When considering a move, sometimes there’s a dilemma. Is this the right time to buy, or should I rent again? In some areas of the country, it’s a clear choice. If mortgage payments will be consistently lower than rent, or at least close, there is an obvious opportunity to see appreciation in your investment and come out ahead in a few years. In our area, it can be a little tricker.

The first step in your decision-making process is to find a good Realtor who will be patient, answer all of your questions and see you through the process — whether you decide to rent or buy this year. Your Realtor will guide you through the process of shopping for homes that fit your situation and budget and will negotiate diligently on your behalf when the time comes. They also have great resources and can refer you to trusted lenders, which is your second most important step in making your decision about a home!

Whether you want to buy now, or even in a year or two, an experienced local lender will provide all the important financial information that you need to make your decision. They will look at your credit score, job history, income, as well as your assets and debt. All this information will help them to map out the best plan for your future, regardless of where you already are in the process. A good lender will give you options for loan programs, helping you create the most competitive offer when you are ready to buy, and they will show what your interest rate would be depending on how much you put down on your loan. They will also have guidance for you on how your tax savings may allow you to make a mortgage payment higher than what you would be comfortable paying for a rental. Your Realtor and lender should be identified early, as they will become your close advisors in this journey to decide whether to rent or buy.

Let’s talk about the upside of buying. Clearly, there are many reasons to buy. First, you can truly make your home your own. Remodeling, updating and even just painting are all your decisions and to your tastes. Second, your investment will grow and make money for you as home values increase. Third, depending on the mortgage program chosen, your payments will remain almost the same for many years, except for minor changes in taxes and insurance. Lastly, the cost of waiting will be higher interest rates — now at all-time lows — and more expensive homes. Your buying power will lessen the longer you wait.

A few years back, we met Margaret and Devon (names have been changed) at a rental in Alexandria where the monthly rent was $2,700. It was a 2-bedroom, 2-bath condo about a mile from the center of Old Town. They were newlyweds and expecting their first child. They mentioned to us that they didn’t think that it would be possible for them to own a home in this area. We suggested they talk with one of our favorite lenders, and they discovered that a mortgage payment for a home up to $550K would be about the same monthly payment. Also — they could get away with just 5% down. Like many newlyweds, they didn’t have quite that much to put down, so their parents gave them a tax-deductible gift of $25K. In this instance, it made much more sense to buy than rent, and this family was thankful for the information. Several years later, their $549K purchase is now worth $635K and growing.

Now, let’s talk about the cons of buying and why some are deciding to rent.

First, when you buy a home, the maintenance becomes your responsibility, so knowing exactly what you are getting into is important. How old are the systems in the home and the roof? What’s new, and what will need to be replaced in the next few years? Your realtor will help you evaluate the home and get the necessary inspections.

Secondly, it’s often competitive to get a home. This past year has been a seller’s market in much of the U.S., and Northern Virginia and D.C. have been particularly difficult areas for buyers. Many listings have had anywhere from 5 to 20 offers on them. Low interest rates and pandemic-induced cabin fever has caused people to reevaluate their space, and in many cases, look for a newer, larger home. The Amazon headquarters and new Virginia Tech campus on the Route 1 corridor created a lot of buzz about increasing values. All of this resulted in high demand and low inventory.

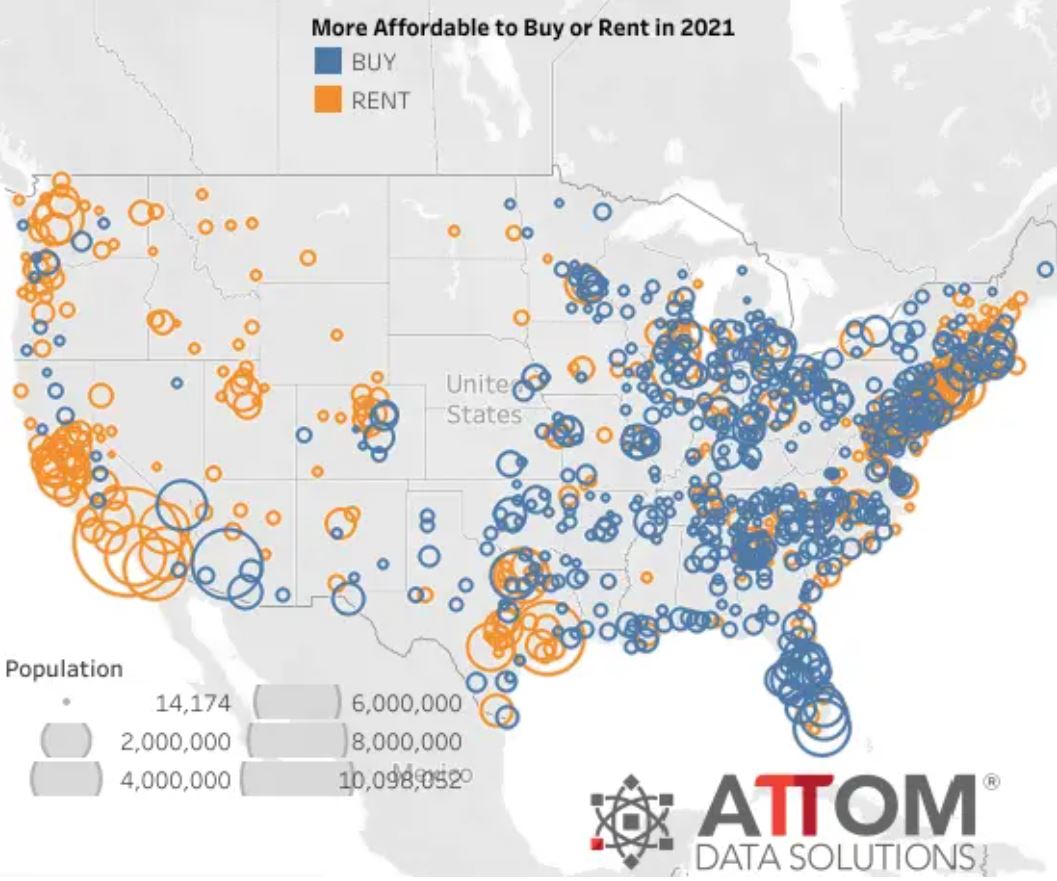

Photo Courtesy Of: Attom Data Solutions

According to ATTOM Data Solutions, a property database company, “owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 63% of the 915 U.S. counties analyzed for the report.”

The bottom line is, your decision on whether to buy or rent will be unique to your situation. You should talk to a Realtor and a lender, sooner rather than later. They will help you with a full evaluation of the market and of your buying power so you can make an educated decision on whether to buy a home this year or to wait.

And, of course, if we can be of assistance, we are always happy to help! We would never try to convince someone to get into a situation that they cannot afford. However, we would also never want someone to miss opportunities that they can afford because they didn’t know their options. Homeownership is often more attainable than people realize. Simple education, guided by the experts, is the key to not missing out on your chance to invest in your future! For a confidential meeting, reach out to Hope and Kim Peele at 703-244-5852.

Kim Peele is a licensed real estate agent with McEnearney Associates, Inc., lives in Old Town and works in Virginia, D.C. and Maryland. She and her daughter Hope Peele are The Peele Group. Kim is a second-generation Realtor and fourth-generation Washingtonian and is dedicated to helping owners through the challenges of selling their home.

Take a look at our website for all of our listings available throughout Washington, D.C., Maryland, and Virginia.

Don’t miss a post! Get the latest local guides and neighborhood news straight to your inbox!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link