always believed that the benefit to our clients is delivered by our agents. The best agents in the business deserve the best support that a company can provide, so that they can in turn deliver exceptional service. Our managing brokers provide guidance, education, tools of the trade, and an environment where agents thrive and excel. That commitment empowers our agents to deliver on the promise of superior service and value to our clients.

5. McEnearney Associates has hit a new milestone in all of Alexandria, what do you think are the things that contributed to your firm’s success?

First and foremost, our agents. Without a doubt, they are the most well intentioned, skillful and determined group of real estate pros that I have ever known. They care about their clients and strive to succeed for them. They have the knowhow and tools required to tackle any situation. And they don’t give up when faced with a challenge. In addition, due to the excellence of our agents, we have a very loyal following in the communities we serve. Our reputation is nothing more than the sum of the reputations of our agents. And that is a tidy sum. A reputation well-earned and respected. Ours is a people business. We are fortunate to have very talented people.

We look forward to answering your real estate questions in 2022. Our best wishes for a Happy New Year!

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: ALX@mcenearney.com or call 703-549-9292.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Home Buyer Programs

As we mentioned recently in our FAQs for Home Buyers, we believe the reality of homeownership is something that should be made more widely available and shouldn’t ever be limited to a select few. Throughout Washington, D.C., Maryland, and Virginia there are many different programs designed to make the dream of homeownership into a reality. These programs can be in the form of down payment assistance, a credit for first-time buyers, financial incentives to reinvest in certain areas of the community, discounts on property taxes, or specific programs for our teachers and first responders. Many jurisdictions have programs that are designed specifically for city or state employees so that they can live in the same communities where they work.

The list below highlights many programs in the DMV and we encourage you to reach out to a McEnearney professional or a qualified mortgage lender to see if one of these programs can help you in your efforts to become a homeowner. (Please note that the availability and qualifications for each of these programs are subject to change.)

WASHINGTON, DC

- DC Opens Doors

- Home Purchase Assistance Program (HPAP)

- Employer-Assisted Housing Program (EAHP)

- ROD 9 – Lower Income Homeownership Exemption Program

- Inclusionary Zoning (IZ) Affordable Housing Program

- Negotiated Employee Assistance Home Purchase Program (NEAHP)

- HomeReady Mortgage

- Home Possible Mortgage

- Mortgage Credit Certificate Program Q&A

MARYLAND

- The Maryland Mortgage Program

- Maryland SmartBuy Program

- Teacher Next Door Program

- Maryland Mortgage Program 1st Time Advantage

- The Educator Mortgage Program

- Settlement Downpayment Loan Program (SDLP)

- Takoma Park Home Stretch Program

- Gaithersburg Homebuyer Assistance Loan Program (GHALP)

- Prince George’s County Purchase Assistance Program (PGCPAP)

- Pathway to Purchase

- HOME Investment Partnership

- Baltimore City Employee Homeownership Program

- Baybrook Boost

- Buying Into Baltimore

- Mortgage Purchase Program (MPP)

- HOC Homeownership Programs for HOC Residents

- Home Possible Mortgage

- HomeReady Mortgage

- Mortgage Credit Certificate Program

NORTHERN VIRGINIA

- VHDA Loan Program

- Virginia Housing’s Down Payment Assistance Grant

- Homeownership Down Payment Assistance Program (DPA

- Moderate Income Purchase Assistance Program (MIPAP)

- Low Interest Mortgage Program

- Fairfax County First-Time Homebuyers Program

- HomeReady Mortgage

- Home Possible Mortgage

- Mortgage Credit Certificate Program

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

FAQs for Home Buyers

At McEnearney Associates Realtors, one of our passions is helping our buyers navigate today’s real estate market. We also believe the reality of homeownership is something that should be made more widely available and shouldn’t ever be limited to a select few. Your trusted McEnearney Associate will help guide you through current market trends, will help advise you on the various types of loan and down payment assistance programs that are available, and will be your advocate throughout the entire home buying process. To see available home buying programs in the area, CLICK HERE.

