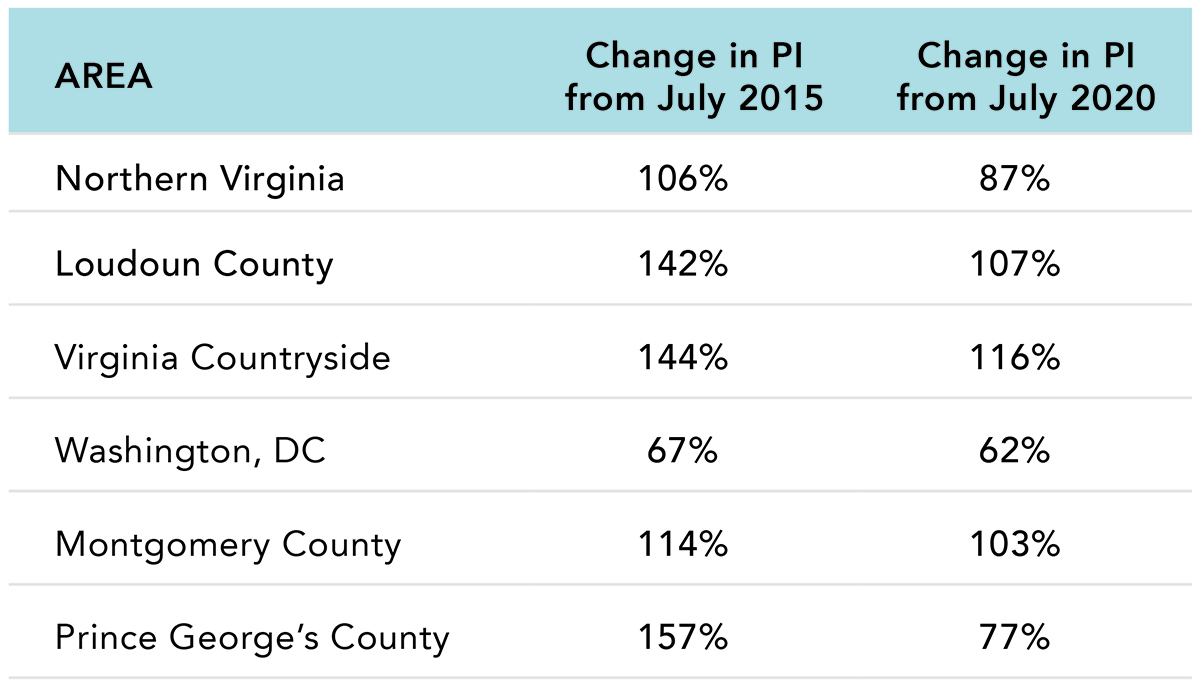

As the region’s most trusted real estate resource, it has always been a priority for us to educate our consumers about the realities of the current market. For many homebuyers in the greater Washington, DC area, the dream of homeownership has become less affordable. And it’s not just because of rising home prices—mortgage rates have risen as well. The numbers tell the story: the cost of a median-priced home today is more than double what it was 10 years ago—and twice as high as it was just in 2020. This escalation has far outpaced income growth, leaving households struggling to bridge the gap. Whether you are buying and/or selling, it has become more important than ever to work with your experienced real estate agent for a full and accurate market analysis.

Why Prices Have Climbed So Fast

Several forces have converged over the past decade to push home prices upward.

Limited Inventory.

The number of homes for sale in our region has remained historically low for years. Owners with low mortgage rates are reluctant to sell, and new construction has not kept pace with demand—especially in affordable price ranges. But finally, more inventory is on the market now – about 40% more than just a year ago.

Resilient Demand.

The DC metro area benefits from a diverse economy, and buyer demand has remained steady in the face of these rising costs.

Interest Rate Dynamics.

The pandemic years saw historically low mortgage rates, which drove a buying frenzy and pushed prices sharply higher in 2020 and 2021. Since then, rates have risen significantly, but rather than cooling prices, higher rates have worsened the affordability crunch by keeping current homeowners in place and reducing available inventory.

Rising Construction Costs.

Labor shortages, higher materials costs, and zoning restrictions have made it more expensive and more difficult to build new housing—particularly entry-level homes.

The Impact on Buyers – and Sellers

For first-time buyers and for those with solid incomes, saving for a down payment while covering rent, student loans, and other expenses is difficult. For move-up buyers, the challenge is different but just as real. Selling a current home may net a substantial gain, but replacing it often means a higher price and a higher mortgage rate, and may carry a capital gains tax on top of that reality. The result? Many are choosing to stay put.

And for sellers, who have held all the cards for much of the last decade, there has to be an awareness that a much more balanced market is the reality today. While inventory is still below pre-COVID levels in most of the region, buyers do have more choices now than at any time since the onset of the pandemic. Those who can afford to buy are taking their time to make a decision, and roughly one-third of the homes on the market have had at least one price reduction. Sellers who believe the market hasn’t shifted will need to adjust to the changing market conditions.

Looking Ahead

The affordability crisis is not unique to Washington, DC, but our region’s strong fundamentals—jobs, education, and quality of life—mean demand is unlikely to evaporate. In the meantime, buyers and sellers alike will need to be strategic, informed, and ready to act when opportunities arise.