We’re now more than two months into the region’s – and the nation’s – efforts to cope with the COVID-19 pandemic and everyone, in every walk of life, has been impacted in some way. The real estate market is no exception. We believe that an important part of what we do at McEnearney Associates is to provide accurate, timely information to our clients so they can make informed decisions, and we want to offer a candid view of some of the myths and the truths about the state of the market.

Myth #1 – Buyers and sellers are sitting on the sidelines and the real estate market has crashed.

There is no doubt that in the first weeks of the region’s shelter-in-place orders, new listing and contract activity dropped significantly. In the first month, the number of newly ratified contracts fell by 45%, and new listings coming on the market fell by 35%. Yet in the month since then, more buyers and sellers have returned to the market and those declines are approaching 20%. Given the uncertainty we’re all facing, that is truly remarkable. And the buyers that are in the market are serious and are making decisions rapidly when they see value. The average number of days a home is on the market before receiving a contract is a popular market indicator of buyer behavior. This year since mid-March that average was 22 days. During the same time period last year, it was 27 days.

Truth #1 – We’re all in the same storm, but we’re not in the same boat.

The Washington, DC region has fared well compared to some areas of the country where real estate is not considered an “essential business.” Some areas – Philadelphia is one example – have experienced drops in contract activity in excess of 80%. On a more personal level, a homeowner who owns a restaurant and can’t make their next mortgage payment is in a very different vessel than their next-door neighbor who works in cyber-security. It’s important to know all those market metrics about days on market, and sales-price-to-list-price ratios, but one’s individual circumstances matter more.

Myth #2 – Home prices are coming down.

All real estate is local, and there are small pockets where it is likely that prices have softened a bit in the face of lower demand. But the number of available homes on the market has dropped as well, so the relative balance between supply and demand hasn’t changed much from last year’s spring market. Overall, there is absolutely no indication of falling home prices. Homes that went under contract last year between mid-March and mid-May sold on average for 99.6% of their original list price. This year it is exactly the same. Based on what we have seen so far, the pace of price appreciation may be slowing, but prices are not coming down.

Truth #2 – Home prices are holding up well, but…

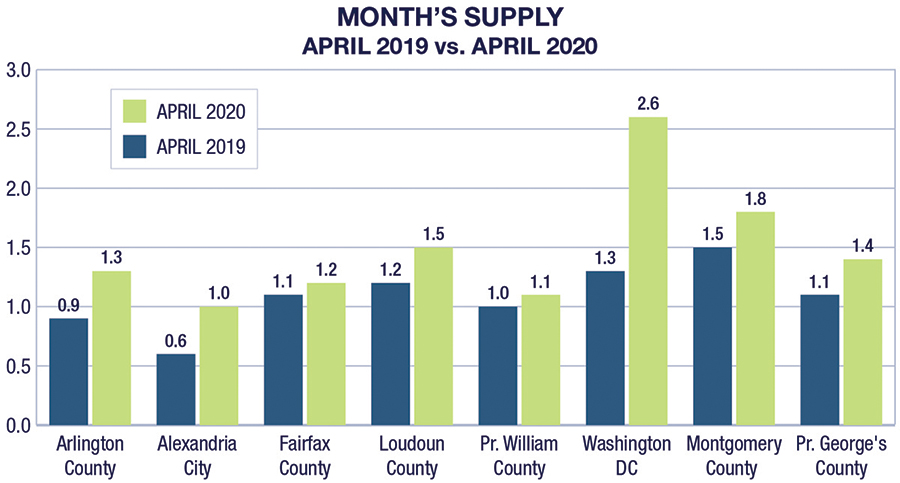

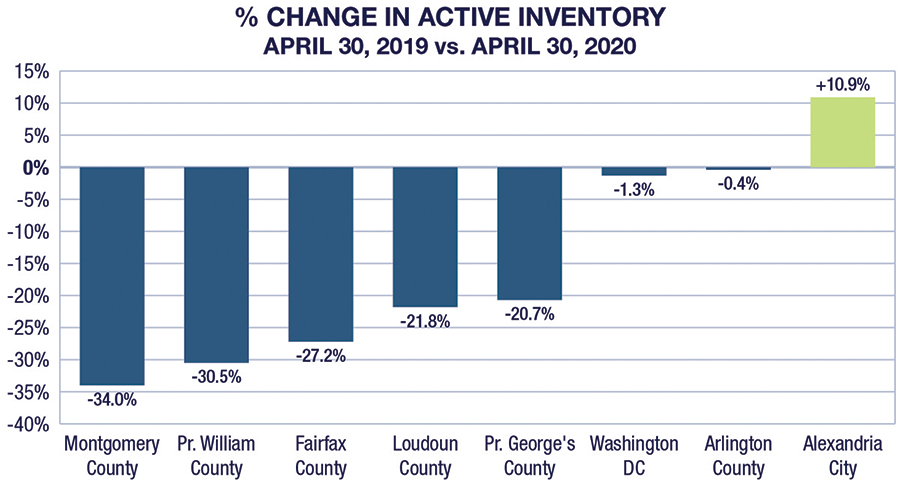

Continuing with the “all real estate is local” theme, active inventory and contract activity vary enormously throughout the region. At the end of April, there were 34% fewer homes on the market in Montgomery County than the previous April, yet in Washington, DC there was almost no change. In the City of Alexandria – still coping with an extraordinary shortage of inventory brought on by the Amazon HQ2 announcement 18 months ago – there were 11% more homes on the market than last April. The velocity and direction of home price movement really comes down to supply and demand, and the accompanying chart shows just how different the various areas of our market are. Washington, DC has twice the supply relative to demand as this time last year, while the suburban markets have not changed much. That makes it a bit more likely that prices in DC are closer to stability while the suburban markets still have some modest upward pressure.

Myth #3 – Mortgage financing is much more challenging.

Financial markets do not react well to uncertainty, and there is plenty of uncertainty to go around. In the first few weeks of COVID-19’s impact, mortgage interest rates fluctuated considerably on a daily – even hourly – basis. Yet in the last month, 30-year fixed rates have stayed right around 3.25%. Those are the lowest rates in history. Buyers with stable employment and the confidence to purchase are able to do so with no more difficulty than last year, and because of the low rates, their money goes further. Yet it is also true that those individuals who have been furloughed aren’t looking to get a mortgage, and if they were, it would be really tough to qualify.

Truth #3 – No one knows which part of the alphabet our recovery will look like.

Are we likely to witness a “V-shaped” recovery, with a rapid return this summer of normal levels of buying and selling activity? Will it look more than a “U,” with a more gradual, prolonged restoration of normalcy? Or will a late summer or early fall reemergence of COVID-19 infections stall the recovery and send the market back down the curve? Anyone who claims to know the answer to those questions with certainty either has a bridge to sell in Brooklyn or is deserving of a Nobel Prize in Economics. We don’t fall into either camp, but we are truly confident that our market is better positioned than most areas of the country – whatever shape the recovery takes. The best that we can do, that our clients can do, is to make those intensely personal decisions, based on one’s own circumstances and the information at hand.

We’re not trying to sugarcoat the reality of the region’s real estate market. We are likely facing an extended period of less real estate activity, and the impact in almost all sectors of economic activity has been and will continue to be significant. Nonetheless, those who have the confidence and stability to be engaged in buying or selling a home should know that the market is alive and – mostly – well.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link