1. What to do if your credit is not great?

Below are a few things that you can do to help repair your credit and raise your credit score.

- Review Your Credit Report – It is important to know what is on your credit report. You will want to dispute any inaccuracies or missing information by contacting the credit reporting agency and your lender.

- Pay Your Bills on Time – While this may be easier said than done, your payment history is the main driver of your credit score. Missed or late payments could have an affect on your credit score for years to come.

- Catch Up on Past Due Bills – You will want to take care of any past due bills or contact your lender if you are struggling to make the payments. They may be able to set up a payment plan that will help.

- Consider a Secure Credit Card – While it works like a traditional credit card, a secure card is one that requires you to put money down as a security deposit to open the account.

- Become an Authorized User – If there is someone you trust with a good credit score they can add you as an authorized user to their account. You can make purchases but they are responsible for the payments. Their responsible use can help your credit and boost your score.

- Keep Some of Your Credit Available – By keeping your credit utilization below 30% you can show you are managing your credit responsibly and not overspending.

- Stay on Top of Your Progress

2. What is the truth about down payments?

Many prospective buyers believe that you need to have a large down payment (10% or more of the contract price) in order to be able to purchase a home. While there can be some advantages to putting more money down, the truth is there are several different options for smaller to no-down-payment loans. It is important to speak to a qualified loan officer who will guide you through your options and help you decide what type of loan works best for you.

3. What does the buying process look like?

The first step in the process is to hire a real estate professional to discuss what it is you are looking for in a new home. Together you will discuss things like location, your wants and needs, budget, architectural preferences, and much more. They will also make sure you are working with a qualified mortgage lender and that you are applying for the type of mortgage which will work best for you. Along with your agent, you will tour properties to eventually identify the one you wish to purchase. They will help you write an offer while discussing things like price, any contingencies you wish to have within your offer, the financing, and any other terms. Once your offer is accepted (ratified), you will work through any contingencies like a home inspection or a financing contingency together. During this time you will also be working with your lender to secure your financing on the property. Once all contingencies are satisfied and your loan has been approved, your agent and lender will help you prepare for settlement – which is when you officially take ownership of the property.

4. How do you buy if you are self-employed?

If you are self-employed the process of buying a new home is no different than it would be for someone who is not. The difference between the two employment statuses as it pertains to purchasing a property revolves around financing. When you are self-employed, your mortgage lender may require additional years of tax returns, additional documentation about your company and its financials, and may require a greater number of bank and/or investment statements than they would for someone who is not self-employed. This is why it is very important that you work with a qualified mortgage lender who can guide you through the process and make everything as seamless as possible.

5. What is buying a home actually going to cost?

When you are buying a home, there are fees and taxes that you will pay in addition to the agreed-upon contract price. We commonly refer to these as “closing costs” and they will vary slightly depending on where you are buying. These costs come in the form of state and local taxes that are charged for the purchase and the sale of a property, and they are based on the contract price. You will also have costs that come with obtaining a mortgage like an appraisal and money that will go towards setting up your escrow account which pays your property taxes and hazard insurance. There is no set amount for closing costs as it will vary depending on the jurisdiction in which you are buying and how your contract is structured. However, most real estate agents and mortgage lenders will tell you that an average for closing costs is between 2% and 3% of the purchase price. Your real estate agent and your lender will walk you through all of the additional costs involved in purchasing a property.

6. What is a bidding war?

A bidding war as it is often referred to is when there are multiple different groups who are trying to purchase the same property. This will often result in one or more of the groups offering to pay above the asking price. Your agent will advise you on the best strategy if you find yourself in a multiple offer or bidding war situation. The strategy may include shortening or eliminating some contingencies or offering to pay above the list price.

