Looking for reasons that the metro area’s real estate market should be in the tank wouldn’t be hard. An uncertain national economy. Conflicts in Eastern Europe and the Middle East. Trade wars. DOGE-related cuts to federal employment. Mortgage interest rates that remain above 6%. Affordability challenges, especially for first-time homebuyers. And if those weren’t enough, the government shutdown in the fall of 2025 was the icing on the cake.

Even with these challenges, the market today looks remarkably similar to a year ago. Except for The District itself, prices are steady to slightly higher, contract activity is off only modestly, and well-priced homes can still attract multiple offers. The pulse may be slower, but the patient is healthy.

The Power of Resiliency

Washington’s economy has always had a stabilizing backbone – federal employment and contracting, education, health care, and a growing tech sector. That mix has made the region one of the most stable real estate markets in the nation; our “highs” are never as high as some areas, and fortunately, our “lows” aren’t as low. While other metro areas (think Miami, Phoenix, and Las Vegas) swing wildly with national trends, the DC area tends to bend rather than break.

Buyers and sellers alike have adjusted expectations. Homeowners who refinanced at 3% mortgage rates remain reluctant to sell, but many who must move – because of job changes, growing families, or downsizing – are finding the market far from bleak. For every blaring headline about economic turbulence, there are quiet stories of families successfully buying and selling homes because they recognize that life doesn’t wait for perfect conditions.

A Shift Toward Leverage

The word of the season for buyers is leverage. For the first time in nearly a decade, they have a bit of breathing room. Inventory levels are up – roughly 40% higher than this time last year – and the frenzy that defined the pandemic years has cooled.