7. What does this market mean for you?

One of the most common questions a real estate agent will get is “How is the market?”. You may think that this is an easy question to answer but it’s actually quite complicated. If you are a homeowner at a time when and where homes are selling very quickly, then it’s a great market for you. Conversely, if you are looking to buy in that market, you know that you might not have any room to negotiate and that you might have to pay over the asking price which makes it a challenging market for you. As you can see, the same real estate market can mean two very different things to buyers and to sellers. Your real estate professional will guide you through the ever-changing real estate market by keeping you up to date on market trends, helping strategize the best way to navigate the current market trends, and to ensure that you have all of the information and data necessary to make the best decision possible.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Should I Consider A Home In An HOA?

When looking to buy a home, an important thing to consider is whether or not you are interested in having a home within either a homeowner’s association or condominium association. What is also important is understanding the differences between the two! While many have heard of HOAs and condos, not many understand exactly what they are. It is even a common misconception that the terms can be used interchangeably — however, they are actually quite different.

So, how can you tell the difference?

As a general rule, most apartment style homes and townhomes fall under an association and most detached homes do not. Of course, there are exceptions to every rule!

Differences Between an HOA & a COA

First of all, what is the difference between a Homeowner’s Association and a Condo Association? Condominiums usually exist within a building, in which owners own their own unit as well as a joint interest in the common areas. Common areas include community spaces such as patios and party rooms, as well as the roof and other exterior features, such as pools, tennis courts and more. Sometimes, they even designate windows and balconies to be common responsibilities. All owners in a condo building own equal share and financial responsibility for maintenance of these common spaces and responsibilities.

In a homeowner’s association, the ownership is a little different. Each member owns their own home and parcel of land. Common areas, such as playgrounds, pools, tennis courts, and parks are owned and maintained by the association. Sometimes the roads are maintained by the HOA, and sometimes it is the county responsibility. There is no joint ownership.

Both condos and HOAs have fees that the owners pay — typically monthly or quarterly. These are different from fines, which owners are required to pay if they break rules in the community. The rules for communities and associations can be vastly different from place to place. The majority of rules are in place with the intention of maintaining the integrity of the community and common areas.

Contingency Period During the Buying Process

Once a contract is agreed upon and signed by both buyer and seller there is a required time period for the purchaser to review the association documents. In Virginia, the period to review is 3 calendar days from receipt. The documents will include meeting minutes, by-laws, rules, and other documents that can give a better understanding of the community and its financial stability.

The good thing about this contingency period is that it is required to be given to all buyers. In a competitive situation with multiple offers, buyers often waive contingencies such as inspection or appraisal. The document review period cannot be waived by anyone and puts everyone on the same playing field. All buyers have the right to know the details of the association they are joining, before they join, and will have the opportunity to cancel if they don’t like what they see.

What to Look for in Association Docs

In short, violations, upcoming assessments, maintenance plans and finances. The association will do a pre-sale inspection and there should be a cover sheet that lists any violations that the seller is required to fix. You and your Realtor should address this with the seller, because the association will expect the buyer to fix them after the sale. Also look for a disclosure on upcoming assessments. These can be hefty and if they are just under discussion at this point, and have not been finalized, an assessment will become your responsibility in future.

We also suggest that you read through any meeting minutes, as they often contain topics of discussion that are concerns to the current owners. This is valuable information if you are buying in the community. I also suggest reading through the current financial statements and most importantly, looking to see how much cash the association has in reserves for future maintenance.

If there is anything in the documents that you don’t like or feel uncomfortable with, you can void the contract during this period. There is no explanation required. It is incredibly important to look carefully and to relay any concerns to your realtor immediately.

What Can Be Included in Fees

Of course, associations are not only about rules and fees! Common areas can also include fun things like pools, fitness centers and playgrounds. Also, some fees cover utilities like water, trash, gas — sometimes even electric, but don’t count on it! A huge selling point for many homeowners is landscaping. Some associations take care of tree trimming, snow removal, and exterior maintenance.

It is important to weigh the cost of the association with what you value most. If a 24-hour security guard is important to you, that peace of mind will cost you a little more.

A good lender should be able to include the dues when they run the numbers for your loan. They should be able to give you a very close idea of what your monthly payment will be.

It is incredibly important to ensure that you are able to pay for not only your mortgage, but also the association fees.

Pros and Cons

Of course, just because your home isn’t a condo or in an HOA doesn’t mean you can do whatever you want. Always be sure to check with the city before making any drastic changes to your home. Some homes are also in a historic district and are required to maintain the historic integrity of the home.

Like most everything else in life, there are pros and cons to all these options. For some buyers, it is perfect to have the amenities and features of a managed community, while others prefer fewer guidelines and requirements. It’s important to weigh all of the factors when deciding what is right for you. I would be happy to chat with you about your options and to share my expertise about buying a home.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many faceted process of buying or selling a home. Contact Hope at 703-244-6115.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Man vs. Machine?

For many a successful Realtor, this recruiting call will sound familiar: “Technology will boost your business and make you a star.” (While I agree it helps, personal relationships and real substance mean the most to me. Signed, Ann D.)

For instance, I absolutely hate to throw out old files which, of course, can be scanned into my iCloud account, the company server or a system we have called “Skyslope.” But, much like holding a real book instead of a Kindle, I really prefer reaching for the old, ink-stained file with scribbled notes from your purchase on North Fairfax Street or Mount Vernon Circle, or sale on Grand View or Prince Street, when it is time for me to sell or help someone buy that property.

What is so blasted precious? A wide range of hidden treasures can be found in those paper files – the first name of the scheduler for the unreachable master carpenter who put in the den bookshelves, the key pricing information for the French drain contractor, as well as for the contractor you didn’t choose and why, or the cell phone number for the talented electrician and his brother who can install fans in 14- to 20-foot family room ceilings (imagine the Flying Wallendas).

Oh, I’m not such a dinosaur that these people aren’t also in my personal Excel resource list, but the context, receipts, paint colors and scribbles are often a huge help in getting onto a pro’s schedule.

Luckily, I have outgrown many out-of-date practices – heck, we used to have 25 copies of a photo made at Ritz Camera, then wield Glue Sticks to attach them to the front of cardboard brochures! Open Houses were heralded with waving helium balloons before we realized that helium is a non-renewable resource – made on earth via nuclear decay of uranium, and it is recovered from mines – TMI? – we even had a tank here in the office.

And even I have graduated to creative tools – Saved Searches, instant alerts to screen and match listings, text flashes – though just last month I went “street walking” with a pen and notebook, like a flat-foot detective, to find clues for commercial lease opportunities – unadvertised empty spaces, old signs, etc.

And even I have graduated to creative tools – Saved Searches, instant alerts to screen and match listings, text flashes – though just last month I went “street walking” with a pen and notebook, like a flat-foot detective, to find clues for commercial lease opportunities – unadvertised empty spaces, old signs, etc.

I also rely on the personal strength and human excellence of my full-time assistant. We take any situation and make it better with laughter and a nice dose of creativity. Using the skilled, real people of our company’s in-house marketing staff means we can personalize each one of my listings far more effectively than using a standardized format in a technology-constrained data dump.

People are just better. We haven’t hired a robo-calling program to make cold calls as some firms have. Some vendors even use call centers to create lists of homeowners who don’t hang up when they are asked whether “they’d sell their home,” then sell those lists to startup real estate companies for targeted mailings or Meta blasts.

These thoughts and years of experience are brought to you by Ann Duff, Realtor, with McEnearney Associates. Based in Alexandria, Ann is busy day-in and day-out in DC, Maryland and Virginia, listing, selling, and leasing distinctive properties with and for wonderful people – and all with a splash of fun! Let’s Get Busy… contact Ann at 703.965.8700 or visit her website AnnDuff.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Zillow closes iBuyer; what does that mean?

If you follow real estate at all, you probably saw the announcement that Zillow is closing its iBuyer program. This is big news, but what does it really mean for Zillow and the real estate industry?

First, let’s clarify what is an iBuyer program. It’s where deep-pocketed online companies give sellers an instant cash offer on their house (the “i” in iBuyer is for “instant”). Usually the sales price is computer-generated (like a Zestimate), and the homes are bought unseen. The buyers are not typically looking to do major renovations and want to resell quickly.