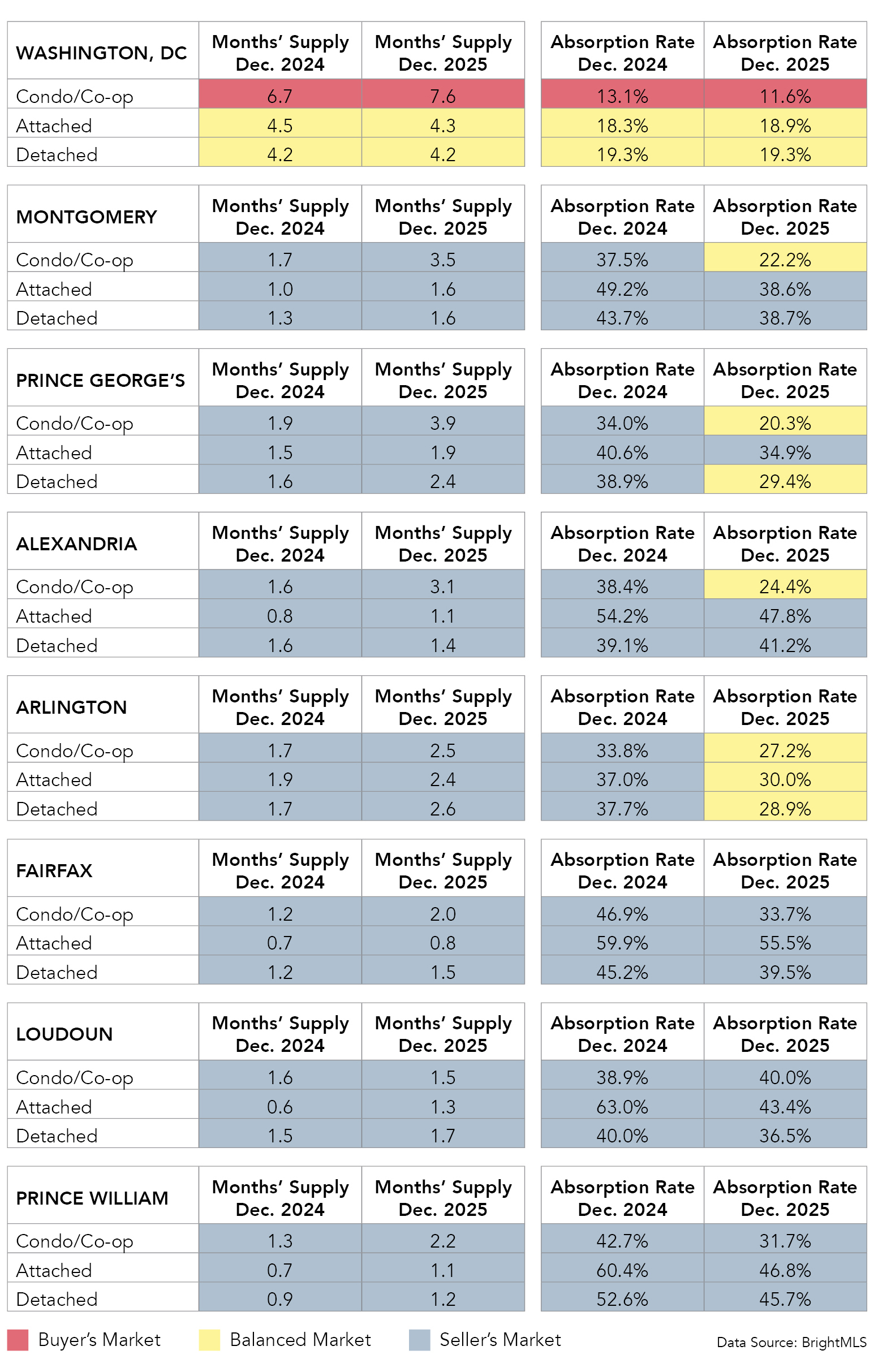

Every month, we look at several key metrics at the county/city level at a deeper level to help us gauge the shift in the market. Chief among those metrics are “months’ supply” and “absorption rates.” The former compares the month-end inventory to the number of contracts that month. We generally judge a supply of less than four months to be a seller’s market, 4-6 months as a balanced market, and above six months as a buyer’s market. Absorption rates measure the percentage of homes that were on the market that month that went under contract: a rate above 30% indicates a seller’s market, rates between 15% and 30% indicate a balanced market, and rates below 15% are a buyer’s market. And in each case, we look at the three property type categories: condos and co-ops, attached homes, and detached homes.

As you'll see in the table below, almost every single local jurisdiction and every single property type have higher supply and lower absorption rates than a year ago. And at the same time, there are considerable differences among those areas. In Washington, DC, the supply of condos and co-ops has risen to 7.6 months from 6.7 months, and the absorption rates have fallen from 13.1% to 11.6% – it’s a buyer’s market now. Those metrics represent very different market conditions from those in, for example, Fairfax County, where the supply of condos and co-ops has risen to 2.0 months from 1.2 months, and the absorption rates have fallen from 46.9% to 33.7%. While the condo market has softened in Fairfax County as well, it’s still (barely) a seller’s market.

It comes as no surprise that the areas that are now more buyer-friendly are those with a higher percentage of their workforce as federal employees. About 21% of DC’s workforce is federal, whereas it’s 9% farther west in Loudoun County. Yet overall, that means more choices for buyers, more room for negotiation, and less pressure to waive contingencies. Meanwhile, sellers are learning that pricing and presentation matter again. Homes that are competitively priced and well-prepared still move quickly; those that overshoot the market will linger.

For buyers who can manage today’s interest rates, this is an opportunity not seen since before the pandemic. With more homes to choose from and less competition, they can make measured, informed decisions. That’s a welcome return to normalcy.

Looking Ahead

The coming months will continue to test the market’s balance between confidence and caution. Much depends on the path of interest rates and the broader economy, but the fundamentals of the DC metro area remain strong. Job diversity, population stability, and the magnetism of the capital region all point to a market that, while not booming, isn’t busting either.

In short, Washington’s housing market is doing what it does best – adapting. It’s resilient enough to withstand the bumps and steady enough to give both buyers and sellers a fair shot. After years of extremes, that balance itself feels like progress.

Note: This article was updated in January 2026.