Online buyers have existed for quite a while now, and many have been very successful. Zillow’s iBuyer program was not national but in a few carefully selected markets with plans to eventually roll out more extensively. Zillow was aggressive in its purchases, relying on the automated price generated. Some buyers were thrilled with their offers, receiving more than they may have expected. In fact, it appears Zillow overpaid for many of the homes and now has a huge inventory that it must sell off, potentially at a loss.

This doesn’t speak well for the Zestimate data or technology-based pricing methods. Why not? In large part, because technology can’t determine a property’s condition, a major factor in pricing homes.

This is no surprise to real estate agents. Recently, I was trying to price a home and was looking at the neighborhood comps. A home a few doors down that looked wonderful in the pictures had just sold for a fairly low price. I called the listing agent to understand why. According to her, the house had a very unpleasant pet-related odor, and the neighboring house was very cluttered, “like a junkyard”. These are extenuating circumstances that automated technology can’t determine or factor in.

Technology wasn’t the only downfall for Zillow’s iBuyer program. Zillow has not been immune to the global supply chain issues and labor shortages. When time is of the essence, these delays can be very costly for the home improvements sometimes needed. Finally, Zillow determined that the iBuyer business scale needed to be very large in order to be as profitable as was hoped and, in the end, they decided that this was something they did not want to pursue.

Does that mean Zillow is in trouble? In short, no.

Before 2018, when Zillow decided to get into the iBuyer business as well as the mortgage business, it offered consumers a marketplace to sell, buy, or rent properties. It also marketed properties listed by real estate agents where buyers can search properties and reach out to an agent for more information or to schedule a showing. The person they contacted was not always the listing agent, but a Premier Agent who pays fees to Zillow to obtain leads.

This marketing program has mostly produced buyer leads. By getting into the iBuyer program, Zillow was hoping to be able to generate more seller leads for their Premier Agents, therefore hoping to increase the number of Premier Agents and their revenue stream.

While there are many in the real estate industry who fear Zillow is trying to replace the real estate agent, I do not believe this is their model at all. Contrary to popular belief, Zillow does not sell properties directly to the public. For their iBuyer program, they rely on a small group of staff to purchase properties. Once a home purchased through the iBuyer program was ready to sell, they would offer it to a vetted Premier Agent.

Real estate agents, of course, have the advantage for detailed information and acute market knowledge, but we can’t offer national searches. We are restricted by our local MLS. Here in the Washington area, we are fortunate to have an expansive area with feeds that include parts of New Jersey and Pennsylvania. But Zillow saw a gap, and thus an opportunity: give the consumer an opportunity to not be restricted by a single MLS.

Zillow is a fine place to start looking for a home, but it should be the first step, not the full process. Most buyers don’t want to wait too long before reaching out to a professional, as we often know about homes not yet listed that are for sale (see my last article “Full Market Exposure” for more details) or know the nuances of a particular home or market.

For those still interested in searching for an online cash buyer, there are still many online iBuyer programs out there. McEnearney Associates just launched McEnearney Advantage. The McEnearney Advantage offers our sellers the option of seeking iBuyers as a way to market their homes.

I recently had a client who wished to do this. We entered the information and received two viable online offers. The first came from a local flipper. We met at the property and he made an offer. The other was strictly an online offer. The seller wasn’t happy with the price offered and decided to move forward by putting his home on the market. The house sold for $38,000 more than the highest iBuyer offer. This isn’t surprising to many – it has been proven time and time again that sellers receive a significantly higher price when they list their home on the market versus selling off-market.

The bottom line is that Zillow is here to stay, as are real estate agents and iBuyers. We will all continue to compete for our share of the market, and we will all continue to offer different services to meet the evolving needs and demands of the consumer.

Rebecca McCullough is a licensed real estate agent in Virginia with McEnearney Associates, Inc. in Old Town Alexandria, VA. If you would like more information on selling or buying in today’s complex market, contact Rebecca at 571-384-0941 or visit her website RebeccaMcCullough.com.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link